Chinese Independent OEMs’ ADAS and Autonomous Driving Report, 2021

-

Nov.2021

- Hard Copy

- USD

$4,000

-

- Pages:165

- Single User License

(PDF Unprintable)

- USD

$3,800

-

- Code:

LMM011

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,700

-

- Hard Copy + Single User License

- USD

$4,200

-

Chinese brands’ ADAS research: Lynk & Co, BYD, Haval and Geely are in the first echelon of L2

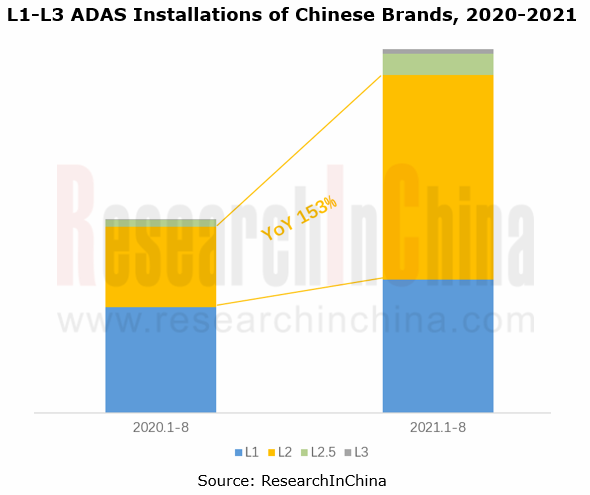

In the first eight months of 2021, more than 1.31 million vehicles of Chinese brands were equipped with ADAS, surging by 88.6% on a like-on-like basis, with an installation rate of 25.3%, up 5.7 percentage points compared with the same period of the previous year.

- The installations and installation rate of L2 ADAS, a segment in which Chinese brands vied for deployment, increased by 153% and 6 percentage points from the prior-year period, separately.

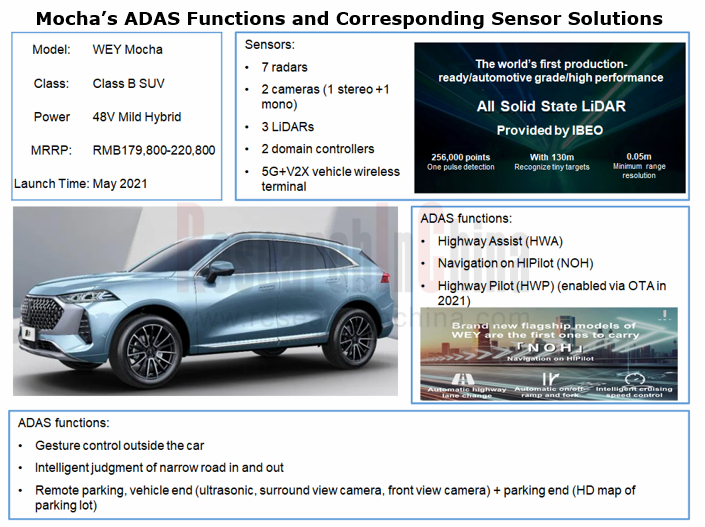

- The installations and installation rate of L2.5 ADAS increased by 227% and 0.8 percentage points. In 2021, a breakthrough has been made in mass production of L2+ ADAS for fuel-powered vehicles like WEY Mocha.

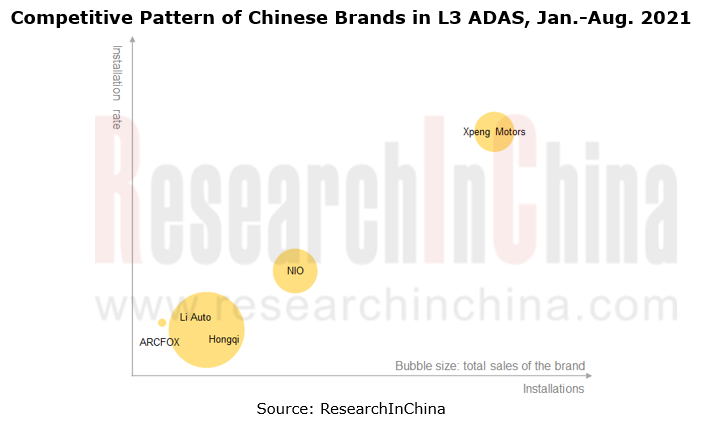

- L3 ADAS was installed in 17,000 vehicles, with an installation rate of 0.3%. Emerging carmakers such as Xpeng Motors, NIO, Li Auto and ARCFOX were the first ones to equip or demonstrate vehicles with L3 ADAS.

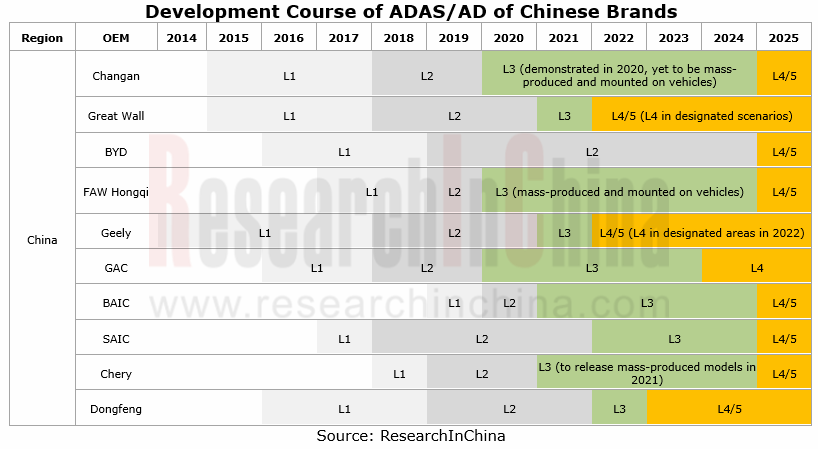

- The recent five-year plans of Chinese automakers show that the mass production of L4 autonomous vehicles in China may concentrate in 2025.

Lynk & Co and BYD have edged into the first echelon of L2 ADAS.

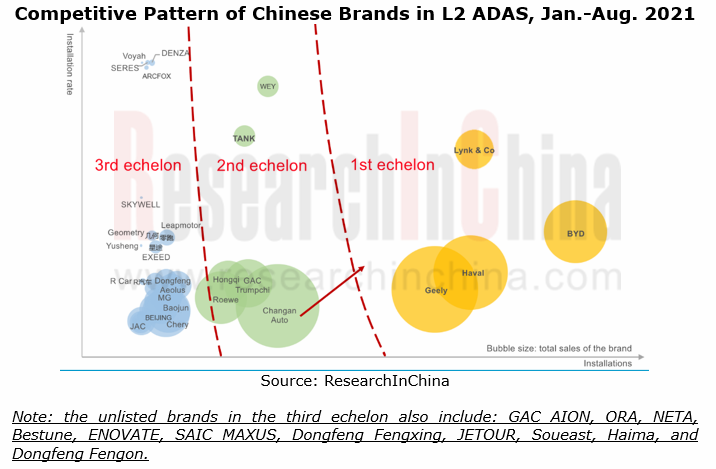

In the L2 ADAS market, Lynk & Co, BYD, Haval and Geely are first-echelon players, of which:

BYD is way ahead of its peers in L2 ADAS installations, which is credited to BYD Han, a model using a sensor solution of 1 front view camera + 3 radars + 4 surround view cameras + 12 ultrasonic radars;

Lynk & Co is among the top few in both installations and installation rate of L2 ADAS, mainly thanks to Lynk & Co 01 and Lynk & Co 03, both using 3R1V sensor solutions.

Changan Auto, GAC Trumpchi, Hongqi and Roewe are in the second echelon, with a bright prospect.

For example, by virtue of huge sale volume, UNI Series and AVATR brand as well as related technical strength, Changan Auto is very likely to boast far higher installations of L2.

A breakthrough has made in mass production of L2+ ADAS for WEY Mocha.

In the L2.5 ADAS segment, emerging brands like Li Auto and Xpeng Motors go ahead of others.

Among traditional brands, WEY Mocha holds a lead, having packed Highway Assist (HWA) and Navigation on HIPilot (NOH). In 2021, it is about to carry Highway Pilot (HWP) and L3 autonomous driving. What makes more sense for Mocha is its breakthrough in mass production of high-level ADAS for fuel-powered vehicles.

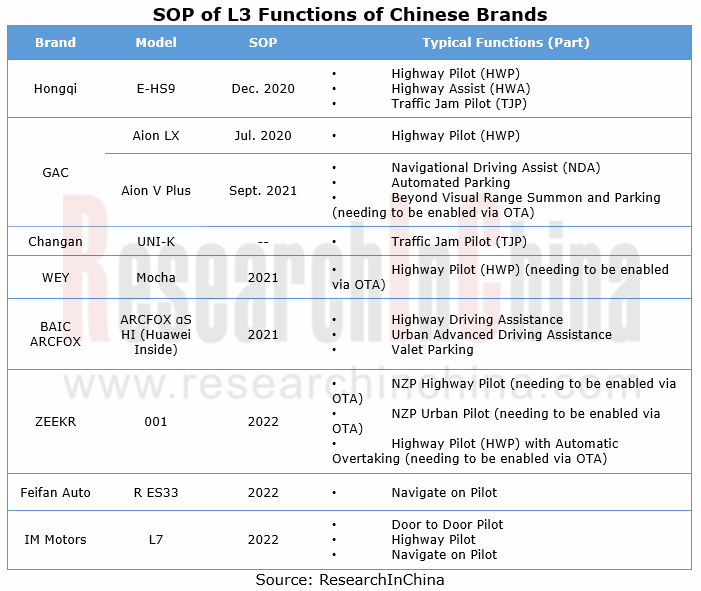

L3 ADAS has been demonstrated on multiple models or mass-produced for them.

In current stage, emerging brands are pacesetters in L3 ADAS, and traditional Chinese brands have completed technology layout:

FAW Hongqi, GAC AION, BAIC ARCFOX, etc. have mass-produced L3 ADAS for their vehicles;

Great Wall WEY Mocha is about to carry L3 functions in 2021;

Changan Auto, Geely (ZEEKR), Feifan Auto, IM Motors, etc. have reserved technologies;

JETOUR X Chery JETOUR built on the Kunlun Architecture is projected to pack mass-produced L3 advanced autonomous driving solutions.

One example is ARCFOX αS HI.

In April 2021, ARCFOX αS HI (Huawei Inside) co-built by BAIC ARCFOX and Huawei made a debut at the Auto Shanghai. The model carries Huawei’s advanced ADS, 3 96-channel LiDARs, 6 radars, 12 cameras, 13 ultrasonic radars, and Huawei chips with computing power of 400TOPS, delivering L3 autonomy and offering capabilities of highway driving assistance, urban advanced driving assistance and valet parking.

The mass production of L4 autonomous vehicles in China may concentrate in 2025.

- A number of brands such as SAIC, GAC and Geely have defined SOP of L4:

In June 2021, SAIC made it clear that it will produce L4 intelligent vehicles in quantities in 2025.

- In July 2021, GAC announced that GAC AION and Huawei co-developed a mid-to-large-sized intelligent SUV BEV with L4 autonomous driving functions, which is projected to be spawned in 2023.

- In October 2021, Geely specified that it will commercialize L4 autonomous driving in 2025 in the Smart Geely 2025.

1 Status Quo of Chinese Brands’ ADAS Market

1.1 Installations and Installation Rate of ADAS Functions of Chinese Brands

1.2 ADAS Installations and Installation Rate of Chinese Brands: Overall Situation

1.3 L2 ADAS Installations and Installation Rate of Chinese Brands: Overall Situation

1.4 L2 ADAS Installations and Installation Rate of Chinese Brands: By Brand

1.5 L2 ADAS Installations and Installation Rate of Chinese Brands: By Vehicle Model

1.6 L2 ADAS Installations and Installation Rate of Chinese Brands: By Price

2 ADAS and Autonomous Driving Layout of Chinese Brands

2.1 ADAS Development Timelines of Chinese Brands

2.2 Comparison of L2, L2+ and L3 ADAS Solutions

2.3 L2 ADAS Layout: Functions and Solutions

2.4 L2+ ADAS Layout: Functions and Solutions

2.5 L3 ADAS Layout: Functions and Solutions

2.6 L4 ADAS Layout: Functions and Solutions

2.7 ADAS Partner Camps of Chinese Brands

3 Research on ADAS/Autonomous Driving of Chinese Brands

3.1 Changan Auto

3.1.1 ADAS Installation (by Brand/Model), 2021

3.1.2 14th Five-Year Plan

3.1.3 Vehicle Intelligence Strategy

3.1.4 Development Course of Autonomous Driving

3.1.5 Autonomous Driving Roadmap

3.1.6 Core Technologies of ADAS and Autonomous Driving

3.1.7 ADAS/AD Systems

3.1.8 Dynamic Deployments in Autonomous Driving, 2020-2021

3.1.9 Avatar’s Resources

3.1.10 Evolution Route of E/E Architecture

3.1.11 Autonomous Driving Tests

3.1.12 ADAS and Autonomous Driving Partners

3.1.13 Dynamic Deployments in Autonomous Driving, 2019-2021

3.2 Great Wall Motor

3.2.1 ADAS Installation (by Brand/Model), 2021

3.2.2 Autonomous Driving Strategy

3.2.3 Development Course of Autonomous Driving

3.2.4 Autonomous Driving Development: Stage 1

3.2.5 i-Pilot Smart Pilot System: System Architecture 1.0 and Hardware Solutions

3.2.6 Autonomous Driving Development: Stage 2

3.2.7 Layout and Autonomous Driving Plan of WEY

3.2.8 Autonomous Driving Development: Stage 3

3.2.9 Autonomous Driving Computing Platform: ICU 3.0

3.2.10 WEY Mocha, L2+ (Scalability to L3)

3.2.11 L4 Autonomous Driving Concept Model

3.2.12 L5 Autonomous Driving Concept Model

3.2.13 Autonomous Driving Tests

3.2.14 Autonomous Driving Partners

3.2.15 Dynamic Deployments in Autonomous Driving, 2018-2021

3.3 BYD

3.3.1 ADAS Installation (by Brand/Model), 2021

3.3.2 Autonomous Driving Development Strategy

3.3.3 Development Course of Autonomous Driving

3.3.4 Autonomous Driving Roadmap

3.3.5 D++ Open Platform

3.3.6 Typical Models on D++ Platform

3.3.7 L2 ADAS

3.3.8 Typical Model with DiPilot Intelligent Driving Assistance System: Han EV

3.3.9 Typical Models on E Platform 3.0

3.3.10 E/E Architecture

3.3.11 Autonomous Driving Tests

3.3.12 Autonomous Driving Partners

3.3.13 Dynamic Deployments in Autonomous Driving, 2019-2021

3.4 FAW

3.4.1 FAW’s ADAS Installation (by Brand/Model), 2021

3.4.2 Autonomous Driving Development Plan of FAW

3.4.3 Autonomous Driving Development Path of FAW Hongqi

3.4.4 ADAS Functions and Solutions of FAW Hongqi

3.4.5 FAW Hongqi’s Dynamic Deployments in Autonomous Driving, 2020-2021

3.4.6 E/E Architecture of FAW Hongqi

3.4.7 FAW Hongqi’s Autonomous Driving Tests

3.4.8 FAW’s Autonomous Driving Partners

3.4.9 FAW’s Dynamic Deployments in Autonomous Driving, 2019-2021

3.5 Geely

3.5.1 ADAS Installation (by Brand/Model), 2021

3.5.2 Development Course of Autonomous Driving

3.5.3 Autonomous Driving Roadmap

3.5.4 ADAS/AD Systems

3.5.5 Parking System

3.5.6 Autonomous Driving Layout

3.5.7 Sustainable Experience Architecture (SEA)

3.5.8 Autonomous Driving Tests

3.5.9 ADAS/AD Partners

3.5.10 Dynamic Deployments in Autonomous Driving, 2019-2021

3.6 GAC

3.6.1 ADAS Installation (by Brand/Model), 2021

3.6.2 "1615" Strategy

3.6.3 Development Course of Autonomous Driving

3.6.4 Evolution Roadmap of ADAS Solutions

3.6.5 ADAS/AD Systems

3.6.6 L4/L5 Autonomous Driving Layout

3.6.7 Autonomous Driving Layout

3.6.8 Evolution of E/E Architecture

3.6.9 Autonomous Driving Tests

3.6.10 Autonomous Driving Partners

3.6.11 Dynamic Deployments in Autonomous Driving, 2019-2021

3.7 BAIC

3.7.1 BAIC’s ADAS Installation (by Brand/Model), 2021

3.7.2 Development of BAIC’s Autonomous Driving

3.7.3 Development Course of BAIC BJEV’s Autonomous Driving

3.7.4 Evolution Roadmap of BAIC's ADAS Solutions

3.7.5 ADAS/AD Systems of BAIC BJEV

3.7.6 BAIC’s Autonomous Driving Tests

3.7.7 BAIC’s Autonomous Driving Layout

3.7.8 BAIC’s Autonomous Driving Partners

3.7.9 BAIC’s Dynamic Deployments in Autonomous Driving, 2019-2020

3.8 SAIC

3.8.1 SAIC’s ADAS Installation (by Brand/Model), 2021

3.8.2 Autonomous Driving Plan of SAIC

3.8.3 Development History of SAIC’s Autonomous Driving

3.8.4 Evolution Route of SAIC's ADAS

3.8.5 Roewe’s ADAS Functions

3.8.6 Feifan's ADAS Functions

3.8.7 IM Motors’ ADAS Functions

3.8.8 SAIC’s L4 Autonomous Driving

3.8.9 SAIC’s Autonomous Driving Road Tests

3.8.10 SAIC’s Autonomous Driving Partners

3.8.11 SAIC’s Dynamic Deployments in Autonomous Driving, 2019-2020

3.9 Chery

3.9.1 ADAS Installation (by Brand/Model), 2021

3.9.2 Intelligence Strategy

3.9.3 Autonomous Driving Plan

3.9.4 Evolution of Autonomous Driving

3.9.5 ADAS Functions

3.9.6 EXEED’s ADAS Functions

3.9.7 Autonomous Driving Partners

3.9.8 Dynamic Deployments in Autonomous Driving, 2019-2020

3.10 Dongfeng Motor

3.10.1 ADAS Installation (by Brand/Model), 2021

3.10.2 Autonomous Driving Plan

3.10.3 Development Course of Autonomous Driving

3.10.4 Development Path of Autonomous Driving

3.10.5 ADAS/AD Functions

3.10.6 Voyah’s ADAS/AD Functions

3.10.7 Voyah’s E/E Architecture

3.10.8 Autonomous Driving Partners

3.10.9 Dynamic Deployments in Autonomous Driving, 2019-2020

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...

High-Voltage Power Supply in New Energy Vehicle (BMS, BDU, Relay, Integrated Battery Box) Research Report, 2025

The high-voltage power supply system is a core component of new energy vehicles. The battery pack serves as the central energy source, with the capacity of power battery affecting the vehicle's range,...

Automotive Radio Frequency System-on-Chip (RF SoC) and Module Research Report, 2025

Automotive RF SoC Research: The Pace of Introducing "Nerve Endings" such as UWB, NTN Satellite Communication, NearLink, and WIFI into Intelligent Vehicles Quickens

RF SoC (Radio Frequency Syst...