Automotive Vision Research: With the division of labor, Mobileye's share in China is expected to exceed 55%

With the development of smart cars, the industry has gradually reached a consensus on "software-defined cars" whose core lies in the separation of software and hardware as well as embedded hardware. From January to May of 2021, many new cars released in China, such as NIO ET7, SAIC R ES33, IM L7, Xpeng P5, ARCFOX αS Huawei HI, ZEEKR 001 and so on, were embedded with a large number of sensor hardware, especially cameras, to achieve ADAS functions above L2/L2+.

In the future, as new cars equipped with high-speed autonomous driving, urban autonomous driving, and memory parking increase in volume, the demand for perception around and inside cars will further rise. It is estimated that more than 11 cameras are generally required for L2+ and above, and over 15 vision-based cameras for L4\L5.

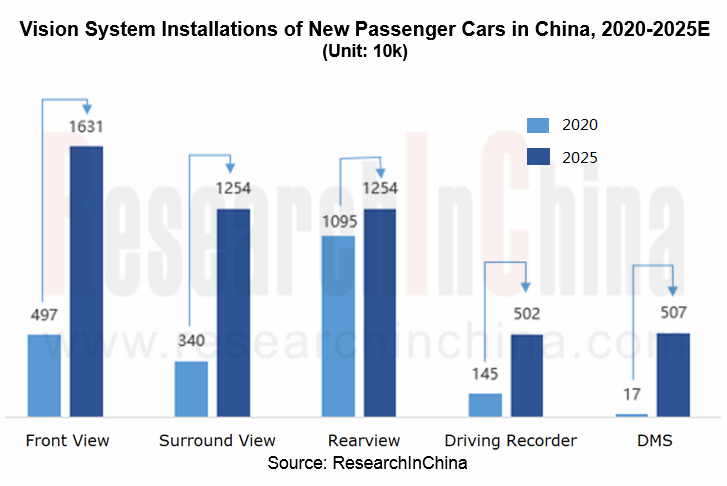

It is estimated that more than 16 million passenger cars in China will be installed with front view system in 2025

Front View: In 2020, 4.968 million new passenger cars in China were equipped with front view, up 62.1% year-on-year; the installation rate was 26.4%, a year-on-year increase of 10.9 percentage points. With the improvement in the computing power and increase of functions of front view system and the relative cost advantage, it is estimated that more than 16 million passenger cars in China will be installed with front view system in 2025 with the installation rate of 65%.

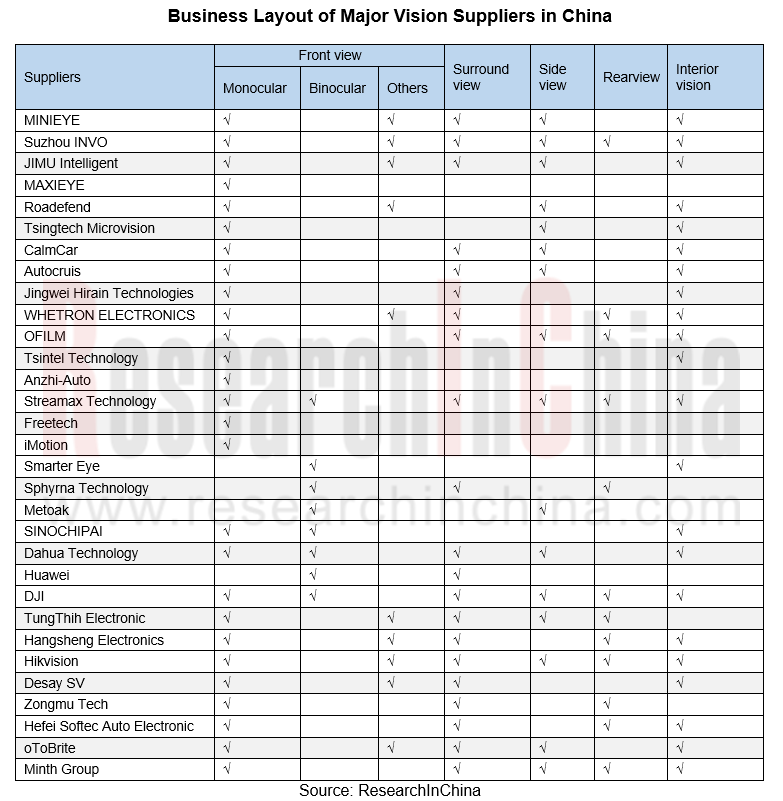

Currently, the front view monocular solution is the mainstream solution for Chinese passenger cars, and some companies are also exploring the application of front view cameras such as binocular cameras. In 2021, Huawei and DJI successively launched self-developed binocular cameras and solutions. Huawei's binocular cameras have been applied on ARCFOX Alpha S. DJI also plans to apply the binocular camera autonomous driving solution to Chinese models in 2021.

Surround View: In 2020, surround view system was available in 3.398 million cars in China, an increase of 44% over 2019; the installation rate was 18%, up 6 percentage points year-on-year. With surround view system's replacement of rearview and the addition of parking functions, surround view system installations will further jump. As surround view system is an alternative to rearview and the 360° surround view + ultrasonic solution becomes the mainstream solution for integrated parking, 360° surround view has entered a new development stage. It is estimated that the installation rate will rise to 50% in 2025.

Visual DMS: According to ResearchInChina, more than 10 new passenger car models, such as Changan Automobile, NIO, Xpeng, WEY, EXEED, Neta, Leapmotor, Geely, WM Motor, GAC Aion, etc., in China was equipped with DMS in 2020. In 2020, DMS was seen in 173,000 cars, with the installation rate of 0.9%. By 2025, the installation rate is expected to leap to be about 20%.

In April 2021, the Ministry of Industry and Information Technology issued Access Management Guide for Intelligent Connected Vehicle Manufacturers and Products (Trial), requiring intelligent connected vehicles to have HMI and driver monitoring functions, which released strong signals of mandatory DMS installation.

Driving Recorder: In 2020, 1.453 million cars in China had driving recorders, an increase of 7.6% compared to 2019. Meanwhile, the installation rate of driving recorders was 7.7%, up 0.9 percentage points from 2019.

Access Management Guide for Intelligent Connected Vehicle Manufacturers and Products (Trial), which requires intelligent connected vehicles to feature event data recording and autonomous driving data storage, will accelerate the assembly of driving recorders on new vehicles. The installation rate is expected to be 20% by 2025.

Mobileye enjoyed about 30+% share of China’s passenger car front view chip market in 2020, and it expects to seize over 55% in 2025

According to ResearchInChina, the main suppliers of passenger car front view system in China include Denso, Bosch, Aptiv, Kostal, Panasonic, Veoneer, Continental, Jingwei Hirain Technologies, etc. The top 10 suppliers in 2020 occupied more than 90% of the market share. In China, only Jingwei Hirain Technologies was shortlisted, with a market share of 3.6%.

The chip (algorithm) supply of front view system generally has two modes: the self-developed mode (from the core chip to system integration) and the division of labor mode (the core chip is supplied by a company (such as Mobileye) while the system is integrated by Tier1 suppliers.

For example, Jingwei Hirain Technologies mainly uses Mobileye's chips for its front view system to realize the functions of identifying vehicles in front, lane lines, and pedestrians. Major customers include SAIC MAXUS, FAW Hongqi, FAW Jiefang, FAW Besturn, Roewe, MG, Geely, JMC, JAC, Sinotruk, Shaanxi Heavy Duty Truck and other automakers.

In addition to Jingwei Hirain Technologies, Aptiv, ZF, Kostal, Wistron, Yihang AI, iMotion, etc. have also established long-term cooperative relationship with Mobileye. According to ResearchInChina, Mobileye enjoyed about more than 30% share of China’s passenger car front view chip market in 2020. At the same time, Mobileye continued to contact new OEMs and Tier 1 suppliers, such as Great Wall Motors, Dongfeng Motors, and Toyota. It launched a full-scale deployment plan with Volkswagen and Ford. It is expected that its market share will reach more than 55% by 2025.

Great Wall Motors: In 2019, Great Wall Motors said that L0-L2+ADAS based on Mobileye‘s technology will be integrated into a series of models in the next 3-5 years. In 2020, Big Dog, the third-generation H6, and Tank 300 were all equipped with the “monocular camera + Mobileye EyeQ4 chip vision” solution, which has realized the autonomous driving function of L2 and above.

Dongfeng Motor: ZF has launched its coASSIST L2+ semi-automated driving system on the 2020 Dongfeng Aeolus Yixuan which was launched late in 2020. ZF coASSIST is the cost-effective (the price is less than $1,000) L2+ solution that helps meet Euro NCAP performance requirements while delivering the most popular Level 2+ ADAS functions utilizing Mobileye, an Intel Company, EyeQ ? technology. In the next few years, it will be applied to Dongfeng Aerolus Yixuan MAX.

Toyota Motor: In May 2021, ZF and Mobileye were chosen by Toyota Motor to develop ADAS for use in multiple vehicle platforms starting in the next few years. Prior to this, Toyota mainly adopted Denso's solutions.

It can be seen that the division of labor mode is more recognized by OEMs. In addition to Mobileye, Horizon Robotics is also making efforts in the field of vision chips.

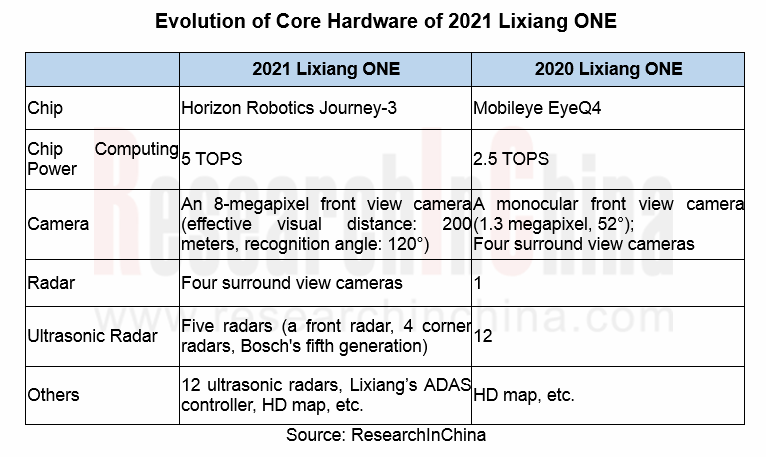

The 2021 Lixiang ONE, released in May 2021, is equipped with two Journey-3 processors developed by Horizon Robotics, an 8-megapixel front view camera (effective visual distance: 200 meters, recognition angle: 120°), four surround view cameras, five radars, 12 ultrasonic radars, Lixiang’s ADAS controller, and NOA navigation assistance driving capabilities.

Domestic suppliers consolidate the commercial vehicle market while working hard on the passenger car OEM market

Since 2017, the commercial vehicle ADAS market has been booming thanks to the mandatory installation of early warning functions such as LDWS and AEBS. Leading companies such as Continental and ZF have launched ADAS and integrated solutions for commercial vehicles. China-based MAXIEYE, Jingwei Hirain Technologies, JIMU Intelligent MINIEYE, etc. have received orders from commercial vehicle OEMs, and realized the large-scale mass production of L1 assisted driving.

While consolidating the advantages in the commercial vehicle ADAS market, local suppliers represented by Suzhou INVO, MINIEYE, MAXIEYE, Freetech, iMotion, etc. have begun to make efforts in the L2 (or above) passenger vehicle ADAS market.

MINIEYE: MINIEYE has secured passenger vehicle projects of BYD and JAC. In March 2021, it was designated by a new energy OEM to conduct a L2+ mass production project. On the basis of Huawei’s MDC 210 platform, it adopts a multi-sensor fusion solution with AEB, ACC, LKA, HWP, TJP and other functions. In addition, it is co-developing L0-L3 autonomous driving perception solutions with Xilinx; it is cooperating with SMART on L3 (or above) ADAS.

MAXIEYE: In October 2020, MAXIEYE won the domestic L2+ production passenger car model project, providing products based on IFVS - intelligent forward visual perception system, which can realize LKA, LCK, AEB, ACC, TJA, ILC, ELK and other functions. In April 2021, in cooperation with HYCAN (formerly GAC NIO New Energy), MAXIEYE will gradually implement the L3 autonomous driving in high-speed scenarios and the L2+ driving assistance system in open urban roads.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...