China Automotive Distribution and Aftermarket Industry Report, 2020-2026

Since 4S store model was introduced in China at the end of the 20th century, China’s authorized dealer system has made a shift from single stores to corporate operation and from extensive management to fine management. For the upstream raw materials, components suppliers provide an array of components to automakers; at the midstream end are automakers which take on design, R&D, manufacture and branding; dealers are downstream players responsible for selling new vehicles and offering aftermarket services. In the whole industry chain, automakers that manage dealers by authorization and rebate policy play a dominant role and have a big say.

In 2019, China produced 25.72 million automobiles and sold 25.77 million units, down 7.5% and 8.2% on the previous year, up 3.3 and 5.4 percentage points, separately, according to the China Association of Automobile Manufacturers (CAAM). China’s automobile circulation industry faces unprecedented challenges as the automobile market is getting through an ever-colder winter. The automotive distribution industry however performs well as a whole. The data from the China Automobile Dealers Association (CADA) shows that in 2019, the top 100 dealers reported a combined output value of RMB1.74 trillion, up 6.3% compared with RMB1.63 trillion in 2018; their total asset investment was RMB802.4 billion, 5.7% less than in 2018 (RMB851.1 billion). In 2019, there were a total of 6,038 4S outlets in China, down 7.5% versus 2018 (6,529); total employment was 420,000 persons, a reduction of 10.6% from 470,000 in 2018.

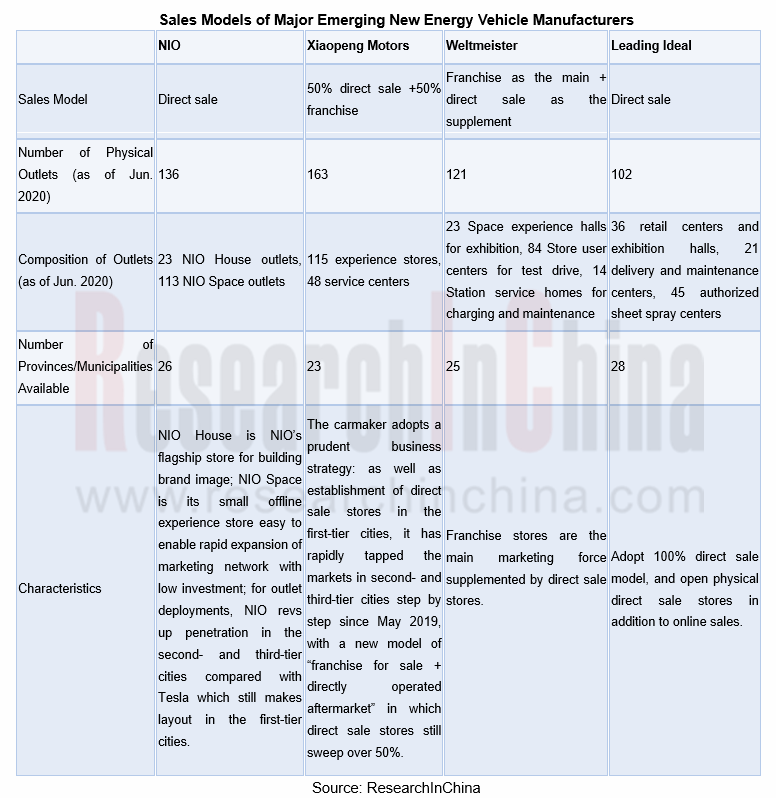

Emerging automakers adopt branding sales models and channels differing from the nationwide dealership model of conventional auto brands, changing from dealership model to direct operation of chain stores by auto brands or their cooperation with authorized dealers. The direct sale model offers totally different brand experience by providing full life cycle services for users, which serves as a solution to drawbacks of the common dealership model, such as non-transparent price and bad user service experience. Yet this model with some disadvantages like enormous investment and complicated operation process does not apply to all new energy vehicle manufacturers. 4S stores still need to shake up their service and profit structures even if they continue to employ the dealership model.

Automobile aftermarket refers to all the car-centric services needed by consumers in the period from post-sale to scrap. The growing aftermarket, especially maintenance and repair segment is accompanied by aging vehicles. That’s because the older the auto parts, the more frequent repairs they need and the more they cost. In current stage, the average vehicle in China is 5 years old, and those aged 4-10 seize over 58%. Vehicle aging, and increasing ownership are dual effective booster to prosperity of the aftermarket, making it a new industrial hotspot. The industry will usher in a boom period.

Automobile aftermarket involves maintenance and repair, auto finance, used car, rental, accessories, beauty and refit, recycling, and aftermarket alliance platform integration/car e-commerce, among which auto finance, maintenance & repair, and used car are the top three segments.

Used Cars

Factors such as household demand, profession, consumer preferences, etc. will prompt car owners to replace or resell their cars in the circulation market through used car dealers, used car e-commerce platforms and other channels. In recent years, the state and local governments will make more efforts to promote automobile consumption with favorable measures which will drive used car consumption and fuel Chinese used car market to grow with larger scale of transactions. In 2020, China saw approximately 14.34 million used cars transacted, with the estimated value of RMB888.8 billion. Although the annual transaction volume dropped by 3.9% in the entire 2020 due to the epidemic, the domestic used car transaction volume experienced consecutive growth from March to December. In the future, the used car market is expected to occupy more market share in the automotive aftermarket.

Repair and Maintenance

In the context of high ownership, aging of vehicles and changes in the maintenance concept, the auto repair and maintenance market continues to swell. The annual repair and maintenance cost increases year by year as vehicles become older, because the number of repairs and the expenses of each repair for old and worn auto parts jump each year. Learning from the experience of developed countries, China is about to see the demand for repair and maintenance hit the peak. In the past ten years, automobile sales volume has been impressive while the growth of new car sales volume has slowed down. In the future, the average vehicle age will continue to rise, which will boost the auto repair and maintenance industry into a golden age. The scale of China's auto repair and maintenance had reached approximately RMB1,332 billion as of 2019, and is expected to hit RMB2,458 billion by 2026, surpassing the auto finance market to rank first in the aftermarket. Amid the anti-monopoly, independent auto repairers are gradually eroding the market share of traditional 4S stores. With the help of the "Internet +" model, the independent repair model will develop more radically.

Auto Finance

Auto finance refers to a variety of financial products for companies, individuals, governments, automotive operators and other entities. It centers on automotive OEMs, stretching to the upstream and downstream of the industry, and eventually to end consumers. Typical auto finance products include dealer inventory financing, auto consumption loans, auto leasing and auto insurance. In recent years, the overall penetration rate of China's new car finance has ascended year by year, like 43% in 2019. According to the proportion of cars involved with financial products, the loan penetration rate is about 35% and the financial leasing penetration rate 8%, meaning loans still lead by a high margin. Compared with mature markets in Europe and America, China's auto finance market for new cars has enormous potentials. As terminal consumption upgrades and credit is widely accepted, auto finance will witness further growth. The car sales volume has fluctuated and the growth rate of the auto finance market has slowed down (about 20%) since 2017, but the momentum of auto finance is more robust than the trend of the car sales volume. In 2019, the overall scale of China's auto finance market reached approximately RMB1.58 trillion, of which licensed auto finance companies accounted for approximately 50%.

China Automotive Distribution and Aftermarket Industry Report, 2020-2026 sheds light on the followings:

Introduction to the automotive distribution industry and aftermarket, including definition, classification, industrial chain, business models, etc.;

Introduction to the automotive distribution industry and aftermarket, including definition, classification, industrial chain, business models, etc.;

Global and Chinese automotive distribution market scale and forecast, including total automobile sales volume, dealer networks, dealers’ automobile sales volume, competitive landscape, new energy vehicle sales models, etc.;

Global and Chinese automotive distribution market scale and forecast, including total automobile sales volume, dealer networks, dealers’ automobile sales volume, competitive landscape, new energy vehicle sales models, etc.;

Automotive aftermarket segments, including market size and forecast, competitive landscape, industry trends, etc. of auto finance, used cars, repair & maintenance, beauty, etc.;

Automotive aftermarket segments, including market size and forecast, competitive landscape, industry trends, etc. of auto finance, used cars, repair & maintenance, beauty, etc.;

Profile, business analysis, brand agency, business networks and marketing of major auto dealers in China.

Profile, business analysis, brand agency, business networks and marketing of major auto dealers in China.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...