Passenger car T-BOX research: T-Box OEM installation rate will reach 83.5% in China in 2025

ResearchInChina has published Global and China Passenger Car T-Box Market Report 2022 to summarize and analyze the T-Box installations and installation rates to passenger cars in China and the world, T-Box suppliers, T-Box development trends, and the App remote control function configuration of new models launched by OEMs.

Passenger car T-Box is developing towards:

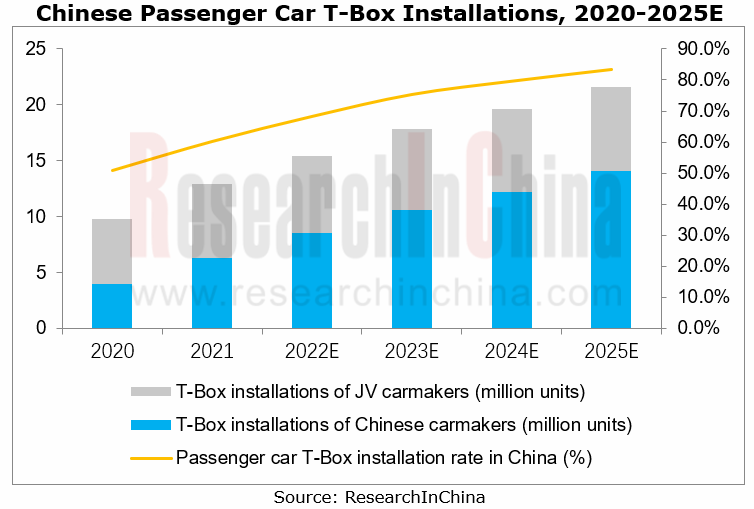

1. T-Box OEM installation rate will reach 83.5% in China in 2025;

2. 5G C-V2X T-Box seizes more and more market shares;

3. Automotive Ethernet is expected to replace CAN bus and FlexRay to become the main connection way of T-Box;

4. The remote vehicle control by mobile Apps becomes ever smarter (AVP, etc.).

T-Box OEM installation rate will register 83.5% in China in 2025

T-Box is mainly used for the communication between vehicle and Internet of Vehicles (IoV) service platform and acts as the core hardware of OEM telematics.

In 2021, 12.94 million passenger cars were installed with T-Box by OEMs in China, a year-on-year increase of 31%; the installation rate hit 60%, up about 10 percentage points from last year. By 2025, over 20 million passenger cars will be equipped with T-Box, and the installation rate will climb to 83.5%, and. T-Box and telematics are growing indispensable to passenger cars.

In 2021, 6.301 million passenger cars of Chinese automakers carried T-Box, a year-on-year spike of 59.9%; 6.634 million passenger cars of joint venture carmakers did so, up 12.9% on a yearly basis. Chinese OEMs make much faster progress in Internet of Vehicles than JV brands.

T-Box installations to passenger cars will keep an uptrend, so will the installation rate, and passenger car Internet of Vehicles will be further popularized, which are contributed by the consumers’ robust demand for intelligent connected vehicles (ICVs), the surge in new energy vehicle (NEV) sales, OEMs’ needs for FOTA as well as regulatory requirements and other factors.

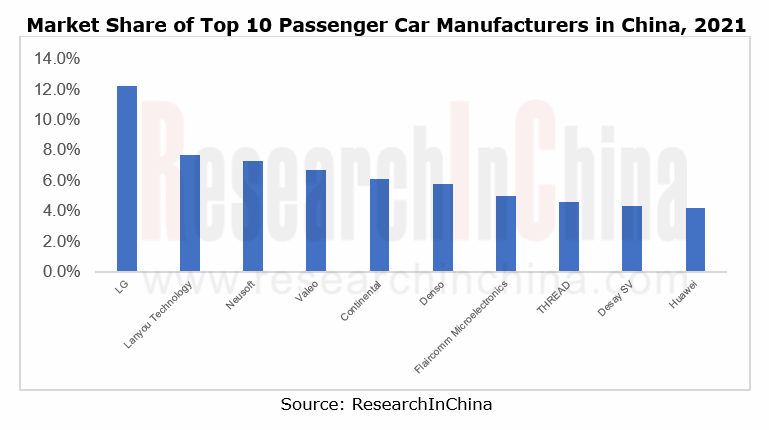

Top 10 OEMs command 64% market shares

Viewed from the market structure, the top 10 T-Box suppliers in China held 64% market shares together in 2021, with LG, Lanyou Technology and Neusoft at the top. Among them, Lanyou Technology, established in 2002 with DFS Industrial Group holding its 80% stake, mainly supplies T-Box products to Nissan and Dongfeng Motor. Lanyou’s T-Box was installed to one million cars in 2021. Also in 2021, Neusoft served 940,000 vehicles, mainly from Geely and Great Wall Motor. Thanks to Great Wall's high sales, Neusoft witnessed fast-growing T-Box installations in 2021.

5G C-V2X T-Box will see the rising market shares

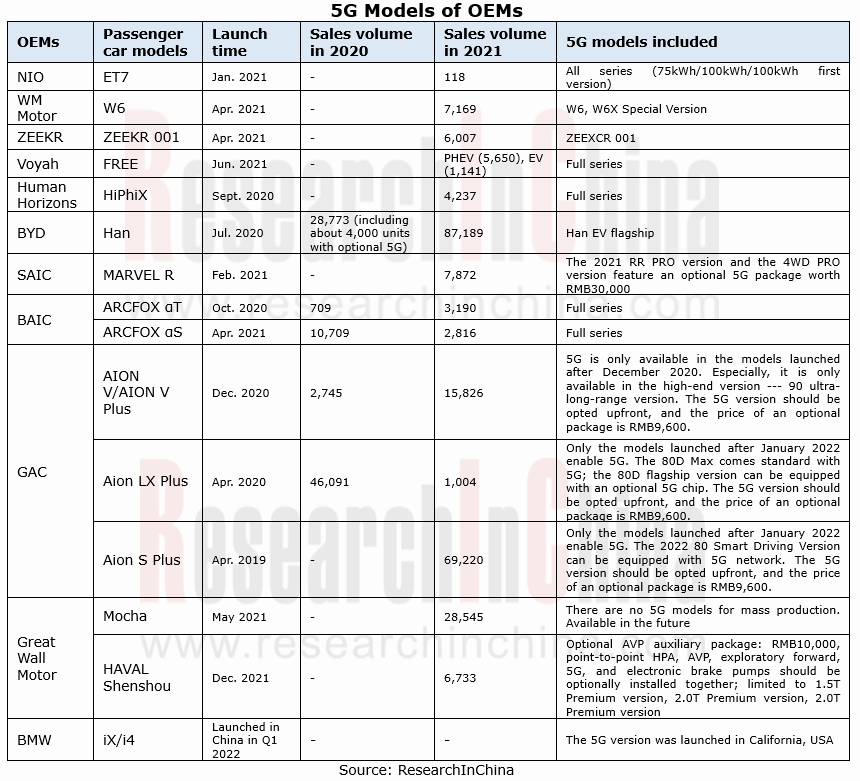

In 2020, the Ministry of Industry and Information Technology of China (MIIT) granted two 5G T-Box models Network Access License. In 2021, 19 5G T-Box models secured Network Access License, making for 9.3% which jumped 8 percentage points year-on-year. From January to March of 2022, seven 5G T-Box models obtained Network Access License. The number is expected to rise throughout 2022. At present, 4G T-Box still prevails, but it will be gradually replaced by 5G T-Box in the long run.

T-Box vendors are vigorously developing T-Box products that integrate 5G, C-V2X, high-precision positioning and other functional modules to create differentiated advantages. As of March 2022, a total of 25 5G T-Box models had gained Network Access License, including one from Samsung Harman, one from Lear, six from Neusoft, three from Datang Gohigh, two from DIAS, two from Huawei, two from JOYNEXT, two from China Mobile IoT, one from HiRain Technologies, one from Lanyou Technology, one from YF Tech, one from China TSP, one from TAGE, and one from Chelutong Technology (Chengdu) Co., Ltd.

Lanyou Technology mass-produced its 5G C-V2X T-Box in August 2021. Based on 5G, it provides high bandwidth, integrates 5G, C-V2X and centimeter-level positioning, supports 5G only and 5G+V2X dual mode, and enables at least 25 C-V2X application scenarios. Lanyou in harness with Huawei, Qualcomm, MTK, UNISOC and other platforms now boasts 5G T-Box customers such as Dongfeng Voyah, Aeolus, Nissan, and Venucia.

Neusoft’s 5G C-V2X T-Box bolsters 16 application scenarios based on three mainstream platforms and V2X national standards, as well as supports 5G NSA/SA communication, L1+L5 GNSS global positioning, Gigabit Ethernet technology, C-V2X communication, CANFD communication, LIN communication, Bluetooth 5.0+ communication, WiFi 6 communication, RKE, TPMS communication and ETC, etc. In 2021, Neusoft's 5G (V2X) BOX were massively available onto New Great Wall Haval H6, ZEEKR 001 and other models.

HiRain Technologies leverages the AP+NAD+MCU architecture for its 5G T-Box, provides multi-platform support (like Qualcomm, MTK), and presents various forms such as stand-alone type, smart antenna type, and multiple communication module integration. Functional interfaces cover 5G SA/NSA, C-V2X, CAN/CANFD, Gigabit Ethernet, dual-band GNSS, WiFi6, Bluetooth 5.2, USB, etc., and can also integrate TPMS, ETC, swap control, Bluetooth key (scalable UWB) and the like. For intelligent driving, centimeter-level positioning, parking lot/vehicle AVP, 10 Gigabit Ethernet high-speed channels and other services are available. Mass production for Dongfeng Voyah and other models has been achieved.

Some companies are also developing T-Box products that support 5G C-V2X. For example, the 5G T-Box being developed by Flaircomm Microelectronics will be compatible with mainstream 5G SOC solutions at home and abroad, and support SA/NSA networking technology, 5G V2X technology, centimeter-level positioning, Gigabit Automotive Ethernet and CAN FD bus technology.

Meanwhile, OEMs have begun to mount 5G C-V2X technology on more and more new models. For instance, SAIC Marvel R is equipped with 5G V2X i-BOX, a fusion of 5G, V2X and high-precision positioning; GAC Aion V, outfitted with Huawei MH5000 5G Module, features a 100M transmission channel and enables intelligent driving with C-V2X.

Automotive Ethernet is expected to replace CAN bus and FlexRay to become the main connection method of T-Box

New automotive functions (such as automated parking system, lane departure detection system, blind spot detection and advanced infotainment system) pose higher requirements on new data bus transmission.

With the release of the new Ethernet protocol in 2021, automotive Ethernet is expected to substitute for CAN bus and FlexRay and be the main connection method of T-Box by virtue of its low cost, low power consumption, low electromagnetic radiation, and strong scalability, thus speeding up updates and calibrations of firmware and software remarkably while reducing downtime caused by vehicle system updates. BMW and GM have confirmed that they will replace the CAN bus with 10BASE-T1S in their next-generation cars.

To date, the T-Box products of leading Chinese players (Lanyou Technology, Neusoft, Flaircomm Microelectronics, HiRain Technologies, etc.) have integrated Gigabit Ethernet to efficiently handle a universe of data from intelligent connected vehicle in the future.

The remote vehicle control by mobile Apps grows ever smarter (like AVP)

Automotive T-BOX is mainly used to communicate with background systems and mobile Apps so as to display and control vehicle information on the mobile Apps.

With the addition of technologies such as cloud computing and HD maps, the remote vehicle control functions on mobile Apps are constantly evolving. For example, AVP allows the driver to remotely control parking via mobile Apps in above-ground or basement public parking lots at a certain distance from their cars. WM W6 and GAC Aion V Plus have offered such a feature.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...