Smart car OTA research: With the arrival of OTA3.0 era, how can OEMs explore payment modes of SAAS?

Driven by the development of smart cars, China's OTA installation rate has been growing. According to ResearchInChina’s data, from January to May 2022, 3.12 million passenger cars in China were equipped with OTA; the installation rate hit 44.6%, a year-on-year increase of 16.2 percentage points. By 2026, the OTA installation rate of Chinese passenger cars is expected to reach 88%, that is, 21.937 million passenger cars will boast OTA.

OTA updates are mainly reflected in infotainment, and will gradually spread to ADAS, body & control, and power.

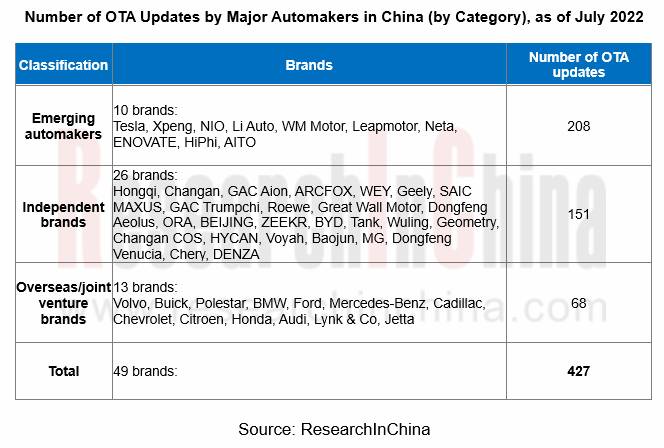

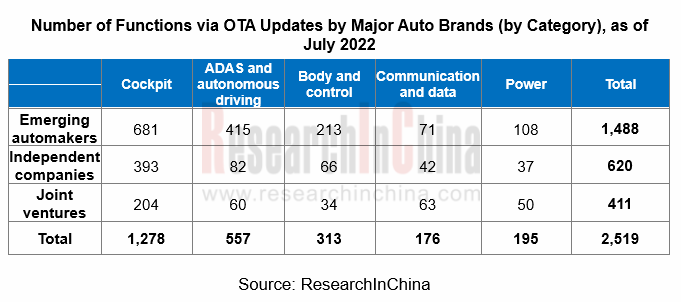

As of July 15, 2022, 49 auto brands (including brands of emerging automakers, independent companies, and joint ventures) had accomplished about 427 OTA updates. Among them, 10 emerging brands had implemented a total of 208 OTA updates, 26 independent brands had completed 151 OTA updates, and 12 joint venture brands had fulfilled 68 OTA updates.

Regardless of emerging automakers, independent companies, or joint ventures, their OTA updates concentrate on cockpits (covering application entertainment, information display, etc.), reaching 1,278 updates; another 557 updates are about ADAS and autonomous driving.

In the era of OTA 3.0, OEMs explore SAAS (Software as a Service)

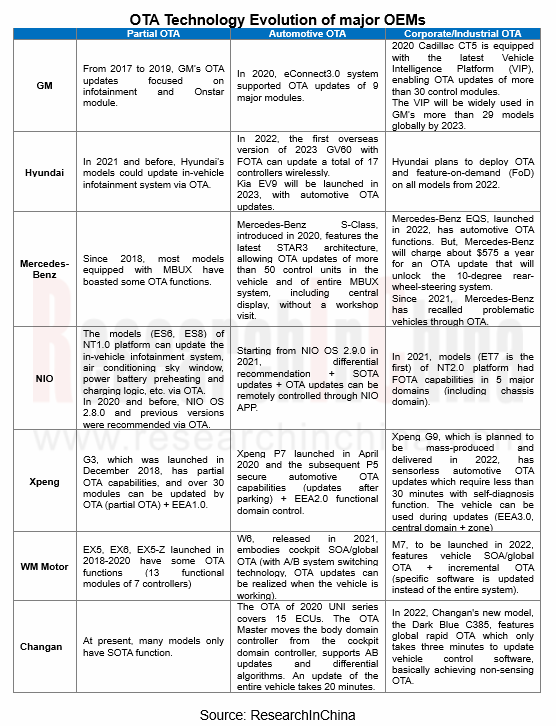

ABUP believes that automotive OTA industry should go through four development stages: component-level OTA, vehicle-level OTA, enterprise-level OTA, and industrial-level OTA. OTA has evolved from the 1.0 era (non-critical safety function updates) and the 2.0 era (automotive OTA) to the current 3.0 era (SAAS).

In the era of OTA 3.0, OTA functional services of OEMs are propelled by demand instead of R&D. OEMs guide users to purchase software OTA services. In the future, SAAS will become an important income source for major OEMs.

With deep involvement of automotive OTA, the business models of automakers are changing. The model of hardware "costization" + software "profit" continues to penetrate in the smart car market. Many automakers have pre-embed hardware in new models, and subsequently open functions through OTA software updates, so as to obtain commercial profits.

In the past two years, both emerging automakers and conventional car companies have been stepping up their exploration of SAAS model. In addition to offering paid OTA for new functions and services, many automakers have announced plans to launch "subscription on demand" services.

In addition to selling cars, Tesla makes money by selling software and services. Its software revenue comes from FSD (Full Self-Driving), OTA updates, and advanced Internet of Vehicles. The price of Tesla's FSD has been rising, hitting as high as $12,000. In addition, Tesla has introduced the Acceleration Boost upgrade for $2,000 that improved the 0-60 mph acceleration of Model 3 Dual Motor (Long Range) from 4.4 seconds to 3.9 seconds.

Hyundai announced to offer OTA and feature-on-demand (FoD) on all models from 2021. Users can not only update software and systems remotely, but also selectively purchase software systems.

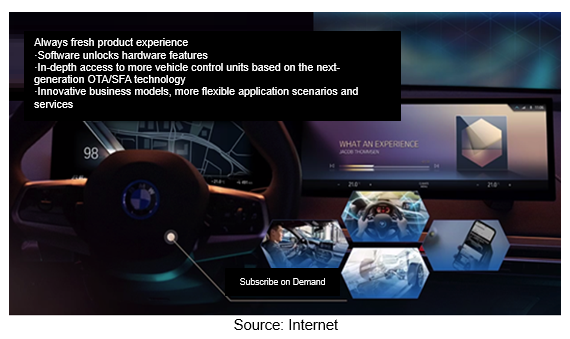

In July 2021, BMW announced about its Functions on Demand system, in which customers can choose to pay monthly subscriptions for certain options. It unlocks the hardware modules pre-installed on the vehicle through software, remotely provides customers with new products and services, and helps customers enjoy the latest products in an innovative way.

In July 2022, BMW launched a number of subscription-based services for drivers in South Korea, including heated seats, a heated steering wheel, high-beam-assist headlights, simulated sound waves, wireless Apple CarPlay and other functions. Heated seats, for example, run for about RMB120 per month. per month or RMB1,180 per year.

At the same time, there have been some changes in the profit models of assisted driving systems of some OEMs. In the past, users had to pay for optional advance assisted driving systems which now tend to be included in the standard configuration, whereas the software cost is included in the car price for the purpose of suppressing the continuous price spike of battery-electric vehicles since 2022 and raising the activation rate of advanced assisted driving systems to collect real road data; in addition, the standard configuration of assisted driving systems improves the cost performance and value preservation rate of vehicles.

On May 6, 2022, Xpeng suddenly made major changes to users' rights and interests. It installed the intelligent assisted driving system software as standard, and canceled the lifetime free charging and free home charging piles. According to the data released by Xpeng in October 2021, the activation rate of XPILOT 3.0 with high-speed NPG is 59.29%, and it will continue to rise thanks to the standard configuration of assisted driving software;

In 2022, Tesla offers free Enhanced Autopilot as standard in China for a limited time, while it still charges FSD as an option;

Li Auto has always adhered to the standard autonomous driving system. The newly launched Li L9 is equipped with the Li AD Max full-stack intelligent driving system and hardware solution as standard;

NIO has altered its business strategy for ET7. It comes standard with LCC and ALC which are ready to use, so that users need not pay additional fees or buy the NIO Pilot Selected Package.

SAAS is paid separately or charged include the car price, and it has become a business strategy that major OEMs should consider and explore.

OTA supervision is becoming strict and standardized

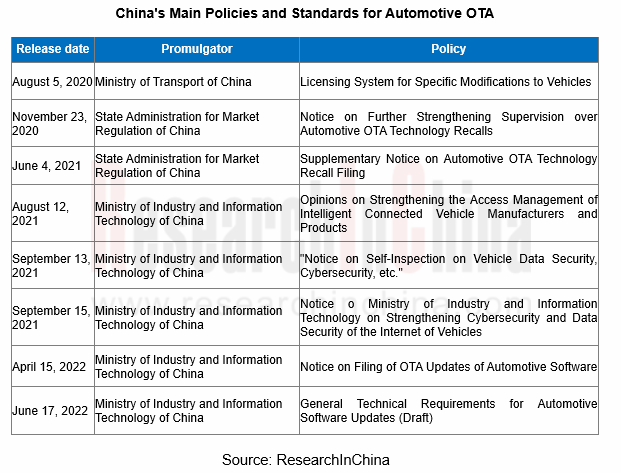

With the rapid growth of automotive OTA technology, China has issued a number of policies and standards about OTA updates in the past two years, clarifying requirements for ICV software updates.

On April 15, 2022, the Ministry of Industry and Information Technology Equipment Industry Development Center issued "Notice on Filing of OTA Updates of Automotive Software", which stipulates that automakers licensed to produce road motor vehicles should file for their vehicles equipped with OTA updates and every OTA update implemented. Authorities have attached great importance to OTA recalls, and have improved relevant procedures and specifications. A strict and effective regulatory mechanism will regulate the software updates of automakers. It will have a positive impact on the development of the entire industry while protecting the rights and interests of consumers.

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...

Prospective Study on L3 Intelligent Driving Technology of OEMs and Tier 1 Suppliers, 2025

L3 Research: The Window of Opportunity Has Arrived - Eight Trends in L3 Layout of OEMs and Tier 1 Suppliers

Through in-depth research on 15 OEMs (including 8 Chinese and 7 foreign OEMs) and 9 Tier 1 ...

China Commercial Vehicle IoV and Intelligent Cockpit Industry Research Report 2025

Commercial Vehicle IoV and Cockpit Research: The Third Wave of Passenger Car/Commercial Vehicle Technology Integration Arrives, and T-Box Integrates e-Call and 15.6-inch for Vehicles

I. The third wav...

Intelligent Vehicle Electronic and Electrical Architecture (EEA) and Technology Supply Chain Construction Strategy Research Report, 2025

E/E Architecture Research: 24 OEMs Deploy Innovative Products from Platform Architectures to Technical Selling Points

According to statistics from ResearchInChina, 802,000 passenger cars with domain...

Research Report on Intelligent Vehicle Cross-Domain Integration Strategies and Innovative Function Scenarios, 2025

Cross-Domain Integration Strategy Research: Automakers' Competition Extends to Cross-Domain Innovative Function Scenarios such as Cockpit-Driving, Powertrain, and Chassis

Cross-domain integration of ...

China Autonomous Driving Data Closed Loop Research Report, 2025

Data Closed-Loop Research: Synthetic Data Accounts for Over 50%, Full-process Automated Toolchain Gradually Implemented

Key Points:From 2023 to 2025, the proportion of synthetic data increased from 2...

Automotive Glass and Smart Glass Research Report, 2025

Automotive Glass Report: Dimmable Glass Offers Active Mode, Penetration Rate Expected to Reach 10% by 2030

ResearchInChina releases the Automotive Glass and Smart Glass Research Report, 2025. This r...

Passenger Car Brake-by-Wire (BBW) Research Report, 2025

Brake-by-Wire: EHB to Be Installed in 12 Million Vehicles in 2025

1. EHB Have Been Installed in over 10 Million Vehicles, A Figure to Hit 12 Million in 2025.

In 2024, the brake-by-wire, Electro-Hydr...

Autonomous Driving Domain Controller and Central Computing Unit (CCU) Industry Report, 2025

Research on Autonomous Driving Domain Controllers: Monthly Penetration Rate Exceeded 30% for the First Time, and 700T+ Ultrahigh-compute Domain Controller Products Are Rapidly Installed in Vehicles

L...

China Automotive Lighting and Ambient Lighting System Research Report, 2025

Automotive Lighting System Research: In 2025H1, Autonomous Driving System (ADS) Marker Lamps Saw an 11-Fold Year-on-Year Growth and the Installation Rate of Automotive LED Lighting Approached 90...

Ecological Domain and Automotive Hardware Expansion Research Report, 2025

ResearchInChina has released the Ecological Domain and Automotive Hardware Expansion Research Report, 2025, which delves into the application of various automotive extended hardware, supplier ecologic...

Automotive Seating Innovation Technology Trend Research Report, 2025

Automotive Seating Research: With Popularization of Comfort Functions, How to Properly "Stack Functions" for Seating?

This report studies the status quo of seating technologies and functions in aspe...

Research Report on Chinese Suppliers’ Overseas Layout of Intelligent Driving, 2025

Research on Overseas Layout of Intelligent Driving: There Are Multiple Challenges in Overseas Layout, and Light-Asset Cooperation with Foreign Suppliers Emerges as the Optimal Solution at Present

20...