Chassis-by-Wire Research: China’s Brake-by-Wire Assembly Rate Is only 2%, Indicating Huge Growth Potentials

With the mass production of L3-L4 autonomous driving, the necessity of Chassis-by-Wire has become increasingly prominent. What is the status quo of Chassis-by-Wire? What is the more advanced product form? Who will lead this market?

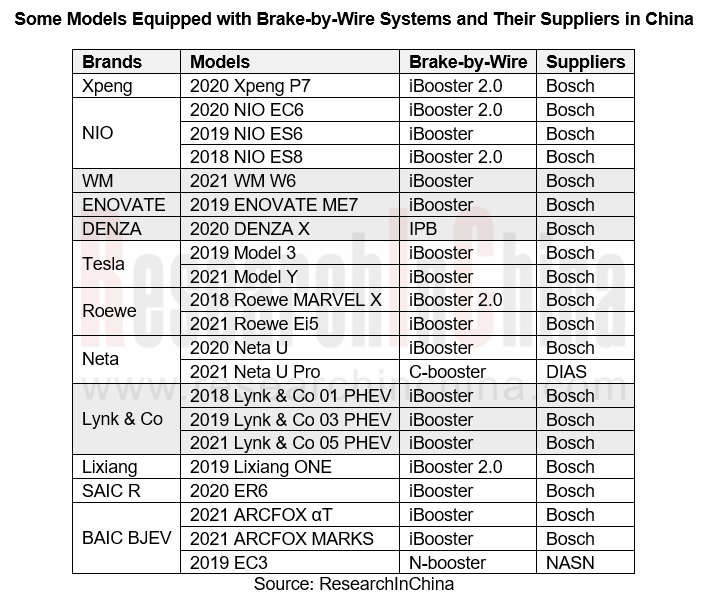

1. Brake-by-Wire takes the lead in mass production, and Bosch dominates the field

There are two key Chassis-by-Wire products: Brake-by-Wire and Steer-by-Wire. Brake-by-Wire has taken the lead in mass production thanks to the demand from new energy vehicles and L3 autonomous driving. China's Brake-by-Wire assembly rate was 1.6% in 2020, and it is expected to exceed 2.5% in 2021.

In 2020, Bosch's Brake-by-Wire products (iBooster, iBooster 2.0, IPB) seized a market share of over 90%, signaling an absolute dominant position.

2. In the EMB era, Brembo, Mando, Haldex, and EA Chassis get a head start

Currently, Brake-by-Wire is mainly divided into Electro-Hydraulic Brake (EHB) and Electro-Mechanical Brake (EMB).

? EHB evolves from the traditional hydraulic brake system. Compared with the traditional hydraulic brake system, EHB boasts a more compact structure and better braking efficiency. It is currently the main mass production solution of the Brake-by-Wire system. Bosch IPB/iBooster, Continental MK C1/MK C2, ZF TRW IBC, Bethel Automotive Safety Systems WCBS, etc. are all EHB solutions.

? EMB completely abandons brake fluid and hydraulic pipelines that are seen in the traditional brake system, but uses the motor to drive the brake to generate the braking force. It is a true Brake-by-Wire system and is expected to become the development trend.

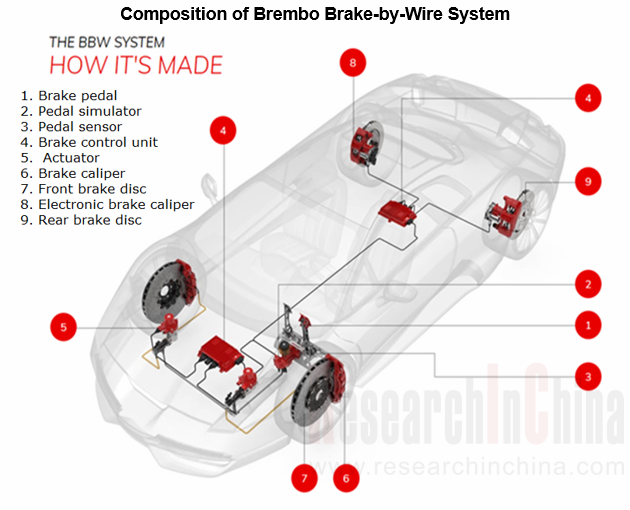

At present, there are no mature EMB products on the market. Major foreign companies such as Brembo, Mando, and Haldex have displayed or released related products, and they may get a head start in future marketization.

In April 2021, Brembo released its Brake-by-Wire product at the Shanghai Auto Show. Brembo has been studying the Brake-by-Wire technology based on mechatronics since 2001.

Mando announced its Brake-by-Wire technology at CES 2021, which is composed of 4 units of EMB (Electro Mechanical Brake), mounted on “4-corner module (4 wheels)”, “E-Brake-Pedal (Electronic brake pedal)”, and DCU (Domain Control Unit).

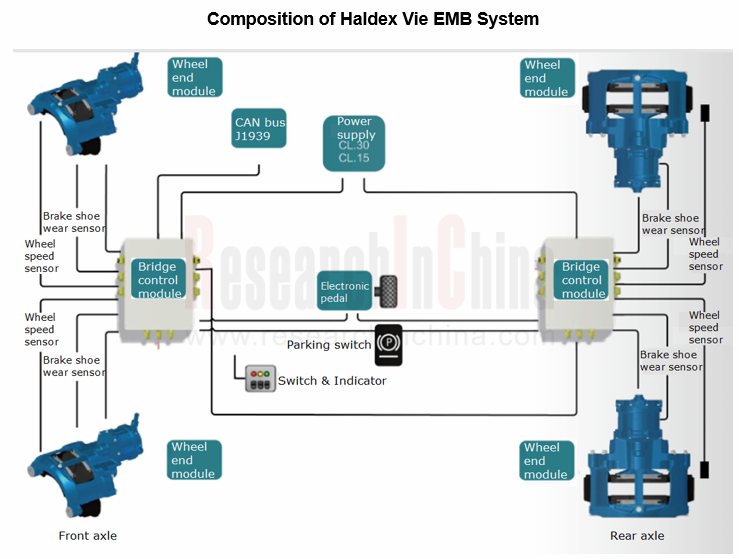

In May 2020, Zhejiang Vie Science & Technology Co., Ltd. and Haldex invested RMB15 million each in establishing Suzhou Haldex Vie, which is dedicated to the production and sale of EMB products. The EMB launched by Haldex Vie targets the commercial vehicle market and can be used on city buses, coaches, trucks and tractors.

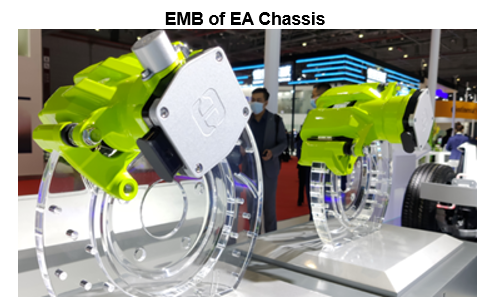

Among domestic automakers, EA Chassis, a subsidiary of Great Wall Motor, has researched EMB by itself and released related products during the 2021 Shanghai Auto Show.

3. Steer-by-Wire represents the next-generation development route

Compared with the booming Brake-by-Wire market, Steer-by-Wire seems too quiet. At present, only four production models of Infiniti adopt mechanically redundant Steer-by-Wire (namely Direct Adaptive Steering? (DAS)) from Kayaba.

DAS retains the mechanical transmission steering mode. When Steer-by-Wire fails, the driver can take over the control. But for autonomous driving, the backup & redundant technology roadmap of the electronic control system may be a better choice.

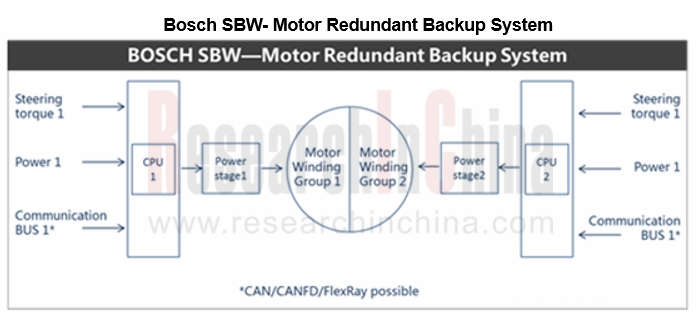

The electronic control system backup & redundant steering (SBW) uses multiple motor controllers at the actuator (steering mechanism) to achieve redundancy. At the steering wheel, multiple sensors are arranged to enable the redundancy of the input signal. Therefore, it can completely remove the mechanical connection between the steering wheel and steering gear. On this basis, it is possible for autonomous vehicles to let the steering wheel extend or retract, which can diversify the layout of the cockpit.

4. SBW will see mass production in 2022-2023, with Bosch and Mando taking the lead in layout

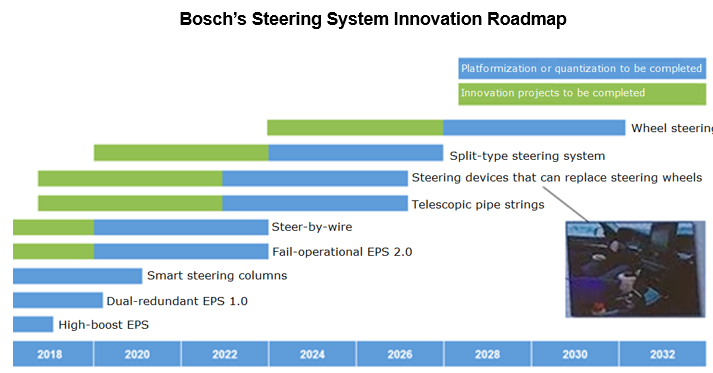

Currently, SBW is still dominated by foreign companies. Bosch, Mando, JTEKT, Nexteer, Schaeffler, etc. have taken the lead in the layout, and they will conduct mass production in 2022-2023.

Bosch will launch SBW- Motor Redundant Backup System in 2023

Bosch adopts the redundant backup technology roadmap for the electronic control system. Its Steer-by-Wire system was first unveiled at the 2019 Shanghai Auto Show, but the product is expected to be applied in 2023.

Mando will mass-produce Steer-by-Wire products in 2022

In January 2021, Mando unveiled its new vision based on safety and freedom, the “Freedom in Mobility”, at CES 2021. Under this vision, Mando demonstrated the “x-by-Wire” technology including Mando’s BbW (Brake-by-Wire) and SbW (Steer-by-Wire)

Mando built its SbW on a redundant E/E architecture and it can be continuously upgraded. It will be mass-produced at the Opelika plant in Alabama, North America, at first, in 2022.

Summary:

On the whole, companies that deploy Brake-by-Wire and Steer-by-Wire simultaneously are more likely to provide users with integrated Chassis-by-Wire solutions, and will grab more lucrative opportunities before autonomous driving is implemented. At present, such companies include Bosch, CNXMotion (a joint venture between Continental and Nexteer), ZF, Mando and other foreign companies, as well as Chinese companies like NASN.

In addition, China-based Great Wall Motor has also started its layout. It conducts independent research and development of Brake-by-Wire and Steer-by-Wire through its two subsidiaries, EA Chassis and HYCET. In 2023, Great Wall Motor will commercialize smart Chassis-by-Wire which integrates a new EEA, Steer-by-Wire, Brake-by-Wire, Shift-by-Wire, Throttle-by-Wire and Suspension-by-Wire to dabble in L4 autonomous driving.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...