Infrared night vision research: as 60% traffic accidents happen at night, infrared imaging technology comes as an effective solution.

This report combs through development trends and market size of automotive infrared night vision, technology routes of main Chinese and foreign night vision system suppliers, and night vision system application of OEMs.

The statistics show that China saw nearly 200,000 traffic accidents happen every year in recent years, 60% of which took place at night and caused 50% of death toll. It is more dangerous to drive at night for the factors such as insufficient lighting and low visibility make drivers miss out or misjudge road conditions. Infrared thermography which is free of visible light can recognize targets with vital signs accurately either in the daytime or at night. With its anti-glare merit, this technology has great potential to protect driving safety at night.

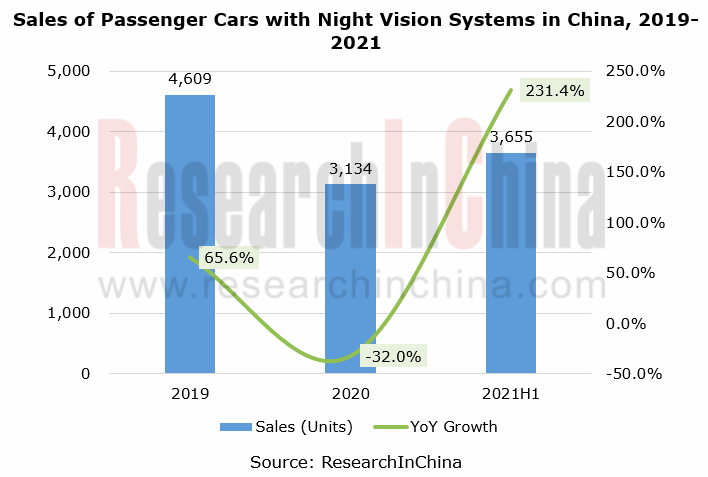

In 2021H1, the sales of passenger cars equipped with night vision systems surged.

From the sales of passenger cars packing night vision systems in China, it can be seen that despite an annualized plunge of 32.0% during the COVID-19 pandemic in 2020, the automobile industry has resumed production in China’s efforts to control the outbreak, selling 3,655 cars with night vision systems in the first half of 2021 alone, a like-on-like spurt of 231.4%. Wherein, Cadillac, Audi and Volkswagen models were the key contributors to the soaring sales of night vision systems in this period.

In current stage, night vision systems still tend to be mounted on high-class models. Through the lens of the sales of passenger cars packing night vision systems in recent two years, those priced above RMB300,000 swept over 85% of the sales, of which the higher than RMB500,000 cars occupied over 60% share. Meanwhile, cars with prices ranging from RMB250,000 to RMB300,000 carried night vision systems as well, sharing 10.3% of the sales in 2020.

The declining cost of infrared detectors and the improving policies make automotive infrared night vision a promising market.

In the past, high price was an enduring constraint on wide adoption of automotive infrared night vision systems. The technology advances have driven down the cost fast:

- The maturing wafer-level and 3D packaging helps to lower the cost of detectors, a key component of infrared night vision system.

- The homemade infrared sensors break the foreign monopoly, having a considerable cost advantage.

- Smaller pixel size drags down the cost of both infrared detector and system integration. Raytron Technology already develops the world’s first large area array uncooled infrared detector with pixel spacing of 8μm and area array size of 1920× 1080, meeting the needs of high-end products that require high resolution and light weight.

The National Technical Committee of Auto Standardization has released the Automotive Active Infrared Detection System (Draft for Comments) and the Automotive Passive Infrared Detection System (Draft for Comments). The deadline for comments is September 27, 2021. The European New Car Assessment Program (E-NCAP) again introduced a range of new tests in the E-NCAP 2018, including AEB cyclist test, pedestrian detection in dark and hazy lighting conditions, and vehicle under test (VUT) hid by obstacles. As the relevant laws and regulations are further improved, the automotive night vision system market has a rosy prospect.

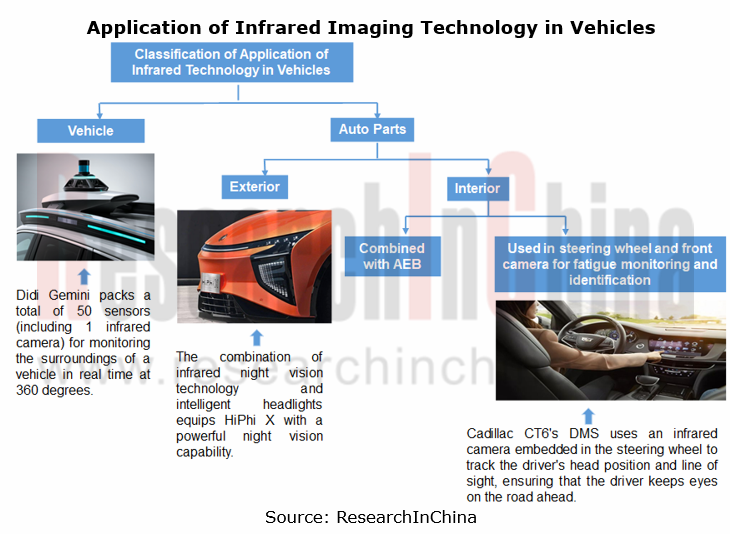

Infrared imaging technology finds ever wider application in autonomous driving.

The application of infrared imaging technology in autonomous driving has become more widespread over the past years, for example:

- In December 2020, Zoox introduced its first autonomous battery electric vehicle equipped with the thermal imaging camera provided by Teledyne FLIR. This device can accurately recognize and classify objects in urban streets around the clock.

- In March 2021, Apple was granted a patent for the night vision system that combines visible light, near-infrared (NIR), and long-wave infrared (LWIR) sensors. The system is applicable to autonomous vehicles.

- On the first day of the Auto Shanghai 2021, Didi Autonomous Driving and Volvo jointly launched “DiDi Gemini”, a new-generation L4 autonomous test vehicle which packs a total of 50 sensors including 1 infrared camera.

- In May 2021, ADASTEC integrated two Teledyne FLIR thermal imagers into its flowride.ai automation platform, with the primary focus on improving detection and safety of all vulnerable road users on or near the road and at bus stops.

Safety is a frequent topic of autonomous driving. Also, autonomous driving needs to have the ability to perceive beyond visual range and work 24/7, in all weather conditions. Infrared imaging technology can meet its needs.

Infrared sensors are a complement to visible light cameras that fail to detect pedestrians in dark conditions. They are not only more affordable than LiDAR but a remedy for the natural defect of LiDAR that it cannot classify objects.

Moreover, infrared sensors can work all day long, which is required by autonomous driving, and provides a longer visual range (the average active vehicle infrared night vision system detects 150m to 200m, and the average passive vehicle infrared night vision system up to 300m). Infrared thermography thus becomes an indispensable technology in the autonomous driving night vision field. The technology will fuse and work with other sensors to make driving safer by playing their respective role. As its price goes down, it will expedite the application of autonomous driving technologies.

As Adasky, an infrared night vision device vendor, said, its Viper infrared thermal imager is not launched to replace a certain type of sensor but works with this sensor to fill the targeted gaps left by other solutions in autonomous driving, so that vehicles have a stronger ability to perceive the surroundings and make decisions.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...