China Automotive Multimodal Interaction Development Research Report, 2021

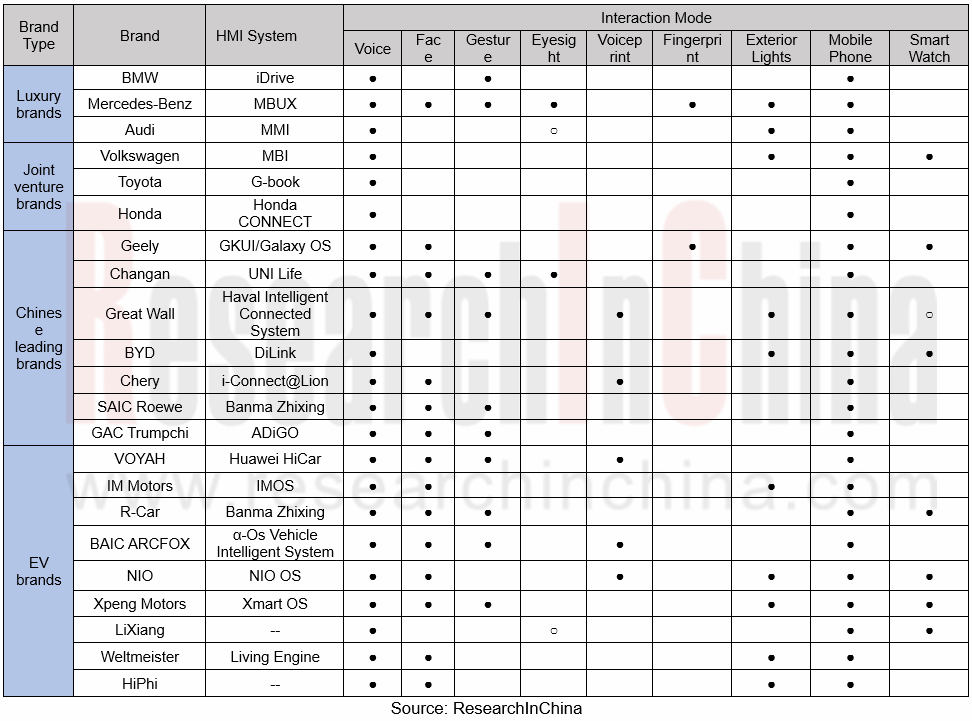

Our China Automotive Multimodal Interaction Development Research Report, 2021 combs through and summarizes the interaction modes of mainstream auto brands.

The current automotive human-computer interaction (HMI) is characterized by the following:

1. In terms of interaction modes, in addition to conventional interaction methods such as touch control, button and knob, voice and mobile phone have become favored options in automotive HMI. Moreover, face, gesture, and car lamp have also become popular interaction options. Some brands even have begun to try new interaction ways, such as eye tracking, voiceprint, and fingerprint.

2. As concerns layout, joint-venture brands remain conservative in interaction modes. They seldom use new interaction methods except for voice and mobile phone. Yet luxury brands are pioneers of multimodal interaction. One example is Mercedes-Benz which has equipped its new-generation MBUX system with multiple new interactions like face, gesture, eye, and fingerprint. By comparison, Chinese leading brands are more active in new interaction modes, for example, Changan Auto has eyesight wake-up and Great Wall Motor offers voiceprint recognition.

Some HMI modes of mainstream auto brands inside and outside China:

Voice as a conventional interaction mode offers improvements in functions.

Besides the original capabilities of voice interaction, features like continuous dialogue, voice area lock, tone switch, and user-defined voice have become next orientations of mainstream brands.

1. Continuous dialogue and voice area lock have been used by several brands.

After a wake-up, a voice interaction system with the continuous dialogue capability needs no repeated wake-up within a certain period of time, which makes the response to instructions more coherent; the voice area lock feature with the ability to locate the voice command issuer, executes commands like “open window” and “adjust air conditioning temperature” more accurately. The brands using the two features include Geely, Changan, Great Wall, Chery, SAIC Roewe, GAC Trumpchi, Xpeng, NIO and Lixiang.

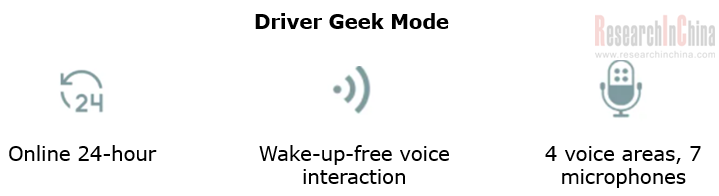

Geely Xingyue L - the “driver geek mode” of Galaxy OS frees the driver of wake-up in 24 hours, and enables lock of four voice areas.

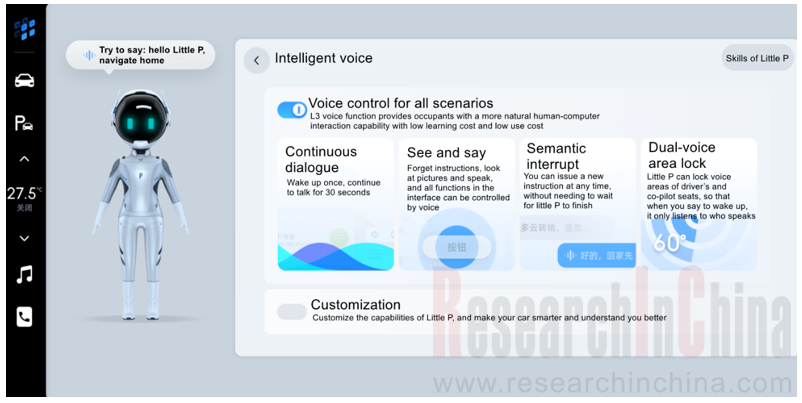

Xpeng Motors – the voice assistant Little P delivers voice functions in all scenarios and allows 30s continuous dialogue and dual-voice area lock.

2. Tone switch refers to the availability of other speech options the voice system provides for users in addition to default voices and sounds, such as, voices of celebrities and game characters. The brands with this feature include Geely, Changan, Great Wall, BYD and Roewe, as well as emerging carmakers like NIO, Xpeng and Lixiang. For instance, Banma Zhixing Venus System mounted on SAIC Roewe RX5 offers five tone options: affinity female voice, intellectual female voice, magnetic male voice, innocent child voice, and passionate female voice.

3. User-defined voice feature allows customization of voice tones and voice functions.

“Voice tone customization” means that the system applies the uploaded voices of the user’s own or his/her families’ in scenarios such as voice response and navigation broadcast. Models carrying this capability include Geely, Great Wall, SAIC Roewe, GAC Trumpchi and R Car.

“Voice function customization” means that users can define a voice command as well as corresponding operation, which brings the voice system into full play and meets the personalized needs of users. The typical brand using this capability is Xpeng Motors.

Geely Xingyue L - Galaxy OS allows users to define voice. The customized human voice is available to all scenarios including navigation and response.

Xpeng Motors - Little P Customization allows Xpeng car owners to define voice commands and corresponding operation via their smartphone APP.

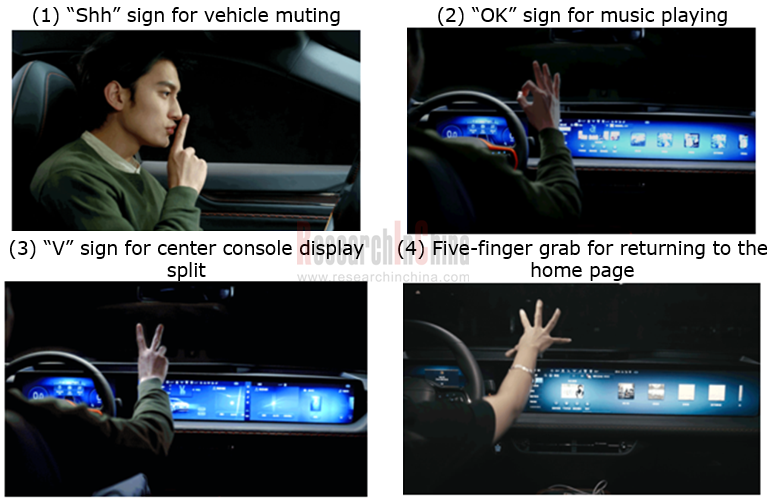

Gesture has become the third new interaction mode behind voice and face.

Gesture interaction uses the in-car camera to judge a gesture and send the data to the vehicle system control unit which will then call out the function corresponding to the gesture. Gesture control is more accurate and quicker, and easier to operate than voice control.

Brands using gesture interaction include BMW, Mercedes-Benz, Changan, Great Wall, SAIC Roewe, GAC Trumpchi, VOYAH, R Car, BAIC ARCFOX, and Xpeng, of which Great Wall and Xpeng support gesture recognition outside car.

WEY Mocha – enable gesture control over ignition, forward/backward movement, suspension, and flameout outside the car.

Changan Ford EVOS - the new-generation SYNC+ 2.0 allows gesture control over muting, music play, interface split, and back to the home interface, etc.

Light interaction is available to brands like Mercedes-Benz, HiPhi and IM Motors.

Light interaction sends a message out by way of flashing, light projection and combination headlight. Light interaction provides channels for communication with traffic participants outside the car, and enables autonomous vehicles to communicate with the surroundings at a time of implementing autonomous driving. Now brands including Mercedes-Benz, Audi, Volkswagen, Great Wall, BYD, HiPhi, IM and Xpeng have packed this interaction mode.

Mercedes-Benz - Projector headlights project warning signs, assisted markings and other information related to driving assistance systems onto the road ahead.

IM L7 - Projection headlights enable the projection of interactive alerts, navigation, vehicle information among others, offering lane-level guidance with HD maps.; combination headlights provide several patterns to show the status of users in the cockpit; interactive taillights enable display of words and emoticons, as well as information, for example, thanks, pedestrian warning and state of charge.

As well as combination headlights, some brands like BAIC and Samsung are trying to add displays at the front and rear of the body to send messages to pedestrians.

BAIC Lite 300 – LED displays at the front and rear of the body show words, emoticons, animations, state of charge and other content.

Multimodal fusion holds a future trend.

Single-modal interaction has a limited role to play in improvement of interaction experience. Multimodal fusion is obviously a feasible and efficient option for better interaction experience in future. Brands that are developing this feature are Mercedes-Benz, BMW, Huawei and Changan.

1. Voice + eye sight

Voice interaction shows little ability to recognize fuzzy pronouns like “this” and “that”. In this case, the addition of eye tracking for locking direction, plus voice commands, can make the response to commands much quicker.

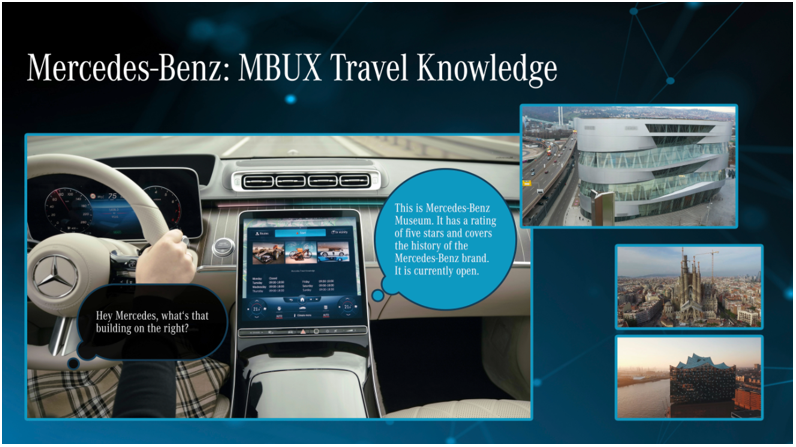

Mercedes-Benz MBUX Travel Knowledge – a driver who fixes his/her gaze on a building says “I want to know the purpose of this building”, and he/she will acquire related information. Cerence Look provides technical support.

2. Voice + lip movement recognition

Accurate acquisition of commands is a key step in the voice interaction process. Complex cockpit environment, noise and high personnel density make it harder to recognize voice. The new voice area lock feature added recently comes as a solution to the problem. Yet for its limitations, the single-model voice interaction technology has a limited effect in improving interaction experience.

The combination with lip movement recognition renders voice recognition far more accurate in voice interaction. Lip movements vary over language. In a noisy cockpit environment, combining lip movements, the system can ensure high voice recognition accuracy, even as the voice sounds low.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...