VCU research: rapid evolution to integration and domain control

OEMs gradually realize independent supply amid the competitive landscape of VCUs for new energy passenger cars

The VCU is the "brain" of new energy vehicles. In the early development stage of China's new energy vehicle industry, VCUs were mainly supplied by foreign vendors. Afterwards, domestic automakers and automotive electronics suppliers have gradually mastered core technologies, so that their industrialization capabilities were greatly improved.

For example, BYD has fully realized independent supply of VCUs, Geely has continuously increased the proportion of self-produced VCUs to about 60%, almost 80% of Changan Automobile’s VCUs are produced by itself, and Chery can produce more than 90% of its own VCUs.

The VCUs of some OEMs or some models are purchased from third-party suppliers like UAES, Bosch, Continental, Denso, G-Pulse Electronics Technology, Atech, Hefei Softec Auto Electronic, Hangsheng Electronics, etc. Suppliers can provide their own software and hardware directly to OEMs, or they can be the foundries of OEMs.

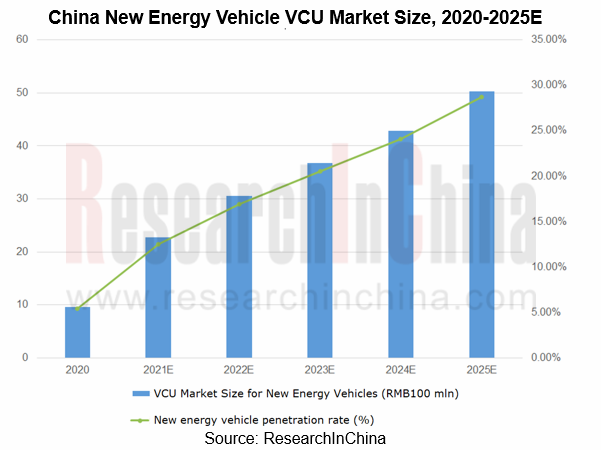

The VCU market size is related to the output of new energy vehicles. By 2025, China new energy vehicle VCU market size will hit RMB5.03 billion (including self-supply of automakers).

Lightweight promotes the development of "electric drive + electric control + VCU" integrated system

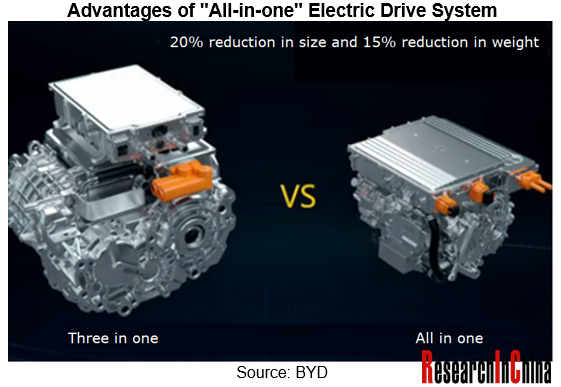

In order to cater to the development trend of electrified, intelligent and lightweight vehicles, VCUs will tend to be highly integrated in the future. OEMs and Tier 1 suppliers have launched "all-in-one" electric drive systems, containing VCUs.

To further reduce the weight of new energy vehicles, improve product performance and ride comfort, BAIC started to try highly integrated products, followed by GM, Huawei, BYD, etc.. "Electric drive + electronic control + VCU" integrated systems have become the focus of OEMs and Tier 1 suppliers.

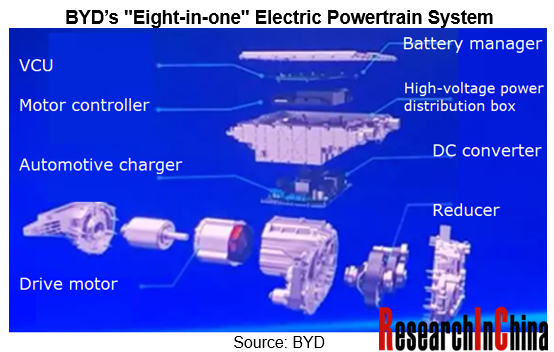

In September 2021, FinDreams Powertrain under BYD launched the "eight-in-one" electric powertrain, which deeply integrates drive motor, motor controller, reducer, automotive charger, DC converter, power distribution box, VCU, and battery manager.

One of the main purposes of BYD's "eight-in-one" integrated system is to reduce the weight of electric vehicles. It can realize the sharing of external high-voltage filters, external interface filter circuits and high-voltage sampling, as well as the in-depth integration of system DC, OBC, power distribution, transformers, inductors and VCU/BMC/MCU chips, so that an H-Bridge, transformers and a lot of high-voltage wiring harness are unnecessary, the magnetic module size is reduced by 40%, the overall volume is cut down by 16% (which can expand the riding space or increase the battery capacity), and the weight is slashed by 10% (which can further reduce power consumption).

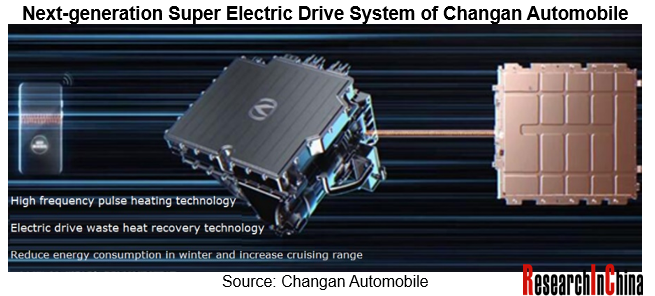

In July 2021, Changan Automobile released the second-generation electric drive integrated system, which combines seven components: VCU, high-voltage junction box, motor controller, DC converter, charger, motor, and reducer. Compared with the first-generation "three-in-one" (integrated motor, electronic control, and reducer) system, the second generation has been significantly improved in comprehensive performance, with the size reduced by 5%, the weight reduced by 10%, the power density increased by 37%, and the efficiency improved by 5%.

Changan Automobile expects to mass-produce next-generation super integrated electric drive in the second quarter of 2022, and which will be first deployed on C385, the first strategic model of the dedicated electric platform (EAP1).

Under the new EEA, VCU develops towards domain control integration

From the perspective of evolution process, automotive E/E architecture (EEA) will inevitably develop towards centralized EEA. From the perspective of mass-produced models, domain-centralized EEA prevail now. The quasi-central architecture consisting of the central computing platform + zonal controllers will be the next step for automakers who finally evolve towards the central computing architecture concentrating the functional logic to a central controller.

With the evolution of the vehicle's EEA, the "all-in-one" electric drive system will eventually be integrated into the domain control system. For example, Huawei's "seven-in-one" DriveONE electric drive system has the most eye-catching domain control solution. The integration of modules, systems, scenarios and solutions effectively improves the system security.

(1) VCUs are integrated into domain controllers

For the development of vehicle EEA, the VCUs of the domain control architecture can be integrated into domain controllers. For example, ENOVATE integrates VCU and BMS to form the first-generation power domain controller VBU with completely independent research and development.

Hardware: The VBU uses Infineon's tri-core processor, has rich I/O resources, and supports Fast Ethernet;

Software: AUTOSAR architecture. The software architecture and interface protocol comply with AUTOSAR 4.2.2;

Application: At present, the VBU has integrated vehicle control, battery management, charging control, and extended range control.

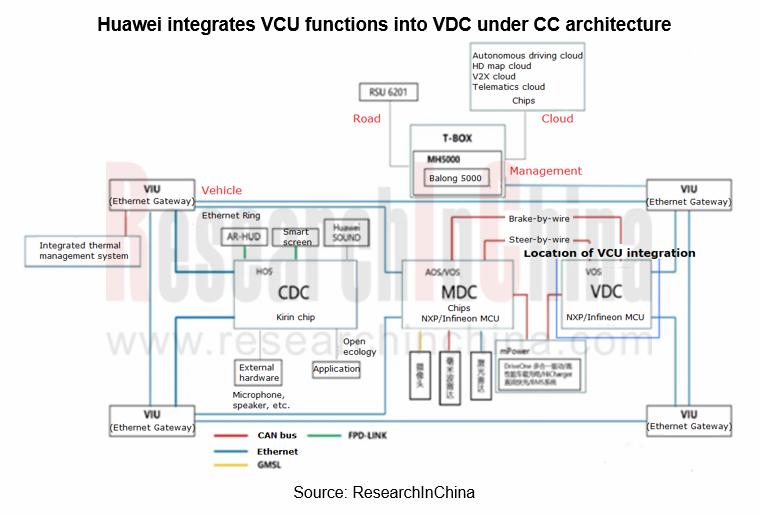

Huawei's CC architecture includes 3 central controllers (smart cockpit, vehicle control, and smart driving) and 4 zonal controllers. Among them, the vehicle domain control (VDC) integrates the original VCU, adopts VOS system, and is compatible with AutoSar.

On the VDC platform, Huawei will develop an MCU and a vehicle control operating system which will be open to automakers, allowing automakers to perform differentiated vehicle control based on the VDC platform.

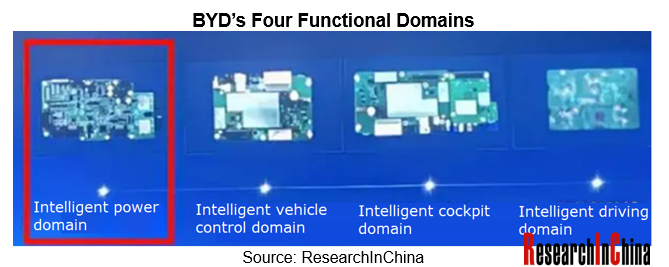

In April 2021, BYD released the e-platform 3.0, which gradually integrates dozens of ECUs in the vehicle into domain controllers of intelligent power domain, intelligent vehicle control domain, intelligent cockpit domain and intelligent driving domain; wherein, intelligent power domain integrates the control part of VCU, BMS, Inverter, PDU, DC/DC and AC/DC.

(2) VCUs are integrated into central computing unit

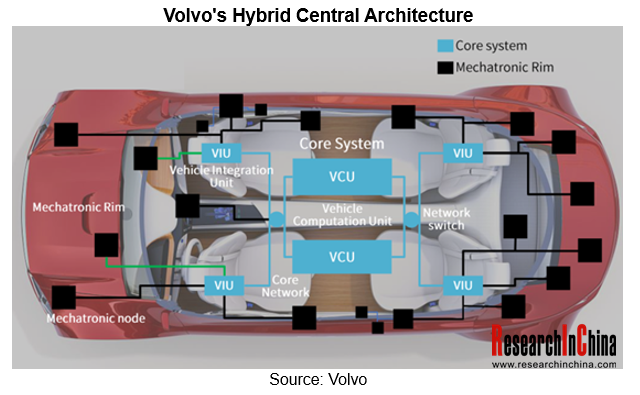

Under the central computing architecture, the central gateway degenerates into multiple zonal gateways, and VCU functions will be integrated into the vehicle control unit of the central computing unit.

For example, Volvo's hybrid central architecture includes a central computing platform, an intelligent interconnection module (IHU), and an autonomous driving module (ADPM) to integrate the original domain controllers into a central computing platform.

ResearchInChina’s New Energy Vehicle VCU Industry Report, 2021 mainly studies the following contents:

Industry overview, market size, competitive landscape, etc. of VCUs for new energy vehicles;

Industry chain, status quo of upstream and downstream of VCUs for new energy vehicles;

The impact of the EEA reform on VCUs for new energy vehicles, the development trend of VCU technology, etc.;

VCU solutions of some OEMs (such as BYD, ENOVATE, Changan, etc.);

VCU solutions of major domestic and foreign suppliers.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...