Research on emerging carmaking strategies: no new cars in 2021, 3 new cars in 2022, can NIO make its renaissance?

The delivery of ET7 is imminent, and the sluggish sales situation is expected to fade out in 2022

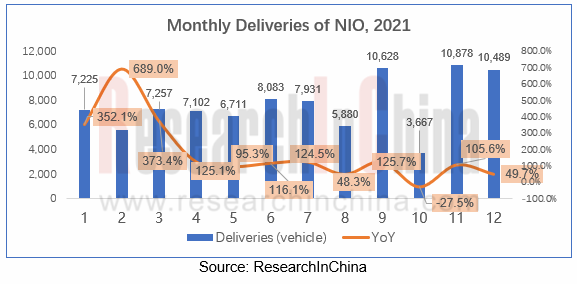

In 2021, NIO sold 90,805 cars, a year-on-year surge of 108%. However, its ranking among emerging automakers by sales volume dropped from the first in 2020 to the third. This is mainly affected by three factors.

First, the delivery plunged in October 2021 due to the reorganization and upgrade of the production line as well as the preparation for the launch of new products.

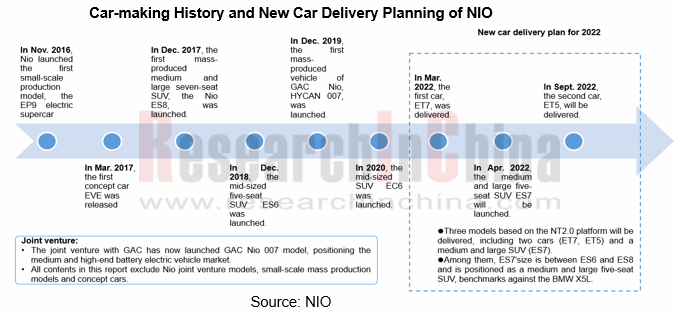

Second, the upcoming ET7, ET5 and ES7 will all be delivered in 2022, which led to a gap throughout 2021 when the existing models ES6 and EC6 were squeezed by new stronger rivals such as Model Y and BMW iX3.

Third, new cars were mainly sold in first-tier cities. In 2021, NIO saw the highest sales volume in the economically developed coastal provinces and cities, especially Shanghai, Beijing and Hangzhou contributed the overwhelming 33%.

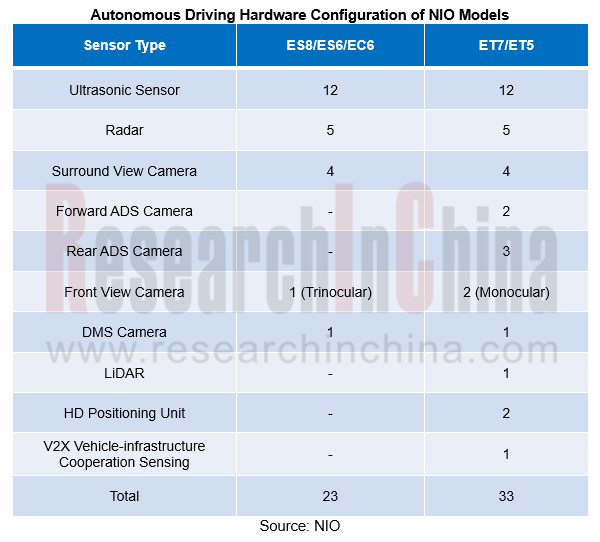

In 2022, NIO will deliver three new models one after another, and its sluggish sales status is expected to fade out. ET7 delivered on March 28th is the first model based on the NT2.0 platform. It is equipped with NIO Autonomous Driving (NAD). Compared with NIO Pilot, it adds emergency active Parking Assist (EAS), emergency lane keeping (ELK), Advanced Driver Monitoring System (ADMS), Power Station Parking Assist (PSAP), autonomous driving functions on some urban roads, etc.

ET7 is equipped with four NVIDIA DRIVE Orin chips with a computing power of 1016TOPS. Two Orin SoCs are used as master chips to realize NAD full-stack computing. The third Orin SoC acts as a redundant backup; if any main chip fails, NAD can ensure safety. The fourth Orin SoC implements local training, and can personalize training as per user habits to speed up NAD evolution.

In terms of hardware configuration, ET7 is equipped with radar, ultrasonic radar, 1,550nm LiDAR and CVIS perception controls in preparation for software upgrades for higher-level autonomous driving in the future. It is worth mentioning that the solid-state LiDAR provided by Innovusion has a horizontal viewing angle of 120°, a maximum detection distance of 500 meters, and a maximum resolution of 0.06°x0.06°. In addition, the watchtower-like layout reduces the blind spots of the sensor.

Relying on Internet operation, community marketing has become a role model in the industry

Most traditional automakers take delivering orders as the ultimate goal, and they terminate marketing campaigns as soon as deals are completed. NIO regards the purchase of products by users as the beginning of its marketing, and makes experience and marketing penetrate into the entire life cycle of products.

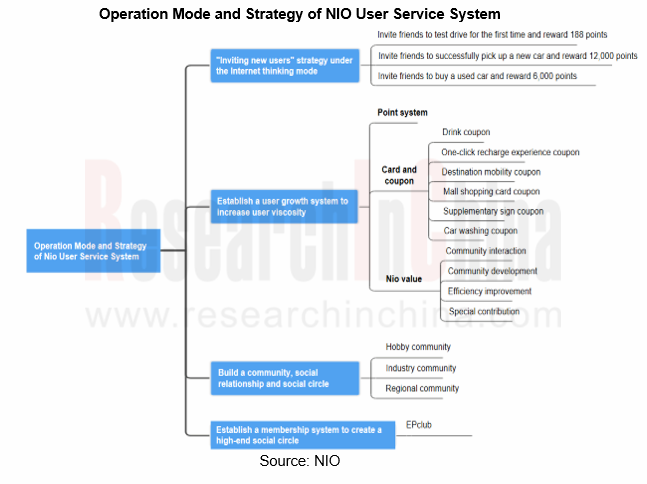

In NIO's ripple model, core car owners are in the kernel, accounting for about 10% of the total car owners. Core car owners play an exemplary role to attract followers closer to them, and continuously expand their influence. Similarly, this model is also vividly reflected in the operation of APP community. For community operation, NIO has established a set of user service system, with the following operation methods and strategies:

1. Recruitment strategy: the Internet operation method is adopted, with reward points for old users who invite new users successfully. The points earned by users can be exchanged for gifts at NIO Life (NIO’s mall), or for coffee coupons, event tickets and some other rewards at NIO House (NIO’s offline user center).

2. User growth system: three evaluation criteria - points, coupons and NIO Value.

Points: exchange for gifts and other benefits.

Cards and coupons: including drink coupons, one-click recharge coupons, destination mobility coupons, etc.

NIO Value: It is an accumulated value that records each user's activities in NIO community and his/her contribution to the community. Its unit is N.

3. A community was established to create a social circle for ordinary users: The community of NIO APP makes it easier for users to find like-minded people according to hobbies, regions and industries.

4. A membership system was erected to forge a high-end social circle.

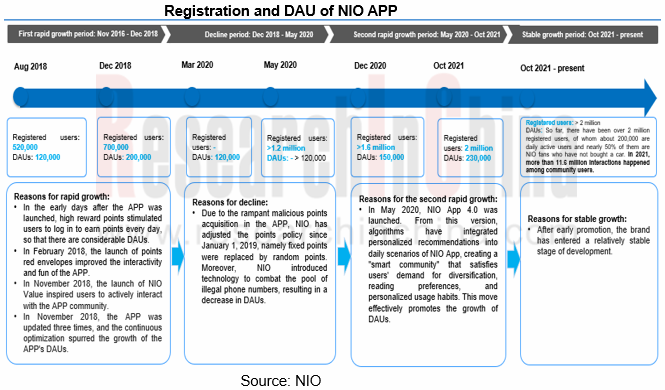

The update frequency of NIO APP is very high. From its launch in November 2016 to February 2022, NIO APP experienced four versions - 1.0, 2.0, 3.0, and 4.0, with a total of 44 updates and an update every two months averagely. The functions of the APP are continuously optimized and adjusted, so that users can always feel refreshed.

Under such operational measures, NIO APP has become the cornerstone for establishing deep connections with users. So far, there have been over 2 million registered users, of whom about 200,000 are daily active users and nearly 50% of them are NIO fans who have not bought a car. In 2021, more than 11.6 million interactions happened among community users, and each EPclub member recommend 25 NIO cars for sale averagely, equivalent to RMB10 million as per the unit selling price of RMB400,000.

NIO lays out the operation ecology of the Internet of Vehicles in advance by manufacturing mobile phones

In terms of intelligent connectivity, NIO's smart cockpit is equipped with the NOMI in-vehicle artificial intelligence system, so that NIO car owners can communicate with other people and vehicles through NOMI. NIO also continuously upgrades and optimizes the functions of NOMI via OTA. For example, NIO has improved the recognition capability and wake-up rate (especially the response to children's wake-up) of NOMI in the Aspen 3.0 unveiled in September 2021; at the same time, it has ramped up NOMI’s control over cars, such as memory of seat positions, adjustment of ambient light brightness, switching of sound field modes and other car control commands. In the Aspen 3.1 launched in January 2022, wake-up words + continuous instructions are added, without calling NOMI before giving a command. NIO plans to optimize the understanding, hearing, and understanding of NOMI in the future.

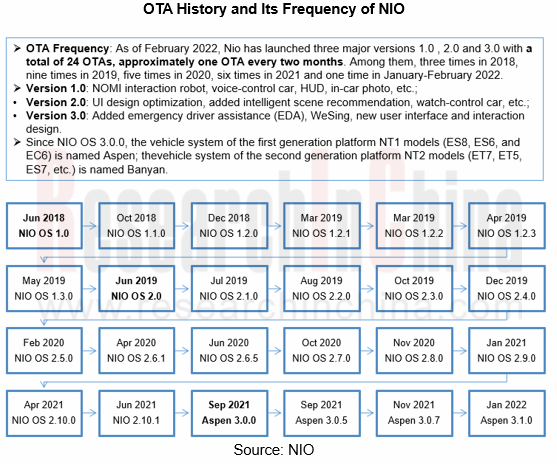

Besides, NIO has maintained a high frequency of OTA updates for the Internet of Vehicles. As of February 2022, NIO had launched three major versions, 1.0, 2.0, and 3.0, with a total of 24 OTA updates and about once every two months. Specifically, three updates occurred in 2018, nine in 2019, five in 2020, six in 2021, and one in January-February 2022.

Features of OTA updates for the Internet of Vehicles:

? All models support OTA updates.

?A major system upgrade is carried out almost every year, such as NIO OS 2.0 (Jun 2019), Aspen 3.0 (Sep 2021).

?As of February 2022, there had been 351 OTA updates, 56.1% of which were reflected in IVI, ADAS and autonomous driving.

In its future planning, NIO expects to form a closed “people-vehicles-mobile phones” loop through interconnection between mobile phones and IVI, realize data sharing, and provide users with more intelligent interactive life experience. It is reported that NIO is preparing for dabbling in the mobile phone industry. Yin Shuijun, the former president of Meitu, has joined NIO and leads the mobile phone business.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...