China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands

Research on Chinese Brands’ Around View System: AVS Going to Integrate with Features of ADAS and Transparent Chassis

ResearchInChina published "China Around View System (AVS) Suppliers and Technology Trends Report, 2021 – Chinese Brands", which sorts and analyzes the Chinese OEMs’ around view functions, Chinese AVS suppliers’ technologies, typical Chinese manufacturers of AVS components, and the AVS development tendencies.

AVS (Around (Surround) View System) serves as a system that delivers real-time imaging to the driver in a 360-degree range around the vehicle at low speeds (excluding systems with only rear cameras).

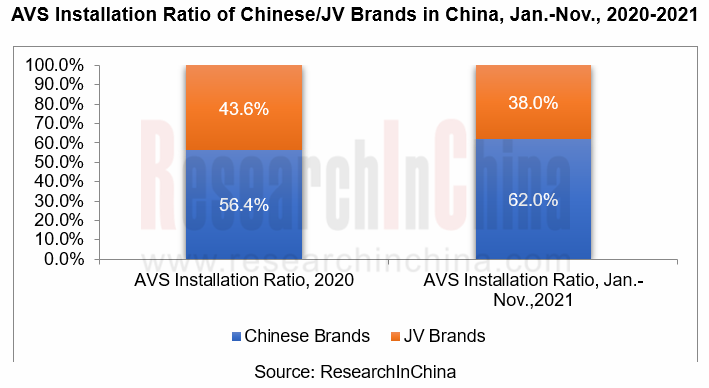

Chinese Brands Dominate the Market in Terms of AVS Installations

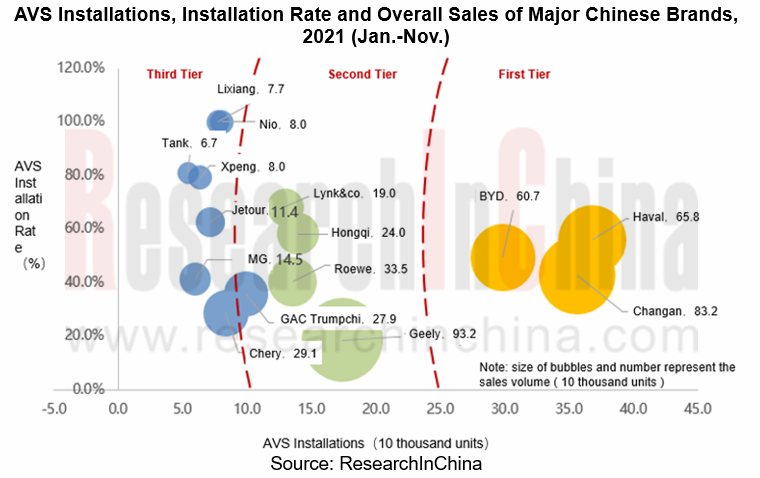

From January to November of 2021, AVS was available onto 4.266 million vehicles in China, an upsurge of 49.2% year-on-year; the installation rate of AVS registered 23.6%, a rise of 6 percentage points on an annualized basis, according to ResearchInChina. Elaborately, local Chinese brands’ AVS installations accounted for 62.0%, an increase of 5.6 percentage points year-on-year, among which Haval, Changan and BYD stand at the first tier; while Geely, Hongqi, Roewe and Lynk&co were in the second echelon.

By price, from January to November 2021, Chinese brand models priced between RMB100,000-RMB150,000 constitute the largest part of AVS installations, reaching 1,366,000 vehicles, sharing 51.7%, and the local brands AVS installation rate in this range is 48.1%, up 4.3 percentage points year-on-year, followed by the Chinese brand models priced at RMB150,000-RMB200,000 and a total of 496,000 vehicles installed with AVS, accounting for 18.8%, and the local brand AVS installation rate in this range is 67.0%, up 8.3 points year-on-year.

By models, from January to November 2021, the top three Chinese brands’ models in terms of installation were Haval H6 (208,000 units), Changan CS75 (156,000 units) and Hongqi HS5 (100,000 units).

In future, AVS installation rate will rise further with the cost reduction brought by gradual integration of AVS into the cockpit domain as well as the popularization of parking solutions combining surround view and ultrasonic.

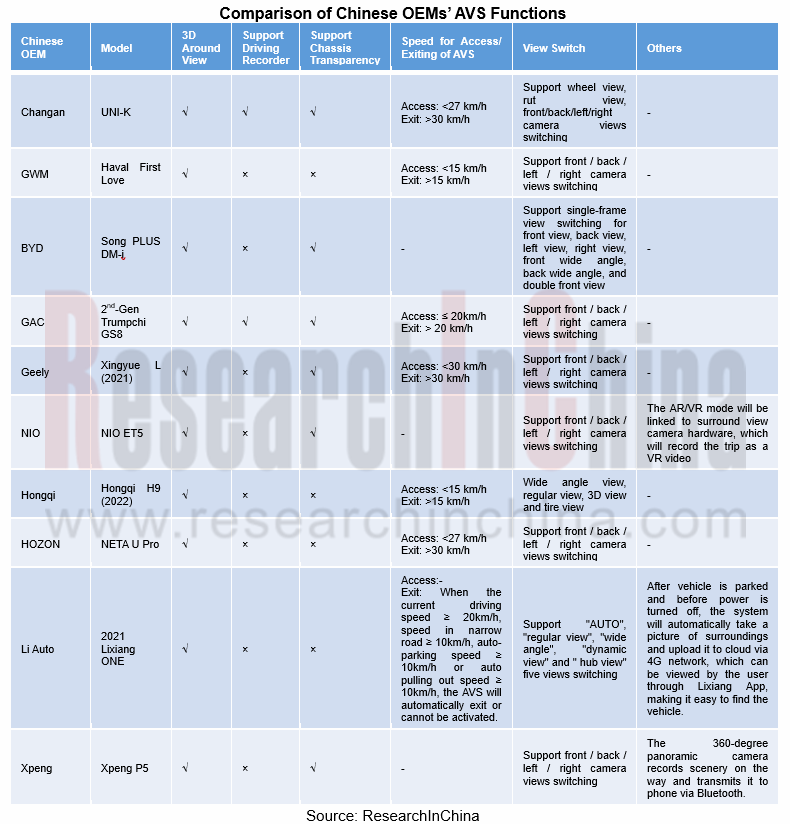

Chinese OEMs’ around view function gets continuously optimized, expanding to transparent chassis and ADAS function

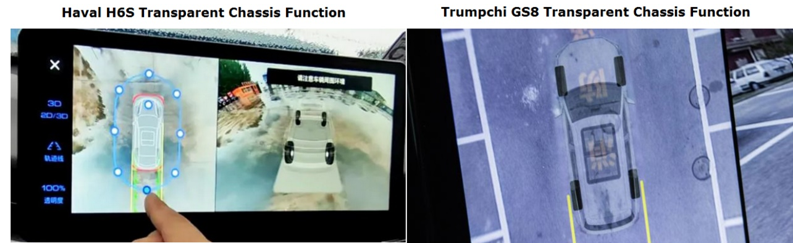

The AVS of Chinese OEMs is functionally evolving from a single 360° panoramic view in the past to rich ADAS features (such as moving object detection and warning (MOD), lane departure warning (LDW), and driving recorder, etc.) and transparent chassis.

For instance, Haval H6S (launched in October 2021) is added with 180-degree transparent chassis based on 360-degree panoramic image, which can realize 0%, 50% and 100% transparency settings; Trumpchi GS8 (unveiled in December 2021) has the AVS not only enabling 2D/3D panorama, MOD (moving object detection), driving recorder, and transparent chassis functions, but with a fusion of ultrasonic to achieve APA automatic parking.

Surround view cameras move toward higher pixel and more powerful perception

For clearer imaging, Chinese AVS suppliers are aggressively developing high pixel surround view cameras.

Ofilm, for example, spawned 2-megapixel HD surround view cameras in September 2021 and is working on 5-megapixel (to be launched in 2023) and 8-megapixel. SOE, a subsidiary of Minth Group, has upgraded its camera pixels from traditional VGA and current popular 1.3-megapixel HD camera to 2-megapixel FHD products, also with a plan for improvement to 8 megapixels in future. CalmCar, in cooperation with ZF, provides 192° fisheye cameras embedded with deep learning-based garage position recognition to enable higher perception capability in the AVP system based on surround view.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...