China Automotive Magnesium Alloy Die Casting Industry Report, 2021

Under the general trend of automobile lightweight, the CAGR of magnesium alloy market demand reached 13.2%

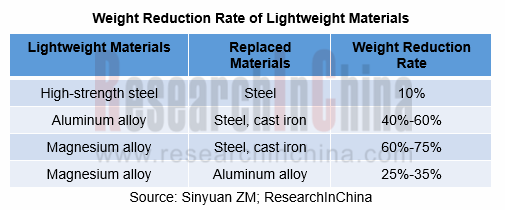

The vast majority of automotive magnesium alloy parts are die casting parts, which are mainly used in housings and brackets. Magnesium alloy is a good substitute for steel and aluminum alloy, and can reduce the product weight by 25%-75%. However, the current application ratio of magnesium alloy in automobiles is much lower than that of aluminum alloy.

Magnesium alloy facilitates lightweight vehicles

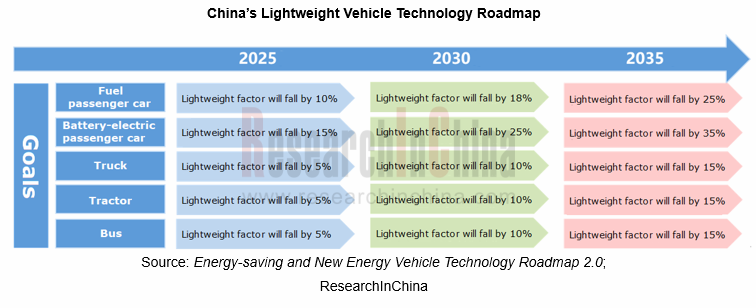

Given energy saving, environmental protection and performance, lightweight vehicles have become one of the important directions for the development of the global automotive industry. In 2020, China released Energy-saving and New Energy Vehicle Technology Roadmap 2.0, putting forward lightweight requirements for all types of vehicles. In addition, major automakers have proposed goals of promoting the development of lightweight vehicles.

At present, lightweight vehicle technology is mainly divided into three types: lightweight material technology, lightweight advanced process technology, and lightweight structure optimization technology. Lightweight materials are the key to lightweight vehicles.

Magnesium alloy features low density, high strength, good heat dissipation, strong vibration resistance, noise reduction, excellent die casting performance, and outstanding cutting performance, as an ideal lightweight material. Under the trend of lightweight vehicles, the market demand for magnesium alloy will grow rapidly.

In 2015, a single car in China only used about 1.5kg of magnesium, which was far lower than the level in Europe, America, Japan and other regions. However, with the rapid development of new energy vehicles and the acceleration of the lightweight vehicle process, the amount of magnesium used in a single vehicle in China has grown rapidly, and it is estimated to reach 15kg in 2020.

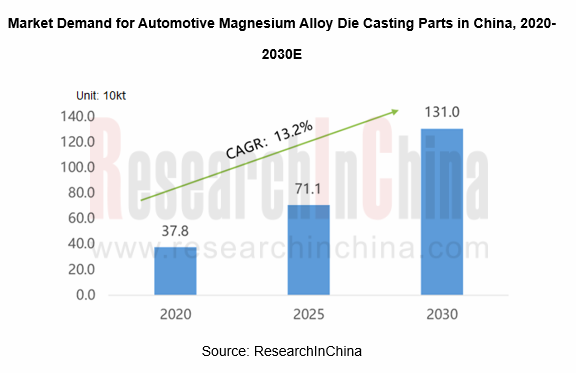

As per Energy-saving and New Energy Vehicle Technology Roadmap 2.0, a single car in China will use 45kg of magnesium alloy, which will account for 4% of the total vehicle weight by 2030 when the Chinese automobile market will demand 1.31 million tons of magnesium alloy die casting parts with a CAGR of 13.2% in 2020-2030.

Magnesium alloy boosts lightweight new energy vehicles

For every 10% reduction in the weight of new energy vehicles, the average cruising range can increase by 5%-8%. Therefore, the demand for lightweight new energy vehicles is urgent. The density of magnesium alloy is 2/3 that of aluminum and 1/4 that of steel, so it is much lighter than the latter two, which means that magnesium alloy is the best choice for lightweight new energy vehicles.

New energy vehicle battery packs account for more than 20% of the vehicle weight, thus lightweight new energy vehicles partly hinge on lightweight battery packs.

Lightweight battery packs can make outer casings, bottom trays, and inner end/side panels lighter. For example, Tesla MODEL S mainly uses aluminum alloy for the battery pack shell which weighs up to 125 kg; if it uses magnesium alloy, the weight will be reduced by about 60 kg or nearly 50%.

At present, Wanfeng Meridian, Qianhe Magnesium, RSM Group, Eontec, Ka Shui Group, etc. have made layout in the field of magnesium alloy casting for battery pack shells of new energy vehicles.

As the world's leading supplier of new energy vehicle batteries, CATL has also deployed magnesium alloy die casting for battery packs. In November 2020, CATL, Sanxiang Advanced Materials, Vansun Group, and Zhuhai Hengqin Yinmei Technology jointly established Ningde Wenda Magnesium-Aluminum Technology Co., Ltd. to build a magnesium-aluminum alloy project with a total investment of RMB800 million. The products include die casting structural parts for battery casings.

Wanfeng Auto Wheel leads the market amid low market concentration

At present, the global automotive magnesium alloy die casting market is highly fragmented with low market concentration The relatively large-scale companies mainly include Georg Fisher, DGS, STIHL, Wanfeng Meridian, SUNDARAM CLAYTON, Gibbs, PACE, etc.

In the short history of China's automotive magnesium alloy die casting market, there are only a few companies of a certain size, mainly including Wanfeng Auto Wheel, RSM Group, Sinyuan ZM, Eontec, Ka Shui Group, etc.

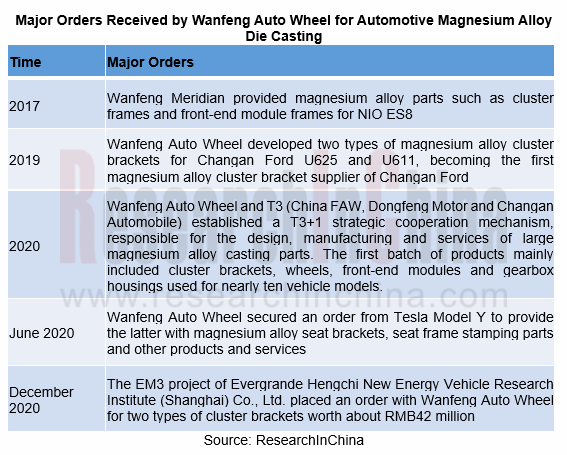

Wanfeng Auto Wheel has become a leader in the automotive magnesium alloy die casting market in China and even in the world through the acquisition of Wanfeng Meridian which was granted the Automotive Casting Excellence Award by The International Magnesium Association (IMA) for two consecutive years. Wanfeng Meridian serves not only Tesla, NIO and other new energy vehicle companies, but also traditional automakers such as Porsche, Audi, Mercedes-Benz, BMW and Volvo.

Enormous market potentials prompt companies to expand production

In view of enormous market potentials, domestic companies have invested in building or expanding automotive magnesium alloy die casting bases to meet the growing market demand. In the future, the competition in the industry will become more intense, and the automotive magnesium alloy die casting market will mature.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...