With the combination of BLE, NFC and UWB, the digital key will present five major development trends

Through communication technologies such as BLE (Bluetooth), NFC, UWB, etc., the digital key turns smart terminal devices such as smartphones, NFC smart cards, smart watches and smart bracelets into vehicle keys, so as to realize keyless entry and start, and remote key authorization and personalized vehicle settings, as well as offer safer key management, comfortable and convenient experience. It will be integrated into smart mobility ecosystem in the future.

In Automotive Digital Key Research Report 2021, ResearchInChina summarizes the digital key market, suppliers, OEMs, etc., and predicts future trends.

Trend 1: From 2022 to 2025, the digital key market will maintain rapid growth

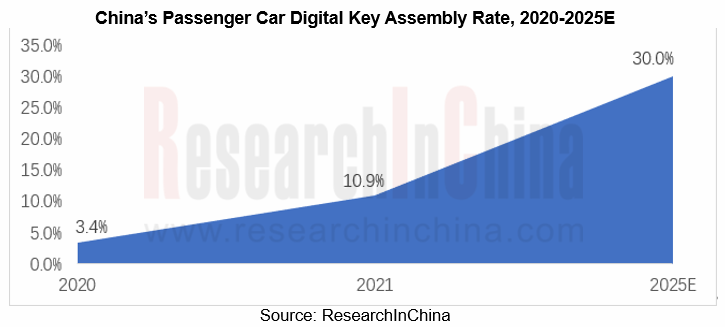

ResearchInChina’s data shows that more than 2 million Chinese passenger cars were equipped with digital keys in 2021, a year-on-year spike of 243%; the assembly rate hit 10.9%, an increase of 7.5 percentage points from the previous year. Affected by the tight supply of chips, the assembly volume of automotive digital keys in 2021 was lower than expected. In the future, as the supply of chips stabilizes, the assembly volume of digital keys will rise rapidly. By 2025, 7.84 million cars will feature digital keys, with an average growth of 38%; the assembly rate will reach 30%, with AAGR of 5 percentage points.

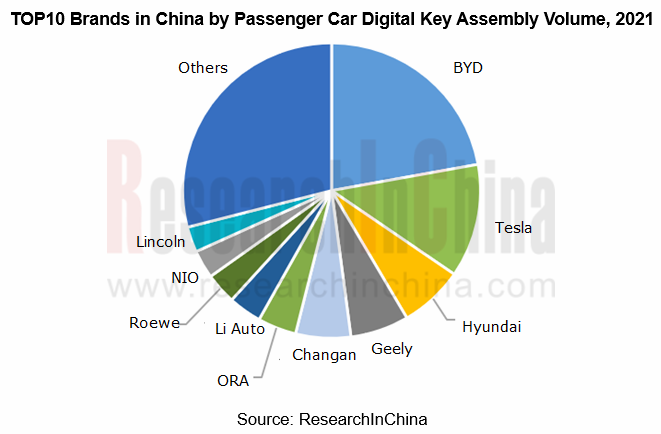

In terms of assembly volume, BYD sees the highest assembly volume of digital keys for passenger cars in China, followed by Tesla; they enjoy a combined market share of 34.6%. From the perspective of assembly rate, Tesla, Voyah, HiPhi, NIO and other emerging brands have achieved 100% assembly rate.

Trend 2: Bluetooth will still be the mainstream solution for digital keys in the future

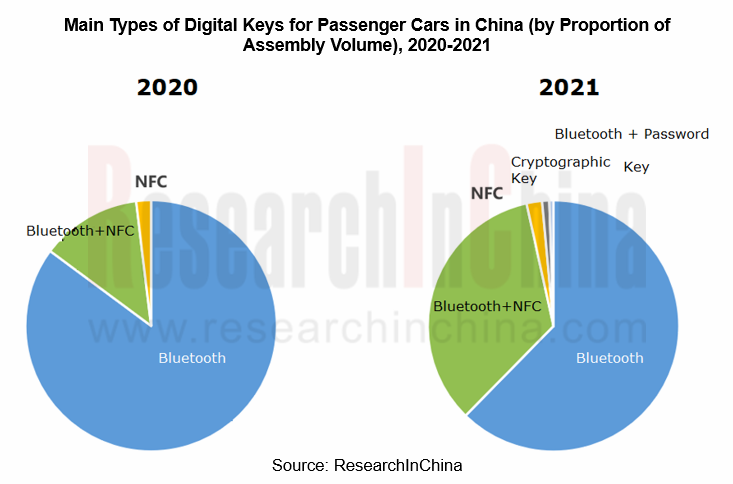

In 2021, Bluetooth keys accounted for 64.2% of China's digital key mass production solutions as the most important solution. In addition, integrated solutions of Bluetooth + NFC or Bluetooth + password keys are gradually being applied by automakers. At this stage, whether it is a separate module or an integrated solution, Bluetooth acts as the most mainstream digital key communication technology.

The main advantages of Bluetooth include:

①It is enough to develop only one application platform as per the Global standards;

②All Bluetooth functions can be connected to a main control device of a car, reducing complexity and cost;

③Bluetooth supports two-way communication, eliminating the need for special tools and reducing development complexity and cost;

④Bluetooth features higher security than the existing RF solution;

⑤It is easy to connect devices such as smartphones directly to cars.

In the future, Bluetooth will play an increasingly bigger role in digital keys, autonomous driving and smart cockpits, and will continue to occupy a dominant position in digital key solutions.

Trend 3: UWB solutions start to be available in cars

In 2022, the market will see the mass production and assembly of UWB keys. BMW will introduce the BMW Digital Key Plus based on the ultra-wideband (UWB) technology promoted by Apple to its 2022 models. NIO will install UWB digital keys for ET7 and ET5 to be delivered in 2022 for centimeter-level high-precision positioning. In addition, Samsung is also cooperating with automakers such as BMW, Audi, Hyundai, and Ford in UWB technology.

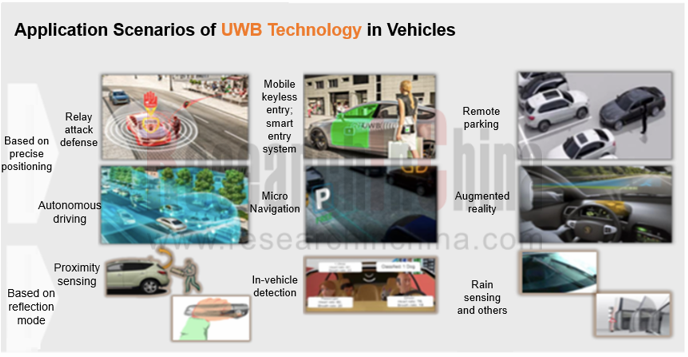

UWB boasts advantages like high positioning accuracy, high transmission rate, high security, and low power consumption. It can meet the wireless connection requirements of users in different scenarios. Especially in terms of security, UWB technology can better prevent relay attacks and prevent radio signals from being intercepted or interfered.

Thanks to high-precision positioning, UWB will be used in vehicles more often.

①Vehicle anti-theft, automatic trailer hitch, in-vehicle occupant monitoring, etc. (developed by Volkswagen & NXP)

②Anti-theft, keyless entry, remote parking, autonomous driving, micro-navigation, AR-HUD, proximity sensing, vehicle interior detection, rain sensing, etc. (developed by Continental Group)

③Tailgate kick, liveness detection (developed by TSINGOAL)

Trend 4: The collaborative solution of NFC+BLE+UWB is expected to become the mainstream

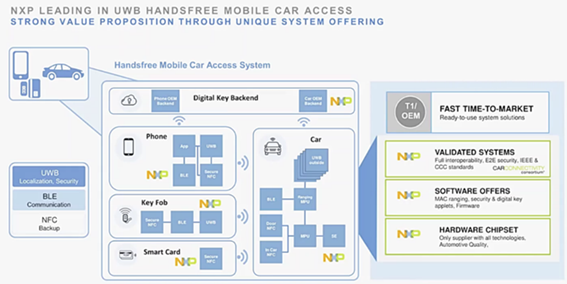

The combination of NFC, BLE (Bluetooth) and UWB is the best solution for digital keys at this stage. Whether it is long-distance, short-distance, or the network environment is weak or the mobile phone is turned off, vehicles can be unlocked smoothly. Specifically, Bluetooth is used to wake up UWB and encrypt data transmission; UWB is used for precise positioning, and NFC enables access when the phone is out of power. At present, foreign suppliers represented by NXP and domestic solution suppliers like INGEEK are all developing this solution.

NXP

Based on core technologies such as NXP automotive UWB IC NCJ29D5 (B/D), automotive Bluetooth SOC KW38, and automotive MCU S32K144, the fusion solution can unlock and start vehicles through NFC-enabled smartphones, remote keys, or NFC smart cards with digital keys.

INGEEK

As the mainstream digital key product solution provider, INGEEK released the next-generation smart digital key in October 2021, which adopts BLE, NFC, UWB and other technologies to unlock vehicles with smartphones or watches and completely replaces physical keys. The system fully connects intelligent cockpit, telematics and Internet social platform to realize complete personalized user experience.

Trend 5: Digital keys will carry more functions amid the trend of smart mobility

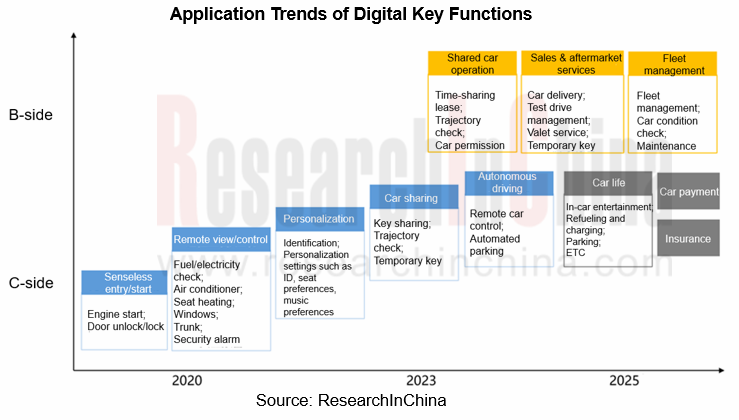

In addition to sensorless entry/start, remote viewing/control, digital keys have more potentials in functions and scenarios.

In the short term, C-side functions in scenarios (such as personalized settings, vehicle sharing, and autonomous driving) and B-side functions (like shared car operation, sales & after-market services, and fleet management) will be the focus that can be tapped. In the long run, digital keys will connect with more ecosystems and carry more functions amid the trend of smart mobility.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...