Joint Venture Passenger Car Brands’ ADAS and Autonomous Driving Research Report, 2021

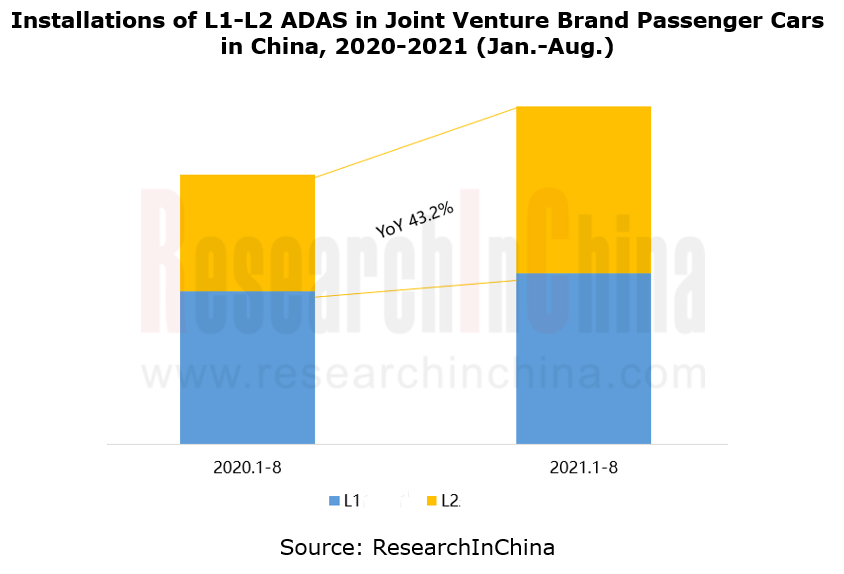

Joint venture brands’ ADAS research: the installations of L2 ADAS surged by 43.2% year on year.

In the first eight months of 2021, 3.87 million passenger cars of joint venture brands in China were equipped with ADAS, a like-on-like jump of 25.4%, with the installation rate up to 49.0%, up 4.9 percentage points. Wherein, the installations and installation rate of L2 ADAS increased by 43.2% and 5.1 percentage points from the same period of the previous year, separately.

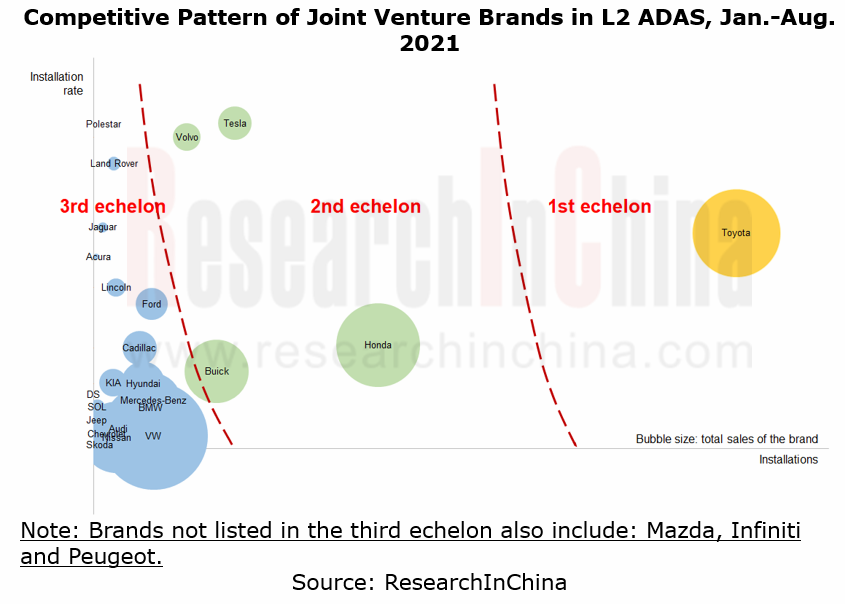

Toyota leads L2 ADAS market.

In the joint venture brands’ L2 ADAS market, Toyota is only first-echelon player, with the system installations far higher than its peers; Honda, Buick, Volvo and Tesla are in the second echelon.

- Toyota’s installations of L2 ADAS approached 700,000 units, driven by its hot-selling models like Corolla, Levin, RAV4 and Avalon, nearly 400,000 units more than the runner-up Honda. In terms of sensor solution, Toyota’s L2 ADAS adopted 1R1V and 3R1V solutions, over 90% of which were 1R1V;

- Volvo boasted a L2 ADAS installation of 95.6% and mainly used 1R1V and 3R1V solutions, of which 1R1V swept over 80%;

- The third-echelon players, Ford and Volkswagen have the potential to leap to the second echelon.

L3 ADAS of Honda and Mercedes-Benz has been approved for use in cars legally introduced on roads in their local markets.

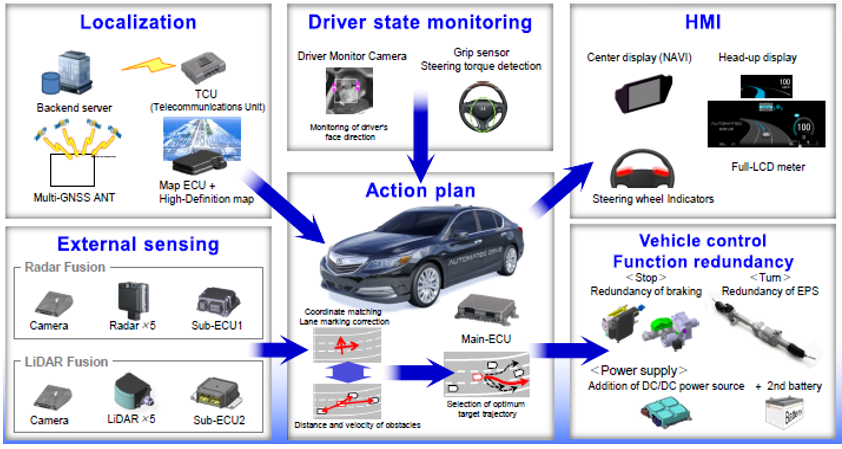

In March 2021, Honda introduced Honda SENSING Elite, a L3 automated driving system first mounted on Honda Legend, the world’s first L3 model legally introduced on roads. This L3 system employs the following sensor solution:

- 1 set of front view stereo cameras

- 4 surround view cameras

- 5 LiDARs (Valeo’s second-generation SCALA LiDARs, 16-channel)

- 5 radars

The sensor layout is shown below.

The composition of Honda SENSING Elite is as follows.

Honda Legend, the world’s first L3 autonomous model legally running on roads, is only available in Japan. Just 100 units have been launched on market for rental, not sold. The MRRP of JPY11 million (approximately RMB660,000) refers to only deposit. There is still no effective way for ordinary users to access L3 automated driving.

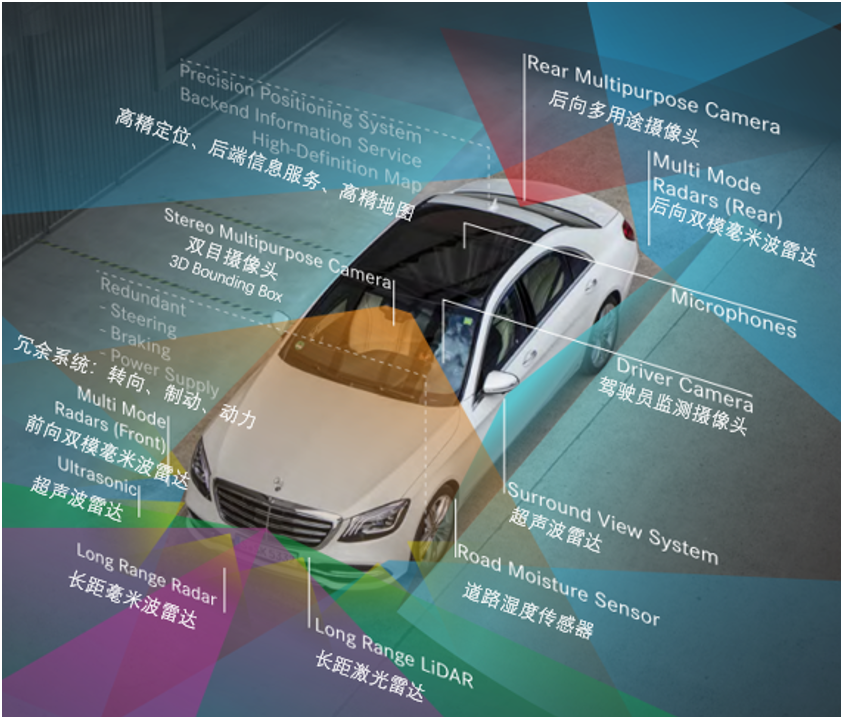

In December 2021, Mercedes-Benz DRIVE PILOT, a L3 autonomous driving system captured the approval for driving on roads from the German Federal Motor Transport Authority (KBA). This L3 system mounted on Mercedes-Benz EQS or S-Class will become available on market in 2022, which means ordinary users will use L3 autonomous driving function on 13,000km highways in Germany as early as the second half of 2022.

The sensor solution for Mercedes-Benz DRIVE PILOT is as follows:

- 1 LiDAR

- 4 angular radars

- 1 long-range forward radar

- 1 set of front view stereo cameras

- 4 surround view cameras

- 12 ultrasonic radars

- 1 wheel camera (working together with the rain sensor on the windshield to perceive whether it is rainy or not)

- 1 rear multi-purpose camera

- HD map

- Driver camera

The KBA has granted approval for Mercedes-Benz’s mass-production and sales of L3 autonomous cars on the basis of the technical regulation UN-R157, a UN Regulation on uniform provisions concerning the approval of vehicles with Regards to Automated Lane Keeping Systems, which was passed at World Forum for Harmonization of Vehicle Regulations of United Nations Economic Commission for Europe.

UN-R157 defines ALKS:

ALKS is a system than controls the lateral and longitudinal movement of the vehicle in the lane for extended periods without further driver command;

ALKS is a system than controls the lateral and longitudinal movement of the vehicle in the lane for extended periods without further driver command;

Limit to passenger cars (M1 vehicles);

Limit to passenger cars (M1 vehicles);

Limit to operational speed to 60 km/h maximum.

Limit to operational speed to 60 km/h maximum.

According to UN-R157 regulation, Mercedes-Benz DRIVE PILOT specifies that there is 10 seconds for the driver to disengage after sending the transition demand, a milestone in the history of “full disengagement of autonomous vehicle drivers”.

UN-R157, the world’s first binding international regulation on SAE L3 automation, has entered into force on January 22, 2021. Noticeably, the contracting states include states of the EU, UK, Japan, Korea and Australia. UN-R157 will provide reliable guidelines for automakers to develop L3 autonomous driving functions in major global markets.

GM and Ford among others will achieve L4 autonomous driving in 2022 at the earliest.

Volkswagen, GM, Ford and the likes develop L4 autonomous driving technologies by establishing subsidiaries or investing technology firms. They plan to first implement commercial L4 in online ride-hailing and logistics distribution.

Volkswagen will develop a new software platform in 2025 to support L4 autonomous driving, through its software subsidiary CARIAD (formerly known as Car.Software). In addition to CARIAD, Volkswagen and its investee Argo AI partnered and plan to achieve fully autonomous driving in 2025.

Cruise Origin, a fourth-generation L4 self-driving car co-launched by GM and its subsidiary Cruise, eliminates the steering wheel, accelerator and brake pedals and features layout of two bench seats that face inward. The car is projected to be spawned at Detroit-Hamtramck Assembly Plant starting in 2022.

In October 2020, Ford and Argo AI together unveiled a fourth-generation self-driving test vehicle refitted from Ford Escape Hybrid. They plan launch of the commercial autonomous service for online ride-hailing and logistics distribution in 2022.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...