Minicars, also known as mini passenger cars, are suitable for short-distance transportation and are positioned as entry-level vehicles. Thanks to low cost, convenient parking and low usage cost, minicars are favored by the working class. In the fuel era, minicars mainly include Chery QQ and Benni MINI. As China vigorously develops electric vehicles, micro electric vehicles have become the focus of minicar marketing and have been recognized by more and more consumers. In recent years, the sales volume of minicars in China has grown rapidly. In 2021, the annual sales volume swelled by 198.2% year-on-year to 978,000 units. It is expected that the industry will continue to grow radically in the short to medium term. By 2027, the sales volume will hit 4.387 million units, with a compound annual growth rate of 28.4% over 2021.

Thanks to star models such as Chery QQ and Changan Benni, minicars enjoyed the market share of 6%-7% before 2008. With the introduction of the policy of popularizing cars in the countryside at the beginning of 2009, the minicar market expanded radically from 30,000 units in 2008 to 750,000 units in 2010. However, the minicar market has been sluggish since 2011 due to the termination of the aforementioned policy. In 2016, only 234,000 minicars (including 120,000 fuel minicars) were sold, accounting for 1.0%.

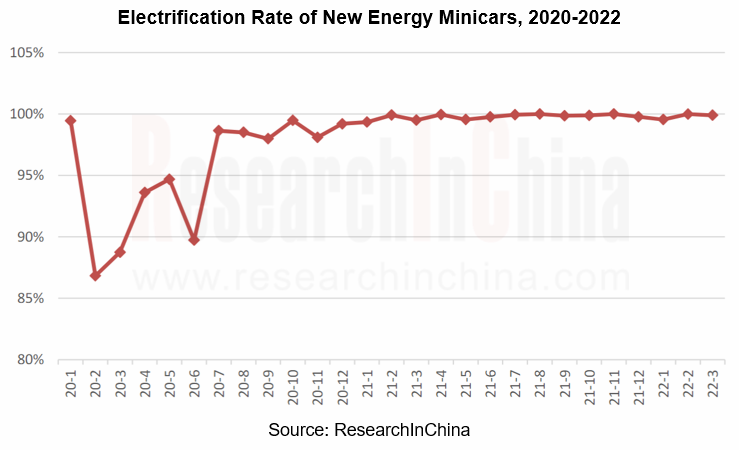

In 2016, the era of electric vehicles came. The subsidy policy sparked the emergence of electric minicars, and pushed up the sales volume of electric minicars to 420,000 units in 2018. But since the subsidy declined, the sales volume dropped to 250,000 units in 2019. In 2020, the stunning Hongguang Mini EV redefined minicars which no longer hover at the low end, so that the market boomed and the sales volume herein soared to 978,000 units in 2021. In the market, nearly 100% minicars are driven by new energy, and they are all battery-electric models. The trend of 100% electrification is expected to continue.

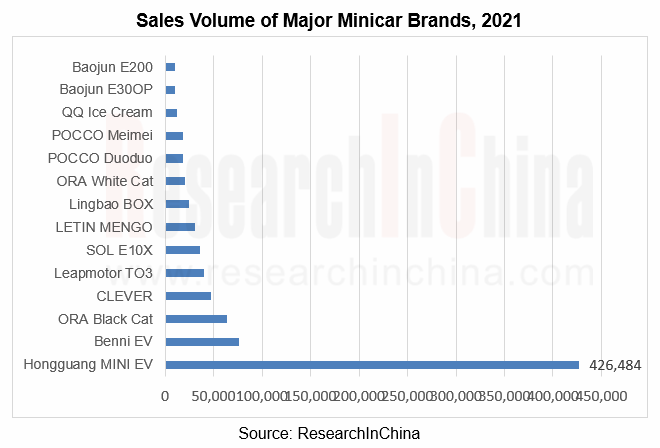

In terms of the competitive landscape, China Passenger Car Association (CPCA) revealed that there were 49 minicar models on sale in the Chinese automotive market in 2021, of which 14 models saw the sales volume of more than 10,000 units each. Among them, SAIC-GM-Wuling's Hongguang Mini EV was far ahead of its competitors with the sales volume of 426,500 units, with a market share of 43.6%. Despite chip shortage and price hikes, the sales volume was still as high as 106,700 units in the first quarter of 2022. Changan Benni EV and Great Wall ORA Black Cat secured the sales volume 76,438 units and 63,492 units respectively in 2021, occupying the second and third places, with the market share of 7.8% and 6.5% separately.

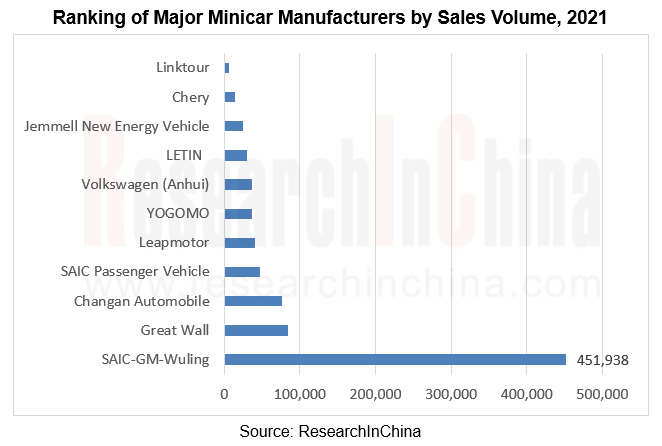

In terms of manufacturers, SAIC-GM-Wuling offered Hongguang MINI EV, Baojun E200, Baojun E300P and Baojun E100 in 2021, which gained the combined sales volume of 451,900 units, accounting for 46.2% of the minicar market. As for the second-ranked Great Wall Motor, ORA White Cat and ORA Black Cat occupied about 8.6% of the minicar market, with the total sales volume of 84,097 units. Changan Automobile only had Benni EV on sale, making up 7.8% of the minicar market as the second runner-up in the market.

Global and China Minicar Industry Report, 2022 highlights the following:

Overview of the minicar industry, including definition, classification, industry policies, etc.;

Overview of the minicar industry, including definition, classification, industry policies, etc.;

The development of Chinese minicar market, including market size, typical brands, driving factors, development trends and competitive landscape at each stage;

The development of Chinese minicar market, including market size, typical brands, driving factors, development trends and competitive landscape at each stage;

Consumption in Chinese minicar market, including customer characteristics, consumption factors and preferences;

Consumption in Chinese minicar market, including customer characteristics, consumption factors and preferences;

Profile, business, main models, and marketing of major minicar manufacturers in China.

Profile, business, main models, and marketing of major minicar manufacturers in China.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...