China Passenger Car Driving and Parking Integrated Solution Industry Report, 2022

Driving and parking integrated solutions stand out in high-level intelligent driving, and the mass adoption is around the corner.

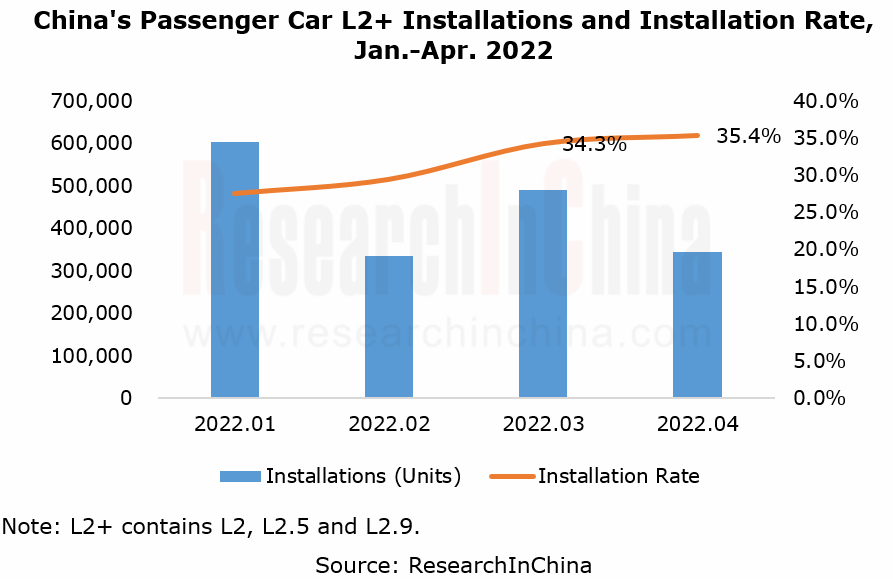

According to ResearchInChina, in the first four months of 2022, China's passenger car L2+ installations hit 1,772,700 units, a year-on-year upsurge of 48.6%; the installation rate jumped from 27.6% in January 2022 to 35.4% in April 2022, up 7.8 percentage points.

Against a background of the widespread use of L2+ intelligent driving technologies, increasing consumers demand for higher-level intelligent driving functions. There is an urgent need to implement high-level autonomous driving functions with low cost and high performance. Driving and parking integrated solutions thus come into being.

Driving and parking integration refers to a solution that combines the functions of the two SoCs of driving and parking into one SoC to enable high-speed driving assistance and low-speed parking assistance at the same time. This solution features low hardware cost, flexible software configurations, and efficient function iterative development.

Compared with the previous development model of separate driving and parking functions, the driving and parking integrated solution enables sensor hardware reusability, lower development cost, and availability of high-level intelligent driving functions (automatic lane change, on/off-ramp, home-AVP, valet parking, etc.) to low- and mid-end vehicle models.

Driving and parking integrated solutions will sink to low- and mid-end vehicle models in quantities.

In current stage, the vehicle models with driving and parking integrated solutions are led by Xpeng P7/P5, Li L9, TANK 500, IM L7, Roewe RX5, Baojun e300/Plus, Geely Xingyue L, and the NOP edition of fuel-powered vehicle JAC SOL QX. In addition, Weltmeister and Mocha plan use of the integrated solutions in their vehicles this year. BYD projects to equip its vehicles with the driving and parking integrated solution Horizon Journey 5 in 2023.

In China, local suppliers such as Freetech, Neusoft Reach, and YIHANG.AI play a dominant role in the driving and parking integrated solution market.

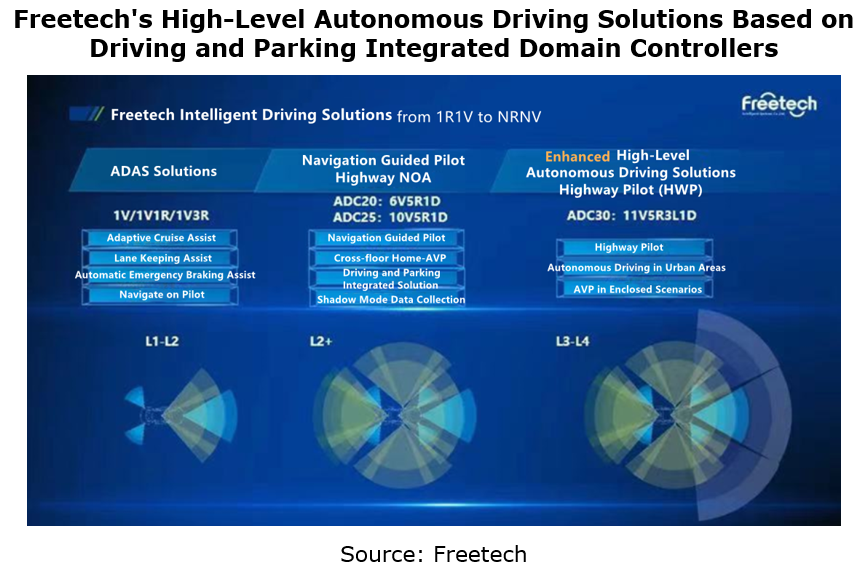

Freetech has rolled out high-level autonomous driving solutions based on ADAS\AD domain controllers (ADC), including three versions: ADC20 (supporting L2.9), ADC25 (urban scenarios), and ADC30 (L3-L4). Meeting the needs of L2-L4 products, they enable on/off-ramp and automatic lane change in highway scenarios, automatic follow in urban traffic jams, and automated parking in low-speed scenarios.

Freetech's latest-generation domain controller platform solution ADC20 adopts an original architecture that not only supports driving and parking integration, but also enables highway navigate on autopilot (NOA). The integrated solution provides improving functions and performance and allows more anthropomorphic system control, using embedded hardware, data optimization and OTA. It will be mass-produced and delivered to passenger car customers in the second half of 2022, offering continuous function OTA updates.

In addition, the high-level autonomous driving solution based on the ADC30 domain controller platform is expected to be spawned in 2023. The solution delivers up to 500+ TOPS AI computing power. In terms of driving, it enables L3 highway pilot (HWP), traffic jam pilot (TJP) and navigate on pilot (NOP); as for parking it enables up to L4 home zone park assist (HPA) and automated valet parking (AVP) functions. The solution subject to the ISO 26262 ASIL D functional safety requirements has been designated by FAW Hongqi.

The fourth-generation autonomous driving domain controller X-Box unveiled by Neusoft Reach in 2022 is a new L2+ standard domain controller product based on SDV development model. The product driven by Horizon Journey 5 AI chip provides L2+ driving and parking functions, allows the access to 8M cameras, 4D point cloud radars and LiDARs, and covers scenarios of highways, urban expressways, some urban roads and various parking lots.

Additionally, X-Box adopts the SOA design solution where service-oriented modular software and algorithms are developed. The product supports cooperative terminal-cloud autonomous driving in a data closed-loop mechanism. It also supports new-generation automotive E/E architectures, and enables intra-domain/cross-domain service subscription and discovery, flexible software deployment, and rapid iteration of the application layer, as well as open system architecture, open multi-dimensional full-stack software capabilities, and joint development.

In security’s terms, X-Box is designed in accordance with ISO 26262 functional safety and ISO 21434 information security requirements. Minimal risk strategies are implemented for typical driving and parking scenarios. Secure boot, secure storage, secure upgrade, and secure communication modules and more are deployed in connection systems at vehicle, cloud and smartphone ends.

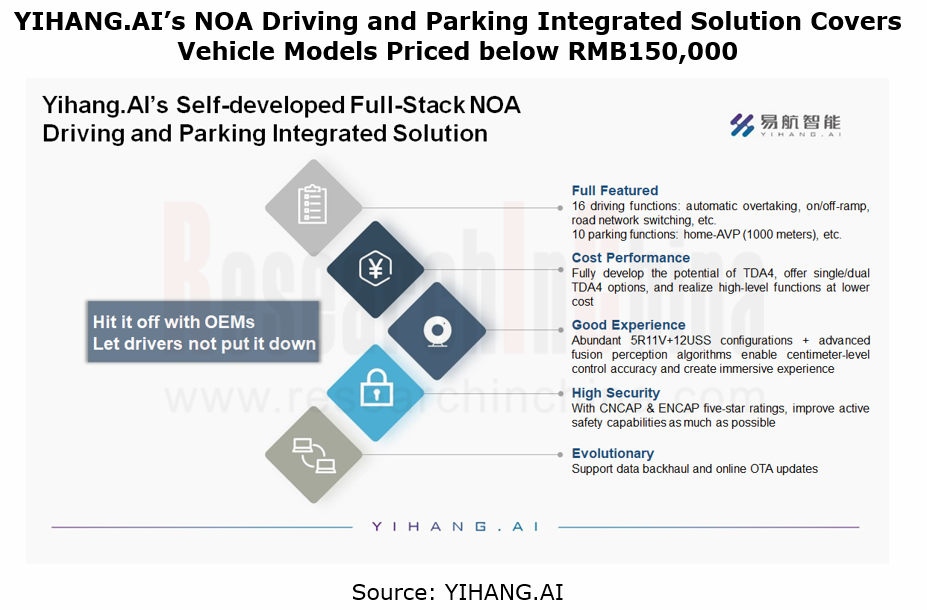

In May 2022, YIHANG.AI announced the launch of an NOA driving and parking integrated solution with price lower than RMB10,000. With 16TOPS computing power, the mass-produced solution enables NOA driving and parking integrated function. It boasts the following features:

- Incorporate 16 driving functions (automatic overtaking, automatic on/off-ramp, automatic road network switching, etc.) and 10 parking functions (1000m home-AVP, fusion parking, etc.);

- The abundance of 5R11V+12USS configurations and advanced fusion perception algorithms realize a centimeter-level control accuracy;

- Even outperform an "experienced driver" on the strength of merging strategy and braking force in NOA mode;

- Cover vehicle models priced below RMB150,000.

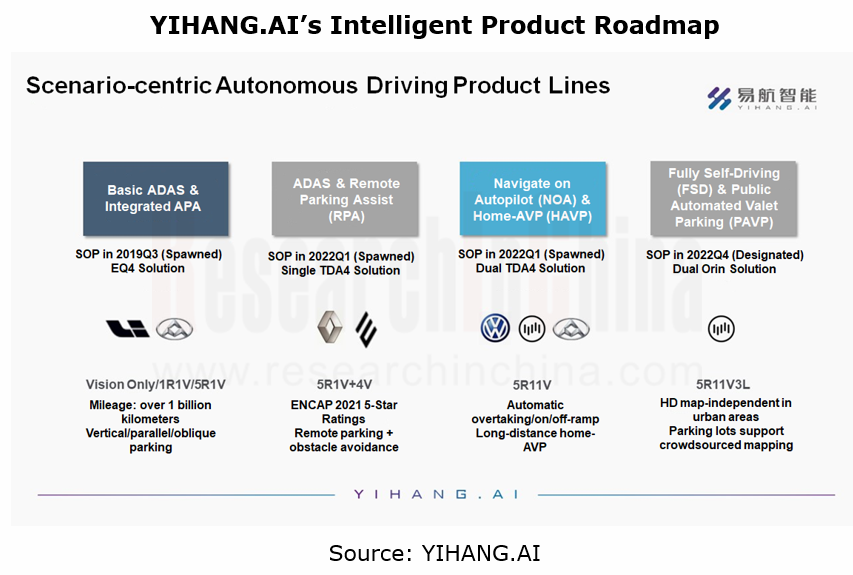

Meanwhile, YIHANG.AI provides multiple configuration solutions such as single/dual TDA4 according to demand. Wherein, the single TDA4 solution can replace L2 ADAS functions and offer higher-level driving assistance on the premise that the cost is flat; the dual TDA4 solution has now been mass-produced for brands like Jiangling, Renault, Weltmeister and SAIC MAXUS. YIHANG.AI is about to introduce an FSD solution for all urban scenarios, and is expected to mass-produce it at the end of this year.

The driving and parking integrated domain will fuse with the cockpit domain.

As automotive E/E architecture evolves from the distributed to the centralized, large computing power chips are mounted on vehicles and some domain controller functions have been integrated, for example, the integration of vehicle control unit (VCU), body control module (BCM), and some gateway functions, and even the fusion of driving, cockpit and body domains.

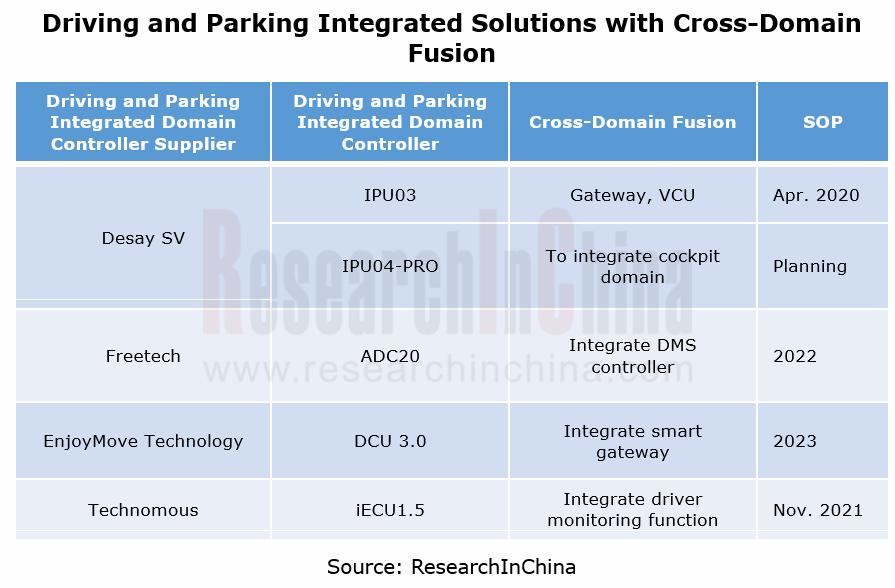

Desay SV's IPU03 integrates gateway and VCU. The company plans to integrate autonomous driving and cockpit domains into its next-generation driving and parking integrated domain controller IPU04-PRO.

Freetech ADC20, a driving and parking integrated domain controller product, integrates driving domain controller, parking domain controller and DMS controller. ADC20 supports an 8MP front-view camera and freespace algorithms used to detect passable areas. Coupled with HD maps, high precision positioning and rear-view camera, it at most enables highway NOA and AVP functions. It has been designated by a first-tier OEM in China and is expected to be produced in quantities this year. OTA updates will be available subsequently.

In the future, the evolution of automotive EEA and SOA will be accompanied by the development from centralized domain controller and cross-domain controller to vehicle central computer and intelligent zone controller, eventually realizing vehicle-cloud computing. The central domain controller therefore will pack a computing platform with higher integration level and greater computing power to support more complex sensor data fusion algorithms for higher levels of autonomous driving.

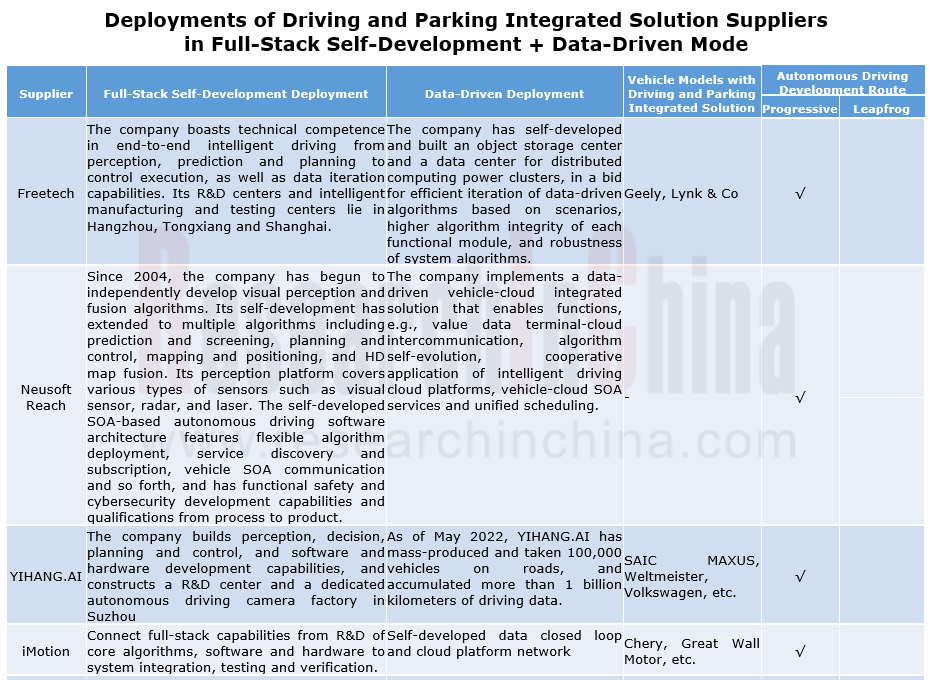

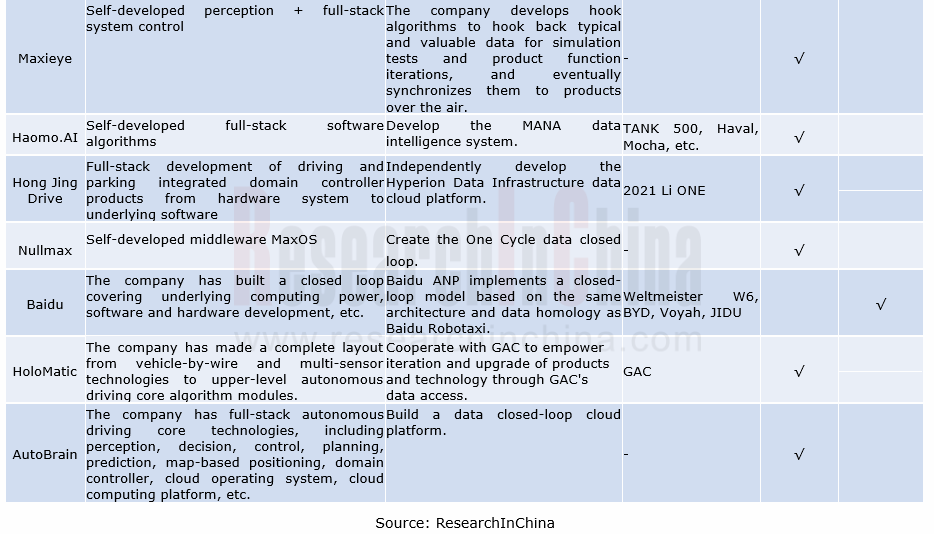

The full-stack self-development + data-driven mode accelerates the implementation of driving and parking integrated solutions.

In the phase of mass production, for the software and hardware in an autonomous driving system are highly coupled, the full-stack self-development allows better analysis of technical problems in the R&D process and meets the customization needs of automakers. In addition, collecting an enormous amount of operational data of real scenarios facilitates iteration of autonomous driving data and technology and thus builds a closed value loop. As a result, driving and parking integrated solution providers race to apply the full-stack self-development + data-driven approach to accelerate the implementation of their solutions.

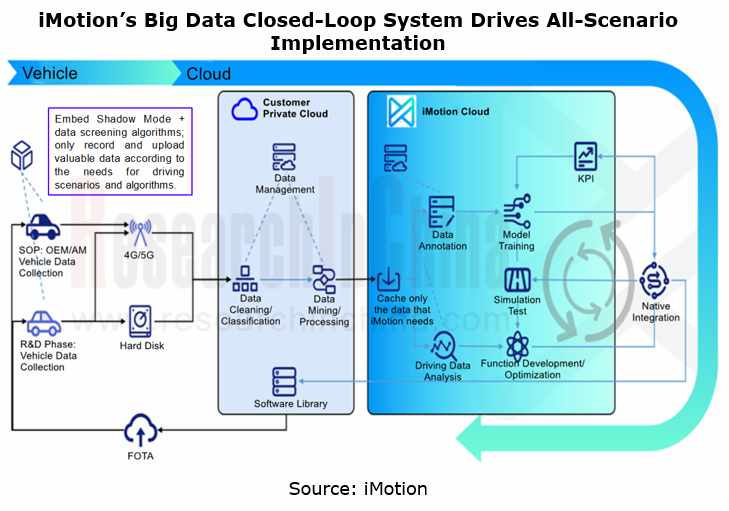

For example, iMotion’s IDC, a self-developed driving and parking integrated domain controller, can provide L2+ intelligent driving experience. As concerns hardware design, it complies with ISO 26262 ASIL-B(D) functional safety requirements and allows continuous iteration and upgrade of scalable platforms with great computing power. As for software architecture, it offers SOA-oriented software architecture, presets basic software, standard middleware and various development tools, and deploys layered software architecture for efficient decoupling of software and hardware.

A set of data closed-loop system released by iMotion can collect a mass of data and haul them back to the cloud platform, improve function algorithms, realize constant product iteration, and ensure the safety of NOA.

iMotion’s self-developed data closed-loop and cloud platform network adopt the native cloud architecture design approach which is scalable and enables interconnection with the national central cloud platform, so that the data of vehicles equipped with iMotion’s solutions can be traced and monitored.

The solution is scheduled to be delivered in the third quarter of 2022, and has been designated by Chery and Eezi Tech among others for their production vehicle models.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...