Automated Parking Assist (APA) and Automated Valet Parking (AVP) Industry Report, 2021

Intelligent parking research: mass adoption of AVP will begin in 2023.

Our Automated Parking Assist (APA) and Automated Valet Parking (AVP) Industry Report, 2021 combs through technology routes, business models, products and solutions of major APA and AVP suppliers, and parking intelligence of OEMs.

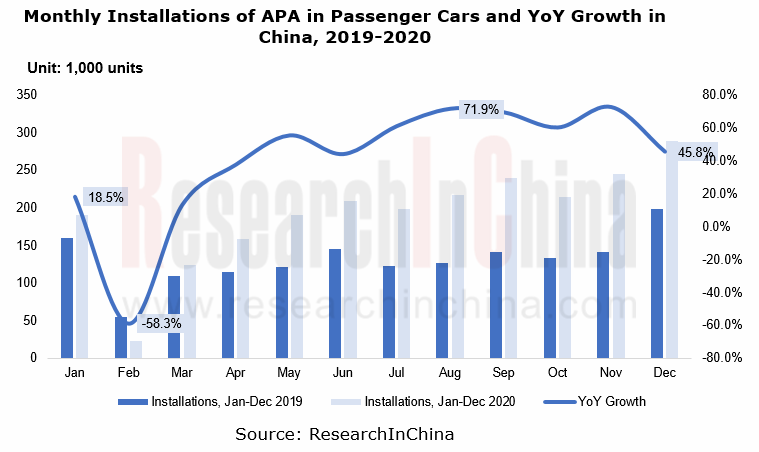

In 2020, the installation rate of APA reached 12.3%, 4.28 percentage points higher than a year ago.

According to ResearchInChina, in 2020, China had 2,308,000 passenger cars equipped with APA, an annualized upsurge of 46.4%, taking the installation rate of APA to 12.3%, up 4.28 percentage points versus 2019; in 2020, the installation rate of APA made a steady growth as a whole, but a decline in February due to the reduced passenger car sales caused by the COVID-19 pandemic.

? Wherein, among APA-enabled models that sell well, most are foreign brands like Mercedes-Benz, BMW and Buick.

? Fully automated parking assist (F-APA) and remote parking are major intelligent parking system solutions at present.

? In OEM market, L3 memory parking and L4 APA capabilities begin to become available to mid-to-high-end and luxury models.

For AVP single vehicle intelligence technologies, memory parking is firstly landed; at the parking lot end, AVP is firstly used in P3 and P4 parking lots.

Automated valet parking (AVP) allows a user who gets off at the designated drop-off point to send a parking instruction via the mobile APP to his/her car which will then drive itself to the parking spot without manual operation and monitoring; as the user gives a pick-up instruction on the APP, the car following the instruction will automatically go to the designated pick-up point; if several cars receive the parking instruction at the same time, they will wait to enter the parking space one after another automatically.

The study shows that AVP that renders vehicles more intelligent can promote vehicle sales, cut down 30% operating cost for parking lots, reduce 10% invalid traffic time in parking lots, and save 10-15 minutes in vehicle pick-up and returning.

The AVP market accommodates large numbers of players which mainly provide three technology solutions: single vehicle intelligence, parking lot intelligence, and vehicle-parking lot cooperation. Of them, single vehicle intelligence primarily supplied by Baidu and ZongMu Technology are most often used by OEMs. In September 2020, at Auto China, the full-size E-HS9 SUV BEV of New Hongqi started pre-sale. This model packs AVP system from ZongMu Technology.

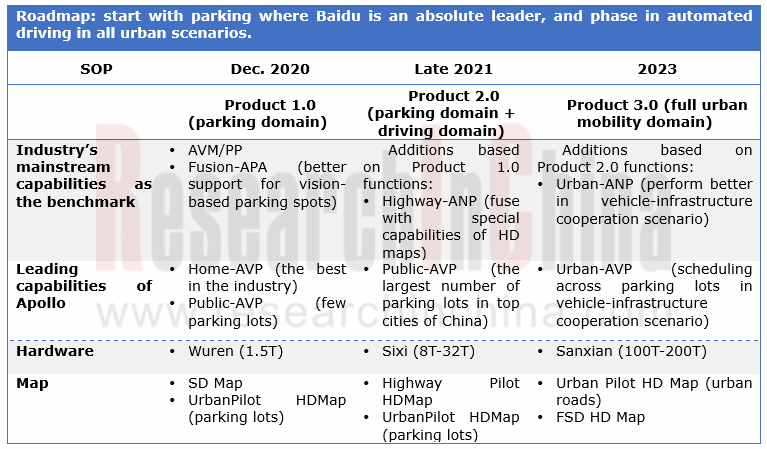

Baidu is a typical provider of AVP single vehicle intelligence solutions. The firm has planned the implementation route for AVP system from short distance to long distance, from easy to difficult. The memory parking (Home-AVP) is the first one to be landed.

? Home-AVP: memory parking. From elevator to parking spot, learn one time; users summon or return cars outside using their mobile phones, and their cars can drive themselves;

? Public-AVP: from any pick-up or drop-off point in the parking lot, users park their cars anywhere in the parking lot, and the cars will automatically find a parking space; the summoned cars will drive themselves to the place designated by users;

? Urban-AVP: from pick-up or drop-off point at most 1km away from the parking space to the parking space, users can summon or return their cars at their will, and the cars will drive themselves.

Bosch is a typical parking lot intelligence solution provider. Together with Mercedes-Benz and the parking lot operator Apcoa, Bosch has deployed a set of AVP system for trial commercial operation at the car park P6 at Stuttgar Airport.

Vehicle-parking lot cooperation solution providers are led by Huawei. The solution is the hardest one to be commercialized for it is difficult to coordinate multiple stakeholders involved (e.g., property companies, independent parking solution providers, OEMs, and mobility platform operators).

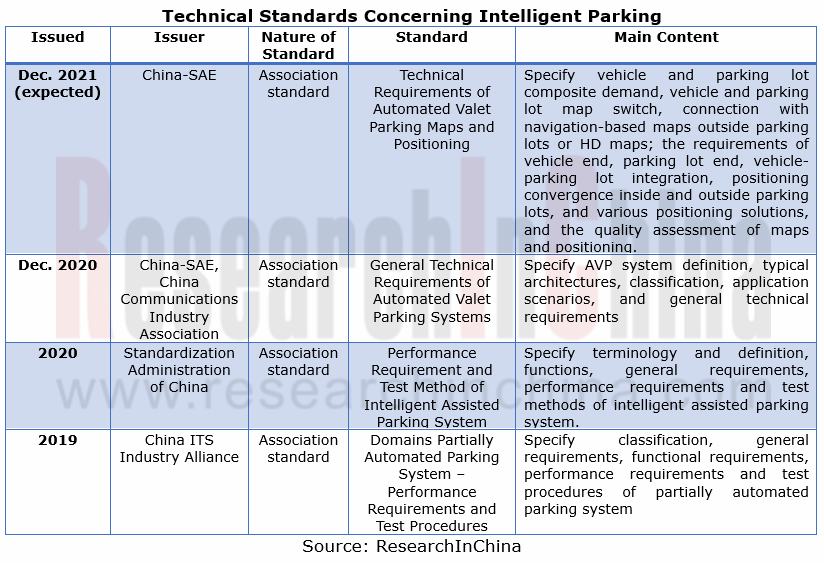

The General Technical Requirements of Automated Valet Parking Systems firstly defines parking lot standards.

In current stage, AVP standards are mainly formulated by associations. To fill the gaps in AVP industry standards in China and deal with the challenge of AVP compatible with multiple solutions, China-SAE and China Communications Industry Association introduced the General Technical Requirements of Automated Valet Parking Systems (T/CSAE156-2020) in December 2020.

The standard covers the three technology routes: single vehicle intelligence, parking lot intelligence and vehicle-parking lot cooperation. It has four parts of content: system definition, security application scenarios, general technical requirements of the system, and general technical requirements of testing.

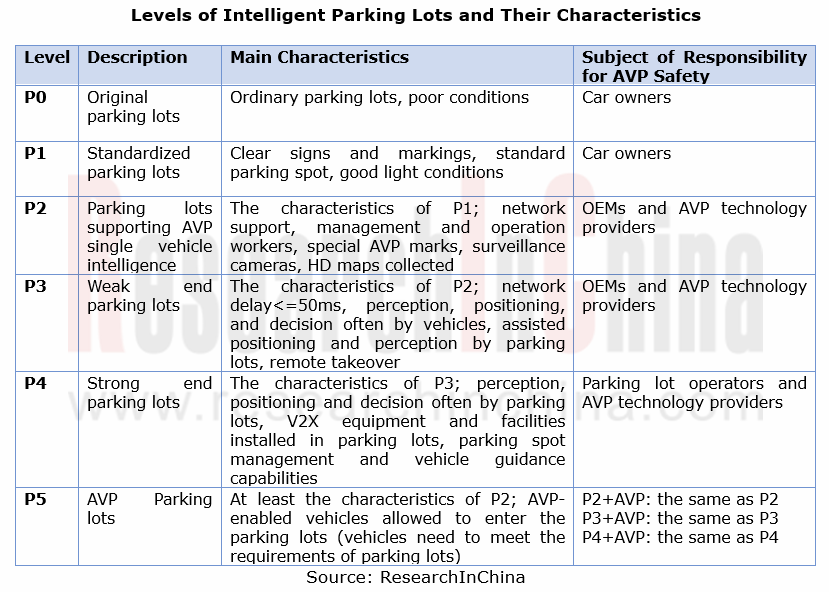

The General Technical Requirements of Automated Valet Parking Systems defines levels of intelligent parking lots: P0, P1, P2, P3, P4 and P5. . On this basis, we have extended interpretation of these levels, as follows:

According to the table above, P2 parking lots meet the conditions needed by AVP single vehicle intelligence; P4 parking lots are basically qualified for being AVP parking lots at the strong end; P3 parking lots meet the conditions of AVP parking lots at the weak end, with most CVIS solutions deployed in P3 parking lots.

Most insiders argue that CVIS is the future of AVP. After exchanges with experts, we believe any technology roadmap needs a subject of responsibility for safety, that is, who takes charge of the safety of AVP system, vehicle end or parking lot end? We think the subject of responsibility at the strong end should be parking lot operators and AVP technology providers, and at the weak end, the OEMs and AVP technology providers.

Application of AVP in P2 parking lots needs L4 intelligent vehicles which are however unlikely to be mass-produced shortly (before 2025). Even if P2 parking lots are built, there will be few vehicles available. So before 2025, parking lots (P3/P4) that support CVIS solutions have plenty of room for growth.

As a substandard of the General Technical Requirements of Automated Valet Parking Systems, the Technical Requirements of Automated Valet Parking Maps and Positioning is under discussion and expected to be drafted in December 2021. The study of other AVP substandards such as AVP parking lot communications, AVP test and memory parking is in the pipeline.

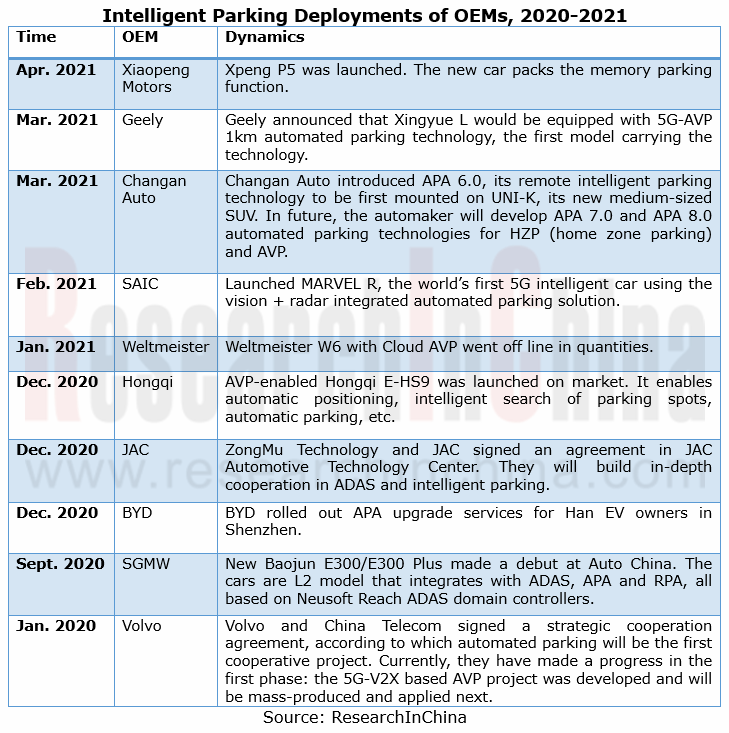

OEMs step up R&D of intelligent parking systems for mass production

OEMs are accelerating R&D of intelligent parking systems for mass production by way of independently developing or seeking external collaborations. Some OEMs like Weltmeister have achieved AVP for L4 automated driving in designated scenarios through working with Baidu; Geely with 5G-AVP technology enabling 1km autonomous parking will step into exploration of intelligent cloud based AVP; with a plan of trying to equip some of its models with memory parking function in late 2020, GAC has installed AVP function in some high-end and luxury models in 2021H1; Great Wall Motor and Baidu Apollo have worked together on mass production of AVP, and announced to spawn AVP-enabled vehicles in 2021.

There is a common belief that the pace of AVP system testing will quicken to gear up for use in vehicles between 2021 and 2022, and the mass adoption of AVP system will begin in 2023.

For parking business models, parking lot operators, OEMs and AVP solution providers make profits by charging AVP subscription fee or pay-per-use billing. Parking lot operators also make benefits with value-added services derived from intelligent parking systems. An example is Bosch which combines electric vehicle automatic charging, autonomous washing of vehicles and express delivery to provide complete solutions for parking lot operators.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...