HUD industry research: rapid adoption of OEM HUD in vehicles is under way and Chinese auto brands perform well.

Head-up display (HUD) projects key information onto the transparent media or windshield before the driver for him/her to look down on the cluster and navigation less frequently. So far there have been three types of HUDs mass-produced: C-HUD, W-HUD and AR-HUD.

In 2025, the penetration of OEM HUD in China will outstrip 30%.

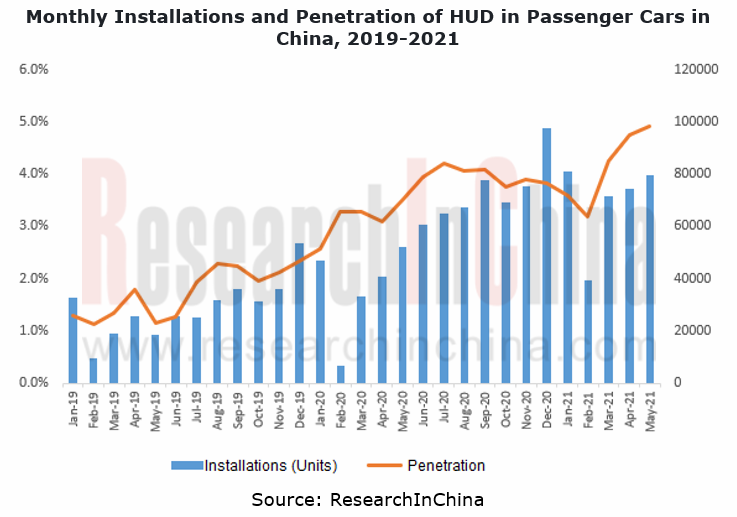

According to our statistics, in 2020, 692,000 passenger cars in China packed OEM HUDs, an annualized spurt of 101.2%, with the penetration up to 3.7%, 2.0 percentage points higher than the previous year. In 2021, the penetration of HUD sustains growth and is expected to be 8% or so at the end of the year, compared with nearly 5% in the first half. It is conceivable that the figure will exceed 30% in 2025.

Three reasons stand out. First, larger size and more information displayed make HUD a third screen for an intelligent cockpit, which is accompanied by higher level of vehicle intelligence and upgrade of projection technology. Second, Chinese leading automakers like Great Wall Motor, Geely, Hongqi and NIO quicken their pace of applying HUDs in their vehicles, and lower their prices to the range of RMB100,000 to RMB150,000. Third, the production-ready AR-HUD will boom in the 3 or 5 years to come.

OEMs work hard on W-HUD and push on with increasing installations.

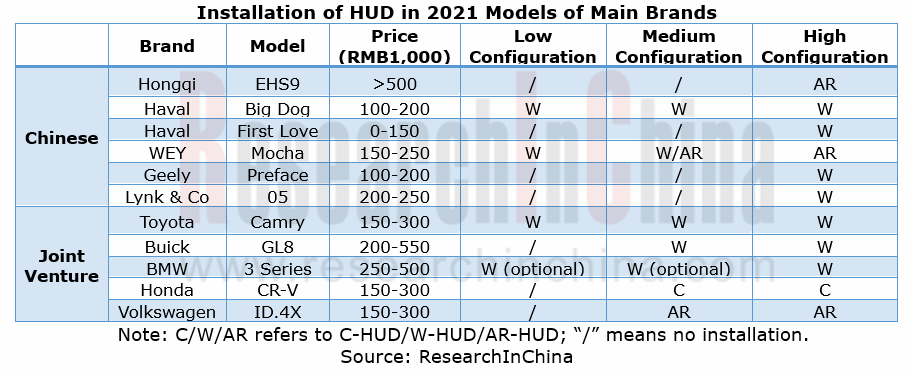

At present, W-HUD as the mainstream solution of automakers is encroaching on the C-HUD market. Our data show that in 2020, W-HUD swept 91.8% of total HUD installations, up 10.2 percentage points year on year. As the technology matures, AR-HUD, which has become available on market in small batches from 2021, will be neck and neck with W-HUD, together driving up HUD installations.

In future, W-HUD will evolve from an optional configuration for high-class vehicles to a standard one for medium & low class. Chinese auto brands play a crucial role in this process. Since 2020, the likes of Hongqi, Haval, Geely, Lynk & Co and Geometry have been the main drivers of W-HUD in China. The prices of HUD-enabled models like Geely Preface, Haval Big Dog and Haval First Love have been lowered to RMB150,000.

Mass production of AR-HUD starts, and TFT solution becomes the first choice.

AR-HUD displays real road conditions. The combination of ADAS functions such as LKA and ACC provides immersive experience for drivers, which is a future trend for HUD.

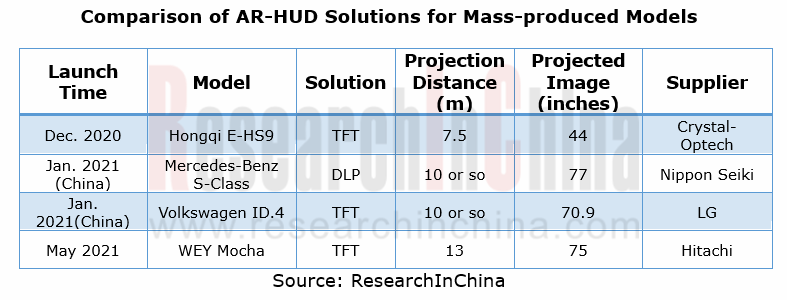

In September 2020, Mercedes-Benz S-Class with AR-HUD made a debut, establishing the age of mass-produced AR-HUD. And then models including Audi Q4 e-tron, Volkswagen ID Series, FAW Hongqi and Great Wall WEY have been competing to offer AR-HUD-enabled versions.

In addition, Hyundai Kia, Hyundai Aini Krypton, GAC, Changan Auto and Chery, among others, plan to equip their new cars with AR-HUD. For example, AR-HUD co-developed by GAC and Foryou Group is to be first mounted on a mass-produced model in the fourth quarter of 2021.

Through the lens of solutions, AR-HUDs spawned so far generally use TFT and DLP technologies. By comparison, TFT costs less so Chinese models prefer this technology; despite high cost, DLP technology that works very well finds application in some highly-configured or top-class models (e.g., Mercedes-Benz S-Class with selling price higher than RMB800,000).

WEY Mocha: launched in May 2021, the model carries AR-HUD which delivers 13m projection distance and 75-inch image where speed, fuel level, distance (to destination), direction, etc. are shown. The device also enhances annotations to lane lines and displays the dynamic distance with other vehicles, with dynamic arrows appearing for guidance when turning or U-turning.

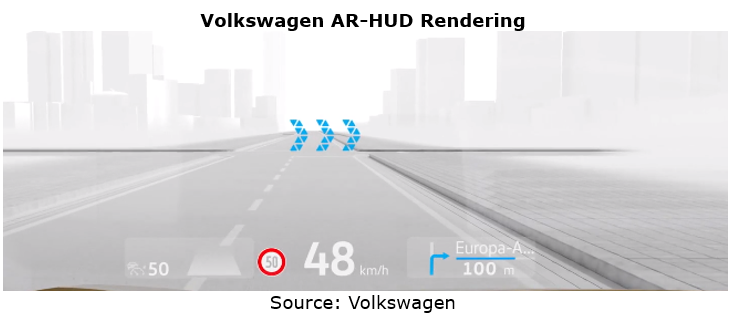

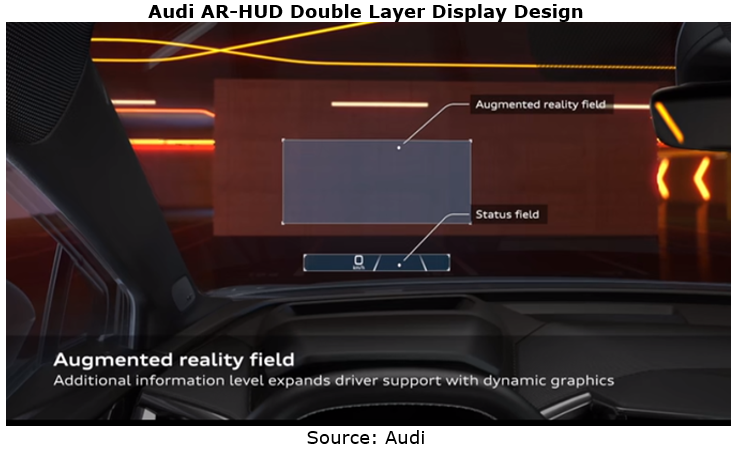

Volkswagen: the automaker has rolled out several AR-HUD-enabled models such as ID.4 and ID.6 since 2021, all of which use TFT projection technology. Differing from WEY Mocha and other China-made cars, these Volkswagen models feature double-layer display design in which the upper layer is AR field where driving assistance information and navigation tips are displayed in the form of dynamic 3D rendering, with virtual image distance (VID) up to 10m and display field diameter of 1.8m (about 70.9 inches); the lower layer is status field displaying speed, navigation, road signs, destination, etc., with VID of 3m.

Things come in pairs. Both Mercedes-Benz and Audi also adopt such display design, which makes images enhanced in much better virtual effects.

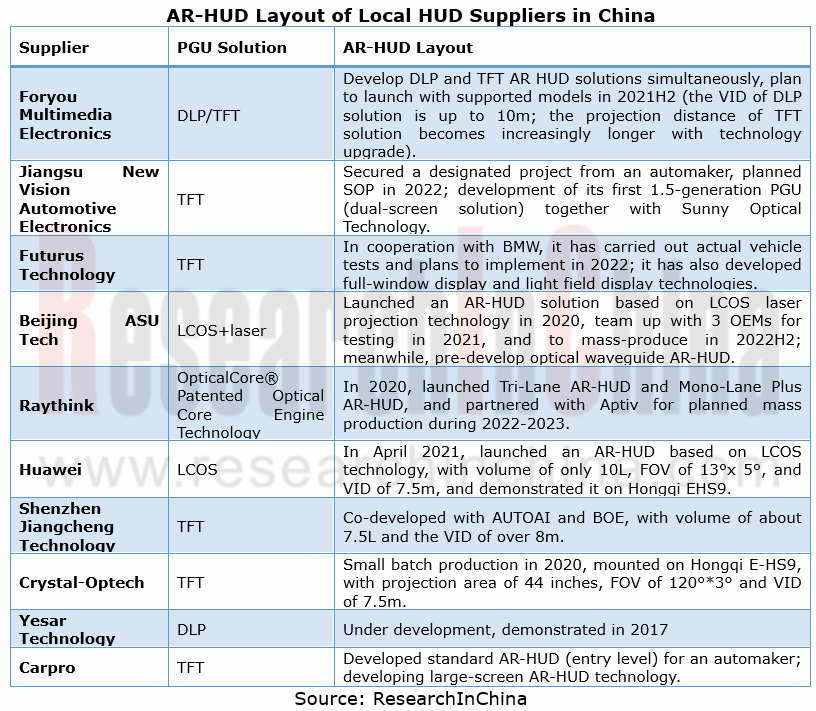

The rising Chinese suppliers pin great hope on AR-HUD.

Nippon Seiki, Denso and Continental have a monopoly on the Chinese HUD market. They target mid- and high-end brands such as BMW, Audi, Mercedes-Benz, Mazda, Toyota, Honda and Buick.

In China, local suppliers like Foryou Multimedia Electronics, Jiangsu New Vision Automotive Electronics and E-Lead Electronic serve domestic automakers including Geely, Hongqi, Great Wall Motor, NIO and Dongfeng Motor.

As AR-HUD comes into being, almost all suppliers gravitate towards it, but local players are more motivated.

Nippon Seiki: the world’s largest HUD supplier boasts annual capacity of nearly 2 million units. In 2020, it was the first one to provide AR-HUD for Mercedes-Benz S-Class. In 2021, it is working hard on construction and layout of HUD production bases in China.

Foryou Multimedia Electronics: as of June 2021, the supplier has shipped a total of 200,000 HUDs which have been used in multiple models of Great Wall Motor, GAC, BAIC, Dongfeng Nissan and Changan Auto. The company has secured designated AR-HUD projects from GAC and others that plan installation in their vehicles in 2021. It is also developing double layer AR-HUD, with the maximum and minimum VID up to 10m and 2.4m, respectively.

Huawei: in April 2021, Huawei unveiled an AR-HUD based on LCOS projection technology, offering 7.5m VID, 13°x 5° FOV and 70-inch image. The device is just 10L much smaller than DLP HUD, and puts projections directly onto the windshield, with no need for special treatment of the windshield.

Giants race to deploy new-generation holographic technology.

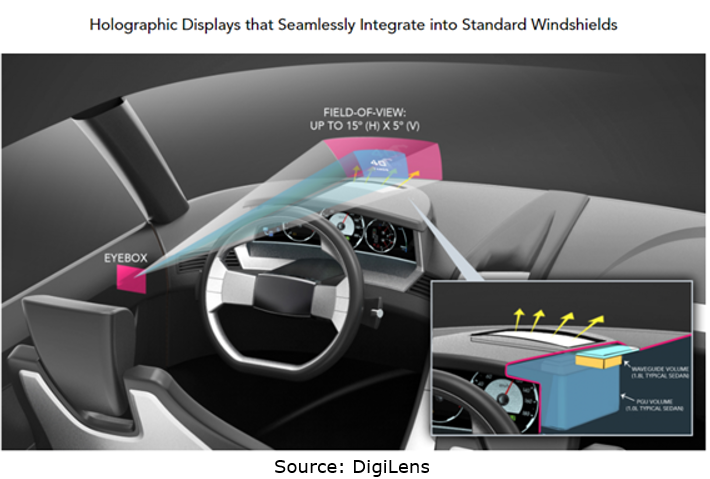

Current mass-produced AR-HUDs still adopt the geometrical optical projection solution that W-HUD uses, which means an ultra-large aspheric mirror is needed to increase the projection distance (AR-HUD VID is required to be over 10m). Thus the package size is so large that OEMs cannot use.

Holographic technology (optical waveguide, HOE, CGH, etc.) which not only reduces the size of the device but widens FOV has been a hot spot for suppliers and automakers.

In September 2020, DigiLens, an optical waveguide start-up, 18% owned by Continental, introduced its CrystalClear? AR HUD based on DigiLens’ proprietary photopolymer material, with the largest FOV up to 15°x5°, luminance of 12,000 nits and package size of just 5 liters, allowing it to fit into most vehicles and displaying images at infinity.

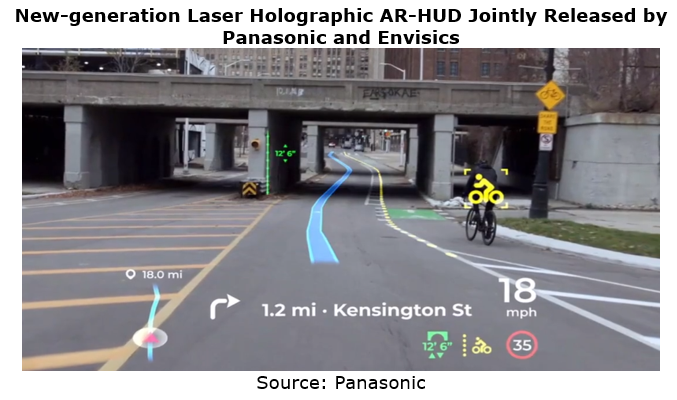

In January 2021, Panasonic together with Envisics rolled out an AR-HUD based on laser holographic technology. Using eye tracking and vibration control technologies, the HUD offers VID up to 10m, FOV of 10°×4°, and image resolution as high as 4K, displaying speed, fuel level, etc. in the near field and navigation in the far field.

Envisics, founded in 2018 and based in the UK, is developing holographic AR-HUD for over ten companies such as Hyundai Mobis, General Motors and SAIC. Its new technology will be the first used in Cadillac’s mass-produced models in 2023.

In July 2021, VividQ, a computer-generated holographic technology (CGH) firm, raised USD15 million in its seed funding round led by UTokyo IPC, the venture investment arm for the University of Tokyo. Its holographic technology will be first applied to automotive HUD for OEMs in China in early 2022.

Moreover, Hyundai/Porsche (investing WayRay), Denso/Intel (investing CY Vision) and BAIC (partnering with Sanji Optoelectronics) are deploying holographic technology as well.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...