In 2021H1, the sales of vehicle models with console multi and dual display surged by 61% and 155% on a like-on-like basis, respectively

Our Automotive Cockpit Multi and Dual Display Trend Report, 2021 combs through the passenger car models with console multi and dual displays during 2020-2021H1, and discusses the relationship between chip, display and system.

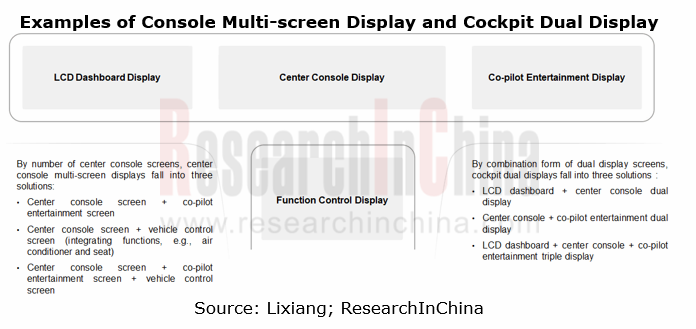

“Console multi-screen display”, a functional description of center console, refers to center console display with two or more screens, for example, center console screen + co-pilot entertainment screen, function control screen, etc.

“Cockpit dual display”, a functional description of cockpit, refers to the abreast layout of in-vehicle displays, that is, integrated design or approximate design, for example, integrated display solutions like “LCD dashboard screen + console screen dual display” and “LCD dashboard screen + console screen display + co-pilot entertainment screen triple display”.

1. The pace of launching models with multi and dual displays quickens.

In 2021H1, a total of 136 auto brands were scrambling for the Chinese passenger car market. In the fairly fierce competition, Chinese and foreign brands kept updating their products from within.

On the face of it, users can directly see how in-vehicle screens are deployed and how many they are. In a connotative view, cockpit software systems implement new hardware and software architectures via high-performance computing chips, thus providing better user experience in actual use. Quite a few automakers make in-depth improvements based on intelligent cockpits, and accelerate the roll-out of models that pack integrated displays, multi-screen displays, and one-chip, multi-screen, dual-system solutions.

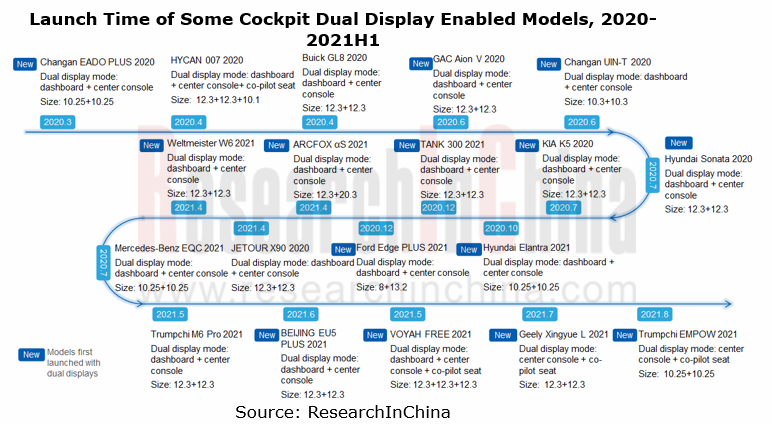

In the case of cockpit dual display, several auto brands including Chinese, German, American and Korean ones have launched their mass-produced models that carry dual/triple displays on market during 2020-2021H1.

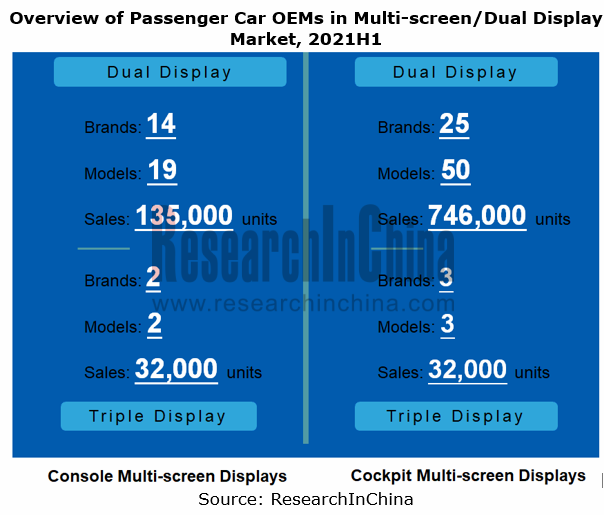

In 2021H1, the sales of models with console multi and dual displays surged by 61% and 155% on a like-on-like basis, respectively.

In spite of the downturn in overall passenger car sales in China, models with multi and dual displays bucked the trend and showed an aggressive growth in 2021H1. The sales of models with console multi-screen displays and cockpit dual displays shot up by 61% and 155% from the prior-year period, separately.

The booming sales of such models indicate how determined automakers are in cockpit disruption, and are also an evidence of their high acceptance in market. The positive effects given by automakers and the market have created an active and effective closed loop, which will make the sales of models with multi-screen and dual displays sustain rapid growth.

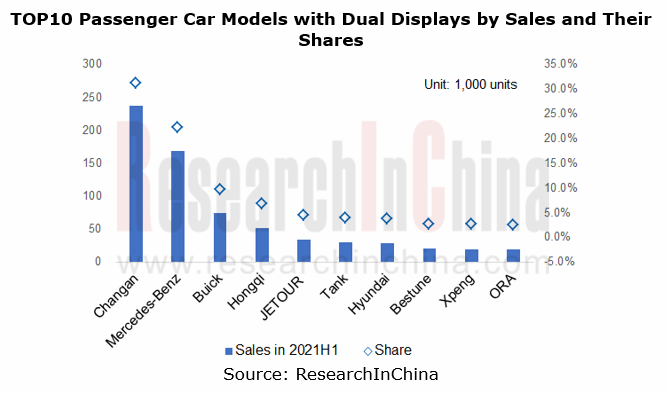

Chinese brands hold a more positive, more open attitude towards cockpit dual displays.

Still take cockpit dual display as an example. Homegrown brands in China have become the main drivers of cockpit dual display solutions in the first half of 2021, with a market share of 62.3%, among which Changan Auto is the most typical player followed by Hongqi and Jetour. In the joint venture brands, Hyundai, Ford and SOL have introduced several dual display-enabled models during 2020-2021H1.

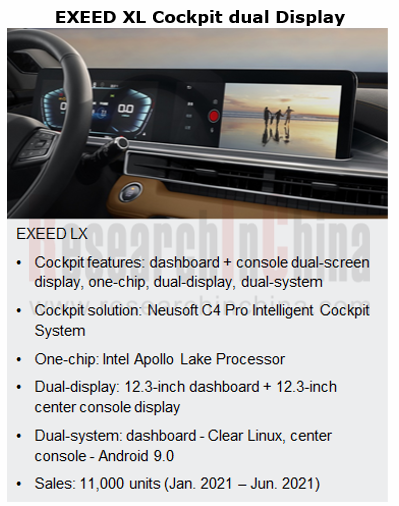

Chery is one of the earliest homegrown brands deploying dual displays and using one-chip, dual-display, dual-system solutions.

In October 2019, EXEED, a high-end brand under Chery introduced EXEED LX, its second model equipped with i-Connect@Lion 3.0 and 12.3-inch dashboard + 12.3-inch console dual-screen display. Differing from the previous versions, i-Connect@Lion 3.0 co-developed by Neusoft, Baidu and Intel enables a one-chip, dual-display, dual-system solution via ACRN hypervisor that runs on the Intel Apollo Lake processor.

This solution has become available to the full range of EXEED models, making the auto brand one of the few thorough implementers of dual displays and one-chip, dual-display, dual-system solutions in the auto industry.

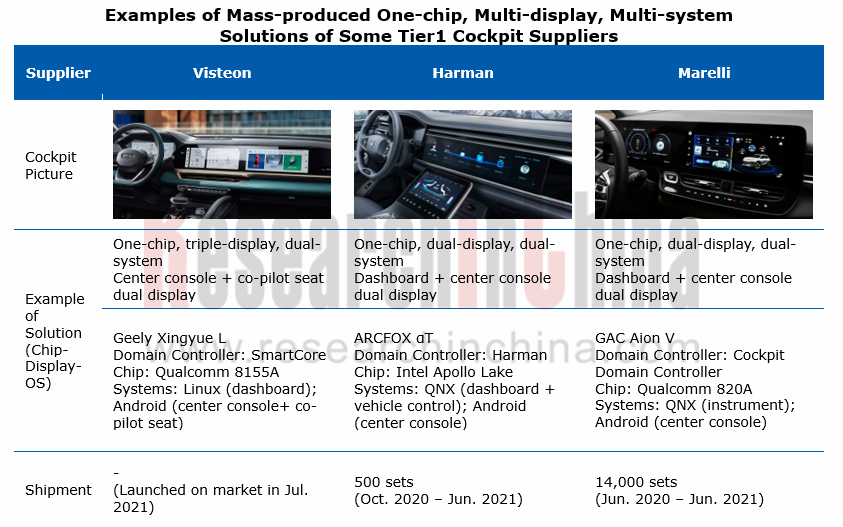

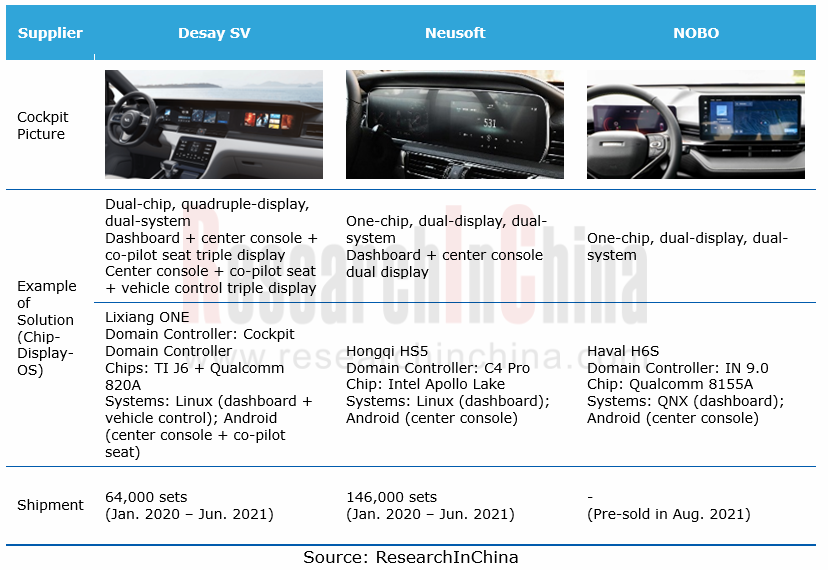

2. Chip vendors and Tier1 cockpit solution suppliers are strong advocates of one-chip, multi-display, multi-system solutions.

Simple technology upgrade is not enough to make cockpits intelligent in a substantial way. High performance chips such as Qualcomm, Renesas and Intel bring in a possibility for multiple operating systems to run on one chip, and also support several screens including LCD dashboard screen, center console screen and co-pilot entertainment screen.

Take Qualcomm SA8155 as an example: as the world’s first mass-produced 7nm automotive digital cockpit chip, the octa-core chip supports 4 2K screens or 3 4K screens, with the computing forces of CPU and GPU up to 80K DMIPS and 1142G FLOPS, respectively. Qualcomm SA8155 has provided one-chip, multi-display solution enablers for mass-produced models like AION LX, WEY Mocha and Xingyue L.

Automotive E/E architecture is shifting to a domain centralized one, which allows Tier1 cockpit suppliers to integrate different operating systems into the cockpit domain controller through hardware isolation or hypervisor technology, so as to realize the one-chip multi-system function on a single hardware platform for higher computational efficiency and lower cost.

One example is SmartCore, Visteon's latest cockpit domain controller which enables HMI seamless connection in multiple display domains such as digital cluster, infotainment and rear seat infotainment. On the strength of its powerful computing force, the Hypervisor-based SmartCore architecture running on two systems allows SmartCore solution to simultaneously drive digital cluster system, infotainment system, and body control system. SmartCore domain controller has provided one-chip, dual-system solution support for mass-produced models like Mercedes-Benz A-Class, AION LX and Xingyue L.

Globally, Tier1 cockpit suppliers both inside and outside China are racing to launch one-chip, multi-display, multi-system cockpit solutions based on high performance chip and cockpit domain controller.

3. Challenges and Trends

Multi-screen and dual displays provide substantially better occupant experience in multiple aspects: in usability, both displays improve the interaction efficiency between people and vehicles to some extent and make it cheaper for users to obtain vehicle information and functions; in scalability, both of them expand the information load capacity of a cockpit and add more driving information and entertainment content.

Meanwhile, the upgrade of current cockpit industry chain technologies including chip, operating system, cockpit domain controller and display will leave more scope for OEMs to conceive and implement multi-screen and dual displays, helping to reshape cockpits technologically.

As concerns whether it is necessary to introduce multi-screen/dual display or one-chip, multi-display, multi-system solution into a car or not, automakers need to take into account a combination of factors such as product orientation, user needs, R&D costs and competitive pattern. As for cockpit interior structure, it is not the use or re-layout of displays that poses technical and cost challenges to OEMs, but how to improve user experience with multi-screen/dual displays of limited number and size, that are introduced into a cockpit based on redesigned software and hardware architecture, in an age of intelligent cockpits. This is really worth OEMs thinking about.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...