Autonomous Driving Simulation Industry Chain Report, 2020-2021 (II)

In addition to simulation closed-loop platform and vehicle dynamics simulation mentioned in the Autonomous Driving Simulation Industry Chain Report, 2020-2021 (I), autonomous driving simulation also involves traffic flow simulation, scenario simulation and sensor simulation modules. The Autonomous Driving Simulation Industry Chain Report, 2020-2021 (II) sorts through companies in these areas.

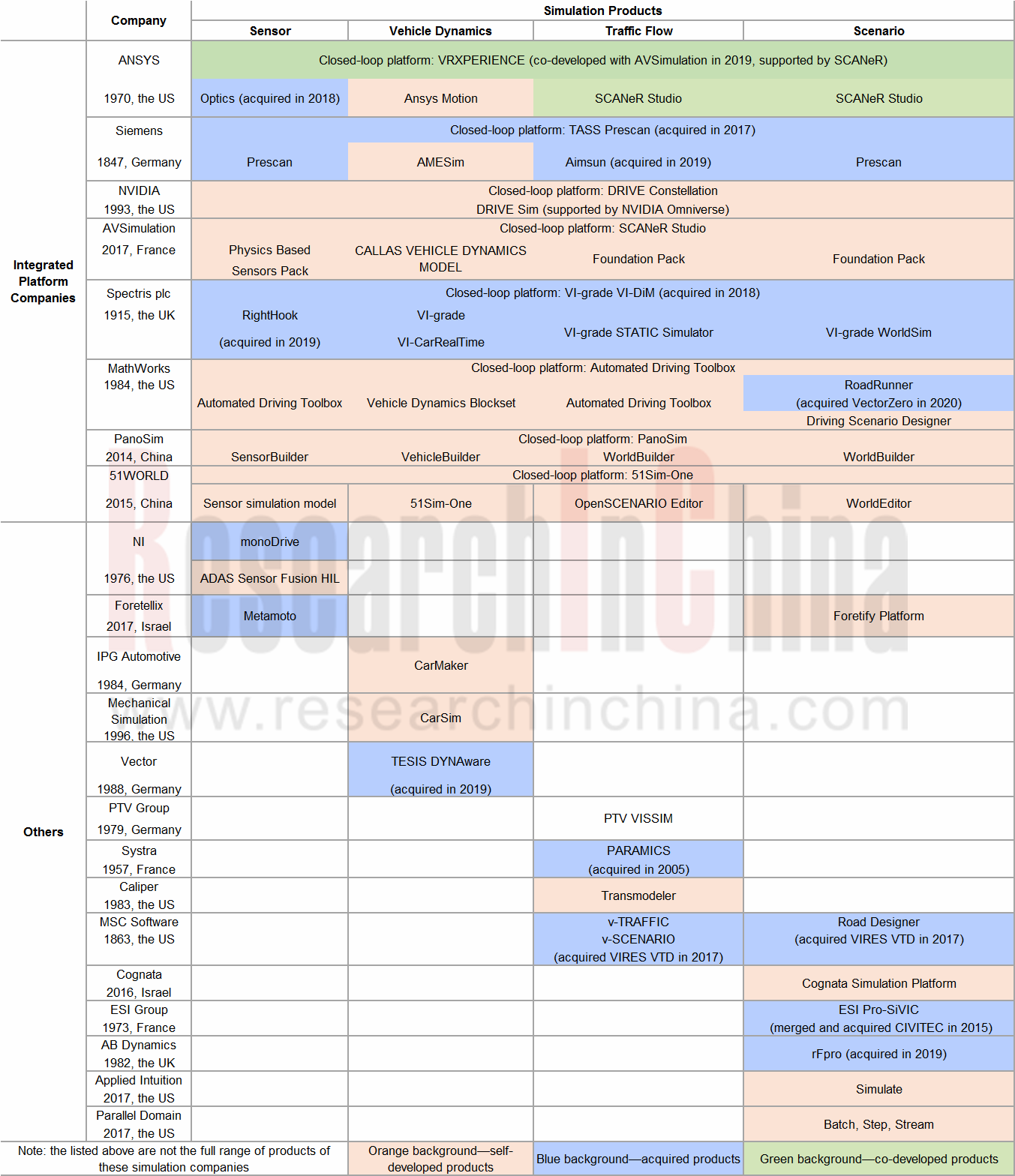

Product Distribution of Some Autonomous Driving Simulation Companies

Acquisitions (or mergers and acquisitions) are, beyond doubt, a shortcut for companies to better technology layout. Autonomous driving simulation is no exception. Ansys’ acquisition of the optical simulation software provider OPTIS and Siemens’ purchase of TASS have been milestones in their development histories of autonomous driving simulation technology.

The more mature the autonomous driving simulation industry becomes, the higher barriers the industry poses. Technology and capital walls put up by simulation giants have been a big hindrance to the growth of start-ups. Players that just specialize in their own field may end up with being acquired or introducing external support. They cannot escape from tycoons at last.

Acquiring these specialized leaders has been an easy way for giants to perfect their layout

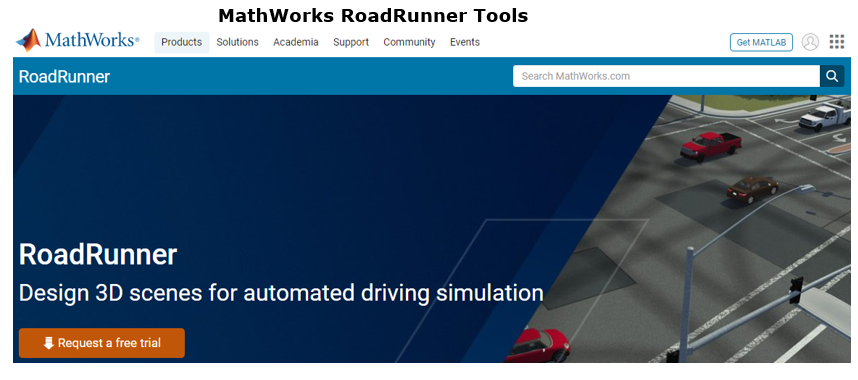

1. VectorZero, the owner of the scenario editor RoadRunner, was acquired by MathWorks, an integrated simulation platform, and its simulation tools were included in MATLAB/Simulink product system.

RoadRunner owned by VectorZero is a scene editor. It can create environments and roads, generate complex road networks composed of roundabouts, intersections and bridges, and custom traffic signs and markings.

Benefits of RoadRunner:

①A variety of editing tools: road tools, junction tools, lane tools, marking tools, prop tools, etc.;

②Quick 3D scene modeling: RoadRunner Asset Library lets users quickly populate their 3D scenes with 3D models.

MathWorks just settles on RoadRunner’s 3D scene capabilities.

In April 2020, the integrated simulation platform MathWorks acquired VectorZero, and brought RoadRunner tools for designing 3D scenes for automated driving simulation, into its MATLAB/Simulink product system.

In May 2020, MATLAB R2020a Version added RoadRunner tools to Automated Driving Toolbox.

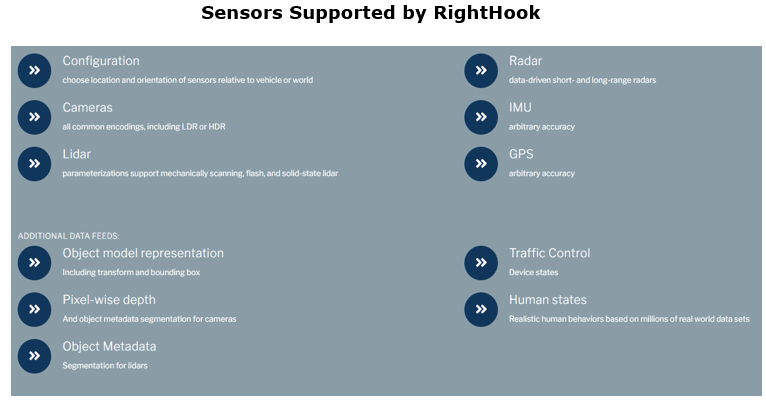

2. The integrated simulation platform Spectris plc acquired VI-grade (vehicle dynamics simulation) and RightHook (sensor simulation).

In July 2018, Spectris plc acquired VI-grade, a vehicle dynamics and driving simulator player, for a foray into the vehicle testing and simulation field.

In February 2019, Spectris plc bought RightHook, a sensor simulation firm, and then merged it into VI-grade.

Benefits of RightHook:

①Provide a complete simulation tool chain including RightWorld and RightWorldHD, RightWorldHIL;

②Enable HD map-based simulation, and rebuild the whole simulation environment according to the HD maps used by autonomous driving companies. The test environment is real driving environment.

VI-CarRealTime, VI-grade’s vehicle dynamics model, provides a set of dynamics simulation services such as hardware/software in the loop.

In November 2020, VI-grade introduced VI-WorldSim that provides urban and public road test environments for ADAS and autonomous vehicles. VI-WorldSim features include traffic, pedestrians, lighting, weather, and sensors to enable users to create and test scenarios for vehicle development programs through an intuitive and easy-to-use desktop editor.

Noticeably, for this product, RightHook provides integrated visual environment for driving simulators, which means the two companies have merged in terms of operation and products.

Start-ups double down on financing, hoping to change the fate of “being acquired”.

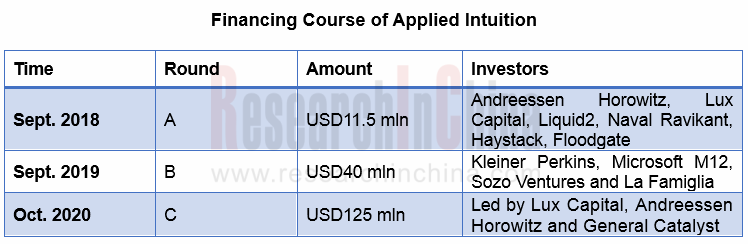

1. Applied Intuition raised USD125 million.

Applied Intuition was founded by Qasar Younis and Peter Ludwig (former workers of Google) in 2017. The company recorded roughly USD26 million in revenue in 2020. The edge of Applied Intuition lies in the ability to use real/synthesized data to build complex scene interactions in a short time and generate thousands of permutations to cover edge scenarios. Meanwhile, in the simulation process, the dashboard of the virtual vehicle can display “the impact of virtual intersections and obstacles on vehicle acceleration and passenger comfort”, and other information.

On October 22, 2020, Applied Intuition raised USD125 million in a Series C funding round led by Lux Capital, Andreessen Horowitz, and General Catalyst, which took its market capitalization to USD1.25 billion.

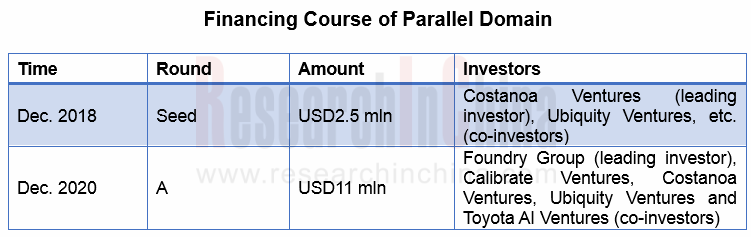

2. The scenario simulation startup Parrallel Domain raised USD11 million in a Series A funding round where Toyota was a co-investor.

Parallel Domain was founded by Kevin McNamara (with a background in Apple autonomous driving technology) in 2017. Parallel Domain can synthesize a variety of scenes (e.g., day, night, fog, rain and city) for sensors (including LiDAR and camera), and also can embed complex elements (e.g., traffic lights, vehicles, pedestrians and animals) in scenes. Its simulation platform provides abundant metadata for users to test various new sensors and technical configurations.

In October 2020, Parallel Domain raised USD11 million in a Series A funding round led by Foundry Group and co-invested by Calibrate Ventures, Costanoa Ventures, Ubiquity Ventures and Toyota AI Ventures.

3. The scenario simulation company Cognata added partners including Hyundai Mobis, Atlatec and Ouster between 2020 and 2021 for accelerating commercialization of products.

Combining artificial intelligence, deep learning and computer vision, Cognata reproduces cities on its 3D simulation platform, providing customers with a range of test scenarios that simulate real-world test driving. In 2020, Cognata increased several partners, gathering pace in product application and variety.

①In November 2020, Cognata teamed up with Atlatec to support Atlatec’s HD maps on the Cognata simulation platform, providing customers with the ability to extend the catalogs of accurate environments available for large-scale virtual validation;

②In January 2021, Cognata and Ouster partnered up in order to develop an accurate virtual LiDAR model in Cognata’s simulation software.

According to the 2020 Blue Paper on Autonomous Driving Simulation of China, the current distribution of autonomous driving algorithm tests is as follows: around 90% tests are completed on simulation platforms, 9% in test fields and 1% on public roads. As simulation technology advances and becomes widespread, the industry aims at 99.9% tests carried out on simulation platforms, 0.09% in closed scenarios and 0.01% on real roads. In the second half of autonomous driving, the commercial use will bring soaring demand for testing, which may catalyze a new round of shuffle in the simulation industry.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...