Global and China Automotive Operating System (OS) Industry Report, 2021

Automotive OS Research: Automotive OS Is Highly Competitive

Automotive OS has always been complicated and dazzling.

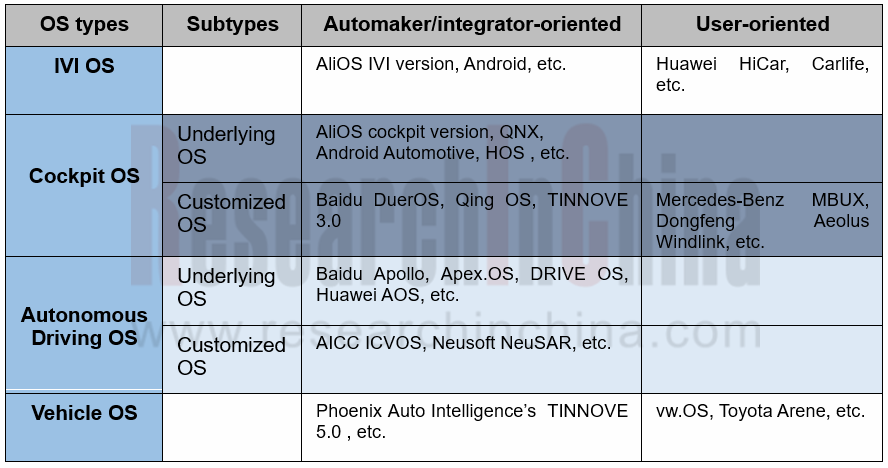

A year ago, ResearchInChina classified "Automotive OS" into four types:

1) Basic Auto OS: it refers to base auto OS such as AliOS, QNX, Linux, including all base components like system kernel, underlying driver and virtual machine.

2) Custom-made Auto OS: it is deeply developed and tailored on the basis of basic OS (together with OEMs and Tier 1 suppliers) to eventually bring cockpit system platform or automated driving system platform into a reality. Examples are Baidu in-car OS and VW.OS.

3) ROM Auto OS: Customized development is based on Android (or Linux), instead of changing system kernel. MIUI is the typical system applied in mobile phone. Benz, BMW, NIO, XPeng and CHJ Automotive often prefer to develop ROM auto OS.

4) Super Auto APP (also called phone mapping system) refers to a versatile APP integrating map, music, voice, sociality, etc. to meet car owners’ needs. Examples are Carlife and CarPlay.

However, profound changes have taken place in the Automotive OS field so far. In this report, we classified Automotive OS from another perspective.

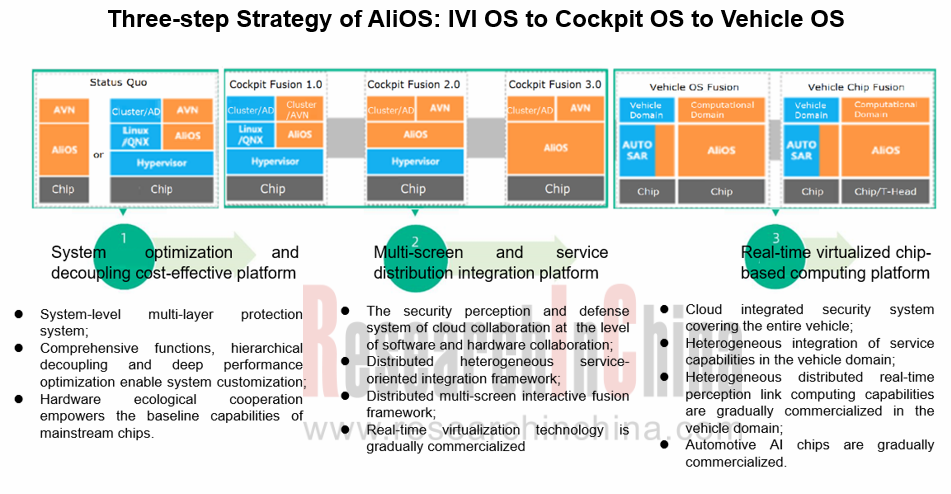

Many Automotive OS vendors have started from IVI OS, with the technological evolution: IVI OS-->Cockpit OS -->Vehicle OS. They are expected to head toward Vehicle OS after 2024.

In 2020, Banma SmartDrive proposed the evolution route of AliOS, namely Smart IVI OS-->Smart Cockpit OS -->Smart Vehicle OS.

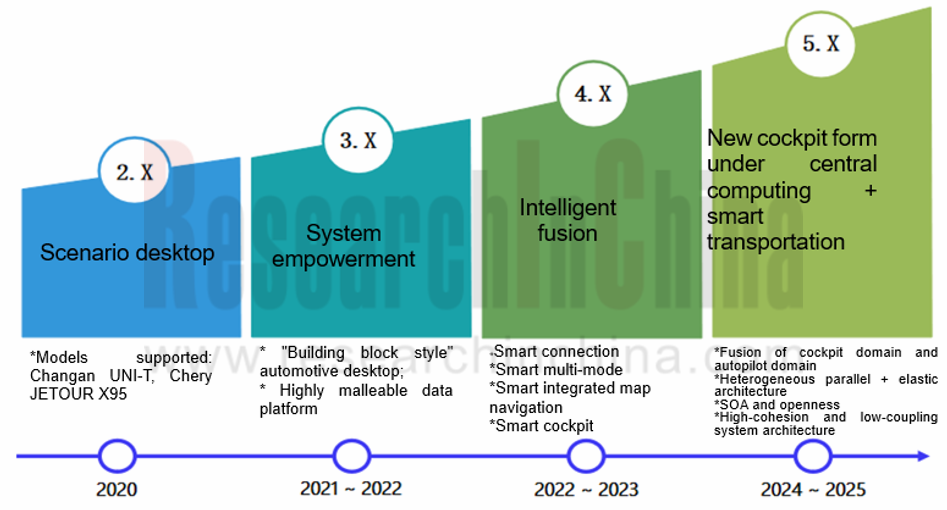

Based on Tencent's ecology, TINNOVE OS follows the technology roadmap from Cockpit OS to Vehicle OS that integrates the cockpit domain and the autonomous driving domain.

Through the "open" and "ecological" approach, TINNOVE OS transfers Tencent’s ecosystem to the system and OEMs. At present, it has cooperated with Changan Automobile, Audi, Chery JETOUR, Ford and other brands. TINNOVE OS has been installed in more than a dozen models like Changan CS75Plus, UNI-T, CS35Plus and CS85 COUPE. Phoenix Auto Intelligence has recently reached in-depth cooperation with Qualcomm, and SemiDrive, etc.

Autonomous Driving OS and Domain Controllers Are Integrated to Be Autonomous Driving Computing Platform

With the popularity of software-defined vehicles and domain controllers, automakers, Tier1 suppliers and core chip vendors have been all making layout from the perspective of platforms and ecology.

Autonomous driving computing platform providers not only lay out Autonomous Driving OS, but also launch domain controllers, and build ecosystems based on computing platforms consisting of Autonomous Driving OS and domain controllers. With these autonomous driving platforms, OEMs and autonomous driving integrators no longer have to deal directly with the underlying operating system and chips, which can greatly simplify the development process and shorten the product cycle.

Neusoft Reach and AICC are typical autonomous driving computing platform providers.

Neusoft Reach’s next-generation autonomous driving computing platform includes the software platform NeuSAR3.0, the all-in-one X-Cube3.0 for ADAS, and the autonomous driving domain controller X-Box 3.0. In October 2021, Neusoft Reach was invested by SDIC and Virtue Capital with a total of RMB650 million.

In February 2021, AICC released the intelligent driving computing platform "Intelligent Vehicle Basic Brain" (iVBB) 1.0, including intelligent connected vehicle operation system (ICVOS), intelligent vehicle domain hardware (ICVHW), and intelligent connected vehicle-edge-cloud basic software (ICVEC). It features rapid application development, platformization, connectivity, scalability and compliance with automotive regulations.

Automotive OS investment soars, and market competition becomes fierce

In March 2021, Evergrande New Energy Vehicle and Phoenix Auto Intelligence signed an agreement to invest 60% and 40% respectively in establishing an operating system joint venture.

In July 2021, the veteran shareholders Alibaba Group, SAIC Group, SDIC, and Yunfeng Capital jointly injected RMB3 billion into Banma SmartDrive for further R&D and promotion of intelligent vehicle OS.

In June 2021, AICC the completed the angel financing of nearly RMB100 million. In October 2021, AICC raised hundreds of millions of yuan in the pre-A round of financing.

The background of the above three companies: Phoenix Auto Intelligence is backed up by Tencent, Alibaba is behind Banma SmartDrive, and AICC is supported by CICV (invested by more than a dozen traditional OEMs and Tier1 suppliers). Plus Baidu and Huawei, which are aggressive in the Automotive OS market, all players are powerful.

The competition in automotive computing platforms, including operating systems, is essentially ecological competition. Who can win the support of more software developers, component companies, service operators, etc. will dominate the future autonomous driving.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...