Automotive PCB research: vehicle intelligence and electrification bring about demand for PCBs, and local manufacturers come to the fore.

The share of electronics in curb weight of a vehicle is rising, expectedly up to 34.3% in 2020, which is accompanied by more vehicle entertainment and safety functions and the growth of new energy vehicles. This gives a direct boost to demand for automotive printed circuit boards (PCB).

The COVID-19 epidemic in 2020 slashed the global vehicle sales and led to a big shrinkage of the industry scale to USD6,261 million. Yet the gradual epidemic control has driven the sales up a lot. Moreover, the growing penetration of ADAS and new energy vehicles will favor sustained growth in demand for PCBs, which is projected to outstrip USD12 billion in 2026.

As the largest PCB manufacturing base and also the biggest vehicle production base in the world, China demands a great many of PCBs. By one estimate, China’s automotive PCB market was worth up to USD3,501 million in 2020.

Vehicle intelligence pushes up demand for PCBs.

As consumers demand safer, more comfortable, more intelligent automobiles, vehicles tend to be electrified, digitalized and intelligent. ADAS needs many PCB-based components such as sensor, controller and safety system. Vehicle intelligence therefore directly spurs demand for PCBs.

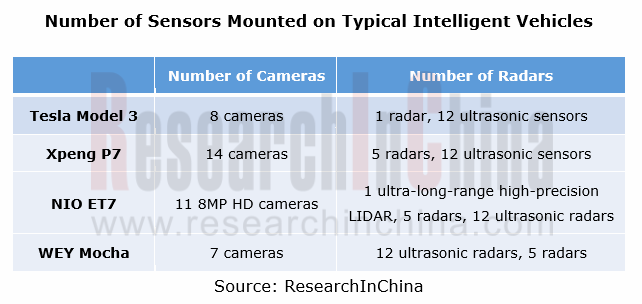

In ADAS sensor’s case, the average intelligent vehicle carries multiple cameras and radars to enable driving assistance functions. An example is Tesla Model 3 which packs 8 cameras, 1 radar and 12 ultrasonic sensors. On one estimate, the PCB for Tesla Model 3 ADAS sensors is valued at RMB536 to RMB1,364, or 21.4% to 54.6% of total PCB value, which makes it clear that vehicle intelligence boost demand for PCBs.

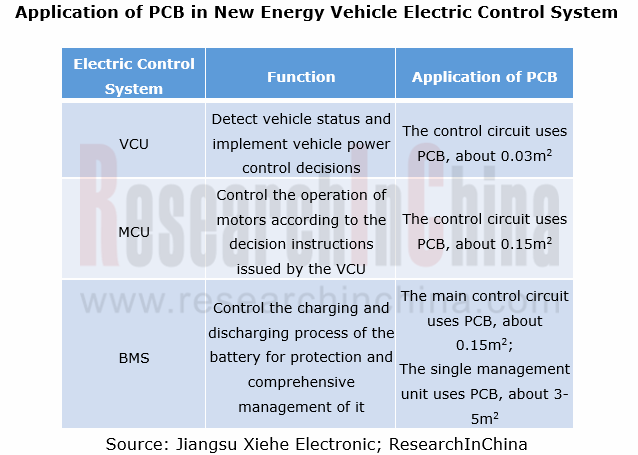

Vehicle electrification stimulates demand for PCBs.

Differing from conventional vehicles, new energy vehicles need PCB-based power systems like inverter, DC-DC, on-board charger, power management system and motor controller, which directly boosts demand for PCBs. Examples include Tesla Model 3, a model with total PCB value higher than RMB2,500, 6.25 times that of ordinary fuel-powered vehicles.

In recent years, the global penetration of new energy vehicles has been on the rise. Major countries have formulated benign new energy vehicle industry policies; mainstream automakers race to launch their development plans for new energy vehicles as well. These moves will be a major contributor to the expansion of new energy vehicles. It is conceivable that the global penetration of new energy vehicles will ramp up in the years to come.

It is predicted that the global new energy vehicle PCB market will be worth RMB38.25 billion in 2026, as new energy vehicles become widespread and the demand from higher levels of vehicle intelligence favors a growth in PCB value per vehicle.

Local vendors cut a figure in the severer market competition.

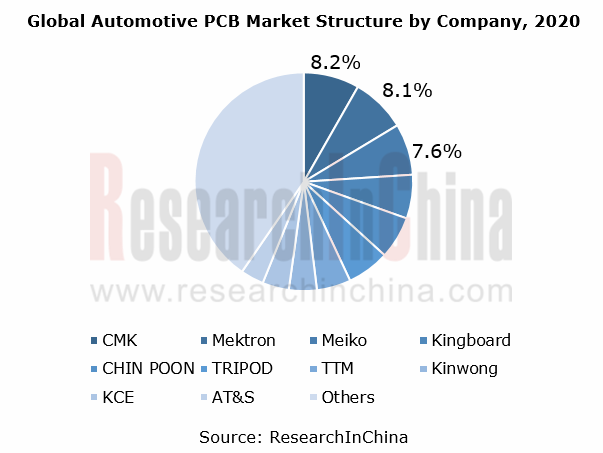

At present, the global automotive PCB market is dominated by Japanese players such as CMK and Mektron and Taiwan’s players like CHIN POON Industrial and TRIPOD Technology. The same is true of the Chinese automotive PCB market. Most of these players have built production bases in Chinese Mainland.

In Chinese Mainland, local companies take a small share in the automotive PCB market. Yet some of them already make deployments in the market, with increasing revenues from automotive PCBs. Some companies have a customer base covering the world’s leading auto parts suppliers, which means it is easier for them to secure bigger orders to gain strength. In future they may command more of the market.

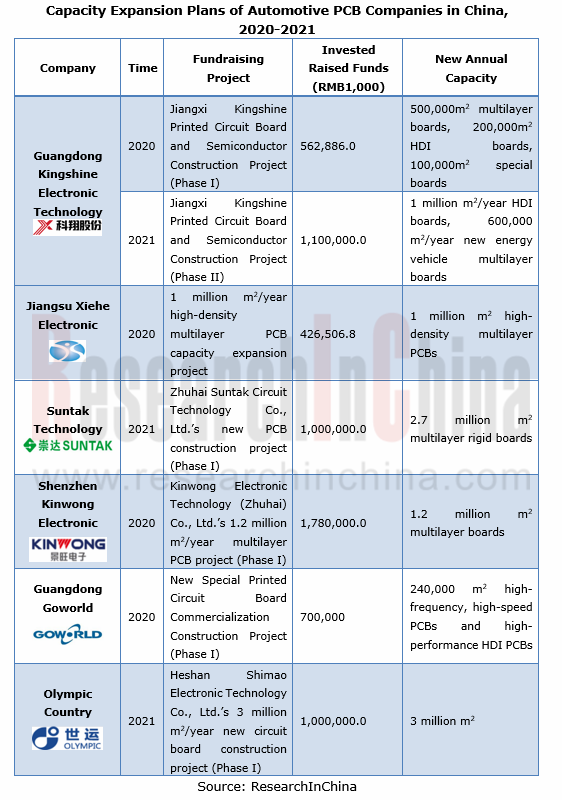

Capital market helps local players.

In recent two years, automotive PCB companies seek capital support to expand capacity for more competitive edges. With the backing of capital market, local players will become more competitive as a matter of course.

Automotive PCB products head in high-end direction, and local companies make deployments.

At present, automotive PCB products are led by double-layer and multi-layer boards, with relatively low demand for HDI boards and high frequency high speed boards, high value-added PCB products which will be more in demand in future as demand for vehicle communication and interiors increases and electrified, intelligent and connected vehicles develop.

The overcapacity of low-end products and fierce price war make companies less profitable. Some local companies tend to deploy high value-added products for becoming more competitive.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...