This report studies autonomous vehicles that transport passengers on short distances, and delves in the product solutions, operational services, and major players in this market.

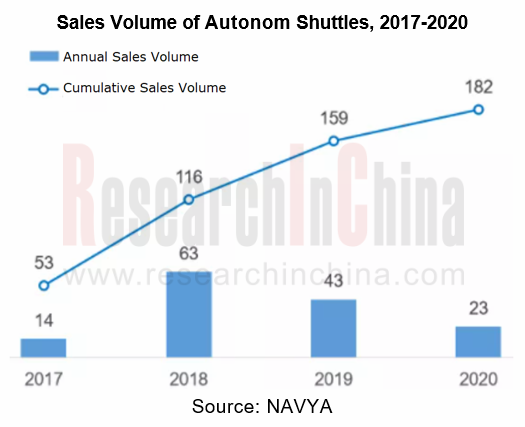

The development of autonomous shuttles slows down

Many companies, including start-ups, Tier 1 suppliers and automakers (like UISEE, Baidu, Bosch, Continental, Dongfeng, Yutong, etc.), will launch autonomous shuttles when trying to develop and test L4 technology, so as to verify the reliability of their autonomous driving solutions.

Among them, Navya and EasyMile, which are the first to enter the autonomous shuttle market, perform mediocrely.

In fact, the smart sensor configuration of L2+ passenger cars has been developing at an amazing speed, and suppliers such as Baidu have applied L4 technology to the L2+ market. L4 autonomous shuttles have developed slowly in the past two years. Although new players have flooded to the autonomous shuttle market, the development momentum herein is obviously not as good as that of the ADAS market and the autonomous driving market for special vehicles (such as autonomous driving in agriculture, mines and ports).

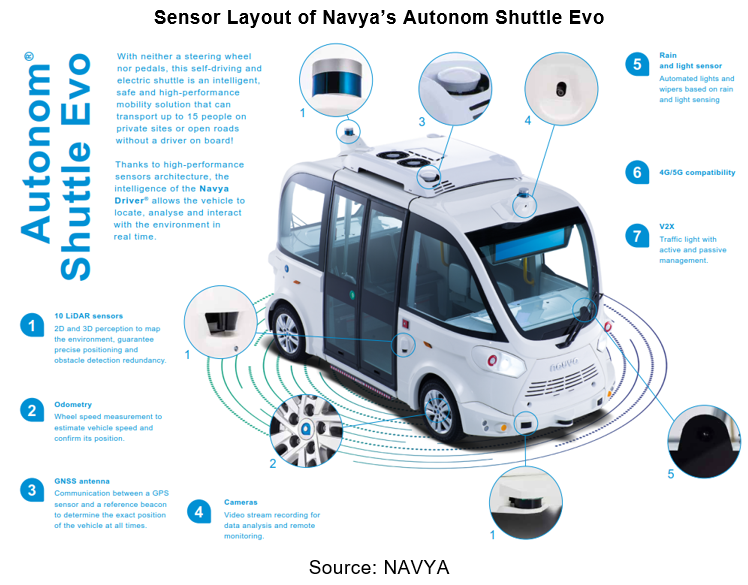

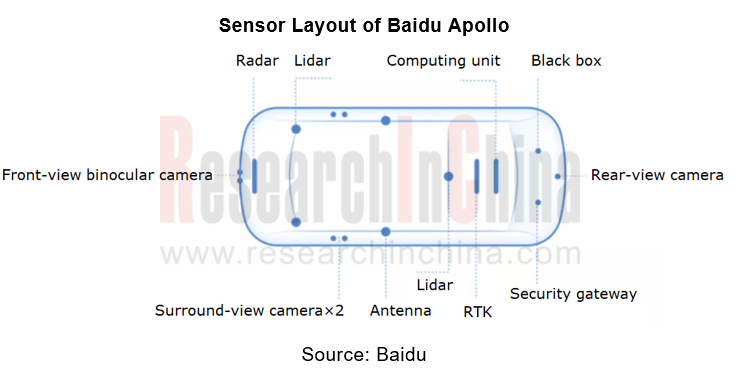

In terms of sensor configuration, autonomous shuttles lag behind the most cutting-edge passenger cars.

For example, Navya’s autonomous shuttle --- Autonom Shuttle Evo uses a lidar + front/rear view camera solution to enable L4 autonomous driving featuring capabilities such as straight driving, turning, U-turning at intersections, autonomous obstacle avoidance, and fixed site parking. It also supports background remote control.

Baidu’s autonomous shuttle Apollo adopts a fusion solution of lidar + radar + front/rear view camera + surround view camera + ultrasonic radar to independently complete a series of driving capabilities such as autonomously exit from parking spaces, following cars, avoiding obstacles, turning/turning around, stopping at stations, etc.

The autonomous shuttle market in China is obviously more booming than abroad

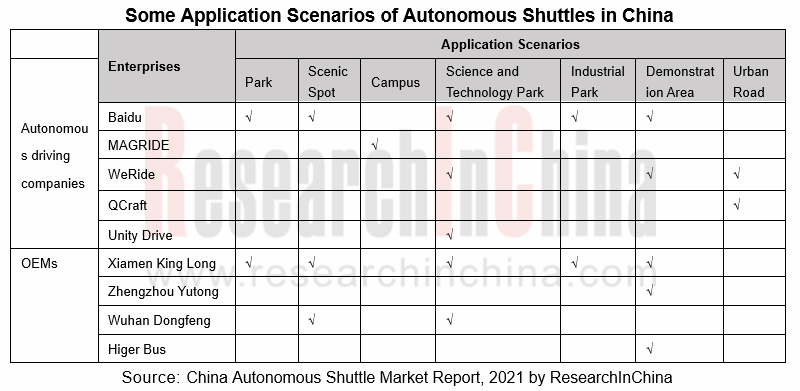

Autonomous shuttles mainly operate in parks, scenic spots, campuses, science and technology parks, industrial parks, demonstration areas and other closed/semi-closed or relatively simple mixed traffic environments, where there are a few vehicles and pedestrians and vehicles run slowly. These scenarios are a good starting point for fast realization and commercialization of autonomous driving.

The autonomous shuttle market in China is obviously more booming than abroad. Baidu’s autonomous shuttles are available in the most scenarios. "Apollo" jointly created by Baidu and Xiamen King Long since 2018 has landed in 35 parks in 28 cities of China. In addition, autonomous driving startups (such as MAGRIDE, WeRide, and QCraft) as well as OEMs (like Xiamen King Long and Zhengzhou Yutong) are actively embarking on this market.

Navya: Global autonomous shuttle sales volume will reach 12,600 units in 2025

The autonomous shuttle market tends to develop more slowly, but it represents a typical scenario for autonomous driving and still attracts more and more players to join. According to the investor report released by Navya in January 2021, the global autonomous shuttle sales volume will reach 12,600 units by 2025, with a market value of EUR1.7 billion.

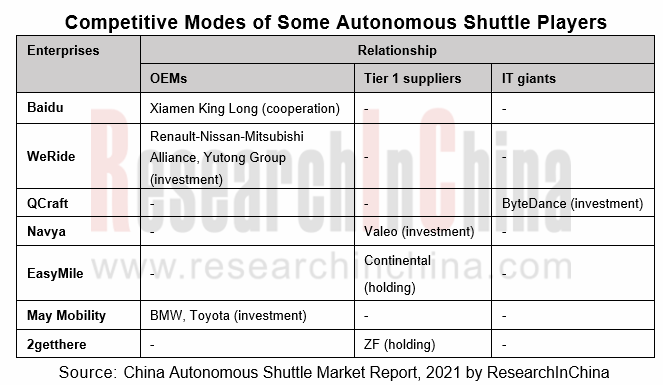

The autonomous shuttle market will thrive sooner or later, but the crucial problem is who can survive the difficult time. At present, autonomous shuttle enterprises are trying to find successful development paths through various forms of cooperation. We have summarized two paths as below.

Path 1: Autonomous shuttle enterprises and OEMs/Tier1s team up to complement advantages

Autonomous shuttle players --- autonomous driving startups, OEMs (buses, passenger cars) and Tier 1 suppliers s have their respective advantages:

- With full-stack layout capabilities in autonomous driving solutions, autonomous driving startups provide L4 autonomous shuttles through OEM cooperation or AM modification.

- Some OEMs use their own vehicle manufacturing capabilities to pre-install and integrate autonomous driving software, algorithms, sensors, etc., and directly embark on actuation.

- The capabilities of Tier1 suppliers in software & hardware layout and system integration cannot be underestimated.

The cooperation between autonomous driving startups, OEMs and Tier1 suppliers is conducive to achieving complementary advantages and enhancing competitiveness.

In March 2021, GM Cruise acquired Voyage, a self-driving car startup that focused on operation in retirement communities. The cooperation will merge Cruise’s engineering and software capabilities with Voyage’s presence in the retirement community market to launch bombshells.

Path 2: Expansion of scenarios and technical service capabilities

Autonomous shuttles have something in common with autonomous logistics vehicles and autonomous taxis in terms of technical solutions, featuring relatively low thresholds to different scenarios.

The French company Navya, which initially engaged in autonomous shuttles, launched Autonom Cab, a driverless taxi, in 2018.

After completing the layout in autonomous taxis, WeRide has dabbled in the autonomous buses and autonomous logistics successively.

In early 2021, WeRide and Yutong jointly built Mini Robobus, and started the normalization test in Guangzhou International Bio Tech Island and Nanjing Eco Hi-Tech Island. Mini Robobus will spread to Zhengzhou, Wuhan and other cities for normalization tests, and it will be commercialized in 2021. Mini Robobus is designed for urban open roads to gradually break the limits of the park scenario and blur the boundary with RoboTaxi.

In March 2021, WeRide acquired MoonX. They will collaborate in business. MoonX, which focuses on autonomous logistics vehicles, is expected to help WeRide realize its expansion in the field of unmanned logistics.

In addition to the above two paths, there must be other paths. Under the background of unclear business models, the expansion, cooperation, mergers and acquisitions of autonomous shuttle companies will occur constantly.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...