Global and China Commercial Vehicle Telematics Industry Report, 2021

In 2021, China’s commercial vehicle intelligent connected terminal industry heads in the following three directions.

The first-generation commercial vehicle intelligent connected terminals mainly for satellite positioning and monitoring became available on market due to policies. During decades of development, occupant entertainment capabilities have been added in addition to original functions such as position detection and driving analysis, so as to meet young drivers’ needs for intelligent connected cockpits. In future, “policies and domestic demand” will combine to promote the commercial vehicle telematics industry head in the following directions.

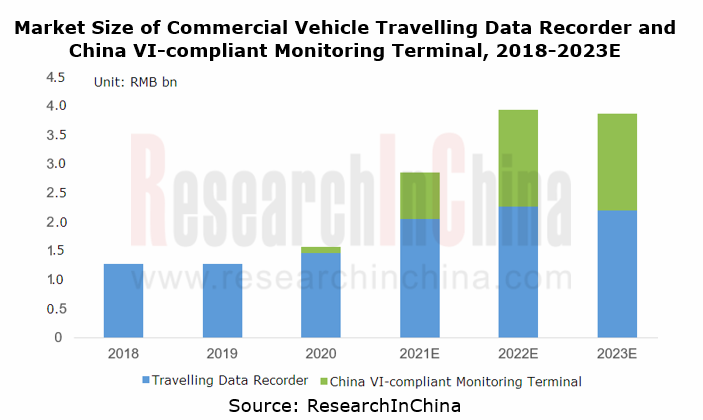

Trend 1: new national standards and new policies will contribute to a nearly RMB4 billion expansion of the market.

As the Chinese Phase VI Emission Standards (China VI) for commercial vehicles and the new version of the national standard Vehicle Traveling Data Recorder came into effect in the second half 2021, it is expected that the market will expand by nearly RMB4 billion.

1. Travelling Data Recorder

In February 2021, the Ministry of Public Security of China released the exposure draft of the Vehicle Traveling Data Recorder (GB/T 19056-XXXX). Compared with the old version, it adds such functions as audio and video recording, Wi-Fi communication, wireless public network communication, automatic timing, protective memory (disaster recovery), and driver identification and requires better positioning capability.

The new national standard is about to take effect on October 1, 2021. And then travelling data recorders will carry more functions but become much more expensive. It is expected that China’s travelling data recorder market will be worth more than RMB2.2 billion in 2023.

2. China VI-compliant Monitoring Terminal

From July 1, 2021 onwards, all homemade, imported and registered heavy duty diesel vehicles (including heavy and light trucks) must be subject to the Chinese Phase VI Emission Standards. According to the policy, vehicles are required to pack standard-compliant on-board terminals for remote emission management before leaving factory. As the standard is implemented, the penetration of China VI-compliant monitoring terminals in heavy, medium-sized and light trucks will reach 100%. It is predicted that the China VI-compliant monitoring terminal market will be worth more than RMB1.6 billion in 2023.

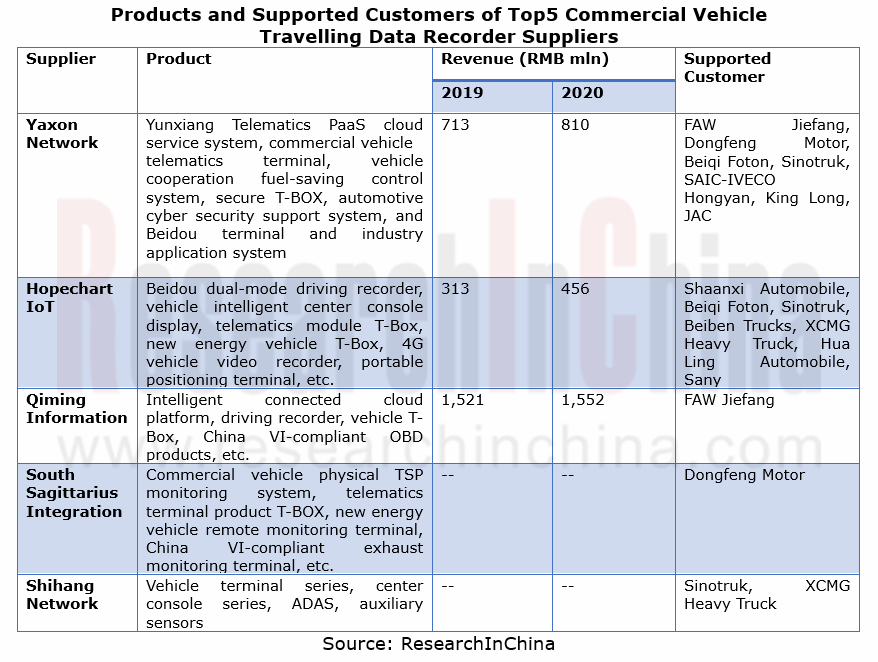

In 2020, the top five suppliers of commercial vehicle travelling data recorders were Xiamen Yaxon Network Co., Ltd., Hangzhou Hopechart IoT Technology Co., Ltd., Qiming Information Technology Co., Ltd., South Sagittarius Integration Co., Ltd. and Shanghai Shihang Network Technology Co., Ltd., together sweeping over 65% of the market.

Trend 2: connected terminals tend to be more integrated and the situation of “multiple terminals per vehicle” will be turn around.

Commercial vehicles are more applicable to autonomous driving scenarios than passenger cars, including ports, mines and highway platooning. Automakers vie for deploying related products. FAW Jiefang J7 L3 Super Trucks for logistics scenarios have been delivered to JD; Shaanxi Automobile Delong X6000 acquired China’s first national autonomous driving license for L4 heavy trucks. As high levels of automated driving are applied, commercial vehicles require telematics terminals to have better technical performance. For example, leading suppliers like Yaxon Network have introduced, tested and applied 5G V2X products.

Yaxon Network 5G OBU: integrate 5G mobile communication, GPS/BeiDou Navigation Satellite System (BDS), and V2X communication.

Yaxon Network 5G-V2X OBU supports Beidou centimeter-level high-precision positioning application. The device can collect all in-vehicle working condition data, location and traffic information, and communicates and interacts with off-vehicle equipment and data platforms via wireless communication modes like 4G/5G, V2X, WIFI and Bluetooth, building an omnidirectional network for V2V (vehicle to vehicle), V2P (vehicle to pedestrian), V2I (vehicle to infrastructure) and V2C (vehicle to cloud) communications.

Yaxon Network 5G OBU has been seen in Zhengzhou Financial Island V2X Project, Xiamen Port Autonomous Driving V2X Project, SAIC-GM-Wuling V2X Project, and Fujian Expressway V2X Project.

Hopechart 5G-V2X Product has undergone testing.

In regard to 5G-V2X R&D, Hopechart’s V-BOX has been tested and installed by OEMs. This product integrates V2V, V2I, 5G and Beidou/GPS satellite positioning modules. Hopechart also works with OEMs on development of an OTA platform which is connected to terminals for commercial vehicle OTA updates.

Trend 3: the increase of young drivers will fuel transformation of commercial vehicle occupant entertainment terminals.

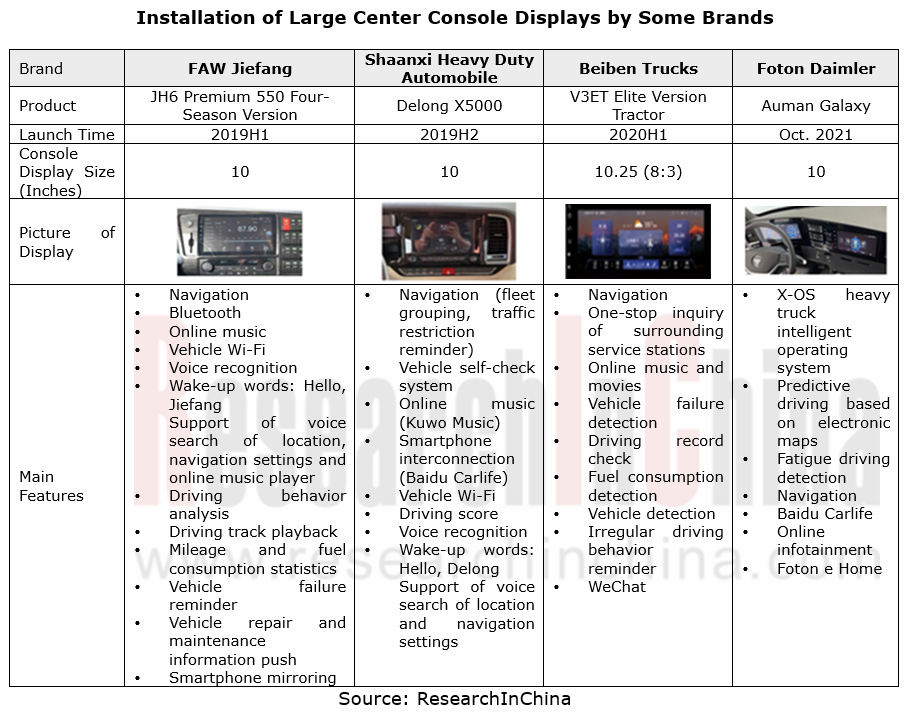

The rising demand for intelligent connected cockpits comes with the increase of post-80s and post-90s drivers. At present, capabilities such as large display, voice, online entertainment and smartphone mirroring hold the trend.

For example, in terms of product form, the mainstream large-size displays for commercial vehicles have been enlarged to current 10 inches from original 7 inches, and some auto brands have began trying to use 12-inch displays.

As for product features, mainstream functions of passenger cars, including online audio and video, voice recognition, remote control and smartphone mirroring, are making their way into commercial vehicles of manufacturers such as FAW Jiefang, Shaanxi Heavy Duty Automobile, Beiben Trucks and Foton Daimler, which have rolled out related products.

On April 19, 2021, Foton Daimler unveiled Auman Galaxy at Auto Shanghai, a super heavy truck that packs 12.3-inch LCD dashboard, 10-inch center console display, and built-in Foton e Home System that offers capabilities like driving behavior analysis, vehicle status check and maintenance reservation. Auman Galaxy also carries X-OS, China’s first heavy truck intelligent operating system that enables a slump in fuel consumption and brings higher economic benefits.

Differing from passenger car telematics focusing on occupant entertainment, commercial vehicle telematics prefers lower cost and higher efficiency. As cockpit capabilities get improved, the connected devices for commercial vehicles may increase ADAS intelligent driving modules for improving computing force of cockpits, and combine AI and big data analysis technologies to identify driving behaviors, reduce driving risks and fuel consumption, and achieve efficient regulation.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...