V2X (Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2021

V2X and CVIS Industry Report: 5G V2X will be a Standard Configuration for Digital Cockpits

After months of debate, in November 2020, the US Federal Communications Commission (FCC) voted for allocation of 75MHz of the spectrum band (5.850-5.925GHz), which had previously been reserved for Dedicated Short-Range Communications (DSRC) services, to Wi-Fi and C-V2X uses, which means the US has given up DSRC and turned to C-V2X.

In 2021, China government has issued the 14th Five-Year Plan (2021-2025) for National Economic and Social Development and the Long-Range Objectives through the Year 2035, and the National Comprehensive Three-dimensional Transportation Network, indicating that in the 15 years to come, China should lead the world in intelligent connected vehicle (intelligent vehicle, autonomous driving, CVIS) by providing full coverage of spatio-temporal information service and transportation perception, and defining China’s “CVIS + autonomous driving” technology roadmap.

C-V2X technology is in the first phase of implementation, and OEMs tend to explore application scenarios.

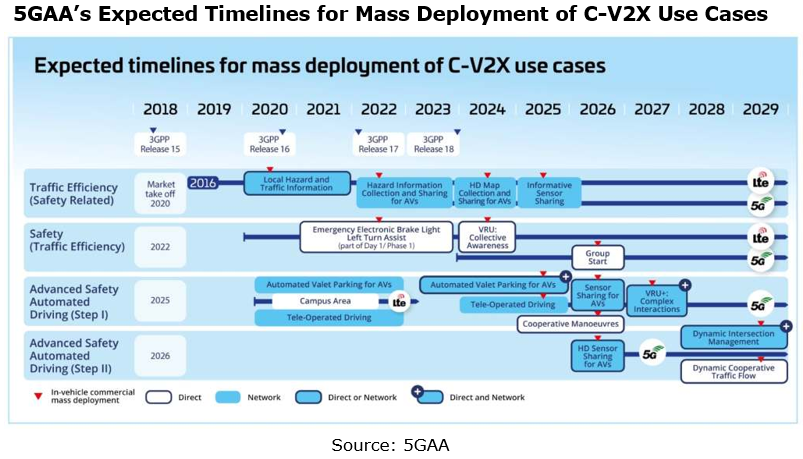

In September 2020, the 5G Automotive Association (5GAA) worked out a C-V2X communication technology roadmap.

Based on the current 3GPP’s 5G technology release speed, global deployment of 5G technology, and automotive communication technology supply chain status, combining 5GAA’s prediction and the reality in China, we think the use of C-V2X technology will pass through the following three phases:

2020-2023:

Having become available to mass-produced vehicles, C-V2X now depends on 4G LTE-V2X(R14, R15)technology to offer basic safety functions: LTE-V2X enables higher traffic efficiency and assisted driving safety, and will support other functions such as electronic brake light, left turn assistance, automated valet parking (AVP) in a parking lot, and remote-controlled driving.

In some low- and medium-speed automated driving scenarios (ports, mining areas, parks, etc.), LTE-V2X (R15, composed of 4G core networks + 5G base stations) works for vehicle infrastructure cooperation.

2024-2026:

Based on NR V2X+5G Uu, achieve CVIS-enabled automated driving (R16-released in July 2020), R17-expected to freeze in mid-2022), with available functions including coordinated protection of vulnerable groups in traffic and cooperative automated driving on urban roads;

HD map data (static/semi-static and dynamic) and sensor data (camera, LiDAR, radar, etc.) can be broadcasted to nearby autonomous vehicles for assisted driving decision.

Beyond 2026:

5G NR V2X will be mature enough to be a standard configuration for highly automated vehicles. The combination of NR V2X and 5G eMBB allows for the sharing and collaboration of high-precision perception data between vehicles, and the collaborative interaction between vulnerable traffic participants. By 2029, it will enable collaborative traffic flow management and automated vehicle flow takeover on highways or at intersections.

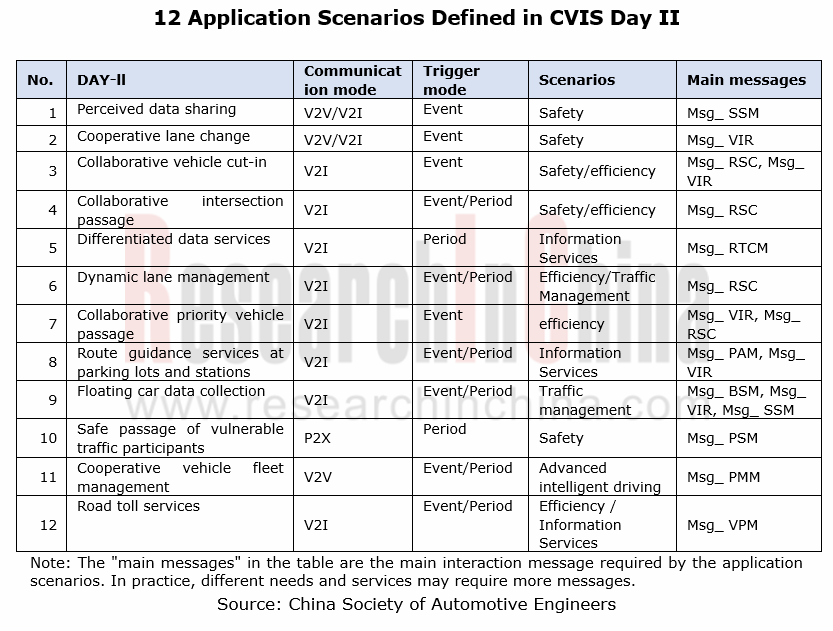

In China’s case, the Cooperative Intelligent Transportation System, Vehicular Communication, Application Layer Specification and Data Exchange Standard (Day II), an association standard, started soliciting opinions in November 2020. Compared with the CVIS DAY I released in 2017, the CVIS Day II underlines the interactions between vehicles, infrastructures and pedestrians and makes the trend to “vehicle-infrastructure cooperation” technology clearer, which means more V2I scenarios will come out and roadside (edge end) capabilities will play a role.

Through the lens of the mass production of OEMs in China, the 17 typical use cases in the CVIS DAY I can already be seen in vehicles; for the typical Day II use cases, the formulation of recommended standards is underway, and development and commercialization is expected to be phased in in 2021.

For example, Ford China is testing “direct connection” mode-based V2I and V2V capabilities such as electronic emergency brake light (EEBL) and intersection movement assist (IMA), and will further integrate V2X with Co-Pilot 360 ADAS and push them to users over the air (OTA).

In future 5G V2X may be a standard configuration for digital cockpits

In the next several years, the stronger computing force of chips will come with much more rapid integration of digital cockpits and a disruption in conventional on-board units like T-BOX; smart cockpits that integrate with more functions including ADAS, V2X and cloud services will hold the trend. Qualcomm's third- and fourth- generation Snapdragon automotive digital cockpit platforms both combine C-V2X. In future, 5G V2X may be a standard configuration for digital cockpits.

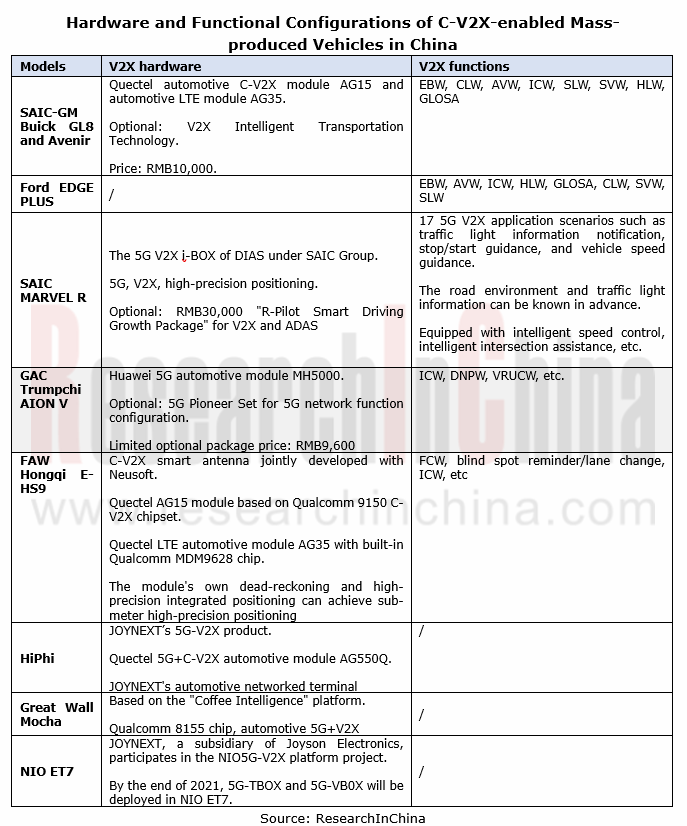

V2X can fuse with on-board smart terminals like IVI system and T-BOX, as well as ADAS or autonomous driving platform. Tier1s and OEMs have been developing corresponding products. Specifically, C-V2X hardware products have the following forms:

- C-V2X+T-BOX on-board terminals can integrate with such technologies and products as 4G/5G module, C-V2X module, CAN controller and GNSS. PATEO’s 5G C-V2X T-BOX packs Huawei MH5000 module. PATEO has partnered with Huawei closely in communication modules since 2009, with their cooperation extending from Huawei MU203 module at first to 4G, 4.5G C-V2X and 5G C-V2X; at the 2020 C-V2X Cross-industry & Large-scale Pilot Plugfest, the fleet co-built by PATEO, Huawei and BAIC completed dozens of scenario demonstrations like V2I (vehicle to infrastructure) and V2V (vehicle to vehicle) and showed applications, for instance, AR navigation, ADAS and lane-level HD navigation map.

- The further integration of UWB / WIFI / Bluetooth keyless entry and other functional modules into all-in-one intelligent antennas already highly integrated with such as GNSS positioning module, 4G/5G and V2X may be taken into account. Honqqi E-HS9 launched in late 2020 carries the C-V2X intelligent antenna that is jointly developed with Neusoft.

- “ETC+T-BOX+C-V2X” all-in-one terminals. An example is China TransInfo Technology Co., Ltd. which integrates automotive-grade ETC and C-V2X PC5 modules into the existing passenger car 4G/5G T-Box platform to connect ETC and V2X to vehicle navigation system and ADAS.

- AR navigation and AR HUD technology will further enhance the fusion of ADAS, V2V and V2I communication technologies, becoming an important display interface for V2X. Mocha, a mass-produced model under Great Wall WEY, has carried Qualcomm 8155 cockpit chip, 5G+V2X and AR-HUD.

- Autonomous driving DCU that fuse with C-V2X can serve as redundant sensors for autonomous driving. Qualcomm Snapdragon Ride hardware stack incorporates planning, positioning (Qualcomm Vision Enhanced) and perception (camera, radar, LiDAR, sensor fusion, C-V2X). V2X software supports ITS protocol stacks subject to SAE and ETSI standards, as well as third-party ITS protocol stacks.

In general, most of the current models spawned by OEMs adopt the technical solutions integrated with V2X module and T-BOX. At present, 5G+LTE-V2X+WiFi+GNSS functions can be integrated into one module priced at RMB2,000 or so.

In future, the price will have a further drop to RMB1,000 to RMB1,500, and those based on R16/R17 5G NR will be a bit more expensive. Optimists predict that China’s passenger car C-V2X OEM terminal market will be worth more than RMB10 billion in 2025.

In addition, in an age of software-defined vehicles, Tier1s can provide OEMs with road scenario tests, middleware (ITS protocol stack) and application layer development services and charge them development and license fees, while the value of pure protocol stack providers will be highlighted.

Foreign protocol stack providers are led by Cohda Wireless, Commsignia, Savari, MARBEN and Veniam; in China, typical players are Baidu Apollo, Neusoft VeTalk, Nebula Link and iSmartWays.

Samsung Harman’s buyout of the V2X software provider Savari in March 2021 and its early investment in Autotalks enable Samsung to offer complete V2X TCU software and hardware solutions in an age of 5G. Samsung 5G V2X TCU is to be mounted on BMW iX SUV at the end of 2021.

In China, Nebula Link, an ITS software stack provider rolls out V2X stack software protocols for conventional Tier1s, for example, offering communication protocol stacks and upper application algorithm software to vehicle V2X products of JOYNEXT, a subsidiary of Joyson Electronics, which have been applied to the mass-produced model platform of one OEM in China.

In addition, V2X modules of Morningcore Technology Co., Ltd. under China Information and Communication Technology Group Co., Ltd. (CICT) integrate with CWAVE II, Nebula Link’s C-V2X national standards-compliant protocol stack. 2 million sets of CX7101N, a full-stack software and hardware integrated solution for mass-produced vehicles jointly introduced by Nebula Link and Morningcore Technology, are projected to be used in the next five years.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...