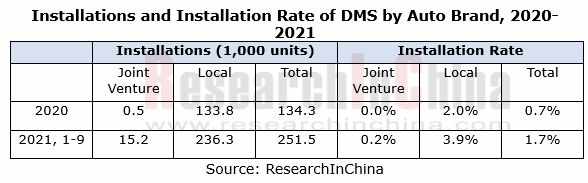

Automotive DMS research: the installations of DMS soared by 244% on a like-on-like basis in the first nine months of 2021.

Our data show that in the first nine months of 2021, China sold 251,511 sets of DMS for new passenger cars, 244% more than in the same period of the previous year, of which 15,201 sets, or 6% of the total were for joint venture brand cars, and 236,310 sets, or 94% of the total were for local brand cars. Top-ranked brands were Changan, Xpeng, Haval, BMW, NIO, WEY, Leapmotor, GAC Aion, ORA and JETOUR.

The main reason for the boom of DMS in China in 2021 is that local brands installed DMS in more of their models. 96,700 units of new models launched in 2021 are equipped with DMS, making up 38% of the total installations. Wherein, the key contributors include Changan UNI-T, Haval First Love (100%), Changan UNI-K (100%), Xpeng P7 (17%), Aion Y (100%), WEY Mocha (100%), Neta U (91%) , Leapmotor T03 (49%), Haval Chitu (100%), and JETOUR X70 (40%).

In the future, DMS will sustain growth, and policies will be the key driver. For example, the Guidelines for Administration of Entry of Intelligent Connected Vehicle Manufacturers and Their Products (Trial) (Draft for Comments) released by Ministry of Industry and Information Technology in April 2021 requires that companies should have monitoring capabilities of human-computer interaction and driver participative behaviors, boosting DMS growth; also, OEMs should equip more of their models with DMS with declining prices.

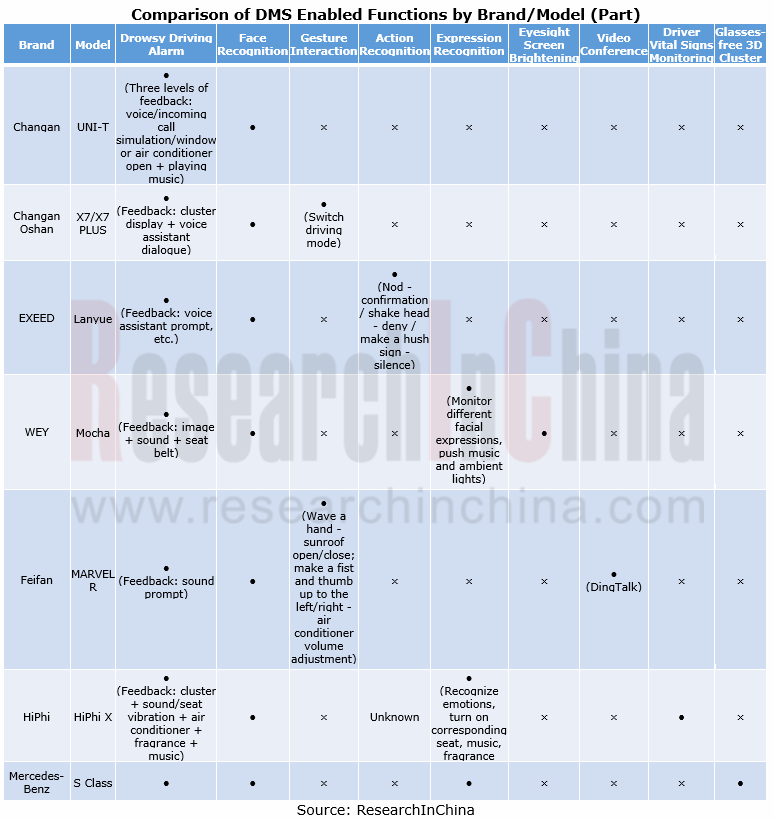

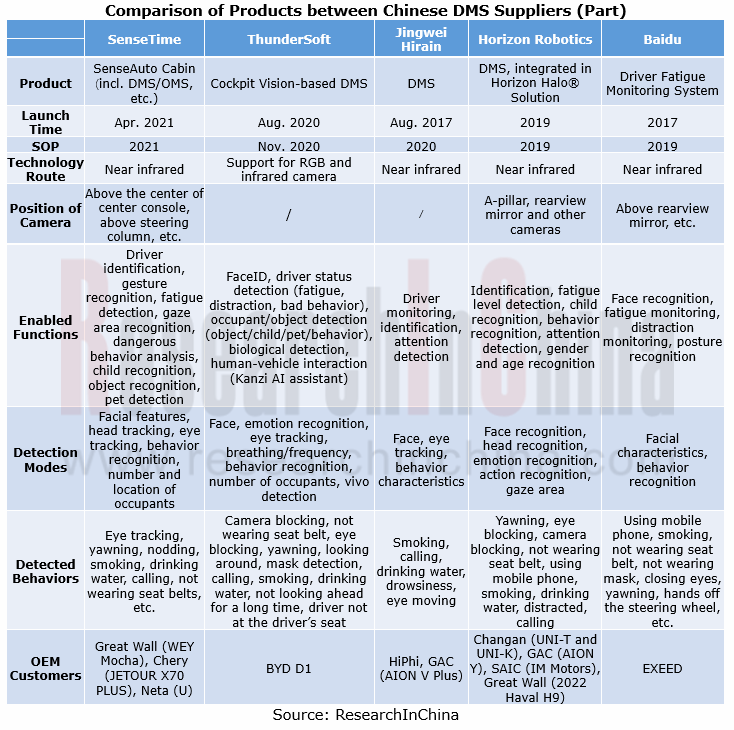

OEMs not only install more DMSs but refine and expand DMS capabilities. As well as driver drowsiness detection and face recognition, their all new DMSs tend to enable more related functions such as gesture interaction, action recognition, expression recognition, and eyesight screen brightening.

For example, the DMS for Haval Chitu enables fatigue/distraction monitoring, face recognition (face login to IVI account, automatic personalized adjustment of seat, theme interface, etc.), and expression recognition (recognizing expressions, e.g., happy, angry and surprised, and pushing corresponding music, air-conditioning and other features). The supplier is ArcSoft.

The DMS for SAIC Feifan MARVEL R enables fatigue/distraction monitoring, face recognition, gesture interaction (waving a hand to open and close sunroof before and after the recognition, etc.), and video conferencing (DingTalk).

Local OEMs not only favor DMS but start deploying OMS. Models including HiPhi X, Voyah FREE, GAC Aion Y, Trumpchi GS4 PLUS, Trumpchi EMPOW, ORA Good Cat, Haval Chitu, Haval First Love, WEY Mocha/VV6/VV7, JETOUR X70 PLUS, and Changan UNI-T/UNI-K have packed both DMS and OMS.

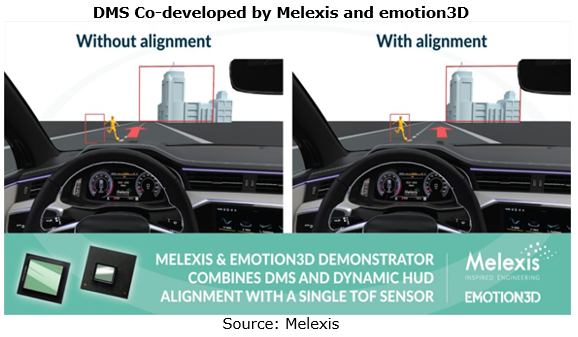

For suppliers, it can be seen that DMS solutions are rapidly fusing with other cockpit functions, or integrating with hardware.

Fusion with HUD among others. For instance, in September 2021, Melexis and emotion3D joined forces to offer a 3D Time-of-Flight (ToF) demonstrator, a solution that combines the driver monitoring system (DMS) with high-precision 3D driver localization, to dynamically align augmented reality head-up displays (AR HUD) objects.

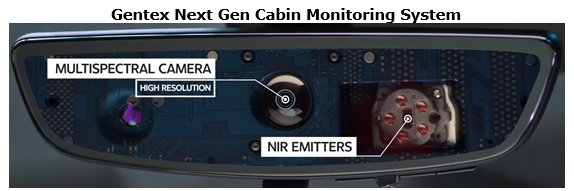

Products that integrate cluster display and interior rearview mirror come into being as well. Examples include an integrated solution for interior sensor technology unveiled by Continental in October 2021, integrating the camera directly into the cluster display for the first time ever; and the next-gen cabin monitoring system launched by Gentex in January 2021, integrated into the interior rearview mirror and combining DMS and OMS.

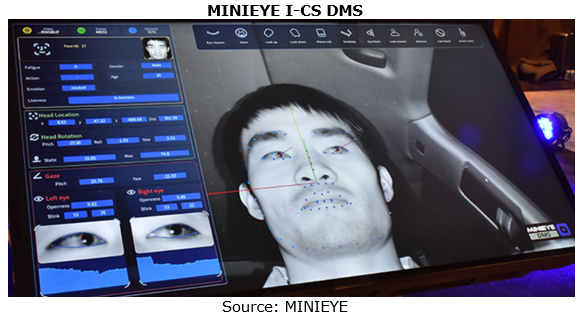

Extension to or fusion with in-cabin perceptions like IMS. For example, the AutoSense solution XPERI DTS introduced in late 2020, integrates DMS and OMS; the I-CS (In-Cabin Sensing) solution launched by MINIEYE in September 2021 allows accurate detection of occupants including their facial features, line of sight, gestures and joints.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...