Autonomous heavy truck research: front runners first going public

Our Autonomous Heavy Truck Industry Report, 2020-2021 carries out research into highway scenario-oriented autonomous heavy truck industry, including OEMs and autonomous driving solution providers inside and outside China.

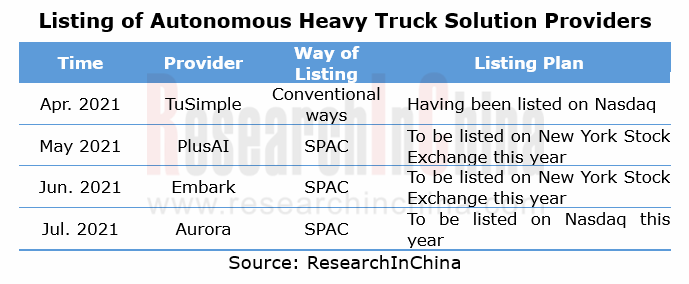

Several autonomous heavy truck companies try to list their shares for financing.

The surging road freight volume and a widening gap in demand for truck drivers, promote the financing boom of self-driving heavy truck industry, and accelerate the R&D of related products and technology landing.

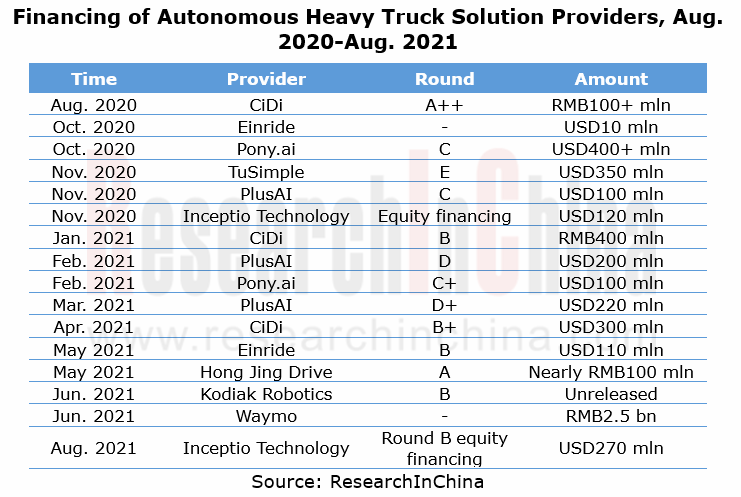

According to incomplete statistics, several autonomous heavy truck solution providers at home and abroad have closed a total of at least 16 funding rounds in the most recent year (August 2020 to August 2021). Examples include PlusAI and Inceptio Technology, two Chinese firms which have raised over USD800 million in all in their recent several funding rounds.

In the meanwhile, some solution providers which suffered sustained losses, and high input and low output, have started resorting to IPO for raising more funds. On April 15, 2021, TuSimple went public on Nasdaq, becoming the world’s first listed company in autonomous driving field. And then a few other autonomous heavy truck solution providers announced listing in the US as special purpose acquisition companies (SPAC).

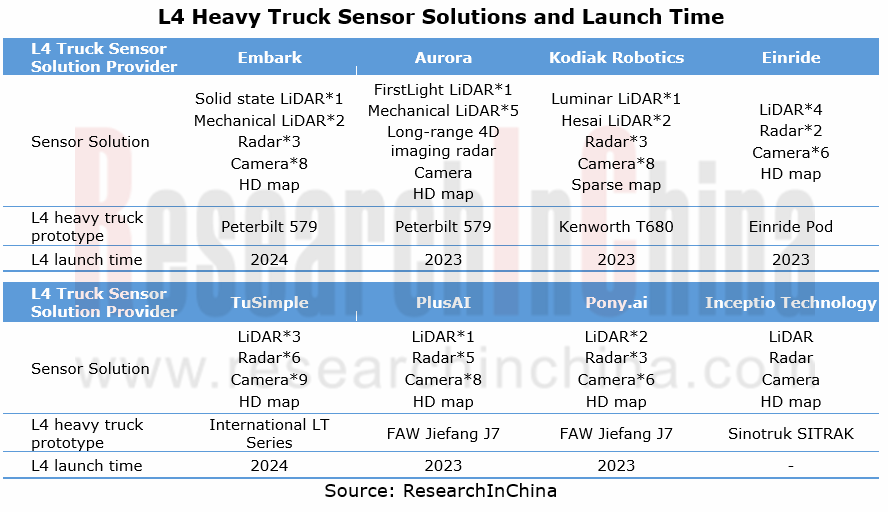

The LiDAR + camera + radar fusion solutions have become mainstream.

Most providers adopt the LiDAR + camera + radar fusion solutions combined with HD map and high-precision positioning, which enable their heavy trucks to drive themselves. Some solution providers like Embark use hybrid LiDAR solutions, that is, the combination of solid-state and mechanical LiDARs enables omnidirectional depth perception of the surroundings of a vehicle.

The time that mainstream solution providers inside and outside China are expected to launch the technology is relatively consistent. In the case of loose policies, autonomous heavy trucks will come into service on highways between 2023 and 2024.

Cooperation modes of autonomous heavy truck industry

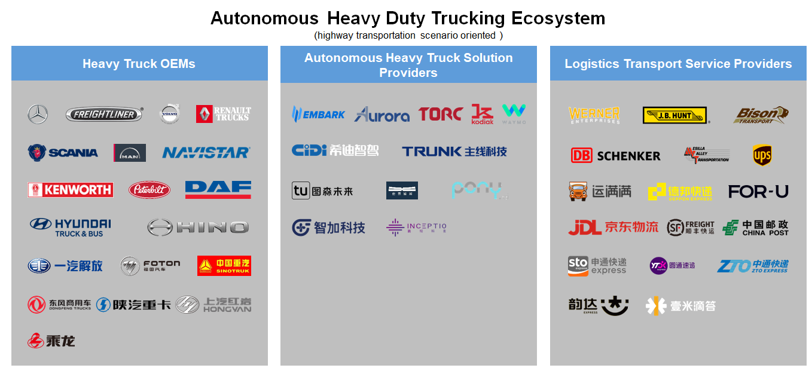

Quite a few heavy truck OEMs and logistics companies race to land on highway scenarios in addition to capital betting on autonomous heavy trucks.

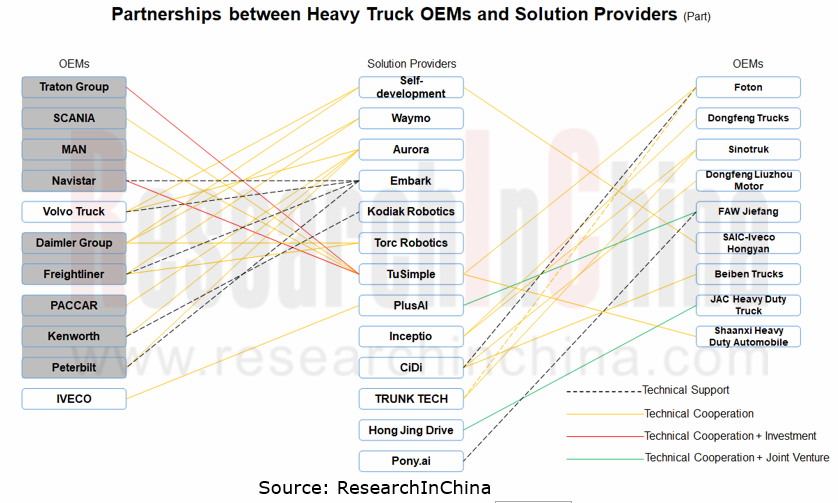

The highway transportation scenario-oriented autonomous heavy truck ecosystem accommodates autonomous heavy truck solution providers, heavy truck manufacturers and logistics transport service providers, which work together to propel commercialization of autonomous heavy trucks. As concerns research and development, solution providers and heavy truck manufacturers jointly develop L4 autonomous heavy trucks based on OEM or AM vehicle models. With regard to commercial operation, solution providers partner with logistics transport service providers on commercial operation and actual freight transport test of autonomous heavy trucks.

In terms of partnerships, autonomous heavy truck solution providers often team up with OEMs, co-developing L4 autonomous heavy trucks based on flagship models in OEM or AM market. Foreign autonomous heavy truck companies develop autonomous driving often under the leadership of their group companies, which means sub-brands of these group companies build technological cooperation with solution providers. For example, Traton under Volkswagen formed a global partnership with TuSimple to jointly develop L4 autonomous driving technology and apply to Volkswagen’s brands like SCANIA and MAN.

Development trends of autonomous heavy trucks

Trend 1: to achieve the goal of “emissions peak in 2030, carbon neutrality in 2060”, the power source of autonomous heavy trucks will shift from diesel to low or zero carbon energy like natural gas and hydrogen.

Trend 2: platooning technology is being reviewed. In January 2019, Daimler Trucks held a contrary opinion on platooning. After thousands of miles of testing, Daimler has come to the conclusion that truck platooning delivers low economic benefits and has natural defects such as needing a driver, so it will end development of the technology and turn to L4 autonomous heavy trucks. Also, what impacts the actual use of platooning will put on the normal traffic has yet to be verified in real road tests.

In the short run, there will be certain barriers to large-scale commercial use of autonomous heavy trucks in China’s business environment.

The development goal of L4 autonomous heavy trucks is to remove driver and let vehicles complete logistics transport and delivery without needing a human driver to monitor. The most direct customers are logistics companies which operate their own fleets, such as JD, SF Express, YTO Express, STO Express, ZTO Express and YunDa Express. Such companies have much expectation of autonomous heavy trucks lowering their total cost of ownership (TCO), which will make autonomous heavy trucks a big market.

In China, truck drivers are generally self-employed and only 17% of them have their vehicles employed by companies or owned by fleets; 83% drive their own vehicles, according to the Survey Report on Employment of Truck Drivers in 2021 released by China Federation of Logistics & Purchasing (CFLP). The blossom of autonomous heavy trucks in China is still a long way off.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...