Chinese ADAS and Autonomous Driving Tier 1 Suppliers Report, 2021-2022

Autonomous Driving Tier 1 Suppliers Research: the installation rate of L2 and above autonomous driving functions in passenger cars hit over 30% in 2022Q1.

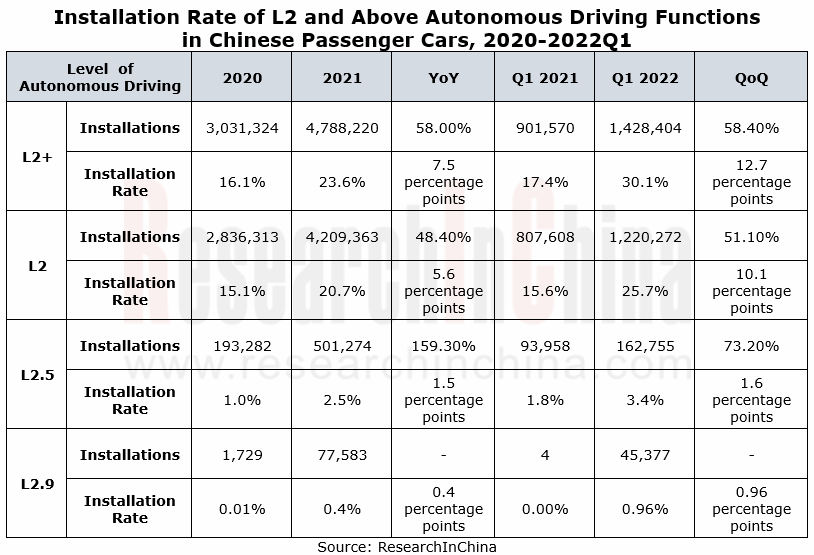

In 2022Q1, the installation rate of L2 and above autonomous driving functions in Chinese passenger cars reached 30.1%, a year-on-year increase of 12.7 percentage points. Specifically, the L2 installation rate went up by 10 percentage points to 25.7%; the L2.5 installation rate rose by 1.6 percentage points to 3.43%; the L2.9 installation rate edged up by 0.95 percentage points to 0.96%.

The boom of ADAS favored a surge in Tier 1 suppliers’ revenue from autonomous driving products.

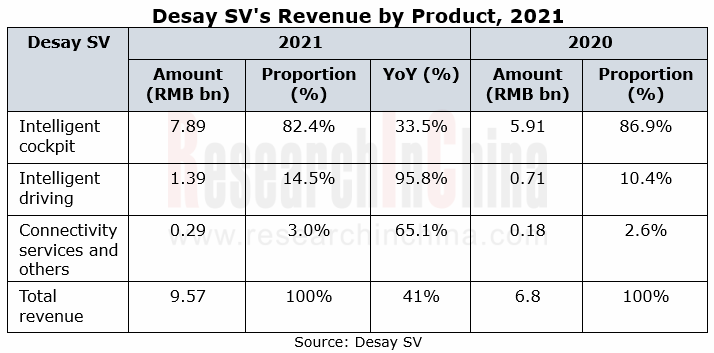

In 2021, Desay SV's revenue from intelligent driving products hit RMB1.39 billion, a year-on-year spike of 95.8%. Desay SV entering the field of autonomous driving in 2016 primarily produces cameras, radars and domain controllers. In the future, it will still focus on perception fusion algorithms and control strategy, and will make further deployments in L3 and L4 autonomous driving solutions. Its domain controller IPU03 was mass-produced for Xpeng P7 in April 2020; the domain controller IPU04 launched in September 2021 is scheduled to be used by Li Auto in 2022; the intelligent computing platform (ICP) "Aurora" became available on market in April 2022.

Neusoft Reach started deploying autonomous driving in 2004. The company works on R&D and commercialization of autonomous driving core technologies, covering autonomous driving systems such as visual perception, embedded high-performance computing, sensor fusion, decision and planning, and vehicle control.

Neusoft Reach provides technologies and solutions for passenger car/commercial vehicle products. Its autonomous driving products include front view smart cameras, driver monitoring systems, domain controllers, and central computing platforms. Its self-developed automotive basic software platform NeuSAR enables effective decoupling of software and hardware. The encapsulation of end-cloud cooperation middleware services helps to connect vehicle-cloud cooperation value data communication links and mobilize cloud platform services to enable the continuous intelligent driving iterations and updates at the vehicle end.

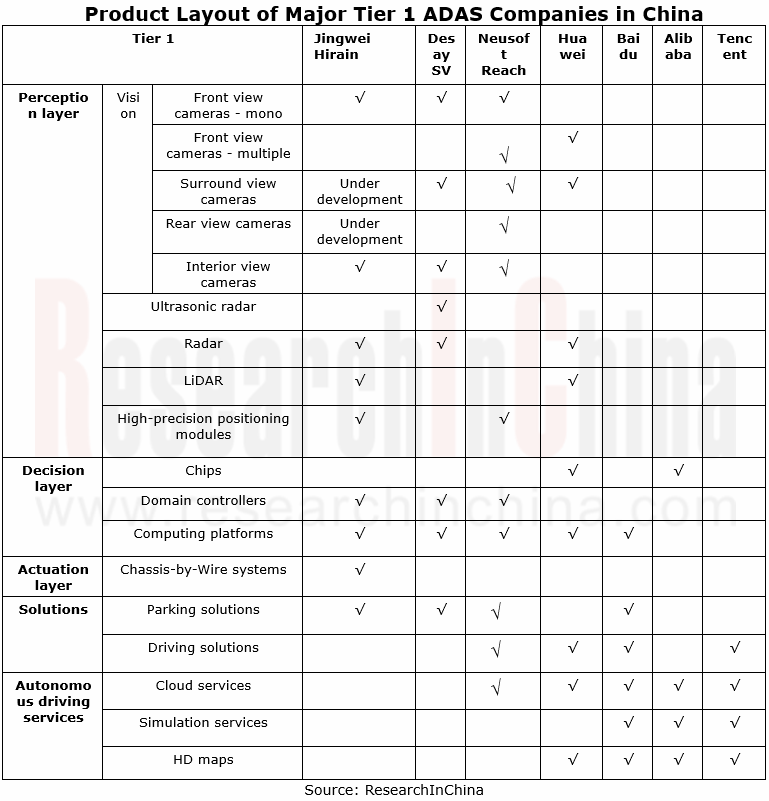

Jingwei Hirain’s revenue from intelligent driving electronics sustained AAGRs of over 100% in recent three years. Jingwei Hirain has begun to deploy autonomous driving in 2015, and established its intelligent driving division in 2017. Its products are led by cameras, radars, domain controllers, computing platforms and chassis-by-wire. The company is working hard to develop system software technology.

Both conventional Tier 1 suppliers and emerging Tier 1 Internet firms are deploying decision layer products

Decision layer products are the bridge between the perception layer and the execution layer. As the core products of high-level autonomous driving, they are responsible for computing, judgment, and decision. At present, Jingwei Hirain, Desay SV, Neusoft Reach, Huawei, and Baidu all have launched their own domain controllers and computing platforms.

Huawei set up the "Internet of Vehicles Division" in 2013. It dabbles in the field of smart cars by starting with the automotive communication module ME909T. Huawei has started developing autonomous driving communication architecture since 2015, and has rolled out the autonomous driving AI chip "Ascend", the Ascend-based intelligent driving computing platform MDC, the intelligent driving cloud service “Octopus”, the intelligent driving operating system AOS, LiDAR, 4D imaging radar, etc.

Huawei keeps enriching its computing platform offerings. In October 2018, Huawei first introduced its intelligent driving computing platforms, MDC600 for L3 autonomous driving and MDC300 for L4. In September 2020, it unveiled MDC210 for L2+ and MDC610 for L3-L4. The vehicle models in which Huawei is negotiating on use of MDC610 include GAC AION LX, Great Wall Salon Mecha Dragon, and GAC Trumpchi. In April 2021 Huawei announced MDC810 an intelligent driving computing platform that supports L4-L5 and will be first seen in BAIC ARCFOX αS Huawei Inside (HI) Edition. The installation of the chip in 2022 Neta TA and GAC Aion is under negotiation. Huawei also plans to launch MDC100 in 2022.

The Institute of Deep Learning Baidu founded in July 2013 has launched an autonomous vehicle project and developed the Apollo autonomous driving open platform. It has introduced autonomous driving service products such as autonomous driving cloud service, simulation service, HD map. In 2021, its products were extended to autonomous driving solutions and decision products. In April 2021, its AVP solution and the corresponding computing platform were first mounted on Weltmeister W6.

Emerging Tier 1 companies are eagerly converting their role in the industry chain.

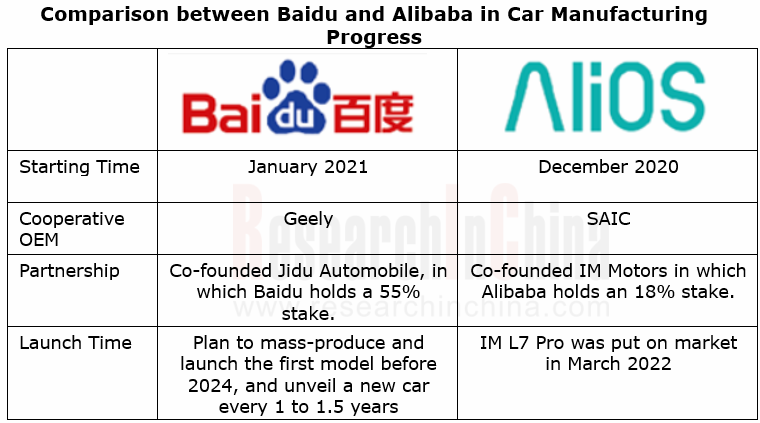

Emerging Tier 1 companies (Baidu, Alibaba, etc.) have made a foray into the automotive field with their superior software technology and data platforms. They are accelerating the development of software-defined vehicles and shortening the development cycle of new automotive products. Meanwhile, they have realized that the Tier 1 market is limited and they need to vigorously change their role in the industry chain into a partner of conventional OEMs to jointly build cars. For example, Alibaba and SAIC together established IM Motors in 2020; Baidu and Geely co-funded Jidu Automobile in 2021.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...