Research Report on Telematics Service Providers (TSP) and Their Products, 2021

Small and medium TSPs will fade away and TSP giants will come to the front

As “smart car as a service” grows, automakers focus more on introduction of technologies or platforms from big data and cloud computing to security, content platform and artificial intelligence, providing more intelligent, more diversified content and value-added services, while making an expansion in OEM market. As the gateway for vehicle traffic flow, telematics service providers (TSP) are catering to the industrial change by constantly extending services content and boundaries, across fields from initial remote service to phone mirroring and connectivity, then to connected IVI system, finally to integrated telematics system covering people, vehicle and life.

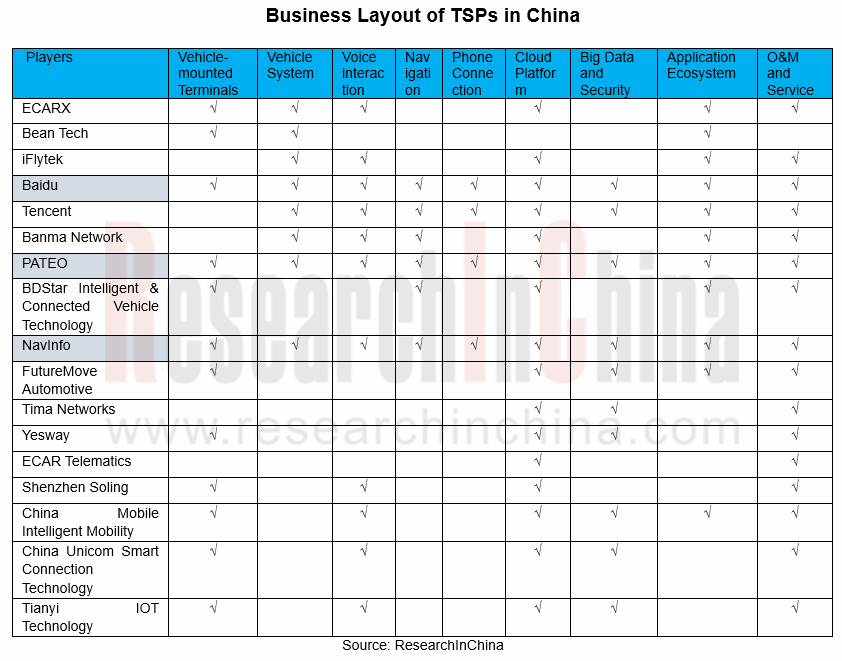

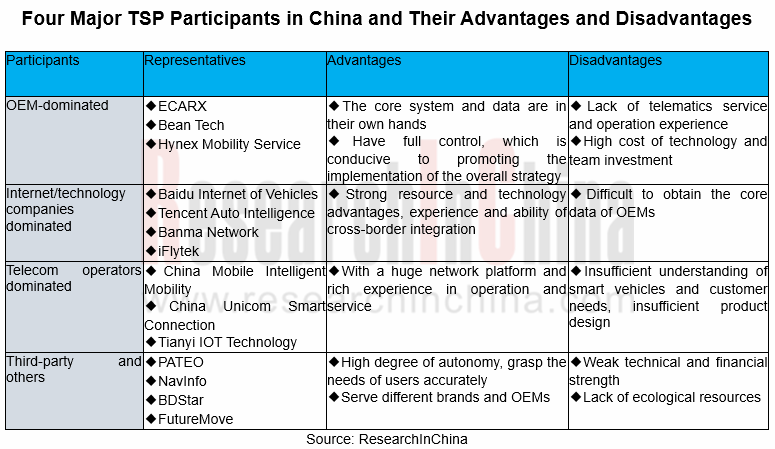

There are four typical types of TSPs: OEMs, telecom operators, internet/technology companies, and third-party platform providers. These players have built a mode of multi-party cooperation. For example, OEMs push for their partnerships with BATH, Pateo and more in their efforts to improve their ability to develop telematics and provide services, and work together with telecom operators to explore 5G + telematics application scenarios and application ecosystem. In the long run, the four major participants will integrate with each other across fields for win-win cooperation.

In future, China’s TSP industry will head in the following directions:

1. The closer connection of a vehicle with people, other vehicles, smart home appliances, living services and smart city comes with TSPs’ greater attempts to extend their services and open up their technology and ecosystem for a gradual coverage of all scenarios of mobile phone, car, home and city.

For example, based on extended BATH ecosystem (Baidu, Huawei, Tencent, Suning, Ping An, UnionPay, China Telecom, etc.) and third-party ecosystem, Pateo has made deployments in mobile phone, car, home and city scenarios, and will add “five new operations”, i.e., New Mobility, New Finance, New Retail, New Insurance and New Marketing. Now it has carried out its landing of new car retail strategy together with New Baojun and Sunning Car.

2. As cross-field integration becomes normal, players will achieve complementary advantages, resource sharing, and ecological integration to build a large ecosystem ultimately.

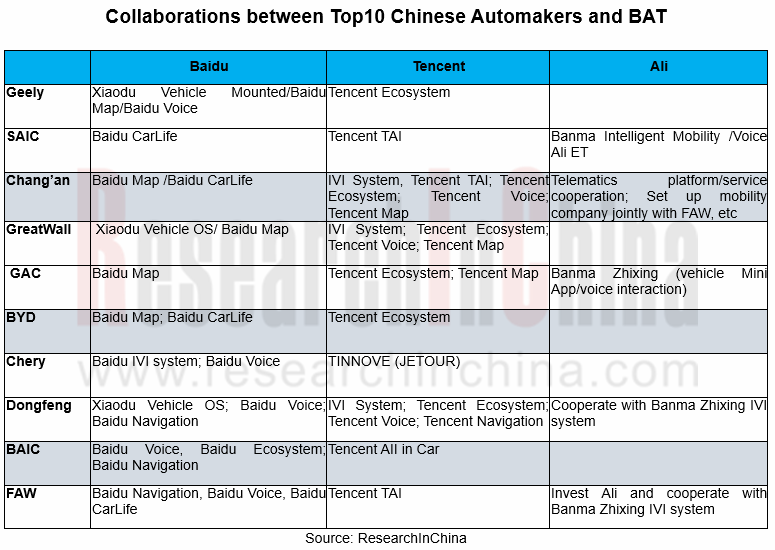

Examples include Baidu, Alibaba and Tencent (BAT) which are establishing closer partnerships with OEMs in more areas. Among them, in late 2020 Alibaba joined hands with SAIC again to set up IM Motors in charge of developing smart electric vehicles, following their establishment of Banma Network Technology (which finished strategic restructuring with AliOS in May 2020, aiming at improving automotive operating system and AI technology and upgrading the cloud-network-edge-terminal open system); based on their in-depth cooperation on intelligent connectivity, cloud technology and Baidu Ecosystem, Baidu and Geely announced they would co-found an intelligent vehicle company in January 2021, with Jidu Auto coming into being on March 2.

3. OEMs-lead TSPs to provide better IVI system-centric services.

Currently, OEMs have found common ground on intelligent connectivity and digital transformation acceleration. To hold core technology and data, Geely, Great Wall Motor and Honda China have founded their telematics company independently or together with others, with IVI system at the core of their multi-directional deployments:

ECARX: by the end of 2020, GKUI ECARX designed for Geely has been found in more than 40 models under Geely, Lynk & Co, Proton and served a total of over 2.3 million users.

On this basis, ECARX built in-depth cooperation with Baidu, with GKUI19-enabled Boyue PRO access to Baidu Map and Baidu Scenario for recommendation in 2020;

In November 2020, Baidu Map vehicle version became first available to Geely Preface upgrade edition.

In October 2020, ECARX raised RMB1.3 billion in a Series A funding round led by Baidu, which will be spent developing its automotive chip business.

In February 2021, ECARX joined hands with Visteon and Qualcomm to jointly provide intelligent cockpit solutions for the global market; in the same month, ECARX was invested USD200 million in its A+ funding round, which will be used for building an international R&D system and further expanding its global operation.

Bean Tech: Haval Fun-Life 2.0 system co-developed by Bean Tech and Haval integrates with Tencent TAI 3.0 features, and has been installed in several models like Haval Big Dog, Haval F7, Gen 3 H6, and WEY Tank 300. In future, Bean Tech will partner more closely with Haval and Tencent to promote its cloud services (supplied by Tencent Cloud Platform) in Great Wall Motor’s overseas markets and provide full-stack intelligent marketing closed loop services from user profiling and SCRM to advertising and user operation.

4. TSPs face intensified competition and a new reshuffle amid telematics industry change, with four or five giants expected to be born by 2025

Currently, most conventional TSPs have been acquired and integrated into other business by tycoons. A handful of TSPs can run independently. Even Baidu, Alibaba, Tencent and Huawei (BATH) are able to deploy just one of dozens of intelligent connected vehicle product lines each. As OEMs regain dominance in software development, TSPs will contend more fiercely and face a new reshuffle. It is predicted that by 2025, four or five bellwethers that have ability to develop full-stack telematics systems and link vehicles with V2X equipment facilities, earphones, watches, bracelets and various IOT (Internet of Things) device will come out. Small and medium TSPs will be edged out by TSP giants.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...