Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2020-2021

Our Global and China Automotive Millimeter-wave (MMW) Radar Industry Report, 2020-2021 combs through and summarizes the characteristics of the global and China passenger car radar markets, related enterprises’ characteristics, development trends and so forth. In the years to come, ADAS functions upgrade, new cockpit applications (e.g., life signs monitoring), and 4D radar launches will combine to drive up the demand for automotive radars.

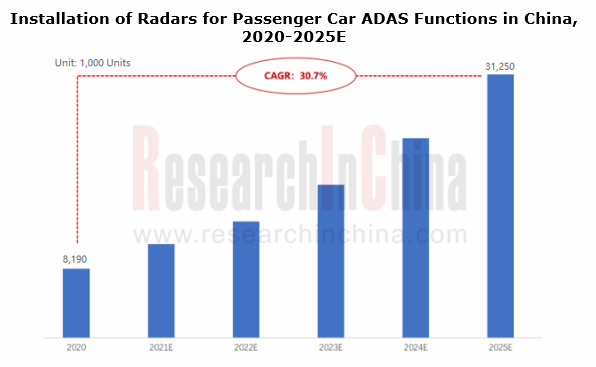

In 2025, China passenger car ADAS functions will carry more than 31 million radars, with demand AAGR of 30.7%.

In 2020, a total of 8.19 million radars were installed in passenger cars in China, including 4.77 million front view radars and 3.31 million rear angle radars. These radars were demanded by front and side road environment detections among L1-L2 ADAS functions.

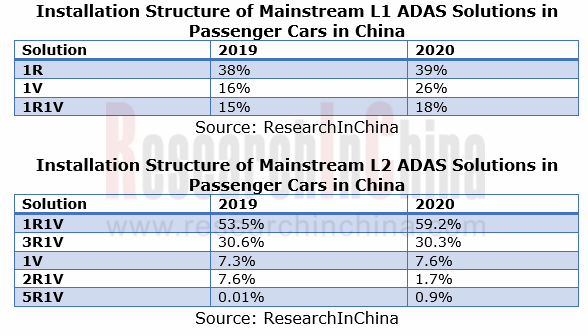

From current mainstream ADAS system solutions, it can be seen that L1 depends on 1R, 1V or 1R1V solution that features simple perception strategy and needs a limited number of radars; L2 needs more radars for requiring a higher level of sensor fusion. Noticeably, the use of 5R1V in vehicles in 2020 provided a further boost to the radar demand.

In a word, the increasing number of sensors per autonomous vehicle is accompanied by ADAS functions upgrade. It is estimated that passenger cars in China will be equipped with over 31 million radars in 2025.

The growth in the demand is expected to follow such trajectory:

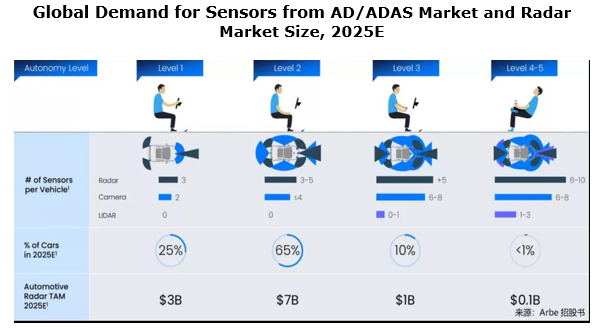

- The upgrade from L1 to L2/L3 will demand 3 or 5 radars;

- For L4/L5, single vehicle may need 7 or even more radars (deployed at both sides of vehicle body);

- ADAS upgrade will fuel the demand for front view radars at first, and then rear angle ones;

- The front view radar + rear angle radar solution is becoming a basic configuration, and the increasing demand for front view radars comes with the launch of L3 functions.

The following picture shows Arbe’s prediction about the demand for various sensors from ADAS in 2025. Arbe argues that in five years, L1 ADAS will be configured with 3 radars, L3 with over 5, and L4-L5 possibly even with as many as 6 to 10. Arbe expresses obvious optimism about the demand for radars.

Cockpit applications like vital signs monitoring and gesture control are expected to be a new engine to the radar growth.

As intelligent cockpit evolves, radars are finding their way into new areas. Currently, they are largely used in cockpits for vital signs monitoring and gesture control.

A. Vital signs monitoring: Wuhu Sensortech Intelligent Technology Co., Ltd. (WHST) was the first one to achieve mass-production

At present, in-vehicle monitoring mainly adopts cameras which invade privacy, while radars can ease the concern. In April 2020, HYCAN 007, a mass-produced model under the brand co-created by GAC and NIO became available on market, which also means the mass production of STA79-4, WHST’s automotive radar used in the car for vital signs monitoring.

In June 2020, at its “Online Launch of Vital Signs Monitoring Technology”, Great Wall Motor also used STA79-4 for vital signs monitoring in vehicle. The solution has been mounted on 2021 WEY VV6.

B. Gesture control: the foreign vendor Acconeer and China’s WHST are exploring.

In-vehicle gesture control is currently enabled using cameras, but the technology requires ultrahigh accuracy devices. 60GHz radar that features up to 7GHz bandwidth for sub-micron resolution required by gesture control becomes a new option for cockpit gesture control. More than that, 60GHz radar can penetrate materials to transmit signals, and the integrated design makes it more compact enough to be hidden inside the housing of a device.

In 2018, Sweden-based Acconeer rolled out A111, a 60GHz pulsed coherent radar applicable to vehicles for smoothly controlling the vehicle functions to be actuated. Furthermore, it can be applied widely in areas from robots and drones, and mobile and wearable devices to Internet of Things, power tools and industry, healthcare and fitness. In automobiles, it is often used for gesture recognition and safety alert.

4D radars being installed in vehicles enjoys a rosy prospect.

4D radar outperforms a 3D one in the following three aspects:

(1) Detect “height”, for example, distinguishing an overpass from vehicles on the road;

(2) Offer higher resolution: 1-degree angular resolution (even lower in the case of super resolution algorithm) in both azimuth and elevation;

(3) Classify static obstacles, able to detect roadside obstacles and small targets, e.g., water bottles and tire fragments.

The unique edge ensures 4D radars to work better in detection of static obstacles and support L3-L5 highly automated driving. As for its application scenarios, 4D radars will be massively seen in ADAS front view function in future to replace some few-channel LiDARs, expectedly becoming a “new star” in radar market.

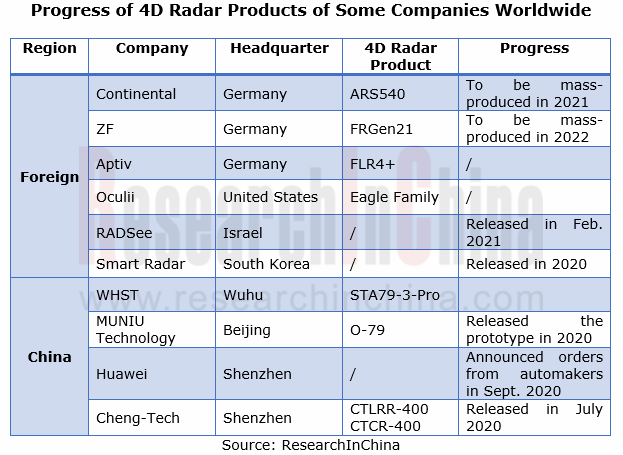

Current foreign 4D radar vendors are divided into two types: conventional Tier1 suppliers like Continental, Aptiv and ZF; start-ups, typically Arbe, Oculii and Vayyar.

Chinese players such as WHST, MUNIU Technology and Huawei, started late but gather pace.

The curtain on the mass-production of 4D radars has been lifted. Continental ARS540 ordered by BMW is to be spawned in 2021; ZF 4D radar mounted on SAIC R ES33 will be produced in quantity in 2022.

In March 2021, SAIC R Brand showcased ES33, its new model of strategic importance. 2 ZF 4D radars are installed at the front bumper of the car, affording an over 300m detection range. Besides, ES33 also bears 31 other perception hardware devices including 1 LiDAR and 12 cameras, hoping to enable L3-L4 automated driving.

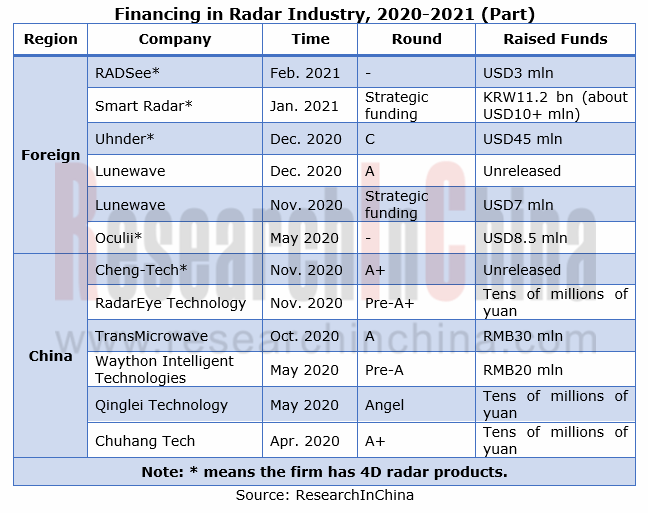

As well as OEMs welcoming 4D radar, capital favors it, too. Since 2020, the financing for nearly 50% start-ups in radar industry has gone to 4D radar.

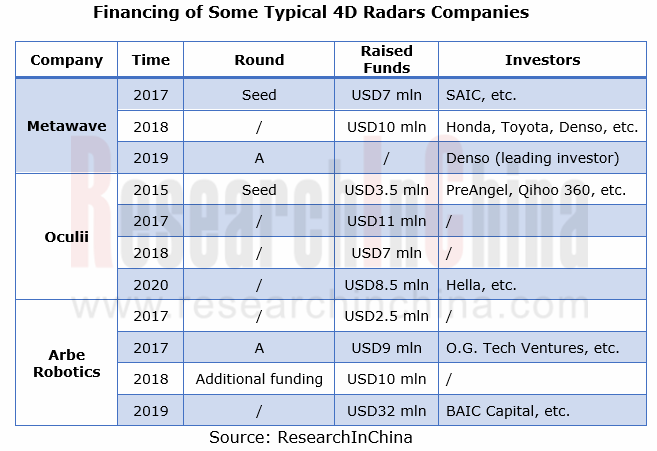

Also, some traditional OEMs and Tier1 suppliers bet on 4D radars in recent years. For example, SAIC, Honda, Toyota and Denso invested in Metawave between 2017 and 2019; BAIC participated in the USD32 million funding round Arbe closed in 2019; in 2020, Hella was an investor in Oculii’s USD8.5 million strategic funding round.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...