Research into skateboard chassis: where to sell, how to sell and to whom it is sold

Rivian, a new carmaker based on skateboard chassis, is quite popular in the market and becomes the focus of the automotive industry when it makes its debut. Also, there emerge a number of skateboard chassis manufacturers like Canoo, Arrival and REE as well as the Chinese peers such as UPower, PIX Moving, ECAR, and IT BOX.

1. Where to sell chassis

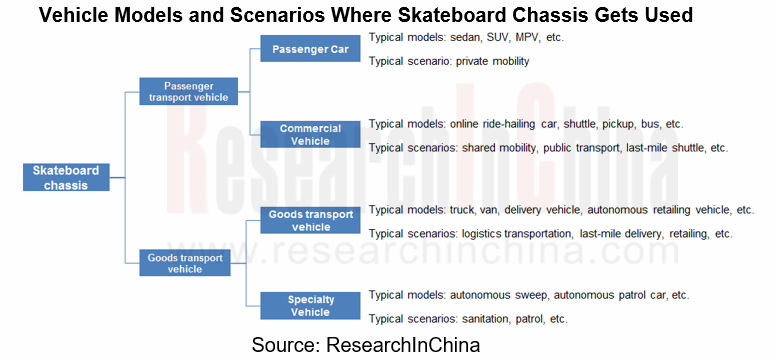

Similar to chassis essential to vehicle, skateboard chassis can broadly finds application in commercial vehicles of varied sizes and tonnage as well as passenger cars with different wheelbases.

Skateboard chassis can be divided by scenario into manned scenarios and non-manned ones, of which the former refers to the transportation of passengers and falls into civil use and commercial purpose; and the latter is complex in a relative sense where the use to carry goods take larger shares, such as trucks, vans and delivery vehicle.

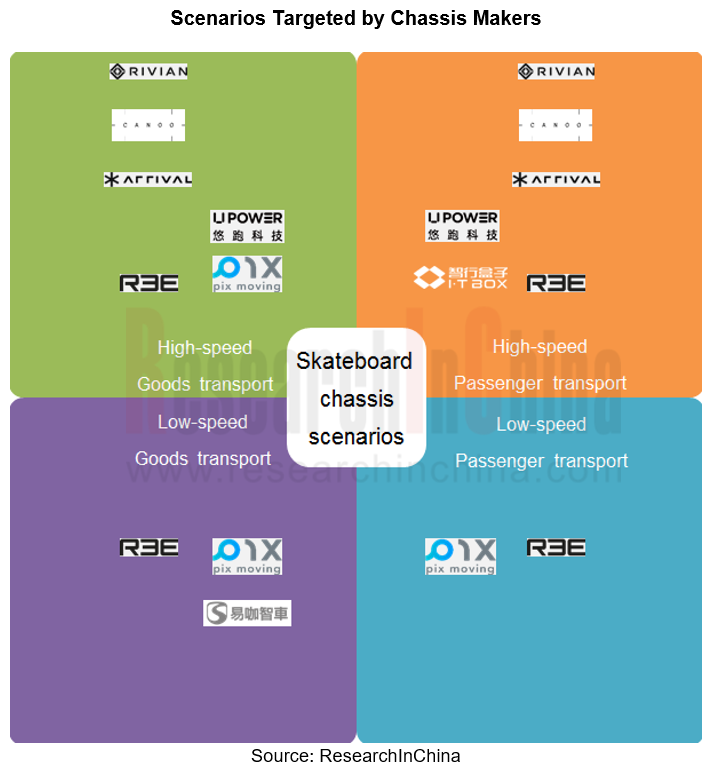

The majority of chassis makers are exploring high-speed transportation of passengers and goods, and only Israeli REE and Chinese PIX Moving and ECAR are involved in low-speed scenarios.

Viewed from the influential skateboard chassis entrants in the market, only Canoo and Rivian chose to enter C-end vehicle market and confront Ford, GM and others. More chassis makers access to B-end market from various aspects, such as Arrival, which engages in both mobility/public transport market and logistics transportation market, IT BOX with a focus on mobility market, and REE, UPower, etc. that set foot in autonomous driving scenario.

2.Skateboard chassis business model: How to sell?

Once its target market is decided and R&D is in place, it is really a teaser for the manufacturers of skateboard chassis how to sell their products and make profit.

Three major business models for skateboard chassis makers:

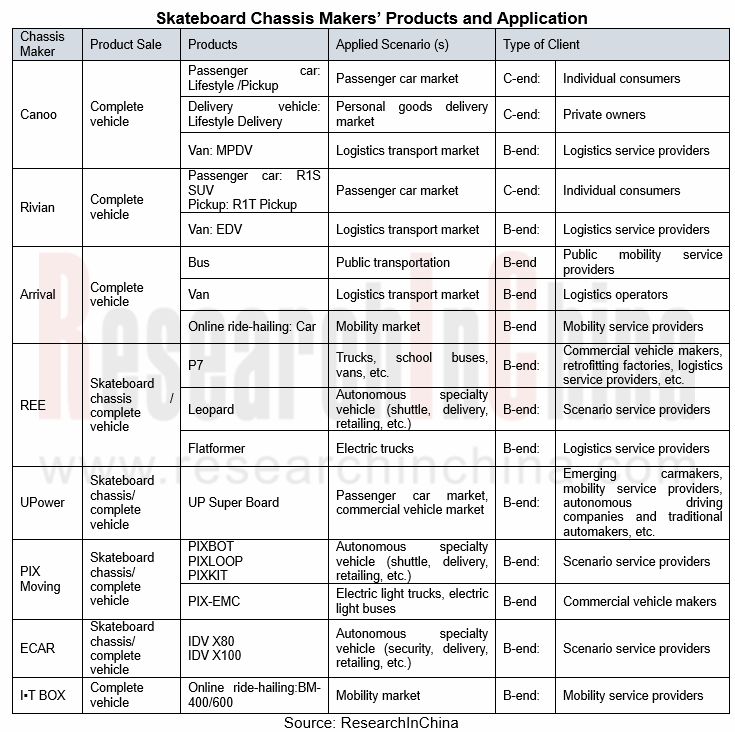

?① For own use, i.e., to sell vehicles based on skateboard chassis, such as Canoo, Rivian, and Arrival.

?② To meet others’ needs, i.e., to sell chassis only and provide customers with the solutions concerned, such as REE, UPower and PIX Moving.

?③ To partner with OEMs and provide customers with vehicle solutions. This model coexists with the second model above.

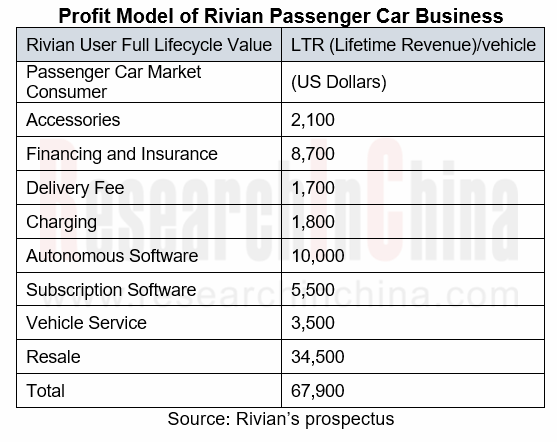

When it comes to the profitability of products, chassis makers bring in profits in the early stage and the middle & later stage, spanning the lifecycle of products. In the early stage, they gain a handful of orders and make some profits by selling either vehicle or skateboard chassis; in the middle & later stage, chassis makers will give full play to its strength in software and seize sizable income through providing software subscription and value-added services for the sold vehicles or skateboard chassis.

3. Where are the opportunities?

Overall, chassis manufacturers have four types of customers:

1) Low-speed autonomous driving. Various models of autonomous driving companies, such as autonomous shuttle, sanitation sweeper, self-driving retailing vehicle and delivery vehicle, have successively run into the autonomous driving demonstration bases across China and have been tested on public roads or in enclosed areas. The L4 autonomy is regarded by chassis makers as a basic skill in the infancy of their chassis development.

2) Scenario service provider. A broad range of such clients are covered, including logistics & transportation scenario, mobility scenario, sanitation scenario, etc., with a high demanding on vehicle model, but with higher demand for custom-made products.

3) Pure electric chassis (class-III) market. Skateboard chassis is highly similar to the chassis of 3rd class in hardware structure, and what differs between them is that skateboard chassis has the walking ability inclusive of support for intelligent driving or automated driving, and are specially developed for battery electric vehicles, more friendly to special-purpose vehicle like school bus. (Note: class-III chassis refers to the chassis that has no vehicle body on it but with engine and powertrain, front and rear axles, steering gear, suspension, wheels and tires, braking system and other assemblies, which cannot drive.

4) Laggard OEMs. They are faced with the amounting pressure and survival is the first concern for them, which, however, can be helped by the chassis makers who stay ahead in ideas of developing autonomous driving and intelligent chassis and enjoy the advantages of low cost, short development cycle and general suitability of products. The partnerships and alliances of chassis makers with OEMs do more good than harm, and they help each other, indeed.

Take the laggard OEMs and scenario service providers for example,

1) For laggard Chinese brand carmakers, it can be a life-saving straw.

According to ResearchInChina, in 2021, there were 108 Chinese auto brands with more than 1 passenger car insured, including 79 Chinese car brands with less than 50,000 units insured (including 71 ones each with less than 20,000 units), with a total market sales share of just 5.5%, which can be truly described as survival in adversity and extremely fierce competition. Small scale, lack of funds, untimely transformation and other reasons make it even more difficult for many laggard automakers amid the COVID-19 pandemic. The emergence of skateboard chassis, shorter R & D cycle and less R & D capital investment seem to be a good way for behindhand carmakers to stage a comeback.

Public information shows that traditional automakers at home and abroad have begun to cooperate with chassis manufacturers about skateboard chassis.

REE: In October 2019, REE and HINO released the Flatformer, a skateboard chassis based on the REEcorner technology solution, and plan to release a prototype in 2022.

UPower: In September 2021, it signed a blanket framework agreement with Sichuan COWIN Auto for joint development and entrusted production of skateboard chassis. (Note: In 2021, Sichuan COWIN Auto had 19,747 vehicles insured)

PIX Moving: In March 2022, PIX Moving reached strategic cooperation with Shanxi Victory Auto, and the two parties will jointly develop and mass-produce the manned intelligent electric trucks, light buses and other commercial vehicle models all of 1.8-6.0ton based on the PIX Moving skateboard chassis EMC platform (electric modular commercial vehicle). (Note: In 2021, Shanxi Victory Auto had 631 vehicles insured.)

2) Domestic logistics & transportation service providers with considerable potential demand

In all scenarios, it is logistics transportation that needs a large number of vehicles to build a fleet, such as YTO Express, STO Express, ZTO Express, Yunda Express, JD Express, SF Express and China Post. In urban areas, a certain scale of van models is required for logistics transportation and distribution. Unlike ordinary van models, express delivery firms need to customize van cockpits and carriages to meet their delivery service needs.

Overseas, UPS and Amazon have placed custom-made orders to chassis makers about the development of pure electric logistics vehicle, which are being delivered successively.

Rivian: In September 2019, it signed an order with Amazon for 100,000 electric vans based on skateboard chassis (a total of three model sizes).

Arrival: In January 2020, it received a directional order for 10,000 dedicated electric trucks and an intentional order for 10,000 units from UPS.

In China, logistics transporters’ attitudes towards skateboard chassis still remain unclear. However, the volume of express delivery in China registered 108.30 billion pieces cumulatively in 2021, a year-on-year spike of 29.9%, indicating a huge market scale. Correspondingly, the demand from enterprises for logistics vehicles is a sizable one.

4. With so big a cake, how should OEMs, Tier1 suppliers and chassis makers share?

The market is full of competitors. By the merit of not changing the chassis but changing the cockpit, the skateboard chassis can give birth to a variety of functional vehicles, with infinite potential. Besides the newly established chassis makers, there are also Tier 1 and OEMs competing to partake of the cake. But the cake is so big, how do the OEMs, Tier 1 suppliers and chassis makers divide it?

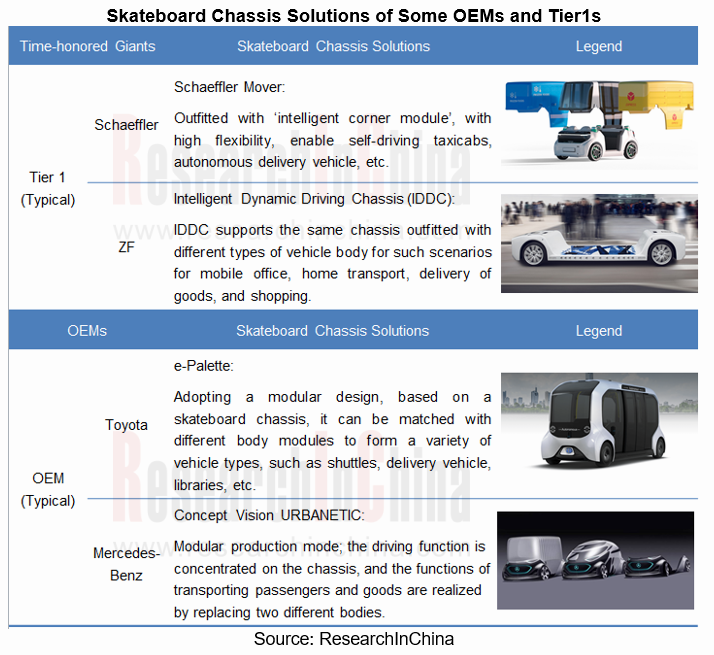

It seems that the time-honored conventional OEMs and Tier 1 suppliers enjoy more edges and a louder voice in chassis manufacturing. Rich technical knowhow and strong R&D strength, strong supply chain management and assembly & debugging capabilities are superior to chassis makers. The influential international giants like Bosch, Schaeffler, and ZF have frequently rolled out their concept models based on skateboard chassis over the recent years.

Entering 2022, Geely Farizon, IAT Automobile Technology and Ningbo Tuopu Group have successively announced their entry into skateboard chassis.

Geely Farizon: On January 19, 2022, Geely Farizon unveiled a super Van based on a control-by-wire skateboard chassis, which can be flexibly combined with the upper body and used for both passenger cars and commercial vehicles, satisfying all scenarios and custom-made needs of urban logistics.

Ningbo Tuopu Group: On February 10, 2022, Ningbo Tuopu Group's wholly-owned subsidiary, Tuopu Skateboard Chassis (Ningbo) Co., Ltd., was established in Hangzhou Bay New District, Ningbo City to develop skateboard chassis, X-by-wire products, among others.

IAT: In February 2022, IAT Automobile Technology Co., Ltd, IAT’s chairman Xuan Qiwu and former Huawei Honor CEO Liu Jiangfeng, and Hong Kong Faristar jointly invested RMB10 million to establish Shenzhen GECKO New Energy Vehicle Technology Co., Ltd. with a focus on skateboard chassis technologies and products, providing related services for urban logistics, commerce, family, shared mobility and other fields.

The time-honored Tier 1 suppliers branch out to skateboard chassis, which is a technical and strategic trend, and also to better serve customers. Service contents cover provision of full or partial skateboard chassis solutions, such as brake-by-wire/ steering/ throttle, suspension, ‘battery + motor + electric control’, etc.; and the service objects are: probably the powerful OEMs from which big orders come and with which deep cooperation have been constantly conducted. For small-batch orders, the quotation of Tier 1 is often too high, which is unbearable for general firms.

The OEM has always regarded chassis as the soul, and it will never be handed over to others, at least not for powerful OEMs. Based on the skateboard chassis, the OEM customers cover B-end and C-end, where the consumer market is basically dominated by OEMs. The painful facts of startups such as Byton, Singulato, and Qiantu Motor have proved that it is not easy for chassis manufacturers to directly build cars; in the to-B market, mobility service providers and logistics service providers hold considerable custom-made demand, a certain confrontation with chassis makers.

For chassis manufacturers, the cake is so big that they can partake of it. There are plenty of needs for autonomous vehicles in different self-driving scenarios, such as autonomous retailing vehicle/ delivery vehicle/ patrol car, etc. The demand for such orders is relatively scattered, which is suitably undertaken by chassis makers. What’s more, mobility service providers, logistics service providers and laggard automakers are also bigger prospective customers.

Avoiding edges, attacking weaknesses, and taking a differentiated route have become the safest and most secure choice for chassis makers. With limited funds and strength, chassis manufacturers especially in Chinese market are exploring the fields where OEMs hardly engage, such as low-speed autonomous driving scenarios.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...