At the 2021 Shanghai Auto Show, Huawei shocked all automakers and suppliers. Huawei has directly and indirectly supported more than 10,000 engineers in the R&D of intelligent automobiles. Except production, Huawei covers almost all of aspects required for digital transformation of automobiles: automotive perception and decision-making, network communications, electric drive, batteries, electric control, cloud-road networks outside vehicles, R&D and marketing.

Compared with the previous R&D investment involved with 1,000 persons (such as Baidu), Huawei's R&D team consisting of 10,000 persons has greatly accelerated the upgrade pace of intelligent networking of China's auto industry. When other countries around the world are still worrying about the pandemic, China will enter the era of leading the development of global automotive intelligent networking from 2021.

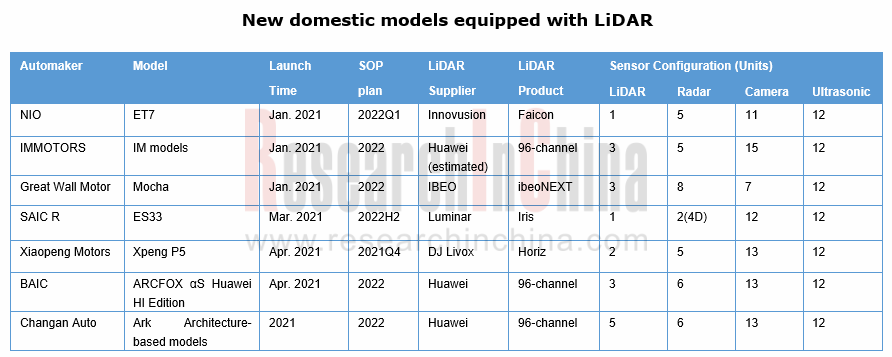

Take LiDAR installation as an example, the new models with LiDAR mainly come from domestic automakers.

On April 14, Xpeng's third mass production car, the P5, was launched. The biggest highlight is that it is equipped with two DJI Livox LiDARs, which can realize the NGP function on urban roads. Following NIO ET7, Great Wall Mocha, IM and SAIC ES33, P5 is another new model equipped with LiDAR.

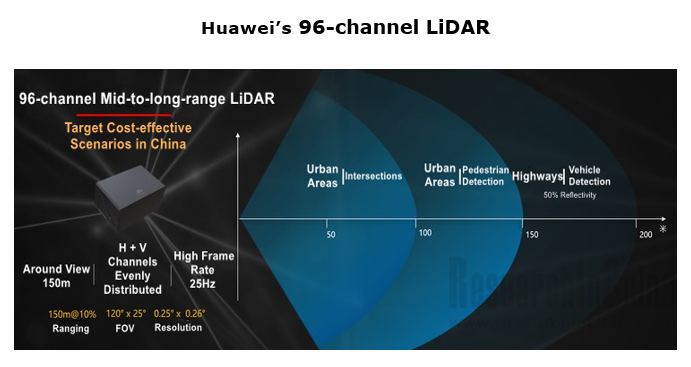

On April 17, the ARCFOX Alpha S Huawei HI equipped with three Huawei’s 96-channel LiDARs (installed on the center and both sides of the front) was officially unveiled; later, Changan’s model based on the Ark architecture will also be equipped with Huawei’s LiDAR.

The second model of Lixiang will also be equipped with LiDAR.

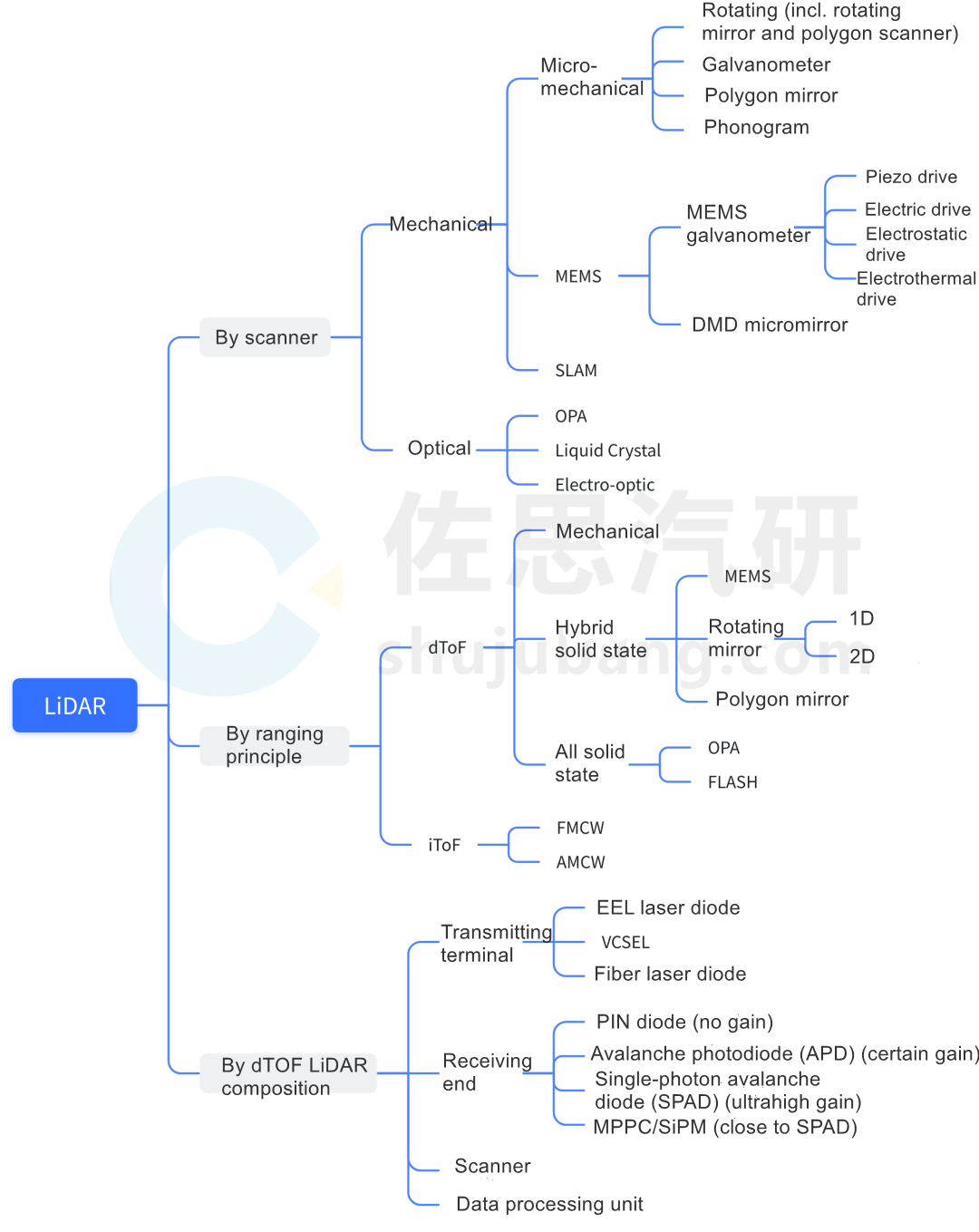

After years of development, automotive LiDAR technology roadmaps and products have been quite diversified. ResearchInChina has sorted out classification and composition of LiDAR, as shown in the figure below.

Early, LiDAR was mainly used in Robotaxi, Robotruck, Robobus, low-speed autonomous driving and roadside perception, etc. in small scale. The extensive application of LiDAR depends on the passenger car market.

As L4 technical solutions are gradually applied to L2-L3 models, LiDAR has been installed widely. LiDAR is currently available on production cars, and is mainly used to enhance ADAS functions and make new cars more appealing.

So far, domestic OEMs prefer to adopt hybrid solid-state LiDAR (including rotating mirror, prism, MEMS) solutions, mainly because:

First, it is easier to reduce the costs of hybrid solid-state LiDAR than mechanical LiDAR. Compared with pure solid-state (OPA, Flash) LiDAR, hybrid solid-state LiDAR technology is relatively mature and easier to commercialize.

Second, the Rotating Mirror Solution (represented by Valeo) is the first technical solution that meets National Automotive Standards and the performance requirements of automakers, and can be supplied in batches with controllable costs.

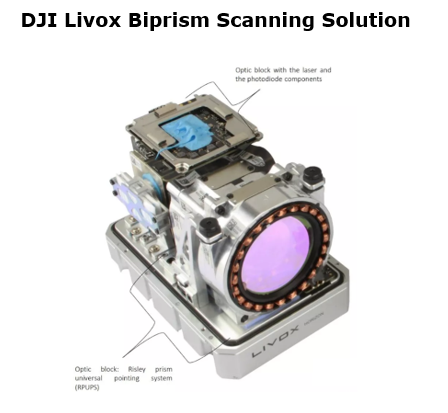

Xpeng P5 is equipped with two LiDARs (installed on both sides of the front bumper) from DJI Livox Horiz (customized version), which use the dual prism scanning solution, with the maximum detection distance of 150m (@10% reflectivity), the lateral field of view of 120 degrees, the angular resolution of 0.16°*0.2°, and the point cloud density equivalent to 144-channel LiDAR.

Xpeng Livox LiDAR uses 905nm wavelength at the transmitting side, APD at the receiving side, and double prism at the scanning side, namely Risley prism universal pointing system, with a unique non-repetitive scanning method.

ARCFOX Alpha S Huawei HI is the first model equipped with Huawei’s three 96-channel LiDARs on the center and both sides of the front. Released in December 2020, the LiDAR has the maximum detection distance of 150m (@10% reflectivity), the field of view of 120°×25°, and the resolution of 0.25°×0.26°.

Combined with other sensors (6 radars, and 13 cameras and 12 ultrasonic radars), the LiDARs can achieve 360° coverage.

Huawei deploys long, medium and short-range LiDARs with a rotating mirror scanning architecture. Like Valeo Scala 1, Scala 2, the LiDARs comply with National Automotive Standards and are available on cars.

In addition to Huawei and Valeo, Innovusion and Luminar adopt similar technical solutions which however exploit two-axis rotating mirror scanning. They will soon conduct mass production for NIO ET7 and SAIC R ES33.

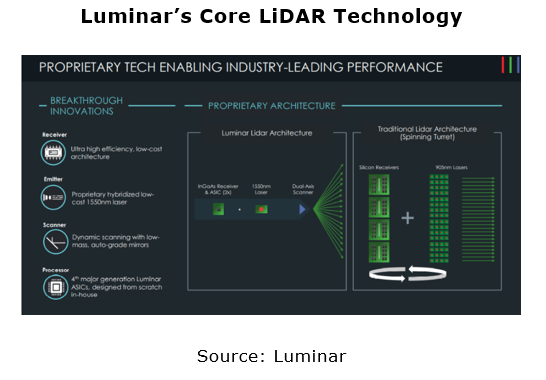

Luminar LiDAR features unique technical advantages: 1550nm wavelength (mainstream: 905nm) at the transmitting side, the low-cost InGaAs detector at the receiving side, self-made fourth-generation custom ASIC chips, and a 2D rotating mirror scanning method.

Luminar's Iris LiDAR based on this architecture has a detection distance of up to 250m (@5% reflectivity), and can detect dark objects on the road beyond 250m, with the resolution of up to 300PPD and the angular resolution of 120°×30°. At the same time, it has low costs. The price of IRIS for L2 advanced assisted driving is US$500; for L4/L5autonomous driving, it is less than US$1,000.

Innovusion and Luminar are alike in technology path. Both use 1550nm wavelength, fiber laser, and dual-axis rotating mirror scanning solution.

In January 2021, NIO ET7 was released, equipped with Innovusion's Falcon LiDAR. It will be mass-produced in 2022Q1.

In addition, RoboSense's MEMS LiDAR --- RS-LiDAR-M1 will soon be carried on Lucid Air. RoboSense released the RS-LiDAR-M1 SOP in January 2021, and will start mass production and delivery of the designated project in 2021Q2.

This product adopts RoboSense’s patented MEMS technology, with the farthest detection distance of 200m (150m@10%), the field of view of 120°×25°, and the resolution of 0.2°x0.2°.

In addition to RoboSense, players using MEMS technical solution include Innoviz, AEye, Pioneer, HESAI, Leishen Intelligent Systems, Zvision, etc. The third-generation product of Valeo’s is also based on MEMS technology.

Innoviz's InnovizOne will be installed on the new BMW iX in 2021; Valeo MEMS is expected to see mass production around 2022.

Main MEMS LiDAR Vendors and Their Typical Products

Source: ResearchInChina

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...