Intelligent Vehicle E/E Architecture and Computing Platform Industry Research Report, 2021

E/E Architecture and Computing Platform Industry Research: Three Evolution Stages of Automakers’ E/E Architectures

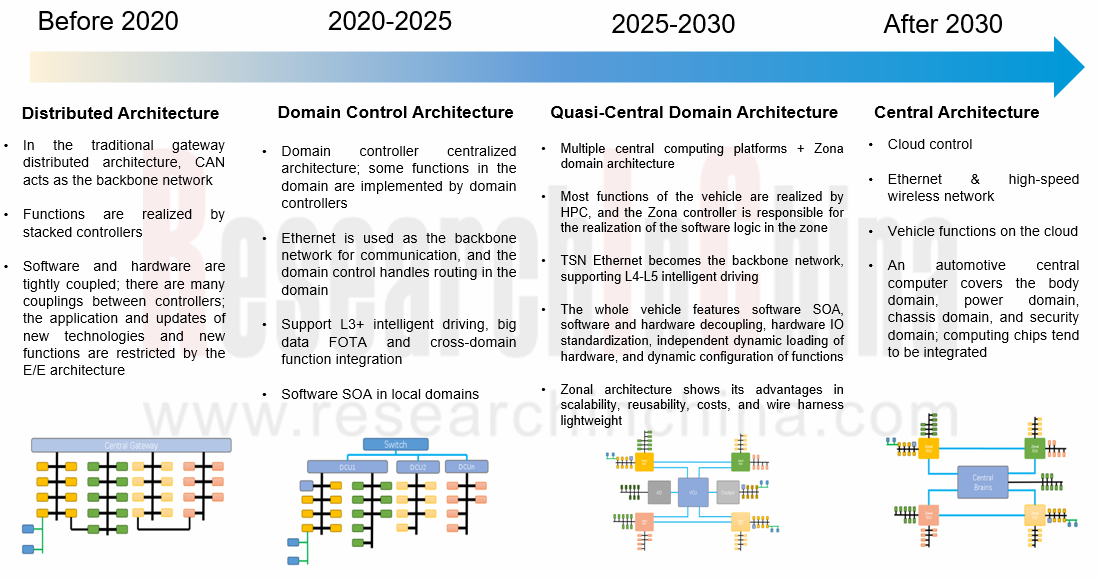

Domain centralized architectures will gradually evolve to quasi-central and central computing architectures

The evolution of the brand-new automotive E/E architecture, which may take ten years, can be divided into three stages:

(1) Domain centralized architecture stage

At present, automakers mainly stay at the domain centralized architecture stage. For example, Volkswagen's E3 architecture, Great Wall’s GEEP3.0 architecture, BYD's E platform 3.0 architecture, Geely's SEA architecture, Xpeng's EE 2.0 architecture, etc. are all typical domain centralized architectures.

Automotive E/E architectures will inevitably develop towards centralized E/E architectures. From the perspective of mass-produced models, centralized E/E architectures prevail now, with domain control over power, chassis, body, intelligent driving and cockpit. However, it is difficult to fully realize standard domain architectures and central architectures due to technical thresholds, diversified configuration gradients, consumption habits and other factors, so the domain hybrid architecture of "distributed ECUs + domain controllers" will be common in the short term.

At present, Volkswagen, BMW, Geely ZEEKR, Huawei, Visteon, etc. adopt three-domain E/E architecture solutions which mainly include intelligent driving domain, intelligent cockpit domain, and vehicle controller domain.

Volkswagen has upgraded the MQB distributed E/E architecture to the MEB (E3) domain centralized E/E architecture which includes 3 domain controllers: vehicle control (ICAS1), intelligent driving (ICAS2), and intelligent cockpit (ICAS3). Modules such as chassis and airbags that do not have integration capabilities belong to ICAS1. At present, ICAS1 and ICAS3 have been developed and installed on ID.3, ID.4 and other models, while ICAS2 has not been developed yet.

In terms of the software architecture, E3 adopts a service-oriented architecture, using CP and AP service middleware to enable SOA communication; as for the communication architecture, E3's backbone network is Ethernet.

On the CC architecture, Huawei has launched three domain control platforms of intelligent cockpit (CDC), vehicle control (VDC), and intelligent driving (MDC) respectively, and released related open platforms and operating systems, such as the autonomous driving operating system AOS, the intelligent cockpit operating system HarmonyOS and the vehicle control operating system VOS.

In terms of communication architecture, the CC architecture has set up 3-5 VIUs (vehicle interface units). All actuators and sensors are connected to distributed gateways so as to form loops. Once a single loop fails to work, the other three loops maintain operation, hereby effectively improving safety.

(2) Quasi-central computing architecture stage

In the next step, automakers will work hard in the quasi-central architecture of “the central computing platform + regional controllers”. Through SOA, it shares the computing power of different domain controllers like a central computing platform. The GEEP 4.0 architecture to be launched by Great Wall in 2022 and the FEEA3.0 architecture (to be mass-produced in 2023) released by FAW Hongqi in 2021 are quasi-central architectures.

Tesla’s EEA architecture is the most advanced, at least 5 years ahead of that of traditional automakers. The E/E architecture of Model 3 has marked Tesla’s entry into the quasi-central architecture stage consisting of central computing module (CCM), Body Control Module Left (BCMLH) and Body Control Module Right (BCMRH), basically materializing the prototype of a centralized architecture with the self-developed Linux, FOTA of the whole vehicle and communication via the Ethernet backbone network.

Tesla's quasi-central E/E architecture has sparked a harness revolution. The wiring harness of Model S/Model X is as long as 3 kilometers, while Model 3 reduces the wiring harness length to 1.5 kilometers, and Model Y further shortens it to around 1 kilometer. Tesla's plans to make the length as short as 100 meters.

(3) Central computing architecture stage

From the perspective of development trends, the automotive E/E architecture will eventually evolve to the central computing architecture, concentrating the functional logic to a central controller. The OEM Great Wall plans to launch the central computing architecture GEEP 5.0 in 2024, and Changan also intends to complete the development of its central domain architecture in 2025.

Evolution of Automotive E/E Architecture

Source: ENOVATE

In the next 3-5 years, OEMs will focus on R&D and layout of quasi-central architectures

As per the E/E architecture solutions of traditional automakers, most OEMs at home and abroad have transferred from distributed architectures to domain centralized architectures, and they have taken quasi-central architectures as the focus of R&D and layout in the next 3-5 years. Quasi-central and centralized architectures can effectively reduce the number of controllers and wiring harnesses, promote the further decoupling of automotive hardware and software, and drag down the cost further. In order to keep up with the upgrades of automotive technology, OEMs speed up the deployment of quasi-central architectures, introduce SOA architectures and make layout in central computing platforms, etc..

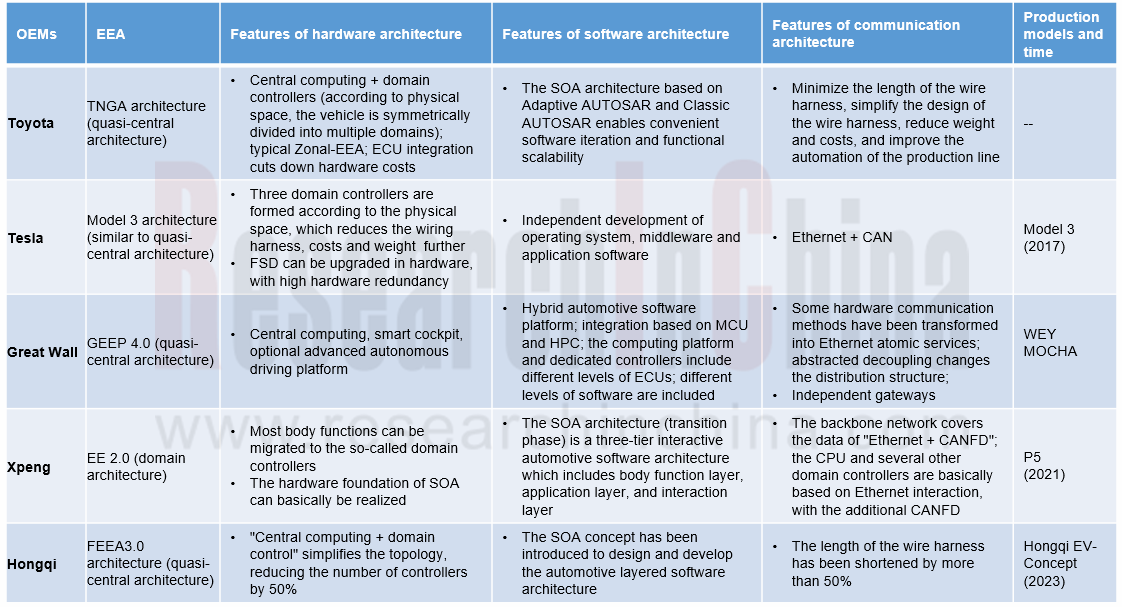

Features of Next-generation E/E Architectures of Some OEMs

Source: ResearchInChina

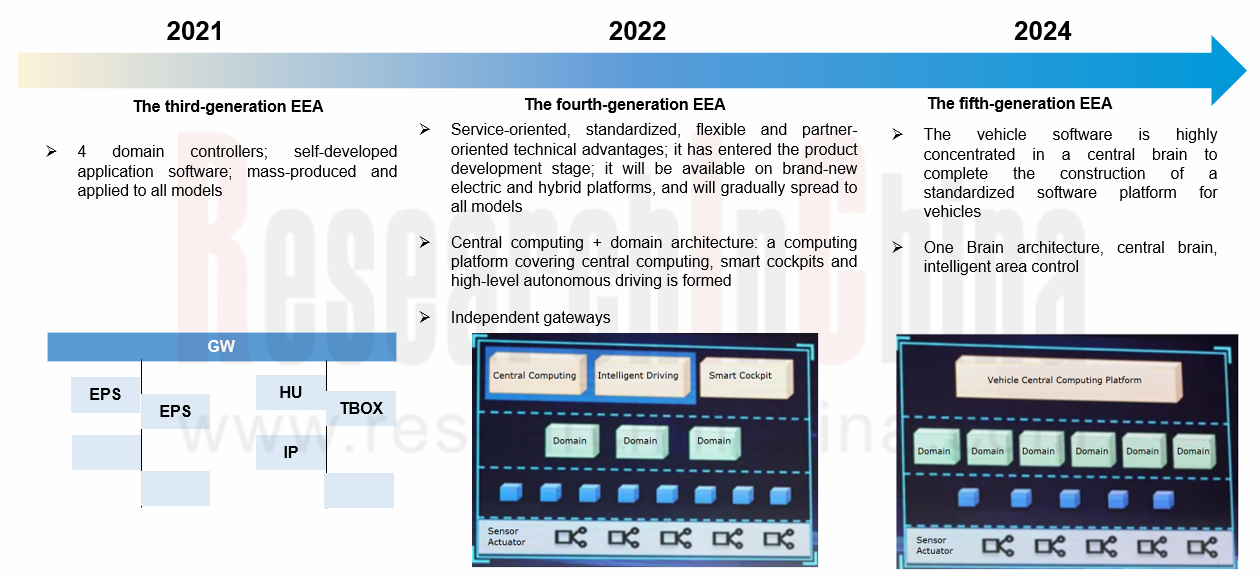

Great Wall has independently developed the GEEP E/E architecture which has evolved to the third-generation GEEP 3.0 so far. As the domain control architecture, it boasts 4 domain controllers. With integrated software and hardware and self-developed application software, it has been successfully applied to all models. At present, Great Wall is actively developing the fourth- and fifth-generation E/E architectures.

As “the central computing platform + regional controllers” architecture, the fourth-generation E/E architecture of Great Wall comprises three large computing platforms for central computing, intelligent cockpit, and optional advanced autonomous driving respectively. The central computing platform integrates body, gateways, air conditioning, EV, power chassis and ADAS, featuring cross-domain integration. It is scheduled to be launched in 2022. The fifth-generation E/E architecture is to highly concentrate the entire automotive software in a central brain to achieve 100% SOA, and it will be available in 2024.

Evolution of Great Wall’s E/E Architecture

Source: ResearchInChina

The FEEA2.0E/E architecture developed by FAW Hongqi independently is a domain control architecture consisting of a new energy vehicle controller, a L3/L4 autopilot controller, and a central gateway controller. It has been mass-produced for E-HS9. FEEA3.0, a next-generation E/E architecture, was released in April 2021 as a quasi-central architecture of “the central computing platform + regional controllers”, reducing the number of controllers and the total length of the wiring harness by more than 50%, as well as adding. It is planned to be deployed on Hongqi EV-Concept in 2023.

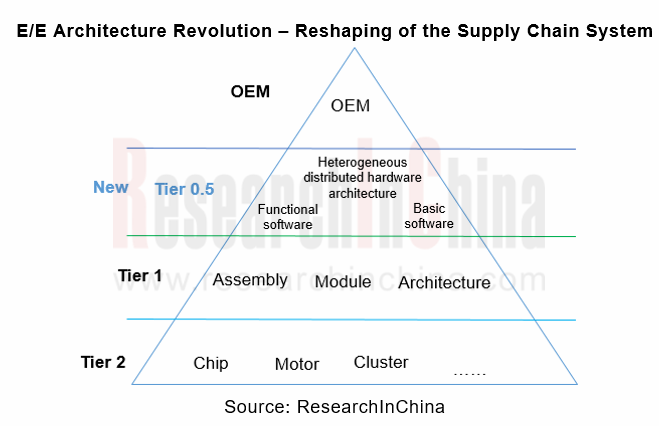

Trends under new E/E architectures

As automotive E/E architectures gradually develop toward central architectures, the centralization of computing power, software services, and peripheralization of sensors and actuators tend to be more obvious; the industrial chain structure has been reshaped, and the business model has undergone significant changes.

(1) The supply chain system is reshaped

Under the traditional distributed E/E architecture, the hardware and algorithms of controllers are provided by Tier 1 suppliers and OEMs coordinate different suppliers, so that the collaboration is extremely inefficient.

Under the new E/E architecture, OEMs enjoy the dominance. Based on their own software and hardware platforms, they directly convey their demand to suppliers, among which Tier 1 suppliers are no longer dominant while Tier 0.5 suppliers emerge to provide algorithms and software for autonomous driving.

(2) The traditional "turnkey" model transfers to the "full stack" development model

OEMs manipulate the development of software platforms (covering functions integrated, suppliers, etc.) to accomplish deeper development. With the development of autonomous driving technology, OEMs are more inclined to carry out "full-stack" development: they gradually master E/E architectures, operating systems, core algorithms, cloud big data, chips and other capabilities, then provide sustainable and iterative product experience and services with a focus on smart scenarios and consumer experience.

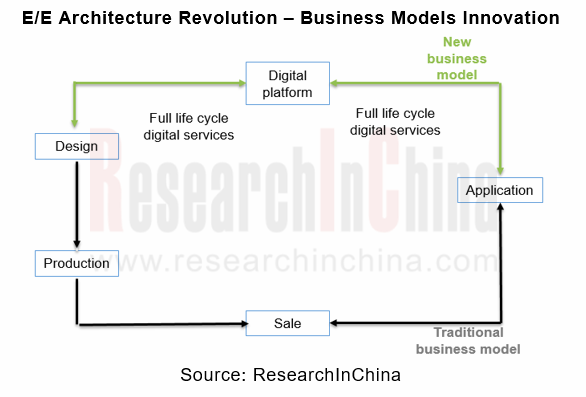

(3) Business models are innovated, and the vehicle OTA sees the completed closed loop of business models

In addition, with the evolution of E/E architectures and the rapid development of vehicle OTA, the sales models of automobiles have altered accordingly. Automakers have turned from one-time product providers to “products + full life cycle services” providers. Around smart scenarios and consumer experience, they provide sustainable and iterative product experience and services. Emerging automakers represented by Tesla update software to iterate and upgrade vehicles.

In addition to vehicle sales, OEMs may charge software updates via OTA in the future. For example, the leader Tesla has earned more than USD1.2 billion from software updates.

Intelligent Vehicle E/E Architecture and Computing Platform Industry Research Report 2021 by ResearchInChina mainly studies the following:

Overview, technology evolution trends, reform trends, market size, etc. of automotive E/E architectures;

Overview, technology evolution trends, reform trends, market size, etc. of automotive E/E architectures;

Status quo, evolution trends, etc. of E/E architectures of major OEMs (emerging brands, independent brands, foreign brands);

Status quo, evolution trends, etc. of E/E architectures of major OEMs (emerging brands, independent brands, foreign brands);

Status quo, planning, etc. of E/E architectures of major Tier 1 enterprises;

Status quo, planning, etc. of E/E architectures of major Tier 1 enterprises;

Status quo of main E/E architectures (including computing architecture, software architecture, communication architecture, power management architecture, etc.);

Status quo of main E/E architectures (including computing architecture, software architecture, communication architecture, power management architecture, etc.);  Solutions of major manufacturers; evolution of new E/E architectures.

Solutions of major manufacturers; evolution of new E/E architectures.

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...