Overseas ADAS Tier1 Suppliers Research: The gap between suppliers has widened in terms of revenue growth, and many of them plan to launch L4 products by 2025

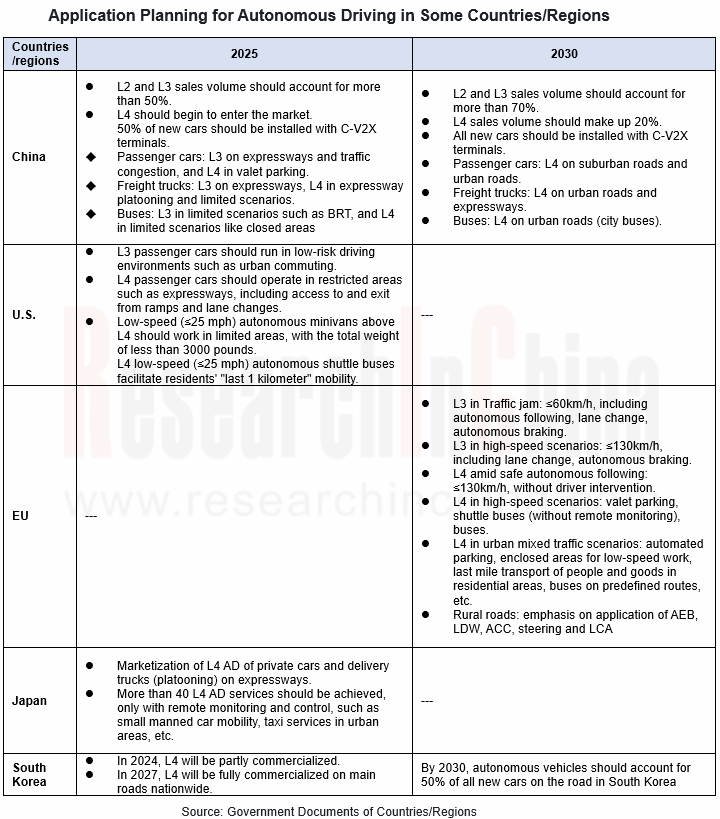

Countries allow L3/L4 vehicles on the road to a limited extent

Germany enacted Autonomous Driving Act in July 2021. Through its new legislation, Germany has become the first country in the world to allow L4 autonomous vehicles onto public roads without requiring a human backup safety driver behind the wheel. Application scenarios include: shuttle buses, short-distance public transport in urban areas, logistics between distribution centers, demand-oriented off-peak passenger transport in rural areas, first/last mile passenger or cargo transport, automated parking of dual-mode vehicles.

Japan's government planned to amend traffic laws to allow L4 autonomous vehicles to drive on some roads and ask lawmakers to approve the change as early as March 2022. Under the revised law, a license system will be introduced for operators of transport services using autonomous vehicles with L4 autonomy. Operators will be required to assign a chief monitor who can supervise the operation by riding a car or through remote control and can command multiple vehicles simultaneously. Japan aims to achieve L4 by 2025, which would allow private cars and delivery trucks (platooning) to operate on expressways, as market-oriented application.

In March 2022, the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) issued the "Occupant Protection Regulations for Automated Vehicles", stating that fully autonomous cars no longer need to be equipped with traditional manual control devices such as steering wheels, brakes or accelerator pedals. The United States plans to realize the market-oriented application of L3 passenger cars in low-risk driving environments such as urban commuting, and L4 passenger cars on expressways (like going on/off ramps, autonomous lane change) by 2025.

In July 2022, Shenzhen, China issued "Regulations on Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone", allowing L3 autonomous vehicles to be tested and demonstrated on open roads in administrative areas with relatively sound CVIS infrastructure.

The ADAS business of major Tier 1 suppliers maintains rapid growth and they vigorously deploy L3/L4 products

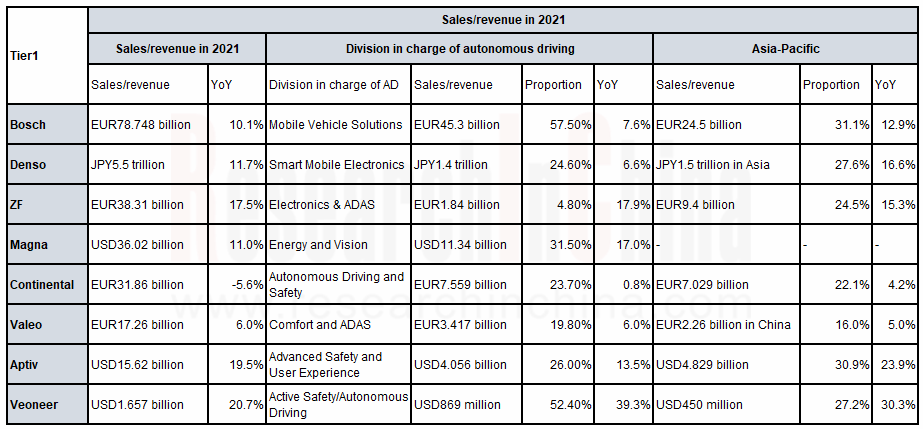

In 2021, a number of Tier 1 suppliers saw the sales related to autonomous driving swell by more than 10% year-on-year. For example, ZF’s Electronics & ADAS Division earned sales of EUR1.84 billion, a year-on-year increase of 17.9%; the sales of Magna's Power & Vision Division jumped 17.0% year-on-year to USD11.34 billion; Veoneer secured sales of USD869 million from active safety, a year-on-year spike of 39.3%.

Source: financial reports of above companies

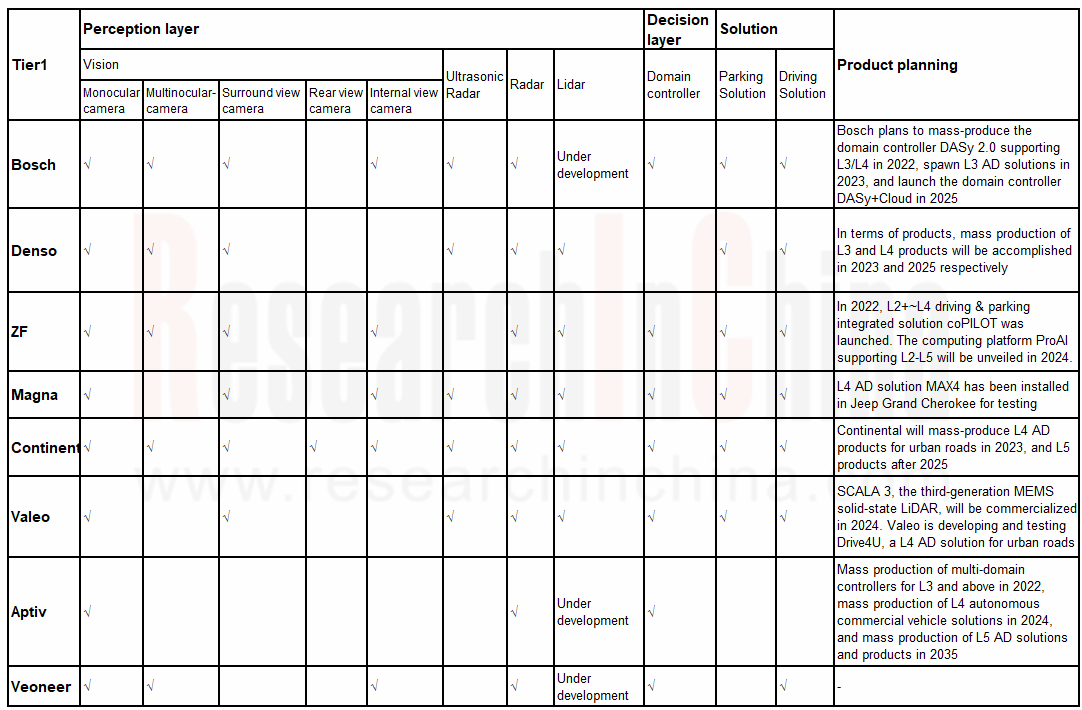

Bosch plans to mass-produce the domain controller DASy 2.0 supporting L3/L4 in 2022, spawn L3 driving solutions in 2023, and launch the domain controller DASy+Cloud in 2025.

Denso aims to achieve sales of JPY500 billion in ADAS field in 2025. In terms of products, mass production of L3 and L4 products will be accomplished in 2023 and 2025 respectively.

In 2021, Continental recorded EUR 7.559 billion in the revenue of its autonomous driving and safety business, accounting for 23.7% and edging up 0.8% year-on-year which was lower than that of its competitors. Continental will mass-produce L4 autonomous driving products for urban roads in 2023, and L5 products after 2025.

In 2021, Valeo Comfort & Driving Assistance Systems Business Group garnered EUR3.417 billion in revenue with a year-on-year spike of 6%, of which autonomous driving contributed EUR1.9 billion or 56%. The ADAS sales will reach EUR4 billion in 2025, with CAGR of 20.5%. Valeo says SCALA 3, the third-generation MEMS solid-state LiDAR released by Valeo in November 2021, which will be commercialized in 2024, offers 12 times better resolution, three times longer range and a viewing angle that is 2.5 times wider than the second-generation. SCALA 3 supports L3 autonomous driving below 130km/h.

Source: ResearchInChina

1 Global Traffic Regulations and Development Planning for Autonomous Driving

1.1 Global Traffic Regulations on Autonomous Driving

1.1.1 UNECE Automated Lane Keeping System (ALKS) Regulation

1.1.2 Autonomous Driving Development Planning in Some Countries/Regions Worldwide

1.2 China’s Traffic Regulations on Autonomous Driving

1.2.1 China's Management Specifications for Road Tests and Demonstrative Application of Intelligent Connected Vehicles (Trial)

1.2.2 Access Conditions of Open Road Tests in China

1.2.3 China's Autonomous Driving Development Planning

1.2.4 China's Intelligent Connected Vehicle Technology Roadmap: Phased Development Goals and Milestones of Passenger Cars

1.3 EU’s Traffic Regulations on Autonomous Driving

1.3.1 Autonomous Driving Act in Germany

1.3.2 Autonomous Driving Development Planning of EU & Europe

1.3.3 EU’s Autonomous Driving Roadmap and Outlook in 2040

1.4 Traffic Regulations on Autonomous Driving and Planning of the U.S. by State

1.5 Japan’s Traffic Regulations on Autonomous Driving

1.5.1 Japan's Action Plan for Realizing and Popularizing Autonomous Driving 4.0 - Classification of Driving Environments for Autonomous Vehicles

1.5.2 Japan's Autonomous Driving Development Planning

1.5.3 Japan's "RoAD to the L4 Project" - Four Themes

1.6 South Korea’s Traffic Regulations on Autonomous Driving and Planning

1.7 Singapore’s Traffic Regulations on Autonomous Driving

2 Summary and Comparison of Overseas Major Autonomous Driving Tier 1 Suppliers

2.1 Overview of Overseas Major Autonomous Driving Tier 1 Suppliers

2.2 Sales/Revenue of Overseas Major Autonomous Driving Tier 1 Suppliers, 2021

2.3 Products and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.4 Lidar and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.5 Domain Controllers and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

2.6 Solutions and Customers of Overseas Major Autonomous Driving Tier 1 Suppliers

3 Overseas Major Autonomous Driving Tier 1 Suppliers

3.1 Continental

3.1.1 Profile

3.1.2 Revenue

3.1.3 Management Structure

3.1.4 Autonomous Driving Product Layout

3.1.5 Autonomous Driving Product Lineup

3.1.6 Autonomous Driving Product - Camera

3.1.7 Autonomous Driving Product - Driver Monitoring

3.1.8 Autonomous Driving Product - Cockpit Monitoring

3.1.9 Autonomous Driving Product - Radar

3.1.10 Autonomous Driving Product - LiDAR

3.1.11 Autonomous Driving Product - Domain Controller

3.1.12 Autonomous Driving Product - Ultrasonic Radar

3.1.13 Autonomous Driving Product - Automated Parking Solution

3.1.14 Autonomous Driving Product - Autonomous Driving Solution

3.1.15 Autonomous Driving Product - Autonomous Driving Solution for Passenger Transport

3.1.16 Autonomous Driving Product - 5G& V2X

3.1.17 Autonomous Driving Planning

3.1.18 Autonomous Driving Partners

3.1.19 Market Layout of Main Autonomous Driving Products

3.1.20 Summary

3.2 Bosch

3.2.1 Profile

3.2.2 Sales

3.2.3 Distribution of Human Resources

3.2.4 Presence in China

3.2.5 Intelligent Driving and Control Division

3.2.6 Main Business

3.2.7 Autonomous Driving Product Layout

3.2.8 Autonomous Driving Product Lineup

3.2.9 Autonomous Driving Product - Third-generation Front View Camera

3.2.10 Autonomous Driving Product - Surround View Camera

3.2.11 Autonomous Driving Product - In-vehicle Monitoring System

3.2.12 Autonomous Driving Product - Radar

3.2.13 Autonomous Driving Product - LiDAR Layout

3.2.14 Autonomous Driving Product - Domain Controller

3.2.15 Autonomous Driving Product - Sixth-generation Ultrasonic Radar

3.2.16 Autonomous Driving Product - Automated Parking Solution

3.2.17 Autonomous Driving Product - Autonomous Driving Solution

3.2.18 Autonomous Driving Product - Middleware

3.2.19 Autonomous Driving Product - Redundant Positioning Solution

3.2.20 Autonomous Driving Partners

3.3 Magna

3.3.1 Profile

3.3.2 ADAS Lineup

3.3.3 Autonomous Driving Product - Camera

3.3.4 Autonomous Driving Product - Driver Monitoring & Lidar

3.3.5 Autonomous Driving Product - Radar

3.3.6 Autonomous Driving Product - Domain Controller

3.3.7 Autonomous Driving Product - Ultrasonic Radar

3.3.8 Autonomous Driving Product - Automated Parking Solution

3.3.9 Autonomous Driving Product - Autonomous Driving Solution

3.3.10 Autonomous Driving & Intelligent Connectivity Planning

3.3.11 Summary

3.4 ZF

3.4.1 Profile

3.4.2 Operation

3.4.3 Corporate Structure

3.4.4 Autonomous Driving Product Layout

3.4.5 Autonomous Driving Product Lineup

3.4.6 Autonomous Driving Product - Camera

3.4.7 Autonomous Driving Product - Driver Monitoring System

3.4.8 Autonomous Driving Product - Radar

3.4.9 Autonomous Driving Product - LiDAR & Sound Sensor

3.4.10 Autonomous Driving Product - Domain Controller

3.4.11 Autonomous Driving Product - Domain Controller and Middleware

3.4.12 Autonomous Driving Product - Autonomous Driving & Parking Solution

3.4.13 Autonomous Driving Product - Automated Valet Parking System

3.4.14 Development Trends & Layout

3.4.15 Summary

3.5 Valeo

3.5.1 Profile

3.5.2 Sales

3.5.3 Automotive Product Layout

3.5.4 R&D Bases in China

3.5.5 Autonomous Driving Product Layout

3.5.6 Autonomous Driving Product Lineup

3.5.7 Autonomous Driving Product - Front View Monocular Camera

3.5.8 Autonomous Driving Product - Surround View Camera

3.5.9 Autonomous Driving Product - Radar

3.5.10 Autonomous Driving Product - LiDAR

3.5.11 Autonomous Driving Product - Domain Controller

3.5.12 Autonomous Driving Product - Ultrasonic Radar

3.5.13 Autonomous Driving Product - Parking Solution

3.5.14 Autonomous Driving Product - Autonomous Driving Solution for Expressways

3.5.15 Autonomous Driving Product - eDeliver4U

3.5.16 Autonomous Driving Products - Move Predict.ai

3.5.17 Autonomous Driving Product - 360° Autonomous Emergency Braking System

3.5.18 Autonomous Driving Partners

3.5.19 Dynamics in Autonomous Driving

3.6 Denso

3.6.1 Profile

3.6.2 Operation

3.6.3 Major Customers

3.6.4 Smart Mobile Electronics Division

3.6.5 Autonomous Driving Capability and R&D Layout

3.6.6 Autonomous Driving Product Lineup

3.6.7 Autonomous Driving Product - Development History of Sensor

3.6.8 Autonomous Driving Product - Camera

3.6.9 Autonomous Driving Product - Radar

3.6.10 Autonomous Driving Product - LiDAR

3.6.11 Autonomous Driving Product - Ultrasonic Radar

3.6.12 Autonomous Driving Product - Automated Parking Solution

3.6.13 Autonomous Driving Product - Autonomous Driving Solution

3.6.14 Autonomous Driving Product - 5G V2X

3.6.15 Tests and Dynamics of Autonomous Driving

3.6.16 Development Roadmap of Autonomous Driving

3.7 Hyundai Mobis

3.7.1 Profile

3.7.2 Operation

3.7.3 Autonomous Driving Product Lineup

3.7.4 Autonomous Driving Product - Camera

3.7.5 Autonomous Driving Product - Driver Monitoring

3.7.6 Autonomous Driving Product - Radar

3.7.7 Autonomous Driving Product - LiDAR & Ultrasonic Radar

3.7.8 Autonomous Driving Product - Automated Valet Parking (AVP)

3.7.9 Autonomous Driving Product - Mobis Parking System (MPS) and Smart Cruise Control (SCC)

3.7.10 Autonomous Driving Product - Autonomous Concept Vehicle

3.7.11 Autonomous Driving Development Planning

3.7.12 Summary

3.8 Veoneer

3.8.1 Profile

3.8.2 Revenue

3.8.3 key Managers

3.8.4 Corporate Development Roadmap

3.8.5 Autonomous Driving Product Layout

3.8.6 Autonomous Driving Product Lineup

3.8.7 Autonomous Driving Product - Camera

3.8.8 Autonomous Driving Product - Driver Monitoring

3.8.9 Autonomous Driving Product - Radar

3.8.10 Autonomous Driving Product - LiDAR

3.8.11 Autonomous Driving Product - Domain Controller

3.8.12 Autonomous Driving Product - Positioning System

3.8.13 Autonomous Driving Product - V2X

3.8.14 Autonomous Driving Product - Autonomous Driving Solution

3.8.15 Development History and Planning of Autonomous Driving Solution

3.8.16 Key Partners

3.8.17 Release of ADAS Technology in 2021

3.8.18 ADAS Availability in 2021

3.8.19 Distribution of ADAS Customers in 2021

3.8.20 Summary

3.9 Aptiv

3.9.1 Profile

3.9.2 Sales by Region

3.9.3 Global Presence

3.9.4 Autonomous Driving Product Layout

3.9.5 Autonomous Driving Product Lineup

3.9.6 Autonomous Driving Product - Front View Camera

3.9.7 Autonomous Driving Product - Radar

3.9.8 Autonomous Driving Product - Radar and Monocular Camera Integrated System

3.9.9 Autonomous Driving Product - LiDAR Investment and Layout

3.9.10 Autonomous Driving Product - Domain Controller

3.9.11 Autonomous Driving Product - Satellite-based Sensing and Computing System

3.9.12 Autonomous Driving Product - ADAS Platform

3.9.13 Autonomous Driving Partners

3.9.14 Dynamics in the Field of Autonomous Driving

3.10 Visteon

3.10 Profile

3.10.1 ADAS Lineup

3.10.2 Autonomous Driving Product - Driver Monitoring

3.10.3 Autonomous Driving Product - Domain Controller

3.10.4 Summary

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...