Global and China Automotive Intelligent Cockpit Platform Research Report, 2021

Next-Generation Intelligent Cockpit Platform: Deep Domain Integration, Pluggable Hardware, Reusable Software

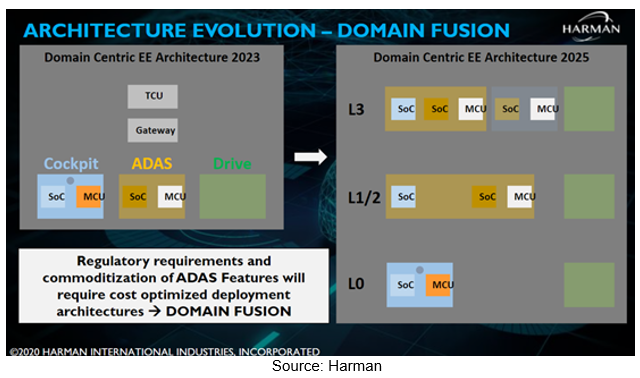

As new-generation E/E architectures evolve, deep integration of cockpit domain may become a trend.

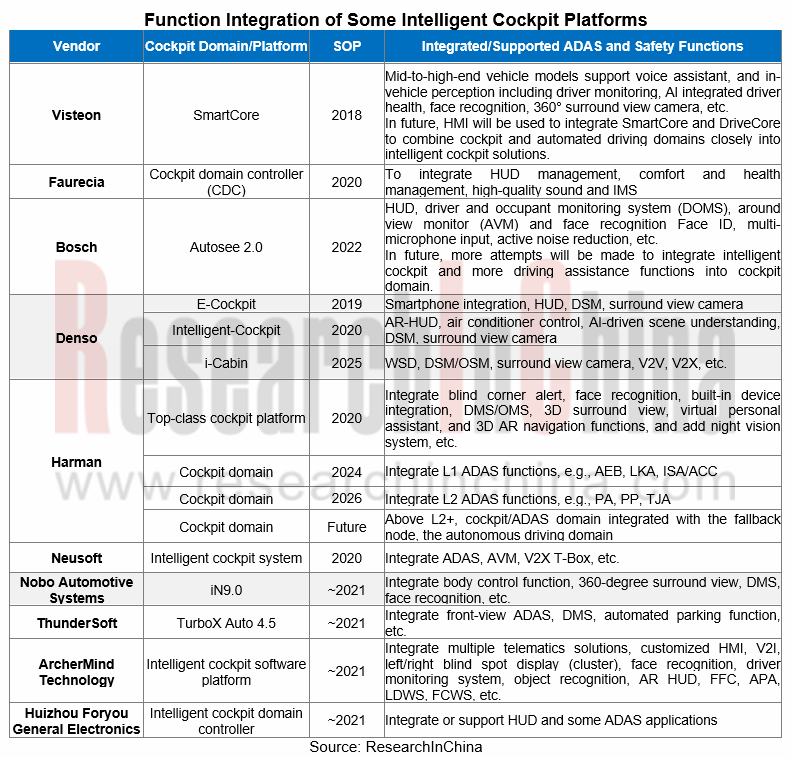

The development of automotive E/E architectures comes with the integration of ADAS functions and V2X systems into the cockpit domain that already combines conventional cockpit electronics.

Through the lens of function integration, the cockpit domain tends to be integrated. As well as basic capabilities including dashboard and center console, rear seat entertainment, HUD and voice, quite a few suppliers currently integrate also surround view camera, DMS, IMS and some ADAS functions into their intelligent cockpit platforms.

In Harman’s case, its cockpit platform already integrates L0 ADAS functions from AR navigation and 360° surround view to DMS/OMS and E-mirror. In future, Harman will combine intelligent cockpit domain controller and ADAS domain controller to support L1~L2+/L3 capabilities, giving OEMs scope for lowering their costs and simplifying systems.

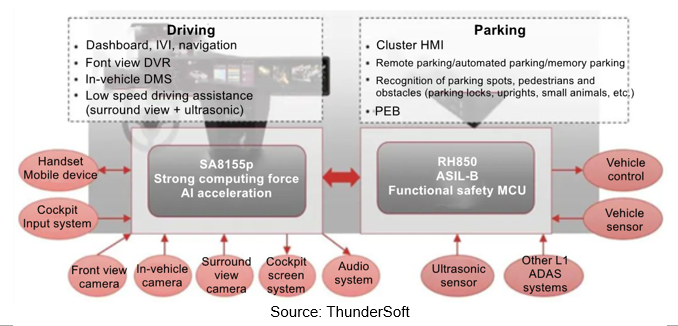

In 2021, ThunderSoft also introduced TurboX Auto 4.5, its new-generation intelligent cockpit platform that allows the cockpit to integrate DMS and automated parking solution and interact with ADAS scenarios. Its intelligent cockpit that can start the built-in computing platform in the parking process optimizes low speed driving with stronger computing force or assists the driver in parking, providing better driving experience.

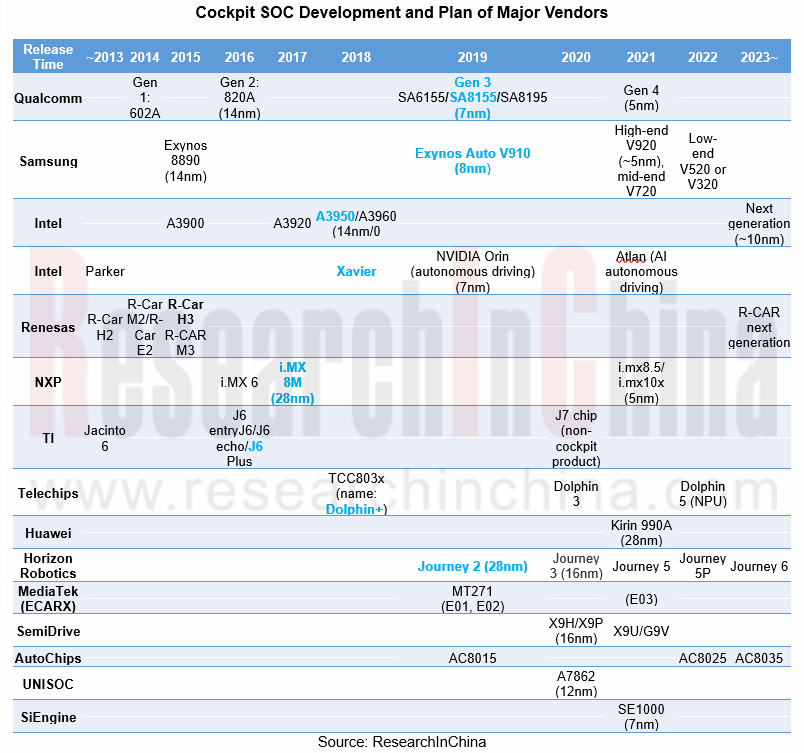

Cockpit SoC trends: stronger CPU and AI computing force, more displays and sensor interfaces, modular and renewable

With a tendency towards intelligent cockpit multi-sensor fusion, multi-mode interaction and multi-scene mode, cockpit SoC as the processing center needs breakthrough upgrades. The next-generation cockpit SoC will head in the following directions:

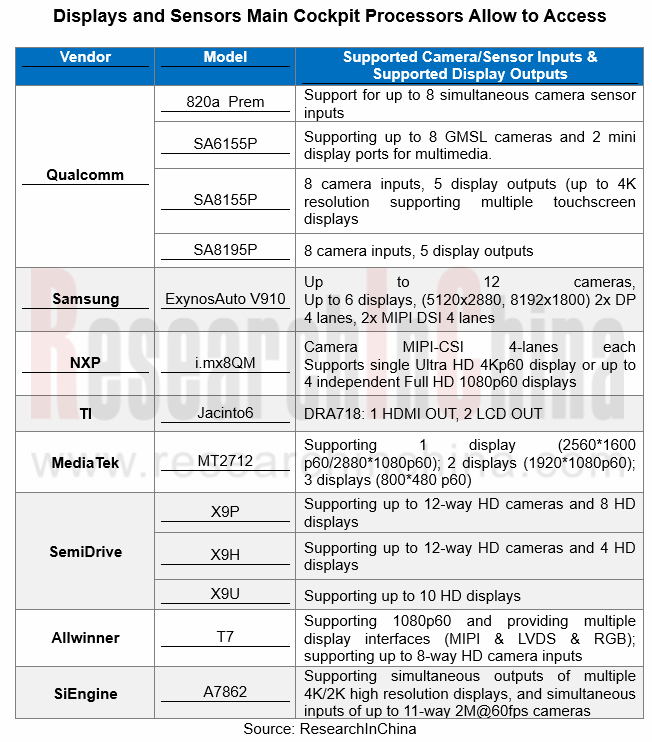

1. Increasingly strong CPU computing force: for example, Qualcomm Snapdragon SA8155P chip and SA8195P CPU boast computing force of 85KDMIPS and 150KDMIPS, respectively; SemiDrive’s latest X9U cockpit chip features CPU computing force of up to 100KDMIPS.

2. Needs for ever stronger AI computing force that allows the driver to interact with voice, graphics and even vehicle functions. In current stage, some mass-produced cockpit SoCs are embedded into AI accelerated computing platforms, affording computing force of 1~5TOPS. Examples include Nvidia Parker for Mercedes-Benz's first-generation MBUX, with AI computing force of 1TOPS, and Samsung’s mass-produced Exynos Auto V910 with AI computing force of approximately 1.9TOPS and its Exynos Auto V920 cockpit chip to be spawned around 2025 with NPU computing force of 30TOPs.

3. Access to more vehicle displays and sensors. For example, Qualcomm 8155/8195 supports up to 8 sensor outputs and 5-way displays; Samsung V910 supports 6-way displays; X9U, SemiDrive’s latest intelligent cockpit chip unveiled at Auto Shanghai 2021 supports 10 HD displays.

4. More advanced chip process. At present, 7nm and 8nm cockpit chips such as Qualcomm 8155/8195 and Samsung V910 have been mass-produced. Qualcomm’s new fourth-generation Snapdragon automotive cockpit chip adopts 5nm process and is projected to be produced in quantities in 2022.

5. Faster chip iteration, shorter release cycle. New cockpit chips are released every 1 or 2 years compared with previous 3 or 5 years, showing faster iteration.

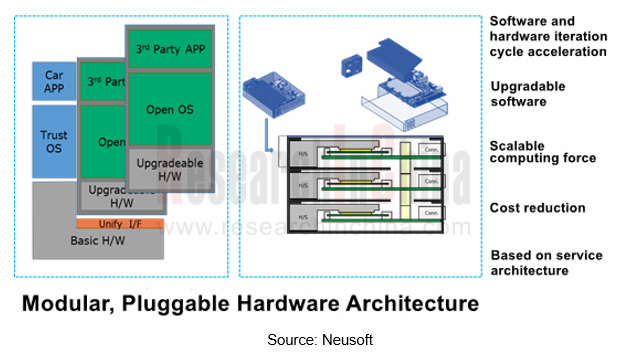

6. Cockpit SoC also tends to be modular, replaceable and scalable. In April 2021, Huawei released 9610, an IVI module with built-in Kirin 990A automotive chip. The chip module featuring pluggable design can be upgraded by way of replacing central processing unit every three years, and each generation with the same interfaces allows direct replacement, covering the full life cycle of vehicles.

Neusoft Vehicle Computing Platform (VCP) also allows flexible, free configurations with hardware plug and unplug. The separation of the computing unit from the functional unit successfully decouples the software and hardware development process, making it a reality features and advantages like upgradable hardware, sharable computing force and scalable software, to build more flexible business models for automakers.

Cockpit software platform: a standard, scalable, open integrated basic software platform

Quite a few technology firms including Continental EB, ThunderSoft, Neusoft Reach, Huawei, ArcherMind Technology and Banma Information Technology have made deployments in intelligent cockpit software platform.

At present, decoupling and separating the intelligent vehicle cockpit software and hardware has been a common belief. Based on service oriented architecture (SOA), the decoupling and reuse of vehicle software and hardware at the underling layer enable rapid iteration of software functions, and the interaction with users over the air (OTA) helps to deliver personalized and differentiated cockpit product experience.

TurboX Auto 4.5, ThunderSoft’s SOA-based intelligent cockpit platform, enables decoupling of scenarios and services, and rapid development and iteration of scenario services.

Besides needed rapid iteration of cockpit software, reusability, scalability and enough flexibility should also be taken into account in SOA design so that the needs for a mass of inputs can be satisfied with minimal software change.

Neusoft already builds its general standard software architecture and software platform that can fast adapt to different mainstream SoC hardware platforms, and help to realize mass production of high-, mid- and low-end multi-platform intelligent cockpits shortly to meet the needs of different OEMs.

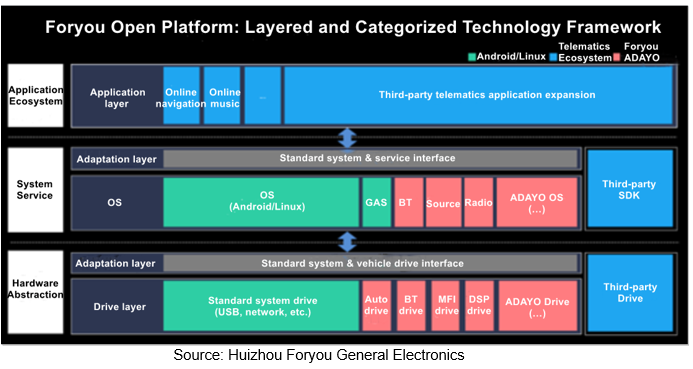

In Jul. 2020, Foryou introduced ADAYO Automotive Open Platform (AAOP) which decouples the telematics software ecosystem at the upper layer and the hardware ecosystem at the underlying layer. AAOP focuses on the intelligent cockpit platform. Based on the standard, modular, layered and categorized software framework of AAOP, Huizhou Foryou General Electronics’ software development model can be transformed from project-based embedded software delivery to layered, categorized software development, which accelerates research and development, reduce R&D preparations and improve R&D efficiency.

Automotive market business models are undergoing disruption. Under the new cooperation model, components suppliers and OEMs partner more closely, and their joint development of cockpit software platforms will become a trend. Tier1s have even been a part of automakers’ engineering design, even partaking in their product design. Platform-based open cooperation on both hardware and software holds a trend. Tier1s are becoming so-called Tier0.5s, while Tier2s work towards Tier1s.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...