Flying Car Research: The prospect is promising. Creator of Google self-driving cars turns to track of flying cars

ResearchInChina released Global and China Flying Car Industry Report, 2020-2026, analyzing eVTOL ((Electric Vertical Takeoff and Landing) from the perspective of status quo, trends, business models, financing, the layout of major players, and product solutions.

Compared with traditional cars and aircrafts, eVTOL has gradually materialized, featuring zero emission, low cost, point-to-point low-altitude flight (short mobility time without geographical restrictions), vertical take-off and landing, land and aerial applications. For example, EHang 216 with multi-rotor electric vertical take-off and landing is used as an ambulance in the coronavirus crisis.

Investors favor urban air mobility (UAM). The total financing of the three unicorns exceeds USD1.5 billion

By 2030, 60% of the population will migrate into cities, which may pose enormous pressure on urban ground transportation. By then, the demand for urban aerial short-distance mobility will increase significantly. Morgan Stanley predicts that the flying car market will reach USD320 billion by 2030.

Flying cars have been favored by many investors due to the broad application prospects. Larry Page, cofounder and CEO of Alphabet, Google’s parent company, was among the first to recognize their potentials, personally funding three companies, Zee Aero, Opener and Kitty Hawk. Particularly, Sebastian Thrun, Google's self-driving team founder turned CEO of flying vehicle startup Kitty Hawk. This indicates the trend of the mobility market: the future transportation may develop in the sky.

Among the three flying car unicorns, Joby Aviation is from the United States, Volocopter and Lilium are from Germany. Joby Aviation has raised the overwhelming USD820 million. Volocopter has announced the signing of their Series D funding round, and its investors include Geely, Daimler, Geely, Daimler, DB Schenker, Intel Capital, etc.

Currently, 5 flying car models have been mass-produced. Electrification and autonomous driving are the mainstream

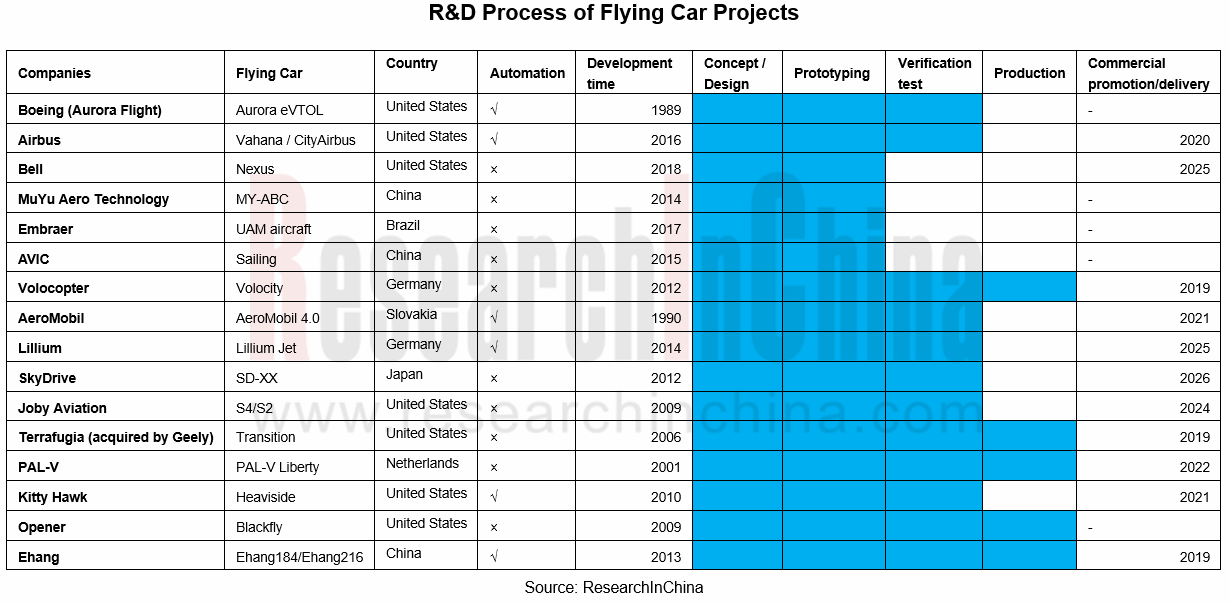

American companies (accounting for nearly 50%) are the most enthusiastic about developing flying cars, followed by Chinese companies. Many companies aim to materialize flying cars around 2025. Five flying car projects have seen mass production, and 38% have realized automation.

Automotive technology and aviation technology are merging with each other. Benefiting from the development of automotive electrification, flying cars have a progress in endurance. For example, Airbus Vahana eVTOL has a range of up to 50 kilometers, which basically enables urban short-distance mobility.

Amid many participants, Geely, Xpeng, Hyundai and other OEMs have deployed the market

Currently, traditional airlines such as Boeing, Airbus, Bell, etc. have embarked on flying car projects. Technology companies follow suit. For example, Uber has established Uber Elevate to develop flying taxis with 9 partners including Embraer, Aurora Flight Sciences, Jaunt Air Mobility, etc.

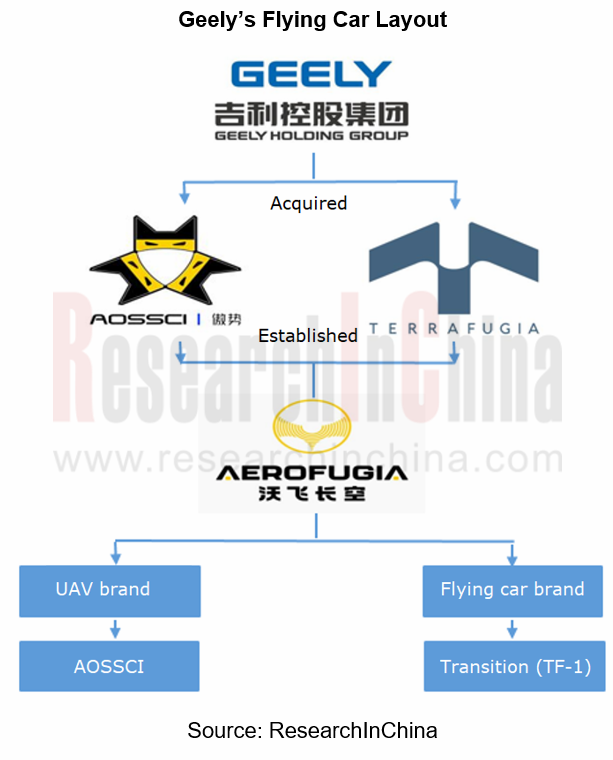

The CEO of the OEM Xpeng recently stated that it will build flying cars in 2021. Geely completed its acquisition of the US flying-car startup Terrafugia, and invested in Volocopter, a German electric flying taxi R&D company, demonstrating its ambition to deploy UAM. Recently, Transition (TF-1), a subsidiary of Geely, obtained the world's first special airworthiness certificate from the Federal Aviation Administration (FAA), USA.

The United States, Germany, China, South Korea, Japan and many other countries have paid attention to the concept of flying cars, and many of them have formulated UAM development plans. Affected by favorable policies, insufficient urban road traffic space, autonomous driving and the development of 5G communication technology, flying cars are expected to become an important way of smart mobility in the future.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...