Sensor Chip Research: Automotive Sensors Have Entered a Technology Iteration Cycle, and Opportunities for Localization of Chips Are Coming

Automotive sensor chips can obtain external environment data for autonomous vehicles and improve the safety of autonomous driving as an indispensable part of autonomous vehicles. With the improvement of the autonomous driving level, the demand for sensor chips in vehicles will keep rising, and the requirements on product performance will also become higher and higher.

The demand for automotive cameras is growing rapidly, and domestic and foreign vendors are competing for the automotive CIS market

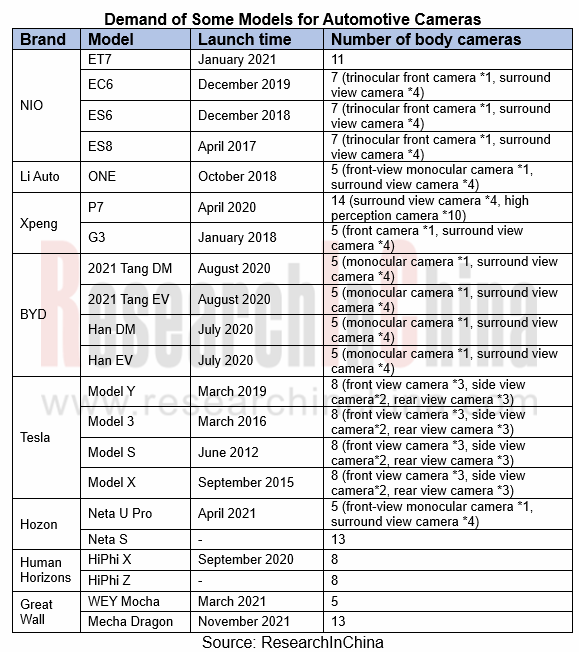

With the fast development of autonomous driving technology, the number of automotive cameras is gradually increasing. The higher the level of autonomous driving, the greater the demand for cameras. At present, all OEMs are actively deploying L3/L4 production autonomous models, which means the demand for automotive CIS chips is enormous.

At present, the automotive CIS market is almost monopolized by oligarchs, with ON Semiconductor occupying nearly 60% market share. Traditional mobile phone camera CIS vendors such as Sony and Samsung have entered the automotive market, and the market share of OmniVision, a subsidiary of Will Semiconductor, is also increasing.

Sony entered the field of automotive CIS in 2015, and has mass-produced IMX490, IMX324 and other automotive CIS. NVIDIA's DRIVE Hyperion 8.1 platform launched in 2021 may use Sony's CIS IMX728 for the front-view camera and IMX623 for the fisheye camera.

In addition to CIS, Sony has also dabbled in the LiDAR chip market. In the first half of 2022, Sony plans to launch the IMX459 1/2.9-type (6.25 mm diagonal) stacked SPAD depth sensor for automotive LiDAR applications using direct Time-of-Flight (dToF) method. By leveraging Sony's technologies such as a back-illuminated pixel structure, stacked configurations, and Cu-Cu connections created in the development of CMOS image sensors, Sony has succeeded in a unique device construction that includes SPAD pixels and distance measuring processing circuit on a single chip.

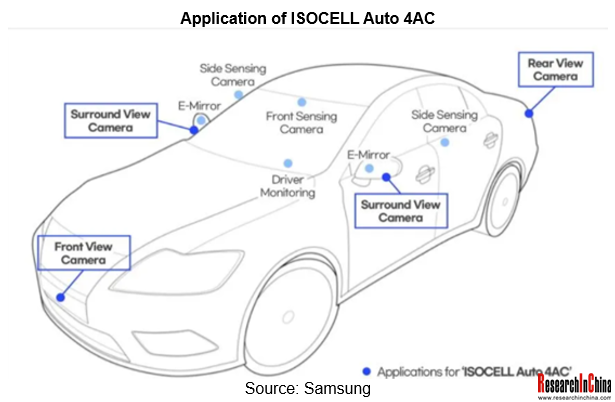

In July 2021, Samsung introduced ISOCELL Auto 4AC, an automotive image sensor. It comes in a 1/3.7-inch optical format with 1.2 million 3.0-micrometer (μm) pixels. With the CornerPixel? technology, it embeds two photodiodes within a single pixel area: one 3.0μm pixel for viewing low light images, and a 1.0μm pixel placed at the corner of the big pixel for brighter environments.

CIS has been out of stock for the past two years and the shortage will continue for some time. In the face of problems such as lack of chips for foreign-funded enterprises and rising product prices, Chinese local enterprises have seen development opportunities.

At CES 2022, OmniVision demonstrated an 8-megapixel automotive front-view camera system for the first time. Using next-generation OX08B40 CMOS image sensors, the system is powered by Xilinx MPSoC and Motovis IP. It will help OmniVision in the 8-megapixel high-end market to compete with ON Semiconductor.

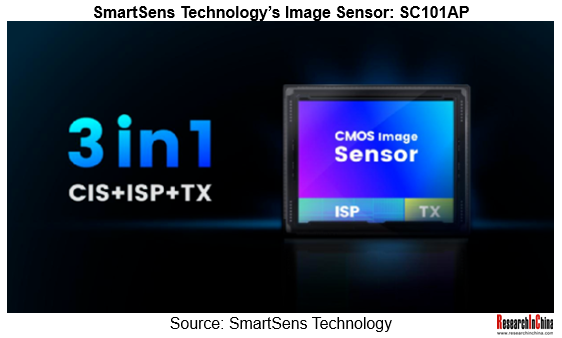

At the end of 2021, SmartSens Technology launched SC101AP, a three-in-one image sensor with integrated ISP and TX functions for automotive applications. The sensor has an optical size of 1/4.2 inches and a pixel size of 2.9μm. It supports video recording and shooting with a resolution of 1MP and 30 frames per second. Its sensitivity has improved by 53%, and the quantum efficiency has leveled up by 31%. SmartSens Technology will release a number of automotive products in 2022, including 8-megapixel ADAS products which are under development, and will be mass-produced in 2023.

GalaxyCore’s automotive CIS products have been used in driving recorders, 360° surround view cameras and cockpit monitoring.

In terms of technology development trends, CIS and ISP chips are both important chips for automotive cameras. ISP analyzes and processes image signals from CIS. Two-in-one automotive CMOS image sensors with ISP are gradually becoming the mainstream of the market. OmniVision's OX03D SoC integrates CMOS and ISP SoC. SmartSens Technology's SC120AT, a two-in-one image sensor with on-chip ISP, can optimize RAW image data and output high-quality video images in the format of YUV 422.

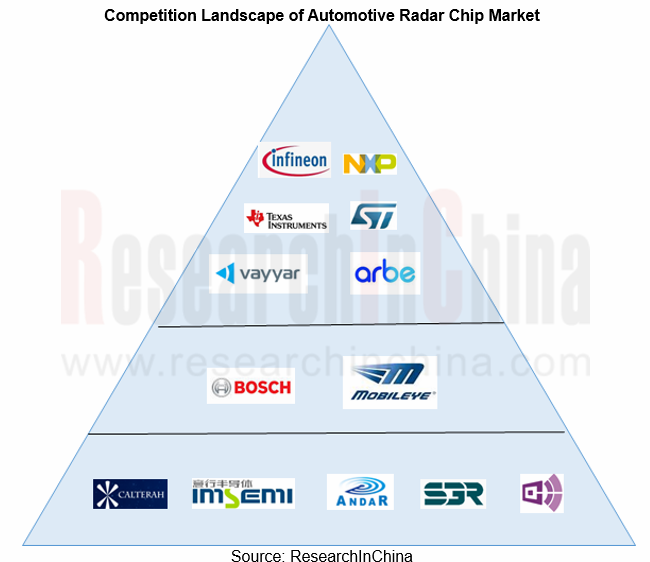

Amid the emerge of 4D radar and product iterations, the chip market pattern is expected to be reshaped

At present, radar chip suppliers are mainly from abroad, and the market share is basically occupied by NXP, Infineon, TI, etc. With the continuous development of autonomous driving, high-resolution radar and 4D radar have emerged. Radar chips have officially stepped into the technology iteration cycle. Domestic vendors may have the opportunity of taking the lead, and the market pattern will undergo certain changes.

(1) Traditional radar chip vendors promote technology upgrades and product cost reductions

Traditional chip vendors are the main players in the radar chip market, especially in the 4D radar chip market. At present, most of 4D solutions on the market adopt TI's chips.

In the past two years, traditional chip vendors have been aggressively improving product performance and further seeking cost control, and they have been committed to providing standardized product solutions for more radar companies.

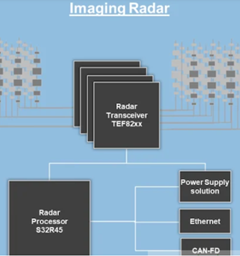

In 2020, NXP announced the first dedicated 16nm imaging radar processor, the NXP S32R45, which will be mass-produced in the first half 2022. The boost is enabled by the combination of proprietary radar hardware acceleration which can deliver up to 64x the compute performance of standard processors, super-resolution radar software algorithms to achieve sub-degree angular resolution and advanced MIMO waveforms that allow simultaneous operation of antenna channels.

The S32R45 radar processor is the flagship of NXP's 6th generation automotive radar chipset family. The combination of NXP’s S32R45 and S32R41 radar processors with the NXP TEF82xx RFCMOS transceivers delivers the fine angular resolution, processing power and range required for production-ready imaging radar solutions.

Texas Instruments launched AWR2944in January 2022, suitable for angular radar and long-range radar. It is approximately 30% smaller than the existing radar sensors, but provides 33% higher resolution than the latter, and detects objects up to 40% farther away from the vehicle.

(2) Domestic radar chip vendors and enterprises speed up their technological layout

Local vendors are at a disadvantage in the radar chip market, but with the iteration of product technology, they are catching up and actively deploying chip technology.

In October 2021, Calterah Semiconductor Technology released the Alps-Mini series automotive radar chips, which meet the automotive regulatory standards, AEC-Q100 and ISO 26262 ASIL-B. The network security unit added on the basis of the previous generation reduces the size by 40% and saves the cost by more than 20%.

In August 2021, Runchip unveiled a 77GHz radar chip - RF77TR34, which adopts RFCMOS process and integrates transceivers (3T4R), PLL, VCO, etc. It will provide samples to customers for evaluation in 2022.

(3) Automotive Tier 1 suppliers have dabbled in the upstream radar chip market

Most of the traditional radar Tier 1 suppliers mainly use third-party chips. In the past two years, they have been seeking changes, hoping to offer differentiated products through chip autonomy.

In 2021, Bosch and the chip foundry GlobalFoundries made a deal to jointly develop radar chips for autonomous driving. Bosch will use the 22FDX radio frequency solution of GlobalFoundries, which operates at a higher frequency, detects farther targets, and is more accurate than the current mainstream low-frequency radar chips.

Tier 1 suppliers have their own unique technology and core intellectual property (IP), which will help them enhance their own competitiveness.

LiDAR has been mass-produced for vehicles, while the chip cost has been declining fast

At present, the demand of production models for LiDAR is low due to its high cost. Chipization is one of the effective ways to slash costs; in addition, chip autonomy can also effectively cut down production costs and create differentiated competition.

(1) On-chip LiDAR

Integrating lasers, detectors, beam steering, and data processing into one chip to form an on-chip LiDAR can effectively reduce product size and costs.

In September 2021, LuminWave released two new chip optical engines - FMCW OE and OPA OE, which will be applied to LuminWave's silicon-optical chip-level FMCW 4D LiDAR products.

Compared with the first-generation chip, the second-generation FMCW SoC chip has four times more parallel FMCW computing units, and up to 128 channels. In addition, other key optical signal processing units are also integrated on the chip, making it one of the most integrated silicon photonics chips at present.

(2) Automotive Tier 1 suppliers deploy the upstream LiDAR chip industry

Now, Huawei, NVIDIA, HESAI, Ouster and other LiDAR Tier 1 suppliers are vigorously deploying the chip business, and forging the LiDAR industry chain by investing in chip makers or self-developing chips.

Ouster launched its self-developed LiDAR chip, L2X, in October 2021, successfully strengthening the company's LiDAR performance. In addition, Ouster acquired Sense Photonics in October 2021 to expand its LiDAR chip product line.

Huawei actively deploys the LiDAR industry chain. Through its subsidiary Hubble Ventures Co., Limited, it has invested in chip companies such as Vertilite and Nanjing visionICs Microelectronics Technology to make a layout for VCSEL, SPAD and other chip technologies. In 2012 and 2013, Huawei acquired CIP, a British photonic integration company, and Caliopa, a Belgian silicon photonics technology developer, to ensure its self-research capabilities in the field of optical chips, and to deploy silicon photonics chip-level FMCW technology in advance.

Automotive Sensor Chip Industry Research Report, 2022 highlights the following:

Classification and industrial standards of automotive sensor chip, sensor chip industry chain (including image sensor chips, radar chips, LiDAR chips, ultrasonic radar chips, etc.), automotive sensor chip market scale, etc.;

Classification and industrial standards of automotive sensor chip, sensor chip industry chain (including image sensor chips, radar chips, LiDAR chips, ultrasonic radar chips, etc.), automotive sensor chip market scale, etc.;

Market size, market structure, technology trends, major suppliers, etc. of visual sensor chips;

Market size, market structure, technology trends, major suppliers, etc. of visual sensor chips;

Market size, market structure, technology trends, major suppliers, etc. of radar chips;

Market size, market structure, technology trends, major suppliers, etc. of radar chips;

Market size, market structure, technology trends, major suppliers, etc. of LiDAR chips.

Market size, market structure, technology trends, major suppliers, etc. of LiDAR chips.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...