Global and Chinese Automakers’ Modular Platforms and Technology Planning Research Report, 2022

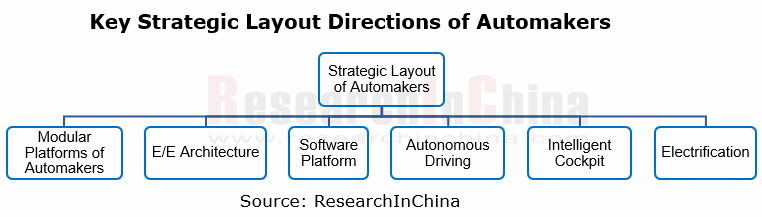

Research on Automakers’ Platforms and Their Planning: the Strategic Layout Directions of 32 Automakers

At present, global automotive industry is in the midst of profound changes unseen in a century. This can be intensively demonstrated through energy, power system, E/E architecture, intelligence and connectivity, application scenarios, user experience, and more. In this context, major automakers are changing their strategic layout. They work hard on key areas from automotive manufacturing platforms, E/E architecture and software platforms to autonomous driving, intelligent cockpit and electrification, and attract consumers and satisfy their needs with differentiated products.

1. Automakers keep upgrading their modular platform architectures.

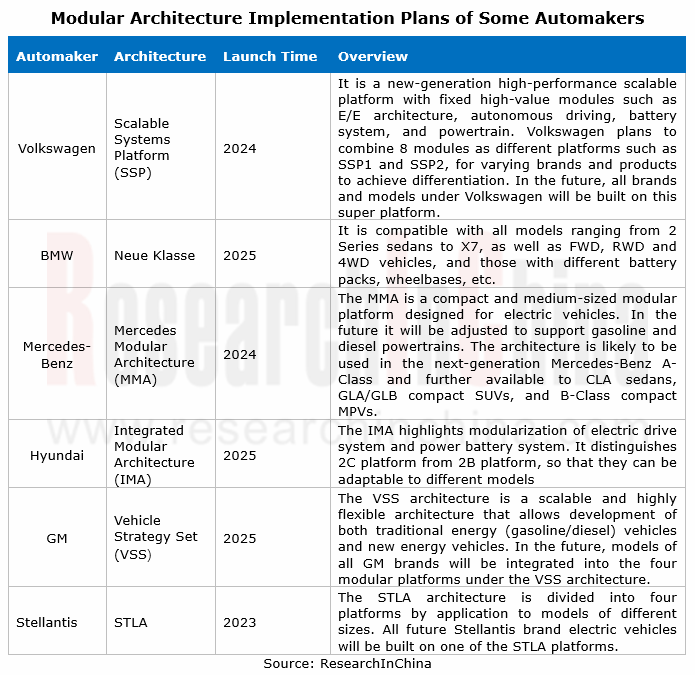

Modular platforms remain superior in increasing the universality of components and lowering R&D and production costs. At present, most automakers have their own modular platforms, or even multiple platforms. Modular architecture outperforms a modular platform. It is an extension and expansion of the platform concept. With higher universality of components and higher scalability, modular architecture is compatible with vehicles of differing classes and power types. Automakers therefore have started gradual transition from modular platform to modular architecture.

Modular architecture favors higher productivity, lower procurement/manufacturing costs, and shorter R&D cycles. In current stage, the generalization rate of components in GAC Global Platform Modular Architecture (GPMA) surpass 60%, compared with 70% in Geely Sustainable Experience Architecture (SEA) and 70%-80% in Toyota New Global Architecture (TNGA).

At present, automakers in China deploy modular architectures relatively early. Among them, BYD, Geely, Chery, and Changan Automobile have launched their own modular architectures. The modular architecture launches of foreign peers are concentrated in the period from 2024 to 2025.

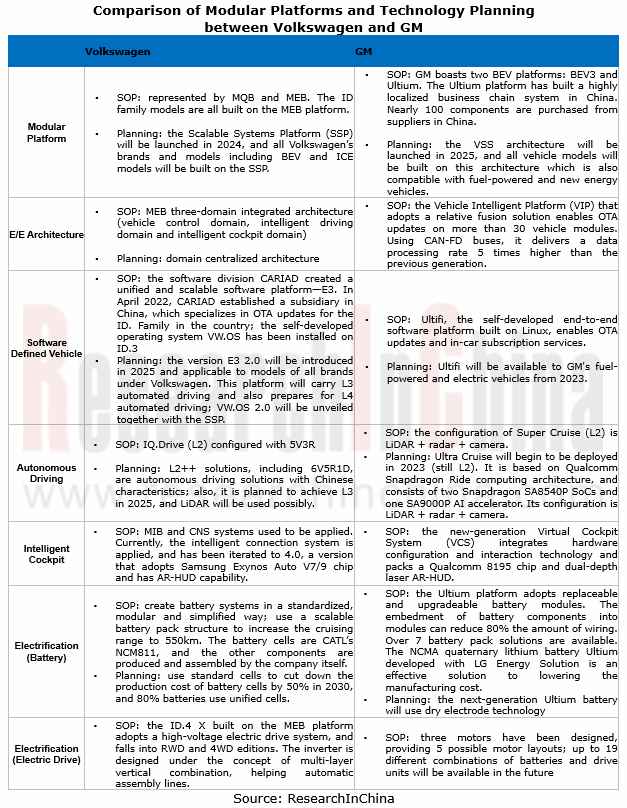

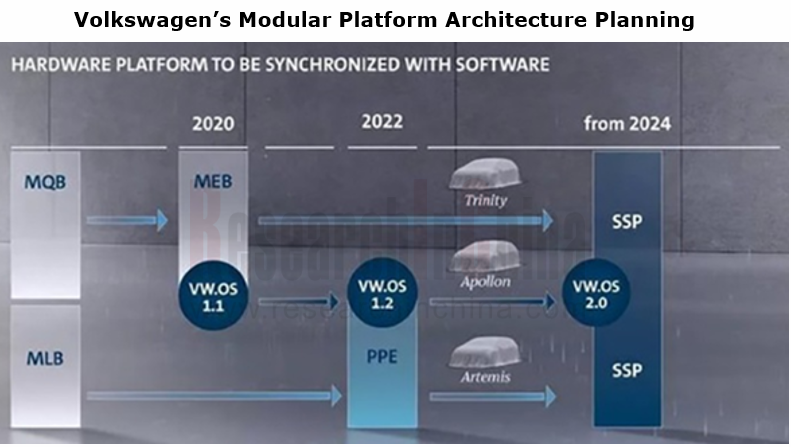

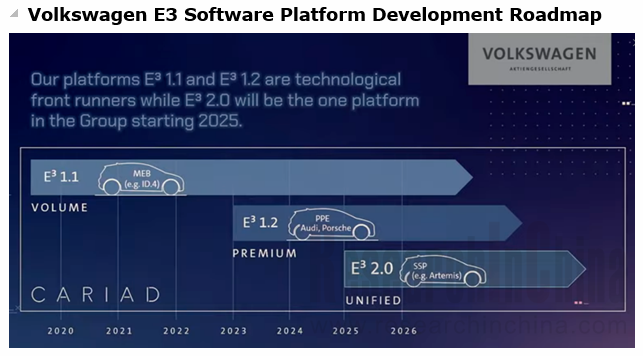

Taking Volkswagen as an example, the company plans to eventually integrate its platforms into SSP, a scalable mechatronics platform architecture applicable to all Volkswagen’s brands and models. In the future, all brands and models at all levels under Volkswagen will be built on this super platform.

2. EEA tends to be centralized.

Through the lens of E/E architecture planning, most automakers plan to deploy centralized vehicle E/E architectures:

GAC projects installation of the centralized E/E architecture "Protoss" in 2023 Aion high-end models;

Hongqi plans launch of its quasi-central architecture FEEA3.0 in 2023;

Great Wall Motor plans to introduce its central computing architecture GEEP 5.0 in 2024;

Changan Automobile is expected to complete the development of its domain centralized architecture in 2025.

For example, GAC has upgraded its E/E architecture in all aspects and has developed the Protoss E/E Architecture, its new vehicle-cloud integrated E/E architecture that enables centralized computing and is about to come out in 2023 at the earliest. This architecture consists of three core computer groups, i.e., central computer, intelligent driving computer and infotainment computer, and four zonal controllers. The intelligent driving domain carries Huawei Ascend 610, a 400TOPS high-performance chip.

3. Automakers transform from independent software platform developers to software service providers.

As autonomous driving and intelligent connectivity boom, large automakers have set off a new round of “software-defined vehicle”-centric transformation and upgrading. Some transform themselves to software service providers by way of establishing software divisions/subsidiaries, independently developing operating systems (OS), and building software platforms.

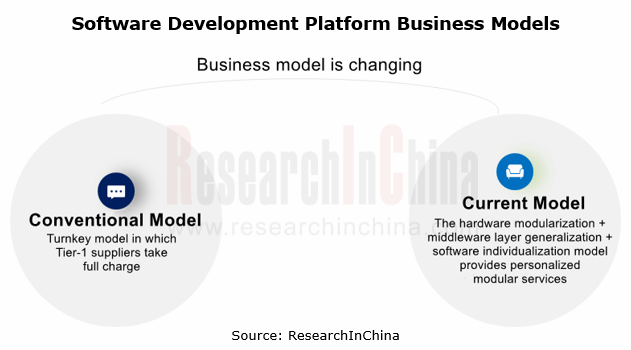

Compared with the turnkey model in which Tier-1 suppliers take full charge in conventional vehicle supply chain, auto brands now take more active part. Joint R&D and flat cooperation gradually blur the boundaries of the supply chain ecosystem, and also diversifies the needs for business models. Modular services thus need providing to meet the individual needs of auto brands with differentiated configurations for different vehicle models. For example, Bosch adopts hardware modularization + middleware layer generalization + software individualization model and adjusts parameters to quickly address the needs of different functions.

Volkswagen is a typical automaker that develops software on its own. In 2019, Volkswagen established a software division and planned to boost the in-house share of car software development from less than 10% to at least 60% in the five years to come. In 2021, Volkswagen changed the software division into CARIAD, a joint-stock company which will be responsible for independently developing the automotive operating system VW.OS and creating the software platform E3. In April 2022, CARIAD announced its China strategy. Its Chinese subsidiary was then established.

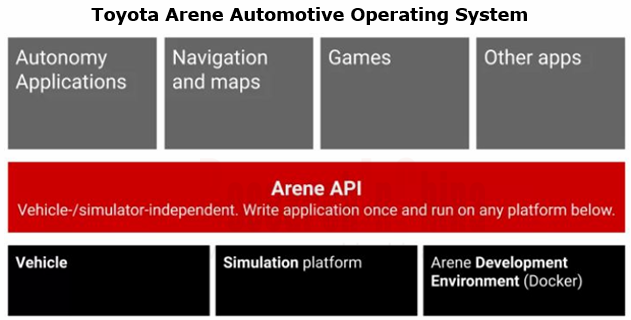

In addition to Volkswagen, GM, Toyota, Mercedes-Benz, Hyundai, SAIC and the like have also begun to self-develop operating systems and deploy their own software platforms, aiming to transform from an automaker to a software service provider. Toyota, which recently acquired the automotive operating system provider Renovo Motors, plans to roll out its own operating system, Arene, in 2025.

4. L3 automated driving of OEMs comes into service.

The mainstream automakers deploy autonomous driving in the following ways:

? Investing in acquiring autonomous driving startups

? Partnering with big tech firms

? Cooperating with other OEMs

? Self-developing, or combining the above ways

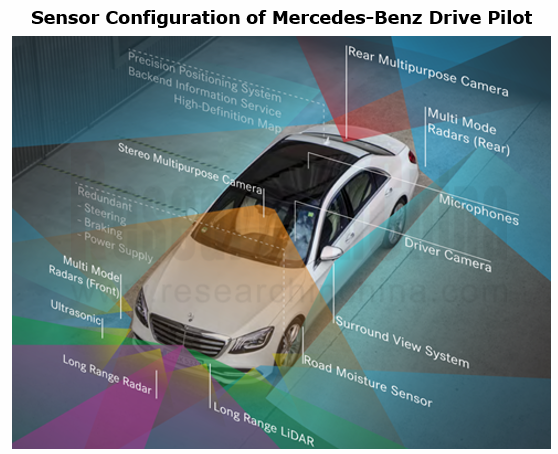

On this basis, these automakers have also introduced their own autonomous driving assistance systems, including Volkswagen IQ.Drive, Toyota Advanced Drive, Mercedes-Benz Drive Pilot, Geely G-Pilot, and GAC ADiGO. Among them, Mercedes-Benz is the world’s first automotive company to meet the United Nations regulation UN-R157. Mercedes-Benz marketed its L3 automated driving system Drive Pilot in Germany in May 2022, and announced that it will be responsible for accidents caused by the system when activated.

Sensor configuration of Mercedes-Benz Drive Pilot:

? 1 LiDAR

? 1 long-range radar

? 4 short-range radars

? 1 stereo camera

? 1 rear view camera

? 1 in-vehicle driver monitoring camera

? 1 differential GPS

Sensor configuration of automated parking:

? 4 surround view cameras

? 12 ultrasonic sensors

5. Intelligent cockpit interconnection platforms connect vehicles, people and everything, playing a more important role.

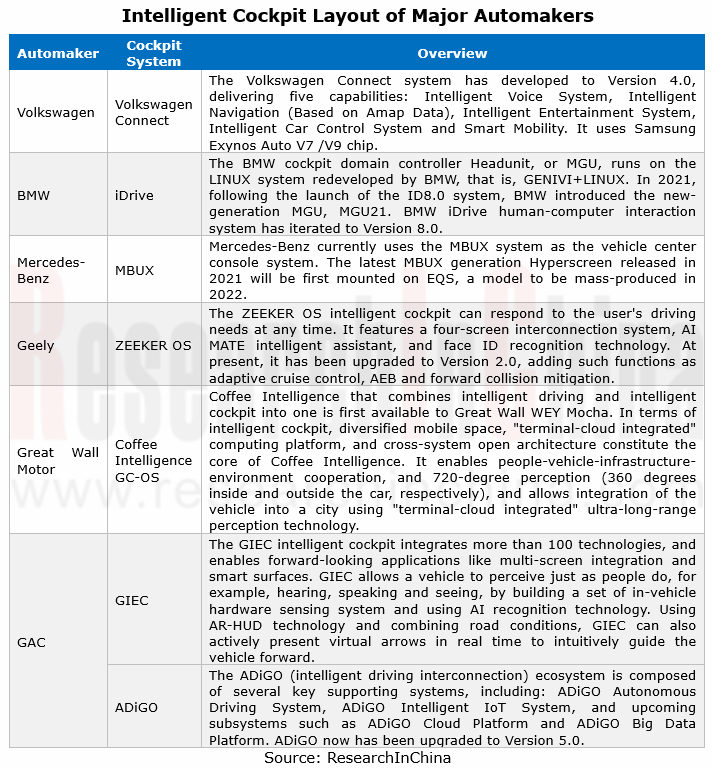

As the Internet thrives, major automakers show much enthusiasm for intelligent cockpits. Almost all of them have rolled out different intelligent cockpit interconnection platforms as selling points, in a bid to attract consumers. Examples include BMW iDrive and Mercedes-Benz MBUX, BYD DiLink and Geely GKUI.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...