Research on digital transformation of automakers: Tesla is still the best reference

Digital transformation means that enterprises make full use of digital technologies (such as big data, cloud computing, artificial intelligence, etc.) in R&D, production, marketing and services to promote the transformation of business models, organizational structures, etc., so that concepts like intelligent manufacturing are derived.

Digital transformation in the automotive industry includes R&D and production digitalization, marketing service digitalization, product digitalization, and management digitalization.

In essence, digitization actually maps and orderly manages the real world (such as cars, roads, car owners, etc.) in the virtual world. The real world is transformed into various information systems through data collection from automobile production, R&D, marketing, services and management. Via the integration of information and data, big data and artificial intelligence technology which optimizes the processing of the virtual world, the process and management of the real world are optimized as well.

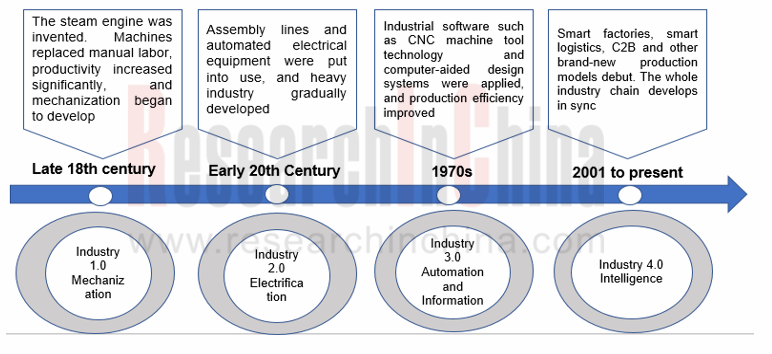

During the “Industry 3.0” era (automation and information age, approximately from 1980 to 2010), production information systems, R&D information systems, sales information systems, user and service information systems, etc. were formed, but these information systems were basically isolated then. Due to the low frequency of information collection, a lot of information still lagged.

With the substantial improvement in chip computing power and storage capacity, the automotive industry has entered the era of Industry 4.0 (intelligence) which will connect information systems in all business links. At the same time, the frequency and precision of information collection will be greatly improved, and some fields may even see digital twin (that is, the virtual world by digital mapping is highly consistent with the real world).

Tesla achieves the highest degree of intelligence among all automakers, and has basically connected the information systems and data of all business links. Tesla not only conducts self-research on electrification, connectivity and intelligence of cars, but also tries its best to develop software systems in the entire life cycle of cars.

Software-driven is the source of Tesla’s subversion of the entire automotive industry. Its self-developed software system named Warp supports its direct sales business in the United States and adapts to growth in China and other markets around the world. Warp is a combination of e-commerce and back-end management software and completely customized to support Tesla's counter-approach to selling and servicing cars. The automaker uses its Warp-powered e-commerce website and its own showrooms, not dealerships, to sell cars. Warp also handles all the back office functions for Tesla such as order processing, supply chain management, manufacturing workflow management, financial accounting and lead management.

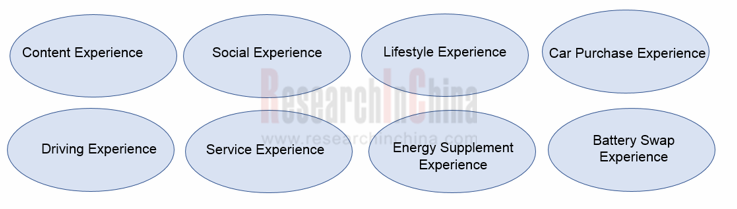

China's emerging automaker NIO adopts a sales model similar to Tesla’s. No matter online or offline, NIO prefers self-operation and self-establishment. It basically relies on online channels to sell products, while displays the brand and offers user experience services offline. NIO's experiential digital marketing is widely praised. In terms of experience marketing, NIO starts from eight aspects: content experience, social experience, lifestyle experience, car purchase experience, driving experience, service experience, energy supplement experience, and battery swap experience.

Take the social experience as an example: users can set up groups in the NIO App. In other words, once a user becomes a car owner, a dedicated car owner service group of 13 people will be formed. In the service group, there are sales partners, service specialists, power-on specialists, as well as various technical specialists and city general managers. When users have any problems in the process of using cars, they can inquire in the group, and someone will respond to and solve problems immediately.

The traditional automakers BMW and Mercedes-Benz have developed APPs which pay attention to functions and require registration. They only provide services for existing car owners, so they are unattractive to potential car owners. The limited traffic cannot support sales volume conversion.

As the emerging automakers represented by Tesla have been digitally operated from the beginning, they are sought after by consumers and recognized by the market. The emergence of new forces has posed tremendous pressure on traditional automakers who thus have formulated digital strategies one after another to boost digital transformation.

At present, automakers mainly deploy digital transformation in five aspects:

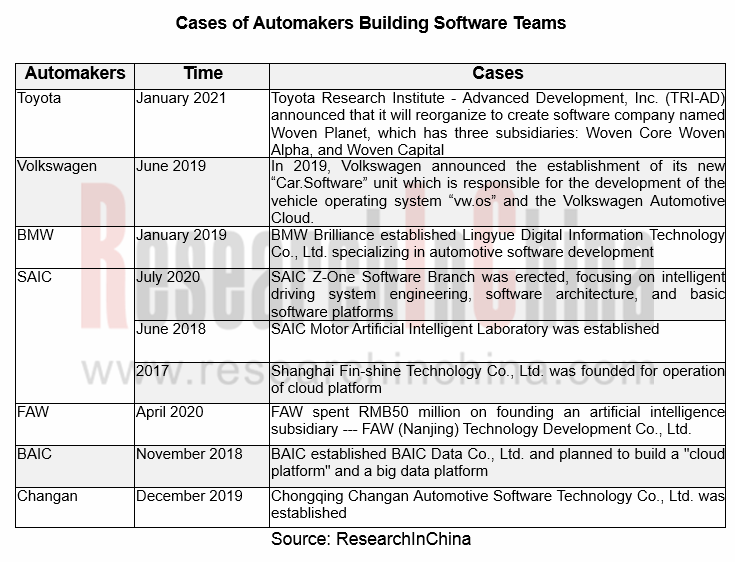

First, they establish software companies or R&D divisions as well as build software teams through self-construction or cooperation.

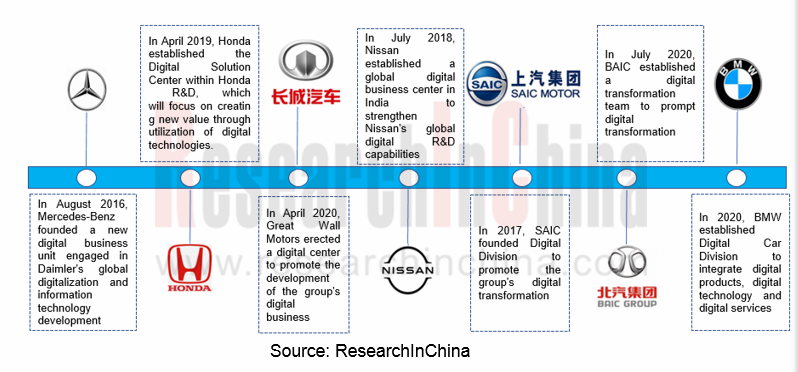

Second, automakers set up digital centers internally to coordinate the digital transformation of the entire groups and promote the implementation of overall digital strategy.

Third, automakers can reduce costs and improve competitiveness by allying with other automakers.

Fourth, automakers prompt digital transformation through cooperation with technology companies (such as Baidu, Alibaba, Tencent, Huawei, etc.).

Fifth, automakers create an online & offline user-centric digital marketing model.

GM’s 4S stores have evolved into a "7S modular dealer service system" consisting of New Car Sale, After-Sales Services, Spare Parts, Information Survey, Pre-owned Car Services, Sharing and Financial Support.

Xpeng's "2S+2S" marketing model disassembles "4S" into two parts: online (marketing and parts available on Tmall) and offline (after-sales services and information feedback). Through the dual-channel linkage of "the Tmall flagship store + offline stores", Xpeng connects both online and offline fields, which not only greatly reduces costs, but also brings consumers with new experience.

This report analyzes 21 OEMs’ strategies and specific measures for transformation. Conventional automakers like Toyota and Changan Automobile have made successes in digital transformation as well, in addition to emerging carmakers.

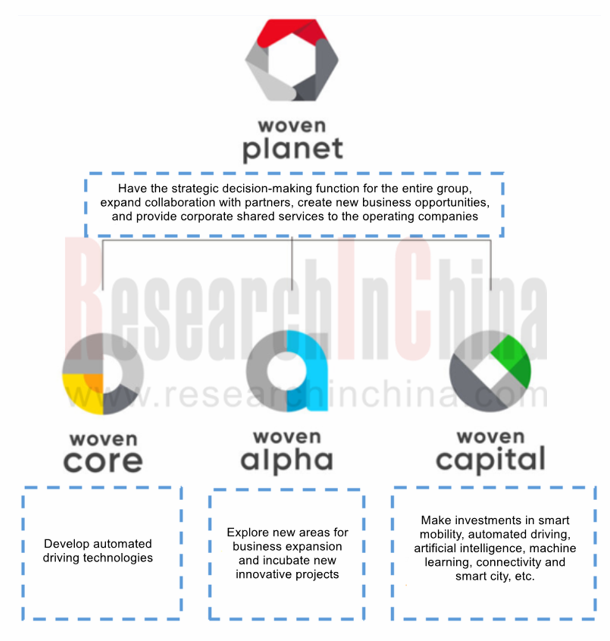

Toyota Digital Transformation focuses on five aspects: first, adjusting organizational structure, with high priority on restructuring of TRI-AD, Toyota’s advanced software company and segmenting its business into “R&D of Automated Driving Technologies”, “Incubation of Innovative Projects” and “Investment in Emerging Areas”; second, launching the Mobility Services Platform (MSPF) for an upgrade to the next-generation mobility services; third, building a cloud service platform for better business and operation models; fourth, creating Toyota New Global Architecture (TNGA) to reform R&D and production links; fifth, developing digital products, with deployments in autonomous driving, HD map, chip, HMI, etc.

Changan Automobile takes software as its corporate strategy, setting up a software center to enhance its digital transformation. For R&D and production, the automaker builds a R&D cloud platform for advancing construction of smart cities; for marketing, it creates an integrated marketing cloud platform and self-establishes an ecommerce platform; for product digitization, it makes deployments in areas from cloud platform and intelligence to telematics by way of independent construction and cooperation.

Despite great efforts on digital transformation, quite a few automakers still face some challenges, such as:

Underpowered transformation, disputed transformation model, and some departments’ reluctance to transform;

Underpowered transformation, disputed transformation model, and some departments’ reluctance to transform;

Poor ability to attract customers online in digital marketing, and lower-than-expected return on offline high investment;

Poor ability to attract customers online in digital marketing, and lower-than-expected return on offline high investment;

Under-investment in digital transformation, which blames for conventional businesses;

Under-investment in digital transformation, which blames for conventional businesses;

Lack of software teams and user operation experience.

Lack of software teams and user operation experience.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...