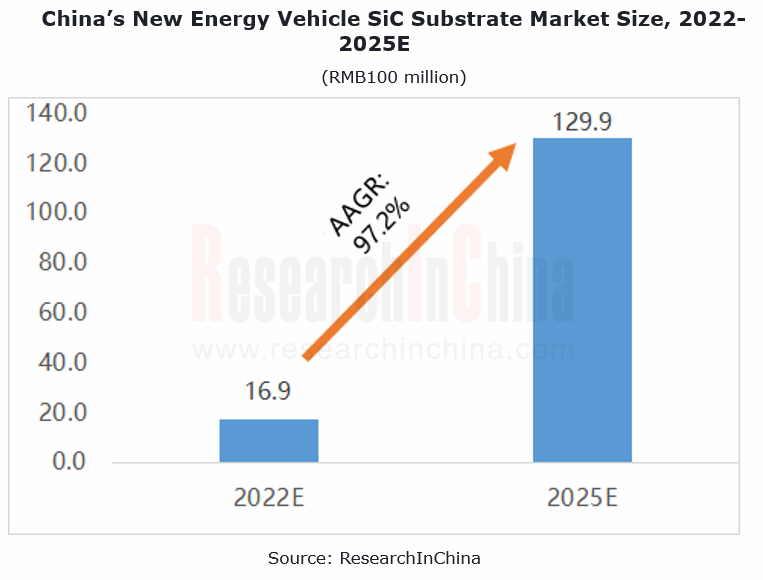

1. In 2025, China's automotive SiC market will be valued at RMB12.99 billion, sustaining AAGRs of 97.2%.

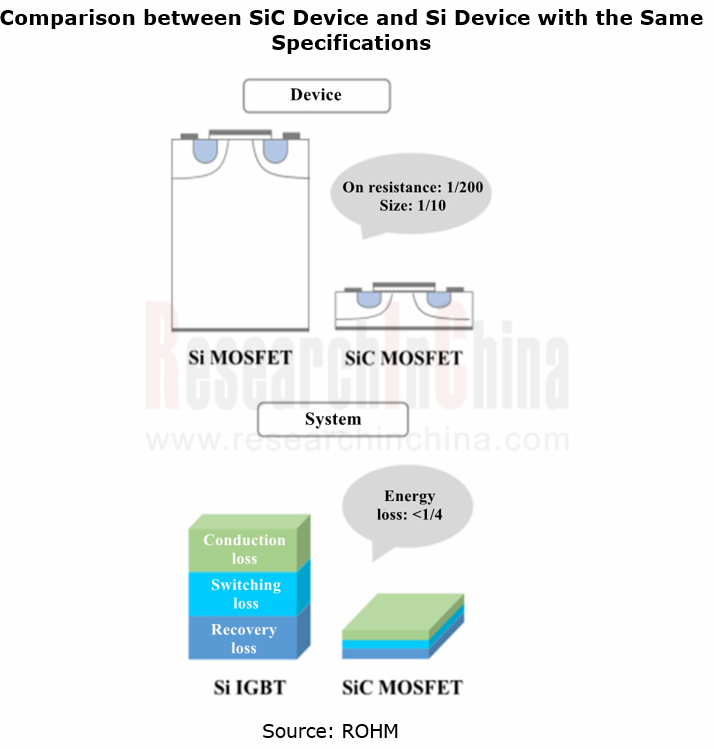

Silicon carbide (SiC) devices that feature the resistance to high voltage and high frequency are seen more and more in new energy vehicles. At present, SiC devices are often used in main drive inverters, OBCs (on-board chargers), DC-DC vehicle power converters and high-power DCDC charging equipment. With compact dimensions, SiC devices can reduce much power loss for new energy vehicles and thus make them still work normally at a high temperature of 200°C. The miniature and lightweight SiC devices can also lessen the energy consumption caused by the weight of a vehicle itself.

On one estimate, China demands around RMB1.69 billion worth of automotive SiC substrates in 2022. Thanks to the growing new energy vehicle market and wider adoption of SiC products, China's automotive SiC substrate market will be valued at RMB12.99 billion in 2025, showing AAGR of 97.2%. SiC substrates are replacing more automotive Si-based IGBTs. From the cost structure (substrate 46%, epitaxial wafer 23%, and module 20%) of SiC devices, it can be seen that China’s new energy vehicle SiC device market will be worth RMB28.24 billion in 2025.

2. 800V high-voltage platforms will favor increasing demand for silicon carbide.

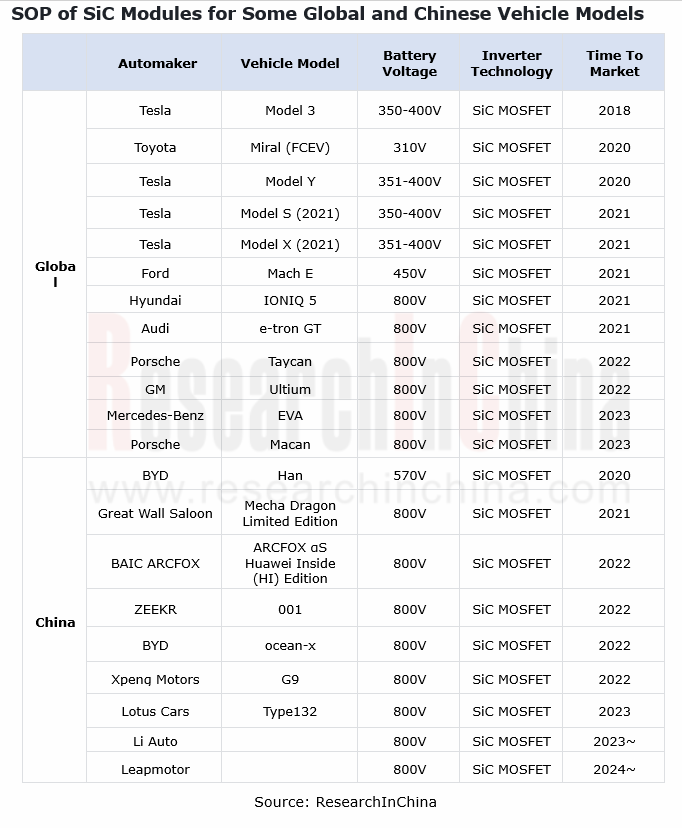

In 2018, Tesla first installed 24 SiC power modules (provided by STMicroelectronics) in the main inverter of Model 3, with supported voltage of 350-400V. The SiC power modules used in Model 3 can bring a 5-8% increase in the efficiency of the inverter compared with the IGBT modules in Model S, that is, the inverter efficiency gets improved from 82% to 90%, enabling a much longer cruising range. After Tesla Model 3 used SiC modules, other automakers including Toyota, BYD, NIO, GM, Volkswagen and Renault-Nissan-Mitsubishi have followed suit.

As OEMs head for 800V high-voltage platforms, silicon carbide becomes more in demand, and the pace of using it in vehicles quickens. From 2021 to 2022, foreign models such as Hyundai IONIQ5, Audi e-tron GT and Porsche Taycan, and Chinese models like Great Wall Saloon Mecha Dragon, BAIC ARCFOX αS Huawei Inside (HI) Edition and ZEEKR 001 have been the first ones to pack 800V high-voltage platforms. 800V and SiC become the best partners.

More new energy vehicles based on 800V architectures will be production-ready beyond 2023. To answer the needs for high current and high voltage, the main drive inverter of motor controllers will be bound to replace Si-based IGBTs with SiC-MOS. According to Infineon's forecast, by 2025, over 20% of power devices for automotive electronics will use SiC technology.

3. Foreign suppliers are making layout of 6 to 8-inch substrates, and Chinese companies 4 to 6-inch.

SiC suppliers are the busiest players in the run-up to a boom in demand.

Foreign companies:

STMicroelectronics: since 2018, the demand from Tesla has facilitated a surge in orders for STMicroelectronics’ 650V SiC MOSFETs. In June 2022, the vendor invested USD244 million to build a new SiC production line in Morocco for exclusive supply to Tesla.

Bosch: from October 2021 to July 2022, Bosch invested a total of EUR800 million to expand its semiconductor capacity and SiC clean rooms, hoping to become the world's leading supplier of SiC chips for electric mobility.

ON Semiconductor: since 2021, ON Semiconductor has provided inverter SiC modules for a Mercedes-Benz EQ fleet. It will also provide SiC products for Mercedes-Benz VISION EQXX concept car (SOP in 2024). Based on its optimistic estimates of the market, ON Semiconductor established a new research center and a wafer fabrication plant in Bucheon, Gyeonggi-do, Japan in July 2022. The vendor predicts that its SiC products will contribute revenues of USD1 billion in 2023 and USD2.6 billion in 2024.

Chinese companies:

BYD Semiconductor: in June 2022, BYD Semiconductor introduced a 1200V 1040A SiC power module, delivering nearly 30% higher power without changing the original package dimensions. According to BYD’s plan, by 2023 all EVs under it will use SiC power semiconductors instead of Si-based IGBTs.

San’an Optoelectronics: in June 2021, its semiconductor base in Hunan became operational, providing silicon carbide used in on-board chargers for BYD. In addition, in February 2022, San’an Optoelectronics and Li Auto established a joint venture to research silicon carbide technologies and expand the silicon carbide market.

Synlight Semiconductor: on December 29, 2021, Synlight Semiconductor and Great Wall Motor signed a strategic investment agreement, under which Synlight Semiconductor will provide SiC products for Mecha Dragon models of Great Wall Motor. The subsequent range of models will largely use SiC products as well.

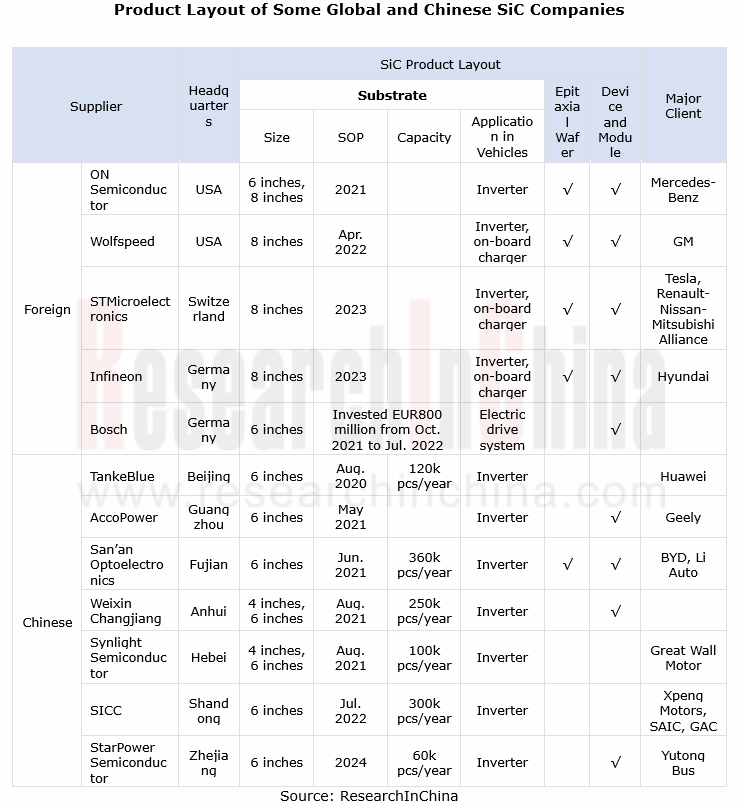

Through the lens of layout of suppliers, there are still big differences between Chinese companies and their foreign peers:

1. Foreign companies have achieved mass production of 6-inch substrates and are deploying 8-inch products; Chinese companies are in the 4 to 6-inch phase.

2. The foreign industry chain is more complete. For example, Wolfspeed, ON Semiconductor, STMicroelectronics and the like have built a vertical supply system of “SiC substrate-epitaxial wafer-device-module”, while Chinese players still stay at one link in the industry chain.

In the future, to meet market demand and gain more competitive edges, Chinese suppliers need to solve issues like industry chain expansion, R&D of automotive-grade SiC MOSFETs, batch manufacturing capacity, and yield improvement in addition to construction of production lines.

1 Overview and Development History of Automotive Semiconductor Power Devices

1.1 Overview of IGBT

1.1.1 Overview of Power Semiconductor

1.1.2 Definition of IGBT

1.1.3 Structure, Working Principle and Electrical Properties of IGBT

1.2 IGBT Chip Technology

1.2.1 IGBT Chip Iteration

1.2.2 Development Trends of IGBT Chip Technology

1.3 IGBT Module Technology

1.3.1 IGBT Module Packaging Process

1.3.2 Structure and Upgrade Trends of IGBT Module

1.4 Application of IGBT in New Energy Vehicles

1.4.1 Application Fields of IGBT

1.4.2 Application of IGBT in New Energy Vehicles

1.5 Overview of 3rd-generation Semiconductor Materials SiC and GaN

1.5.1 Overview of SiC and GaN

1.6 Application Scenarios of SiC and GaN

1.6.1 Application Scenarios of SiC and GaN

1.6.2 Application Trends of SiC in Automotive Field

1.7 Policies and Trends for 3rd-generation Semiconductor Materials

1.7.1 Policies for SiC and GaN

1.7.2 Power Semiconductor Development Trend 1: High Power, Low Thermal Energy, and Low Cost

1.7.3 Power Semiconductor Development Trend 2: SiC Is in the Early Stage of Boom

1.7.4 Power Semiconductor Development Trend 3: SiC MOSFETs Will Replace Si-Based IGBTs

2 Global and Chinese New Energy Vehicle IGBT Markets

2.1 IGBT Industry Chain

2.1.1 IGBT Industry Chain and Business Model

2.2 Global IGBT Market

2.2.1 Global IGBT Supply and Demand

2.2.2 Global IGBT Industry Chain Layout and Planning

2.2.3 Competitive Landscape of Global IGBT Market

2.2.4 IGBT Delivery Time and Prices of Global Mainstream Companies

2.3 Chinese IGBT Market

2.3.1 Chinese IGBT Supply and Demand

2.3.2 IGBT Industry Chain Layout and Trends in China

2.4 Chinese New Energy Vehicle IGBT Market

2.4.1 IGBT Value per New Energy Vehicle

2.4.2 China's New Energy Vehicle IGBT Market Size

2.4.3 Competitive Landscape of China's New Energy Vehicle IGBT Market

2.4.4 The Latest Developments of Chinese Automotive IGBT Companies

2.4.5 China's New Energy Vehicle IGBT Standards

2.5 Summary of IGBT Companies

3 Global and Chinese New Energy Vehicle SiC Markets

3.1 SiC Industry Chain

3.1.1 SiC Industry Chain

3.1.2 SiC Substrate

3.2 Global SiC Market

3.2.1 Global SiC Industrialization Pattern

3.2.2 Global New Energy Vehicle SiC Market Size

3.3 Chinese SiC Market

3.3.1 China’s New Energy Vehicle Market Size

3.3.2 China's New Energy Vehicle SiC Market Size

3.4 SiC Layout of Companies

3.4.1 SiC Layout of Suppliers

3.4.2 SiC Layout of Automakers

3.5 Summary of SiC Companies

3.5.1 Summary of Global SiC Companies

3.5.2 8-inch Wafer R&D of Global SiC Companies

3.5.3 3rd-generation Semiconductor Companies in China

4 Global Companies

4.1 Infineon

4.1.1 Profile

4.1.2 Operation in 2021

4.1.3 Business Layout

4.1.4 Product System of Automotive Electronics

4.1.5 History of IGBT Technology

4.1.6 IGBT Product System

4.1.7 Automotive IGBT Products

4.1.8 New Energy Vehicle IGBT Customers in China

4.1.9 CoolSiC? Products

4.1.10 Application and Customers of SiC Products

4.1.11 GaN Products

4.1.12 Main Products and Technology Planning in 2022

4.1.13 Customers in Automotive Fields

4.1.14 Industry Dynamics

4.2 Semikron

4.2.1 Profile

4.2.2 Power Semiconductor Products

4.2.3 IGBT Modules

4.2.4 7th-generation EV IGBT Module Products

4.2.5 The Latest EV IGBT Module Products

4.2.6 SiC Modules

4.3 Fuji Electric

4.3.1 Profile

4.3.2 Operation in 2021

4.3.3 Power Semiconductor Products and Application

4.3.4 History of IGBT Technology

4.3.5 7th-generation X Series IGBT Modules

4.3.6 Intelligent Power Modules (IPM)

4.3.7 History of RC-IGBT Technology

4.3.8 EV/HEV RC-IGBT Modules

4.3.9 SiC Modules

4.3.10 Industry Dynamics

4.4 Mitsubishi Electric

4.4.1 Profile

4.4.2 Operation in 2021

4.4.3 Global and China Layout

4.4.4 Power Semiconductor Products and Application

4.4.5 History of IGBT Technology

4.4.6 IGBT Modules

4.4.7 EV IGBT Modules

4.4.8 SiC Products and Application

4.4.9 Power Semiconductor Business Planning

4.5 ON Semiconductor

4.5.1 Profile

4.5.2 Operation in 2021

4.5.3 Power Module Products

4.5.4 IGBT Module Products

4.5.5 EV IGBT Modules

4.5.6 SiC Products

4.5.7 Automotive Electronics and Customers

4.5.8 Strategic Transformation

4.5.9 Industry Dynamics

4.6 Denso

4.6.1 Profile

4.6.2 Business System

4.6.3 Operation in 2021

4.6.4 SiC Products

4.6.5 Industry Dynamics

4.7 ROHM

4.7.1 Profile

4.7.2 Operation in 2021

4.7.3 Layout in China

4.7.4 Power Device Products and Application

4.7.5 History of IGBT Technology

4.7.6 New IGBT Products

4.7.7 History of SiC Technology

4.7.8 4th-generation SiC MOSFET Products

4.7.9 EV Power Products and Solutions

4.7.10 Industry Dynamics

4.8 Hitachi Power Semiconductor Device

4.8.1 Profile

4.8.2 Global Layout

4.8.3 Products and Application

4.8.4 Product Features

4.8.5 IGBT Chip Technology

4.8.6 IGBT Module Technology

4.8.7 IGBT Module Products

4.8.8 EV IGBT Products

4.8.9 SiC Product Families

4.8.10 Industry Dynamics

4.9 STMicroelectronics

4.9.1 Profile

4.9.2 Operation in 2021

4.9.3 Global Layout

4.9.4 IGBT Products

4.9.5 Automotive IGBT Modules

4.9.6 History of SiC Technology

4.9.7 SiC Products

4.9.8 EV SiC Products and Application by Tesla

4.9.9 EV Power Module Products and Solutions

4.9.10 Industry Dynamics

4.10 Renesas

4.10.1 Profile

4.10.2 Operation in 2021

4.10.3 Iteration of IGBT Products

4.10.4 8th-generation IGBT Products

4.10.5 Application of IGBT in Electric Vehicles

4.10.6 Products and Solutions in Automotive Fields

4.10.7 Electric Vehicle Strategy

4.10.8 Industry Dynamics

5 Chinese Companies

5.1 BYD Semiconductor

5.1.1 Profile

5.1.2 Development History

5.1.3 Products and Application

5.1.4 IGBT Products

5.1.5 New Energy Vehicle IGBT Products

5.1.6 SiC Module Products

5.1.7 New Energy Vehicle SiC Modules

5.1.8 Revenue and Net Income

5.1.9 Unit Price and Cost of Products

5.1.10 Capacity, Output and Sales

5.1.11 Top Five Customers

5.1.12 Procurements and Suppliers

5.1.13 Industry Dynamics

5.2 StarPower Semiconductor

5.2.1 Profile

5.2.2 Development History

5.2.3 IGBT Module Product System

5.2.4 Product Application

5.2.5 New Energy Vehicle IGBT Module Products

5.2.6 Revenue and Net Income

5.2.7 Capacity, Output and Sales of IGBT Modules

5.2.8 Major Customers

5.2.9 Procurement of IGBT Module Raw Materials

5.2.10 Independent R&D and Procurement of Chips

5.2.11 Industry Dynamics

5.3 CRRC Times Electric

5.3.1 Profile

5.3.2 Development History

5.3.3 Power Semiconductor Business

5.3.4 IGBT Products

5.3.5 SiC Products

5.3.6 Automotive IGBT and SiC Modules

5.3.7 Capacity and Customers of Automotive IGBT Modules

5.3.8 Industry Dynamics

5.4 MacMic

5.4.1 Profile

5.4.2 Development History

5.4.3 Products and Application

5.4.4 EV Power Module Solutions

5.4.5 Revenue and Net Income

5.4.6 Capacity, Output and Sales/Output Ratio

5.4.7 Independent R&D and Procurement of Chips

5.4.8 Customers

5.4.9 Industry Dynamics

5.5 CAS-IGBT Technology

5.5.1 Profile

5.5.2 Products and Application

5.5.3 IGBT Products

5.5.4 IGBT Modules and Automotive IGBT Modules

5.5.5 Partners

5.5.6 Industry Dynamics

5.6 Sino-Microelectronics

5.6.1 Profile

5.6.2 Development History

5.6.3 IGBT Technology Route

5.6.4 Main IGBT Products

5.6.5 Customers

5.6.6 Product Operation Plan

5.6.7 Industry Dynamics

5.7 Hua Hong Semiconductor

5.7.1 Profile

5.7.2 Process and Products

5.7.3 Development History of Power Devices

5.7.4 Power Devices and IGBT Products

5.7.5 Operation in 2021

5.7.6 Fabs and Capacity Layout

5.7.7 Capacity and Capacity Utilization

5.7.8 Industry Dynamics

5.8 Silan Microelectronics

5.8.1 Profile

5.8.2 Development History

5.8.3 Products and Application

5.8.4 IGBT Technology Route

5.8.5 New Energy Vehicle IGBT Modules

5.8.6 Operation in 2021

5.8.7 Output, Sales and Capacity

5.8.8 Industry Dynamics

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...