Car audio research: ranking of L2+ smart car audio suppliers by market share

The National Development and Reform Commission has upgraded the development of intelligent vehicles to a national strategy as early as 2018. Recently, intelligent vehicles have fit into several national policies as key development goals. Strong market demand and favorable policies have enabled mass production of smart cars equipped with L2 driving assistance functions.

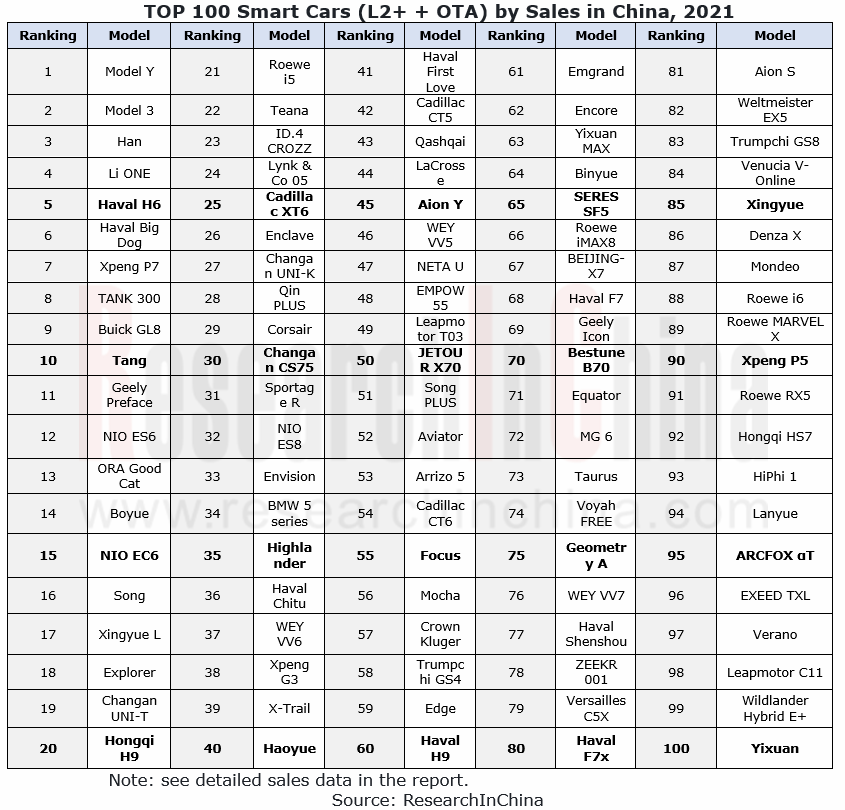

In China, L2/L2+ (OTA-enabled) smart cars embrace all mainstream models on offer, such as Tesla Model S/Y, BYD Han/Tang/Song, Li ONE, Xpeng P9 and NIO ES6/EC6. The audio configuration of these models not only leads the market in hardware but also in software. This report highlights audio system configurations and features of L2/L2+ (OTA-enabled) smart cars in China, and aims to analyze the intelligent development trends of car audio.

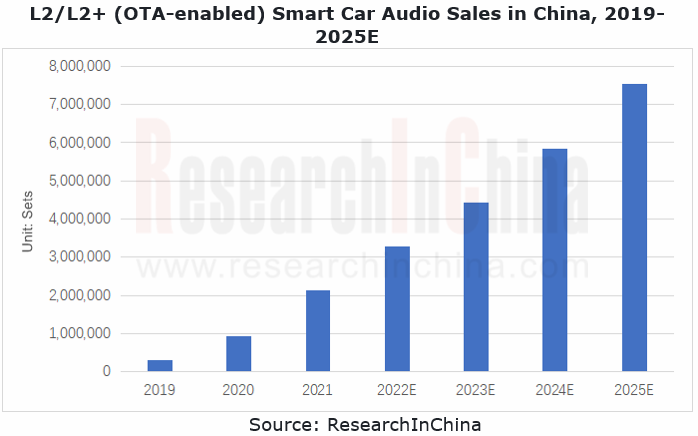

From 2019 to 2022, the rising sales of smart cars (L2+ with OTA) in China are accompanied by the growing smart car audio installations. In 2021, the smart car audio sales hit 2.13 million sets, soaring by 131% on the previous year, a figure projected to surge to 7.55 million in 2025.

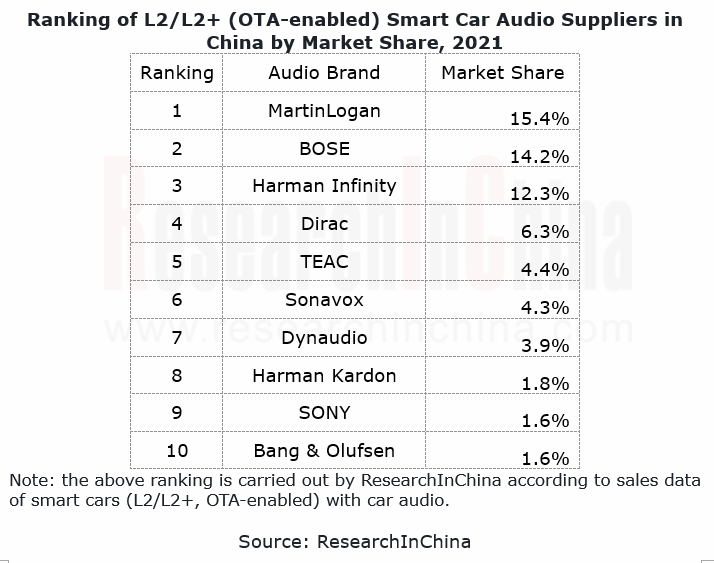

World-renowned audio brands take lion’s share in China's L2/L2+ (OTA-enabled) smart car audio market. From 2021 to April 2022, the top three players were MartinLogan, Bose and Infinity, with a combined market share of over 50%; among the top ten brands, there was only one Chinese brand, Suzhou Sonavox Electronics.

OEMs: the integration of software and hardware promote audio intelligence.

As intelligent connected vehicles become widespread, conventional car audio systems have fell short of consumers' needs for intelligent, high-quality, scenario-based, personalized driving and rising experience. The rise of smart cars, especially new energy vehicles, gives a boost to a number of established car audio companies. Their most advanced hardware and software technologies become available to smart cars, letting consumers enjoy high-quality car audio systems that were once reserved for conventional high-end models.

Tesla

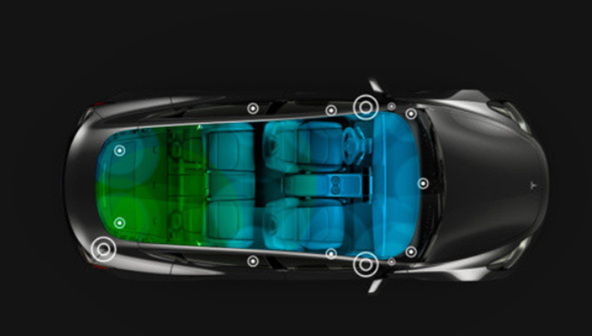

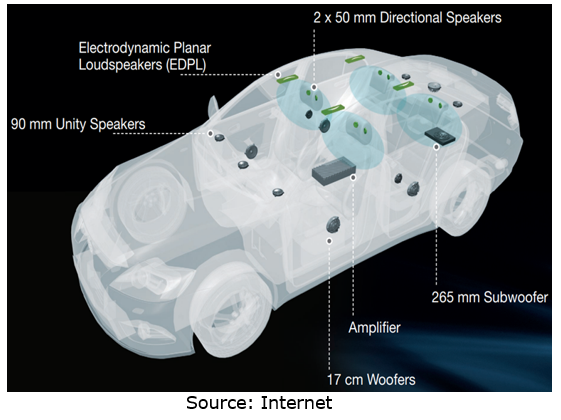

Tesla has partnered with MartinLogan, a giant American electrostatic speaker manufacturer. Model 3 packs MartinLogan's high-end audio systems, including 14 speakers and two amplifiers. In terms of hardware, Tesla Model 3 installs the 14 speakers in different positions inside to create surround sound effects. With its speaker patents and technology in zero distortion, MartinLogan further helps create studio-level dynamic sound effects for Model 3. As concerns software, Model 3 allows OTA updates on immersive sound and other sound effects via, and can also use the sound equalizer to adjust sound quality parameters according to user preferences.

Great Wall Motor

Great Wall Motor cooperates with Infinity, a subsidiary of Harman. TANK 300 is equipped with Harman Quantumlogic surround sound system, as well as 9 Infinity speakers and exterior independent power amplifiers, which ensures the best sound field in the car. As for software, Harman Quantumlogic can convert ordinary stereo or multi-channel sound sources into 7.1-channel surround sound effects, and also adopts the active noise-cancelling (ANC) technology to deliver cinema-level in-car sound quality and effects.

BYD

BYD Han EV is equipped with a new audio system tailored by Dynaudio. The whole car carries 12 Dynaudio speakers and independent amplifiers. With regard to hardware, 12 Dynaudio's own Magnesium Silicate Polymer diaphragm material (MSP) cones ensure full coverage of the sound field of the car. And the car also uses Dynaudio’s 75mm dual voice coil speaker, coupled with the 10-inch dual voice coil woofer speaker on the right rear side, can meet the needs of users who prefer bass. Dynaudio's soft dome tweeter that features a unique coating can reduce the nonlinear distortion of the speaker, and also help the speaker to dissipate heat, so that the system can work stably for a long time.

In terms of software, BYD Han EV provides 4 featured sound modes for users to choose. Users can freely optimize the sound field at the driver's seat, copilot seat or rear seats, enabling each occupant to enjoy the optimal sound field. Dynaudio's unique speed-dependent volume control (SDVC) technology, combining real-time vehicle speed and noise data, dynamically adjusts the frequency response of each speaker, ensuring minimal impact of noise on musical expression.

Hardware driver: build a car mobile concert hall.

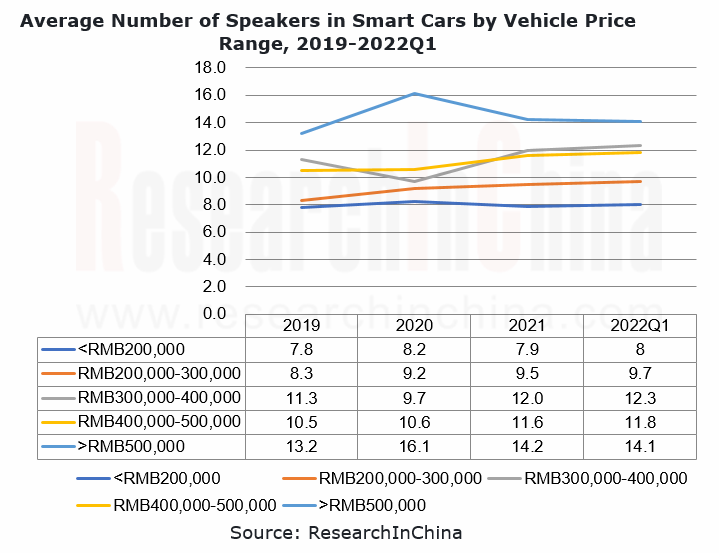

It is easier for users to feel the hardware upgrade of car audio system from the number of speakers installed. In the case of fuel-powered cars, the popular model Toyota Corolla bears 4 to 6 speakers; the high-end model Mercedes-Benz S-Class packs 15 speakers and offers an optional configuration of 31 speakers (the optional price is RMB76,700). Smart cars generally carry 8 to 12 speakers, and some models (e.g., Tesla Model X and NIO ET7/ET5) are fitted with more than 20 speakers.

The more speakers, the better sound effects in cars. Yet the number of speakers is not the only factor, and quality plays a bigger part.

With vanishingly low inertial distortion, MartinLogan electrostatic diaphragm precisely tracks the input signal, engages the air, and flawlessly transmits the audio signal to human ear in a very small space.

Dynaudio’s Hexis built-in dome technology reproduces real sound in cars. Hexis is a small inner dome that sits inside the tweeter's diaphragm. The dimpled inner dome of Hexis eliminates unwanted standing waves. Hexis delivers greater control over resonances in the cavity behind the diaphragm than the felt ring, while smoothing out undesired reflections in the dome.

Software driver: tailor audio experience for different people.

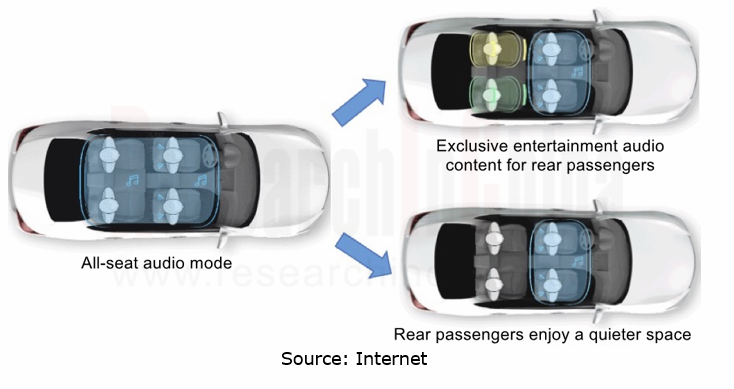

Harman Individual Sound Zones (ISZ) is an integrated audio entertainment solution that introduces virtual, simultaneous, in-car entertainment systems. Harman’s ISZ is intended to create individual listening zones for each passenger, enabling passengers to personalize their own audio experience without interference from other vehicle occupants.

Bose SeatCentric Call Placement technology is similar to Harman’s ISZ. Using headrest-mounted Ultra Nearfield speakers, the solution allows drivers to receive phone calls from whichever virtual location they prefer, improving privacy and intelligibility.

iFLYTEK's Feiyu intelligent audio management system uses AI technology as the underlying operation logic, and connects hardware systems, making itself a software and hardware integrated vehicle intelligent audio management system. This system enables independent sound field partition, active road noise reduction, in-vehicle AC compensation and other technologies, and also creates a high-quality sound field for each car combining virtual surround technology.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

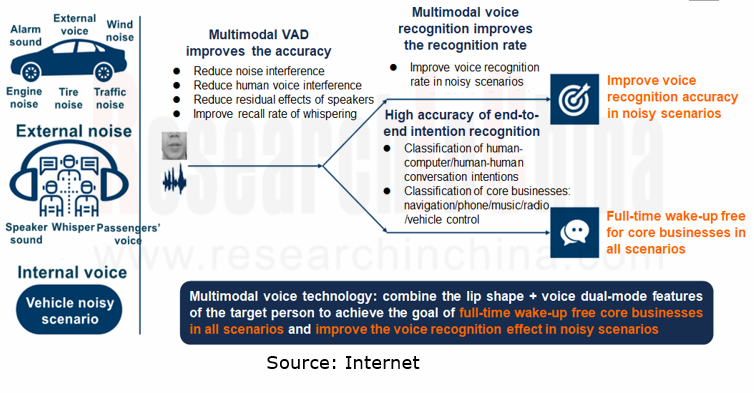

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...