LiDAR research: Chinese passenger cars will carry over 80,000 LiDAR sensors in 2022

1. The mass production of LiDAR is accelerating, and the installations are expected to exceed 80,000 units in 2022

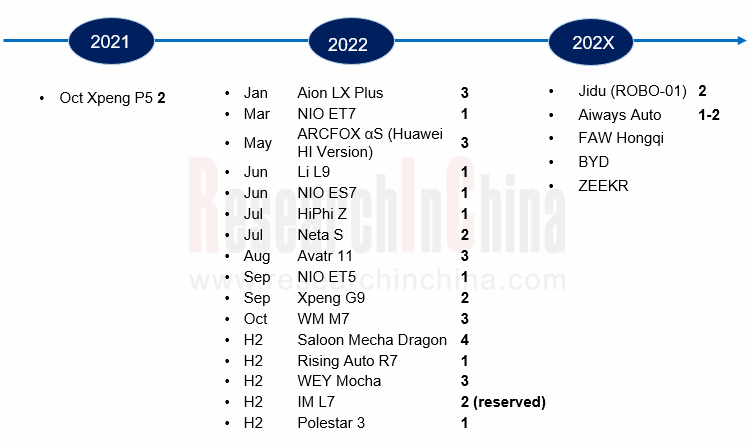

Since 2021, LiDAR industry has entered the stage of commercialization. Local OEMs have taken the lead in mass-producing a number of models, including Xpeng P5, Aion LX PLUS, NIO ET7, and Li L9.

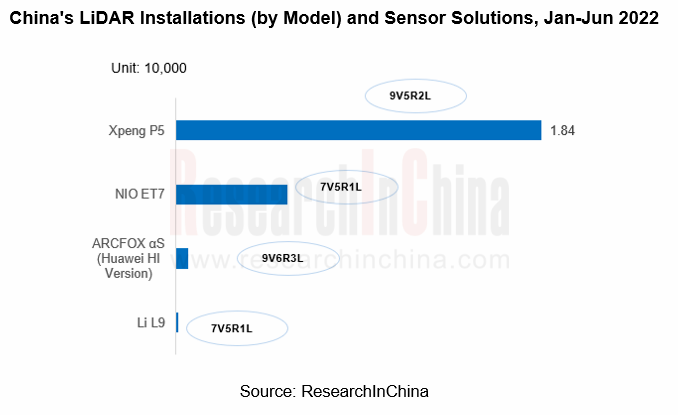

According to the statistics from ResearchInChina, Chinese new passenger cars were equipped with 24,700 LiDAR sensors in the first half of 2022, of which 18,400 units or 74.4% was seen in Xpeng P5.

In the second half of 2022, there will be more than 10 new models featuring LiDAR to be delivered in China, including Xpeng G9 and WM M7, which will spur LiDAR installations to exceed 80,000 units in the full year.

2. The "rotating mirror + MEMS" technical solution is the first choice for mass production

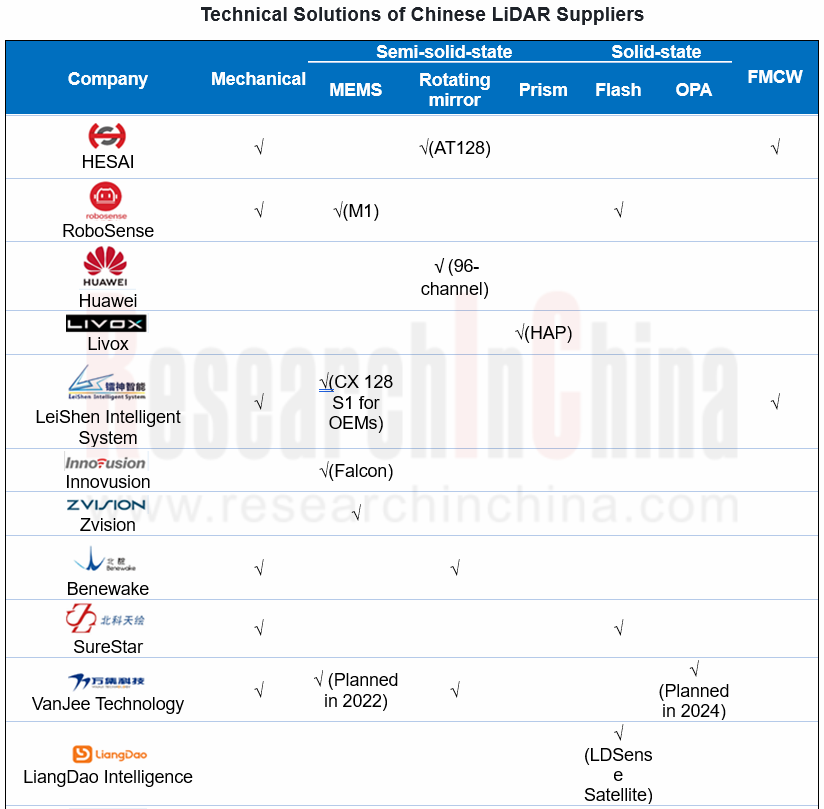

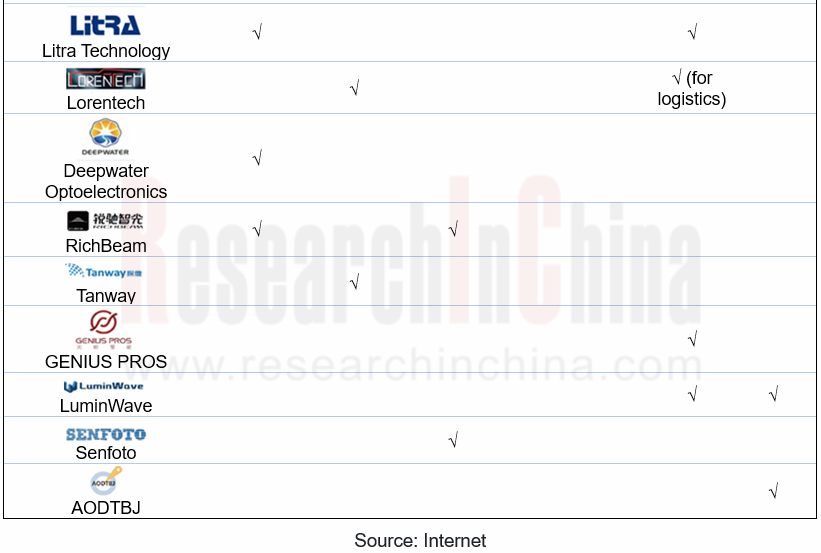

At present, production models mainly adopt "rotating mirror + MEMS" technical solution, such as HESAI AT128, RoboSense M1, Huawei 96-channel LiDAR, Innovusion Falcon, etc...

RoboSense launched it semi-solid-state LiDAR - M1 in June 2021. Based on 2D MEMS smart chip scanning technology, it has “GAZE” function with intelligent zoom and detection distance of 150m for 10% reflectivity targets. So far, it has been designated by 40+ models. In 2022, it served GAC Aion LX Plus, IM L7, WM M7, Xpeng G9, Lotus, etc.

Huawei's 96-channel hybrid solid-state LiDAR adopts a rotating mirror solution, with a field of view of 120?x25? and a maximum detection distance of 150 meters. It has been mass-produced for ARCFOX αS (Huawei HI version), Neta S, and Avatr 11, and will be applied to other models such as Saloon Mecha Dragon which will boast 4 units located at the front, rear, and both sides of the front.

In the short term, the "rotating mirror + MEMS" solution is still the mainstream for local LiDAR installations on vehicles. In the long run, solid-state solutions (flash, OPA) and FMCW LiDAR will be play main roles.

Especially, the flash solution has achieved a breakthrough. In May 2022, LiangDao Intelligence released its first self-developed flash lateral LiDAR - LD Satellite for Chinese market, with a chip-based design and a vertical field of view of 75°-90°. It will be mass-produced in the second half of 2023. In the future, LiangDao Intelligence will combine LD Satellite with its experience in perception development and verification testing to provide LiDAR software and hardware integrated solutions for Chinese market.

A number of enterprises have deployed OPA technology, such as VanJee Technology, Litra Technology, GENIUS PROS, LuminWave, etc. Among them, VanJee Technology plans to release silicon-based OPA LiDAR with a range of 30 meters in August 2022, and automotive silicon-based OPA LiDAR in June 2024.

In addition, Chinese companies such as LeiShen Intelligent System and HESAI are developing FMCW technology. In July 2022, Aeva announced that the first Aeries? II 4D LiDAR had been produced and shipped to customers as the world's first FMCW LiDAR delivered. This will inspire breakthroughs in FMCW technology in China.

3. Mass production and delivery capabilities should be improved comprehensively

Thanks to the definite LiDAR technology route, many Chinese suppliers have improved capacity swiftly through foundries, cooperation and self-built factories.

The "Maxwell" intelligent manufacturing center invested by HESAI with nearly US$200 million is expected to be fully put into operation in 2022, with an annual capacity of more than one million units. Innovusion cooperates with Joyson Electronics. The first automotive-grade LiDAR production line has an annual output of 100,000 units. The second production line located in Xiangcheng District, Suzhou is expected to be put into operation in 2022, with a monthly capacity of 20,000 units.

In addition to large-scale production, suppliers are reducing LiDAR cost and accelerating mass production and applications through hardware integration and chipization. For instance, HESAI AT128 is a long-range semi-solid-state LiDAR based on a VCSEL array (the second-generation chip is provided by Lumentum). The VCSEL array embedded in the chip replaces the traditional discrete light source to significantly slash the manufacturing cost of LiDAR.

The solid-state LiDAR of LiangDao Intelligence leverages the flash technology upgrade solution - VCSEL electric drive scanning and SPAD partition receiving technology to dramatically amplify the detection distance of flash LiDAR. Plus the design of optical lens, it offers a wide field of view.

In general, Chinese LiDAR suppliers mainly focus on cost reduction in laser transceiver module (about 60% of cost). For a long time, the technology of electronic components such as lasers and detectors has been monopolized by foreign companies. However, in recent years, some Chinese enterprises have gradually broken through technical barriers, launched automotive-grade products, and secure orders from automakers.

Vertilite’s VCSEL has been certified by AEC-Q102 and IATF 16949, and won the bid for a major LiDAR customer's OEM mass production project. In March 2022, the company received investment from Huawei, Xiaomi, BYD, DJI, etc.; in August, HESAI and RoboSense became its shareholders.

Fortsense began to develop LiDAR SPAD chips in 2019, successfully taped out in 2021, and received a custom order from a leading automaker in early 2022.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...