DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022

DENSO CASE Research: The semiconductor business will help it go "from Toyota to the world”

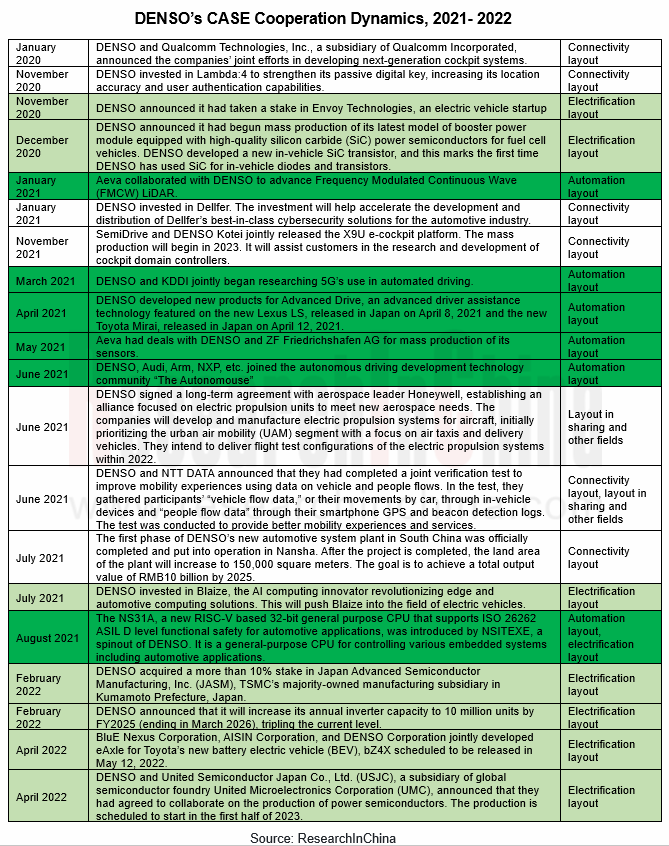

ResearchInChina has released DENSO CASE (Connectivity, Automation, Sharing and Electrification) Layout Research Report, 2022 to sort out and study the layout of Japan-based DENSO Group in the fields of automation, connectivity, electrification and other fields, summarize its development dynamics in 2021-2022 and predict its future business focus.

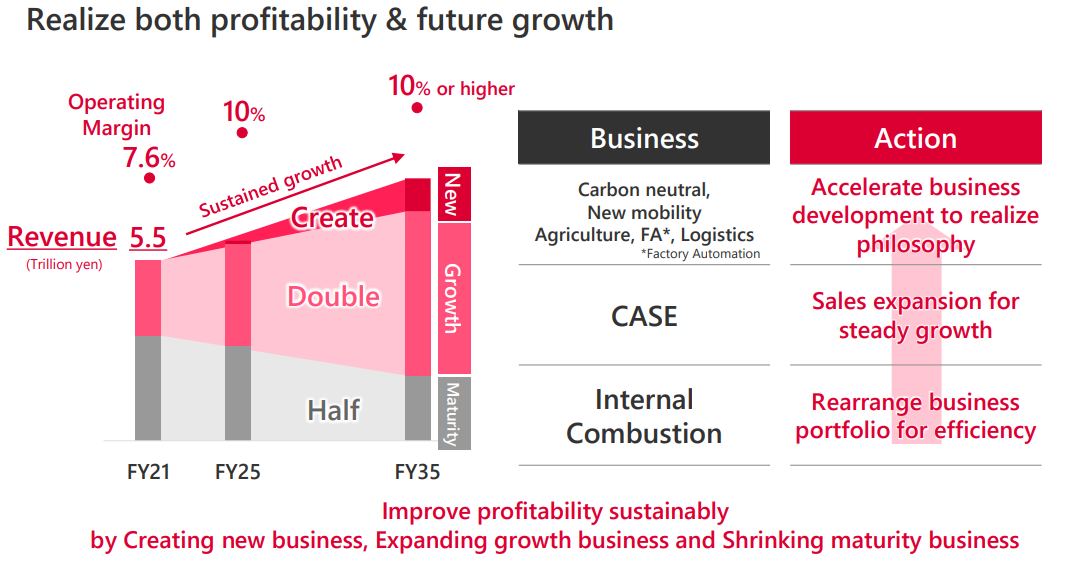

1. DENSO's future growth will mainly hinge on CASE

With the transformation and development of CASE, DENSO has built relatively sound technical capabilities in the fields of automation, connectivity, and electrification, and its future growth will mainly hinge on CASE.

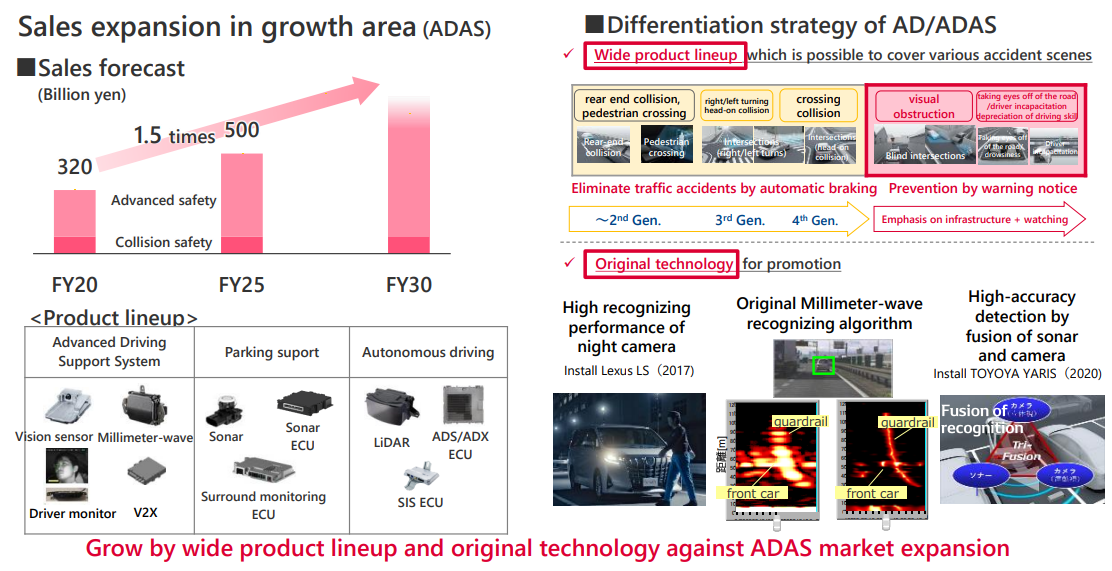

In the field of automation, DENSO has formed ADAS (L2-L4), surround-view systems, AVP, autonomous platooning, autonomous taxis, a series of active safety systems, AD systems and ADAS through the provision of cameras (front-view monocular/binocular, surround-view), radar (forward, corner), LiDAR, ultrasonic radar, integrated control software for autonomous driving and other products. In addition, it provides users with integrated software and hardware solutions.

At this stage, DENSO mainly applies the autonomous braking function to the front, rear, left and right directions, and to avoid traffic accidents in scenarios such as crossing intersections. In the future, DENSO will strengthen the development of early warning functions with the help of V2X and other infrastructure.

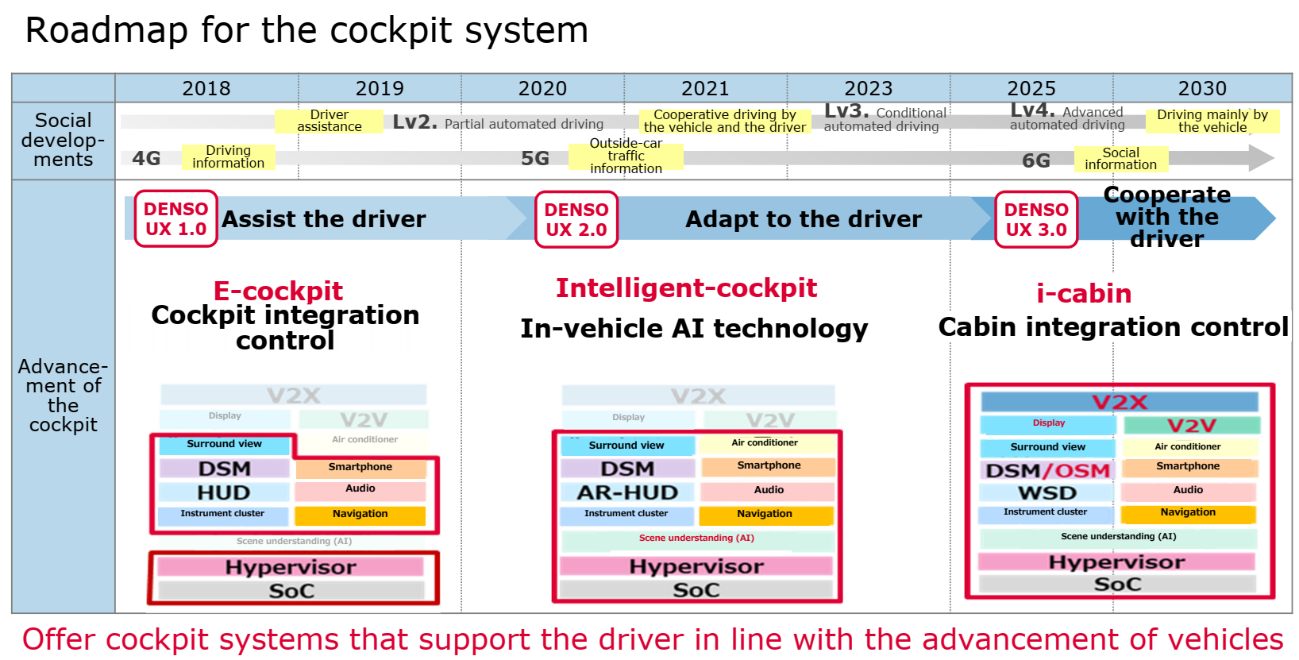

In the field of connectivity, DENSO’s products cover automotive communication, IVI systems, digital keys, OTA solutions, cyber security solutions, cockpit domain control platforms, clusters & center consoles, HUD, DMS, etc. Among them, automotive V2X communication equipment features wireless communication, vehicle positioning and status judgment, and it enables safe driving assistance through wireless vehicle-to-vehicle and road-vehicle communication. It has been installed in Toyota Prius, Crown, Lexus RX, Lexus LS and other models. DENSO plans to integrate V2X, V2V, display systems, DMS/OMS and other functions into the bottom layer of cockpit to offer a more intelligent cockpit solution by 2025.

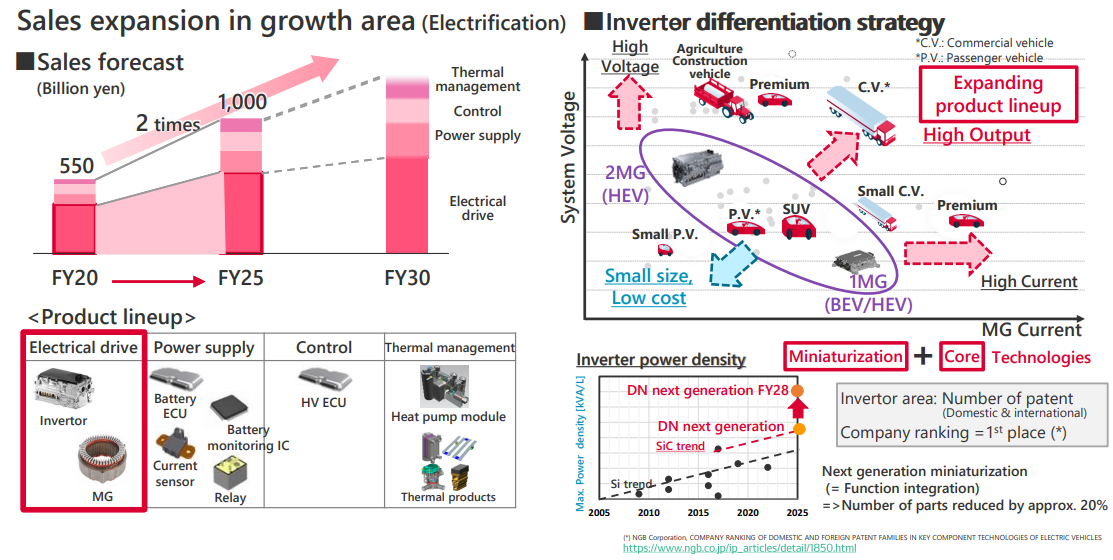

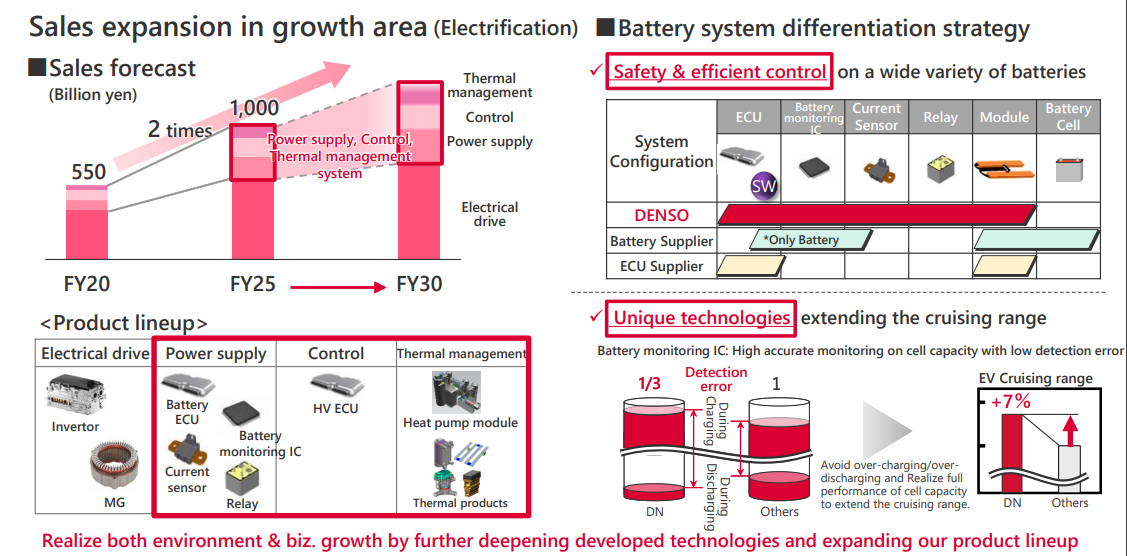

In the field of electrification, DENSO focuses on the development of core products across electrified powertrain platforms (PHEV, HEV, BEV, FCEV): battery packs, motors, inverters, and energy management systems.

According to the plan, DENSO will center on the development of inverter and stator winding technologies before 2025, extend to power modules, control modules and thermal management systems from 2026 to 2030, and further enhance its supply chain.

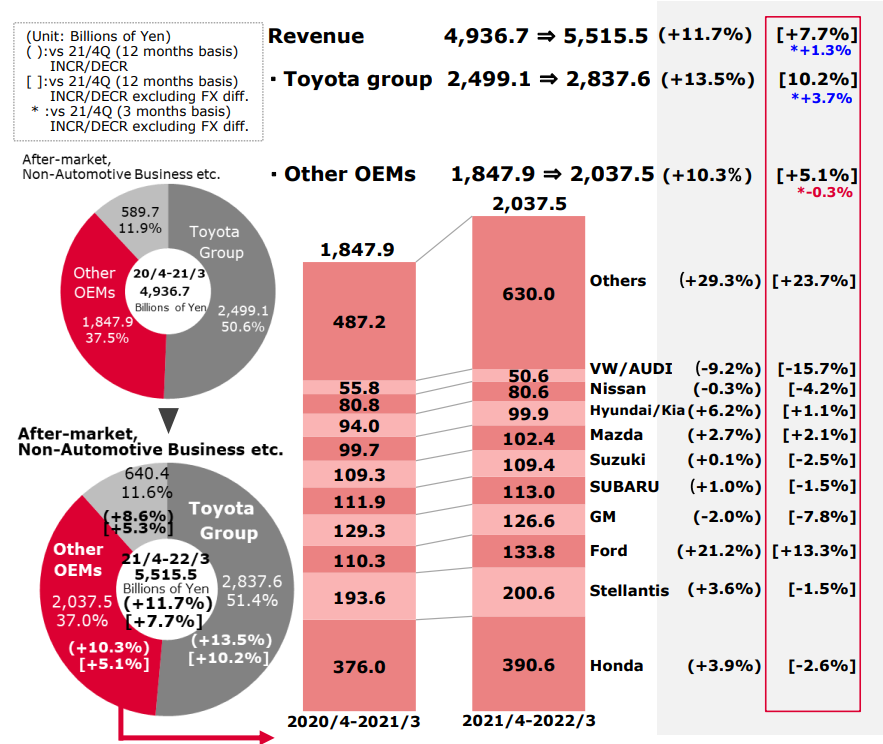

2. Toyota contributes over 50% to DENSO's revenue

After DENSO was separated from Toyota in 1949, the two have maintained an amicable and cooperative relationship. In FY2022, Toyota contributed 51.4% to DENSO's revenue, an increase of 0.8 percentage point from the previous fiscal year; the order intake worth JPY2,837.6 billion, up 13.5% year-on-year.

DENSO's CASE products are mainly tested and mass-produced through Toyota. For instance:

In April 2021, DENSO announced it had developed products for Advanced Drive, an advanced driver assistance technology featured on the new Lexus LS and the new Toyota Mirai. DENSO’s newly developed products used in Advanced Drive include LiDAR, a binocular vision system, an Spatial Information Service Electronic Control Unit (SIS ECU), an Advanced Drive System Electronic Control Unit (ADS ECU) and Advanced Drive Extension Electronic Control Unit (ADX ECU).

In April 2021, DENSO announced it had developed products for Advanced Drive, an advanced driver assistance technology featured on the new Lexus LS and the new Toyota Mirai. DENSO’s newly developed products used in Advanced Drive include LiDAR, a binocular vision system, an Spatial Information Service Electronic Control Unit (SIS ECU), an Advanced Drive System Electronic Control Unit (ADS ECU) and Advanced Drive Extension Electronic Control Unit (ADX ECU).

In May 2022, BluE Nexus Corporation, AISIN Corporation, and DENSO Corporation announced that they had jointly developed eAxle for Toyota’s new battery electric vehicle (BEV), bZ4X.

In May 2022, BluE Nexus Corporation, AISIN Corporation, and DENSO Corporation announced that they had jointly developed eAxle for Toyota’s new battery electric vehicle (BEV), bZ4X.

In addition, DENSO's forward-looking layout and innovative products in CASE almost reflect Toyota's presence. They are deeply bound and closely tied up in CASE transformation.

3. The semiconductor business will help DENSO go "from Toyota to the world”

In 2022, DENSO's layout concentrates on the semiconductor field.

In February 2022, DENSO acquired a more than 10% stake in Japan Advanced Semiconductor Manufacturing, Inc. (JASM), TSMC’s majority-owned manufacturing subsidiary in Kumamoto Prefecture, Japan. With this equity investment, DENSO became JASM’s third largest shareholder. TSMC will build a new chip factory in Kumamoto Prefecture, Japan through JASM to produce cutting-edge logic semiconductors for image sensors and MCUs, with mass production scheduled to begin by the end of 2024. The acquisition will enable DENSO to stably purchase cutting-edge semiconductors with circuit line widths of around 10-20 nanometers in Japan.

In February 2022, DENSO acquired a more than 10% stake in Japan Advanced Semiconductor Manufacturing, Inc. (JASM), TSMC’s majority-owned manufacturing subsidiary in Kumamoto Prefecture, Japan. With this equity investment, DENSO became JASM’s third largest shareholder. TSMC will build a new chip factory in Kumamoto Prefecture, Japan through JASM to produce cutting-edge logic semiconductors for image sensors and MCUs, with mass production scheduled to begin by the end of 2024. The acquisition will enable DENSO to stably purchase cutting-edge semiconductors with circuit line widths of around 10-20 nanometers in Japan.

In February, DENSO announced that it will increase its annual inverter capacity to 10 million units by FY2025 (ending in March 2026), tripling the current level. In order to achieve this goal, DENSO will expand or build new factories in Japan, the United States, China, Europe, Southeast Asia, India and other countries and regions. In addition to supplying products to Toyota, it will contact European and American OEMs.

In February, DENSO announced that it will increase its annual inverter capacity to 10 million units by FY2025 (ending in March 2026), tripling the current level. In order to achieve this goal, DENSO will expand or build new factories in Japan, the United States, China, Europe, Southeast Asia, India and other countries and regions. In addition to supplying products to Toyota, it will contact European and American OEMs.

In April 2022, DENSO and United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of global semiconductor foundry United Microelectronics Corporation (UMC), announced that they had agreed to collaborate on the production of IGBTs at USJC's 300mm fab. The production is scheduled to start in the first half of 2023.

In April 2022, DENSO and United Semiconductor Japan Co., Ltd. (USJC), a subsidiary of global semiconductor foundry United Microelectronics Corporation (UMC), announced that they had agreed to collaborate on the production of IGBTs at USJC's 300mm fab. The production is scheduled to start in the first half of 2023.

"DENSO is considering spinning off its JPY420 billion chip business”, CTO Yoshifumi Kato said in an interview in June 2022.

"DENSO is considering spinning off its JPY420 billion chip business”, CTO Yoshifumi Kato said in an interview in June 2022.

With the development of mobility technologies such as autonomous driving and electrification, the importance of semiconductors in the automotive industry is becoming more and more prominent. Recently, DENSO's semiconductor layout mainly pivots on digital chips with high computing power, which will be mainly used in AD systems/ADAS. In order to obtain more semiconductor-related resources, DENSO has successively formed close capital bonds with Renesas, Infineon, TSMC, and UMC.

At present, DENSO keeps an eye to meet the internal chip demand and support Toyota. If DENSO splits its semiconductor business in the future, the relationship with Toyota is expected to be loosened, facilitating its global expansion. After all, DENSO has become the world's fifth-largest supplier of automotive chips by sales volume, and digital semiconductors to mass-produced in 2023-2024 will be a blessing.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...