Automotive lighting research: the penetration of ambient lights has reached 31%, and intelligent lighting is reshaping the third living space.

Favorable policies and consumption upgrade help automakers reshape their vehicles, a third living space in which technology, intelligence, comfort and emotion are the main themes. Automotive intelligent lighting components such as intelligent headlights and ambient lights will better meet the personalized needs of consumers. Intelligent and emotional automotive lighting systems open up a new space for vehicle intelligence.

Automotive lighting intelligence is not only reflected in the upgrade of people-vehicle interaction enabled by headlights and taillights, but also in the rapider penetration of automotive ambient lights and the intelligence of interior lighting for delivering better driving experience. This report aims to analyze the development trends of automotive lighting intelligence in China through introducing the intelligence routes of major automotive lighting manufacturers and the features of intelligent lighting systems for key vehicle models of OEMs.

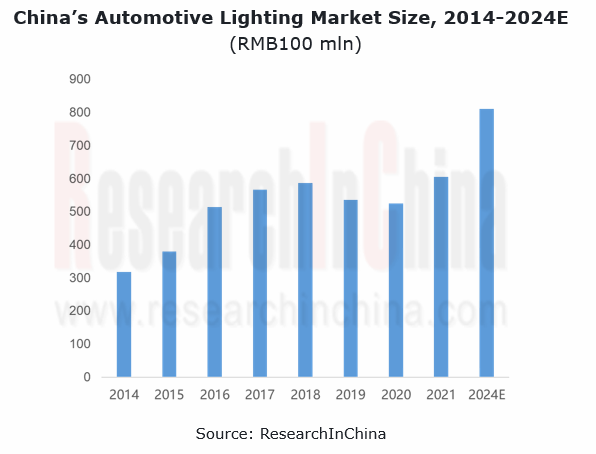

China’s automotive lighting market was worth RMB60.45 billion in 2021, jumping by 15.2% year on year. As the pace of automotive lighting intelligence accelerates and the value of intelligent lighting per vehicle rises, we predict that China’s automotive lighting market will be valued up to RMB80.9 billion in 2024.

Global market: Chinese lighting companies have a long way to go overseas

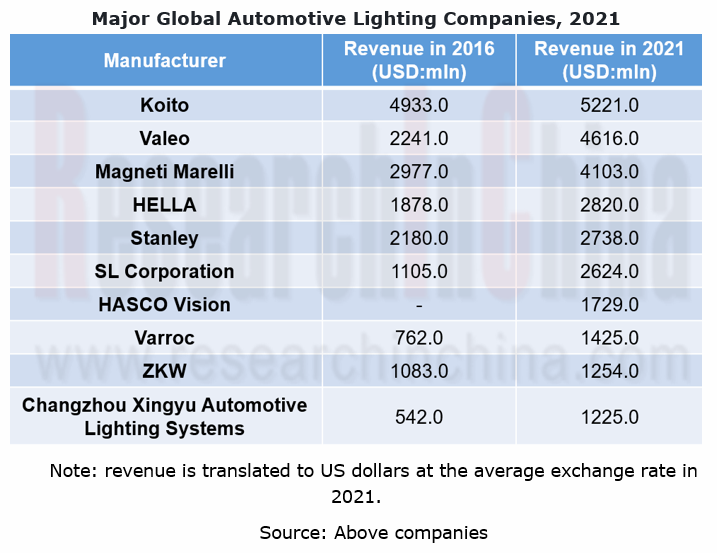

In the global auto parts industry, automotive lighting is a highly concentrated segment. Leading manufacturers in Europe, America and Japan dominate the market. In 2021, two Chinese companies, HASCO Vision (a holding subsidiary of SAIC Group) and Changzhou Xingyu Automotive Lighting Systems edged into the club of leading global automotive lighting manufacturers. HASCO Vision grew out of nothing from 2016 to 2021 (Shanghai Koito Automotive Lamp Co., Ltd., a joint venture established by Shanghai Automotive Lamp Factory under SAIC and Japan's Koito. HASCO bought the shares of the company held by Koito in 2018. The company was then renamed HASCO Vision as a holding subsidiary of SAIC Motor); Xingyu's revenue multiplied by 126% during the same period. Yet in 2021 more than 90% of the revenues of the two companies came from the Chinese market, and foreign markets otherwise contributed low revenues, indicating that Chinese lighting companies still have a long way to go abroad.

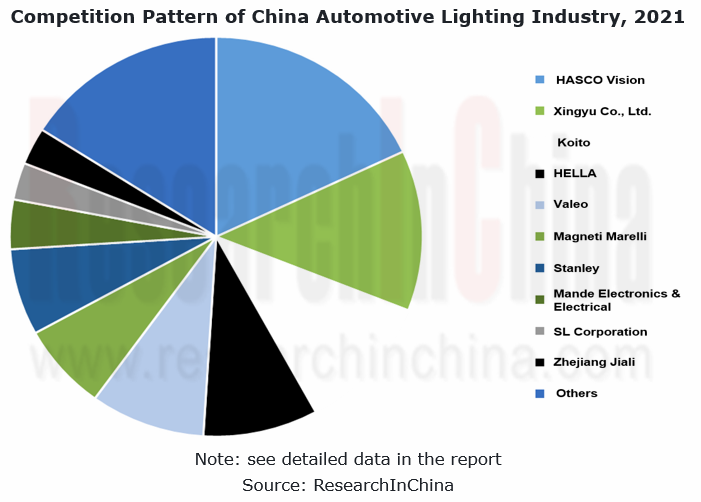

As with the global market, much of China’s automotive lighting market is still commanded by a few industry bellwethers, with the total market share of the top four players exceeding 50%. The difference is that in the Chinese market, HASCO Vision and Changzhou Xingyu Automotive Lighting Systems are respectively positioned first and second, and of the top ten manufacturers, four are Chinese companies, taking a combined share of about 38%.

Lighting manufacturers: automotive lighting evolves from static shaping to dynamic interaction.

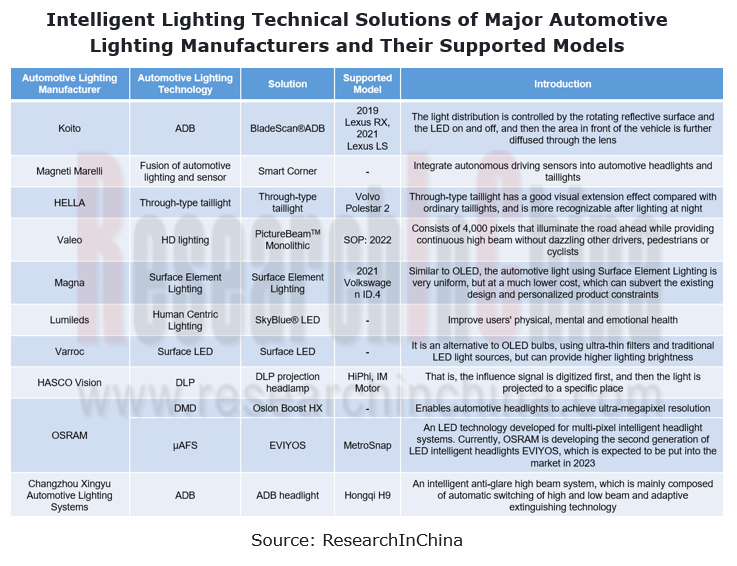

The rise of intelligent vehicles is a technological innovation booster to automotive lighting manufacturers. Multiple technology routes enable the evolution of automotive lighting from static shaping to dynamic interaction, allowing ordinary consumers to experience lighting systems that were once reserved for conventional high-end vehicle models.

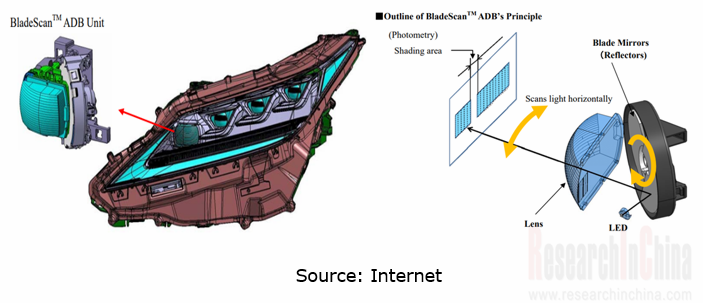

Koito BladeScan?ADB system

The system uses a pair of fast-revolving blade mirrors to change the shape and depth of the beam. Each headlight has 10 LEDs contained in the compact modules at the corners of the joints. The light from the system-controlled LEDs all pass through the mirror blades, the light is then continuously reflected out, and the light distribution is precisely controlled by synchronizing the rotation of the mirror blades and turning on/off the headlight LEDs. BladeScanTM ADB ensures high-resolution light distribution equivalent to the use of 300 LEDs and minimizes the shading area to maximize the lighting area.

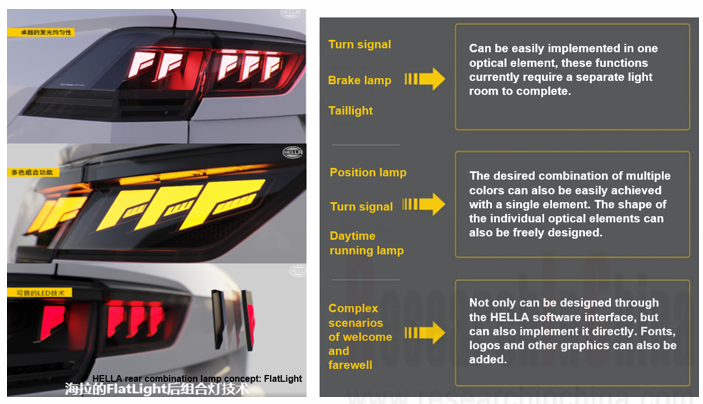

HELLA rear combination lamp concept: FlatLight

HELLA presented an innovative light guide concept based on micro-optics in early 2021. It enables particularly homogeneously illuminated surfaces with an extremely low module depth of only 5 millimeters. The technology will change the known functional characteristics of signal lights, and implement indicator, brake and tail light in just one optical element. The FlatLight concept requires about 80% less energy compared to conventional LED taillights.

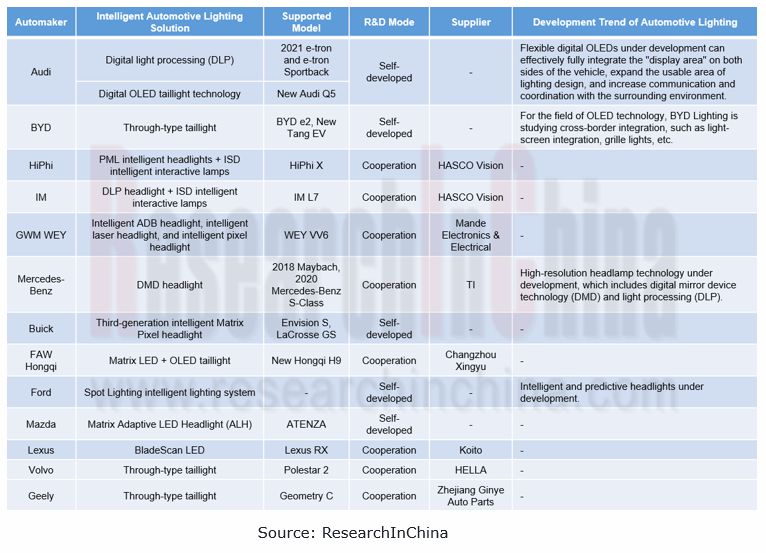

OEMs: the cooperation + self-development dual approach sets the trend for intelligence.

To meet consumers' needs for automotive lighting systems, OEMs enhance automotive lighting intelligence by way of working with lighting manufacturers and independently developing, a dual approach setting the trend for automotive lighting.

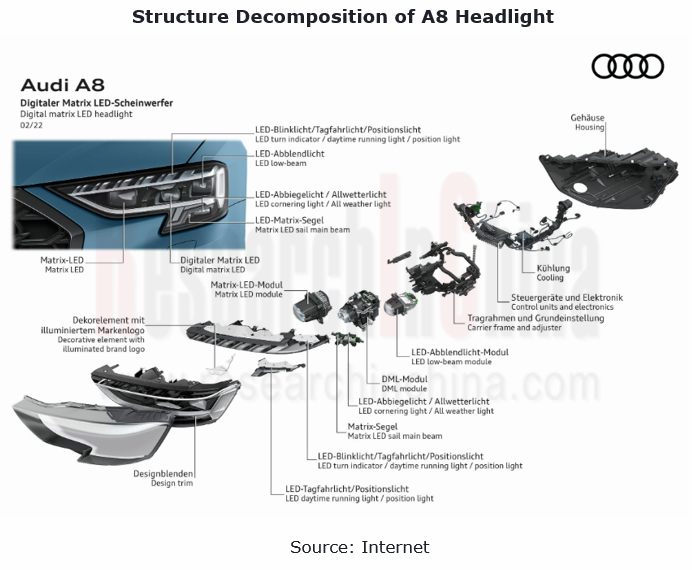

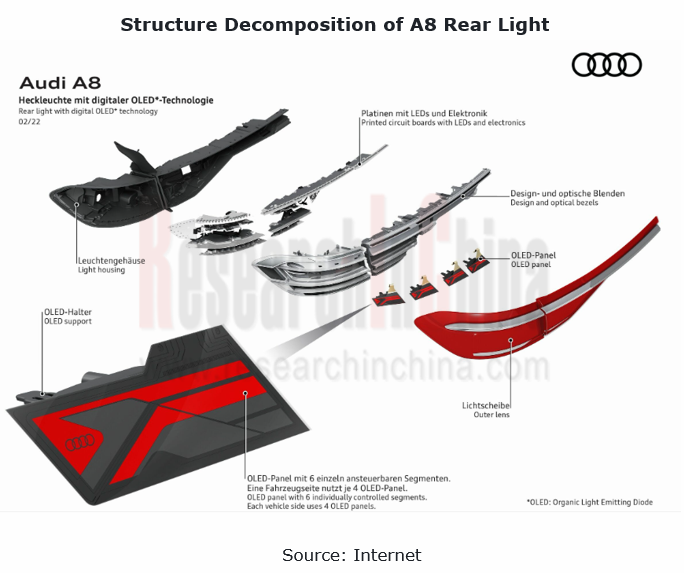

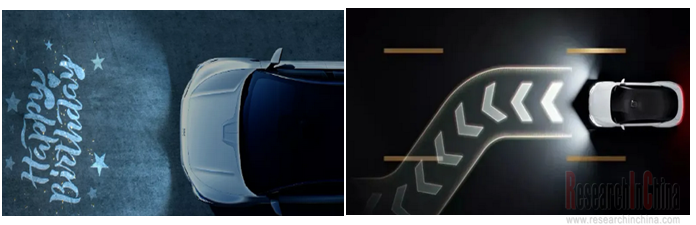

Digital Matrix Headlights for 2022 Audi A8

The new 2022 Audi A8 offers technical upgrades on the headlights. The digital matrix LED headlights use digital micro-mirror device (DMD) technology, similar to video projectors. Each headlight comprises some 1.3 million micromirrors that refract the rays into tiny pixels, thus ensuring high-precision light control. This headlight system also illuminates the driver’s lane in especially bright light, ensuring no departure from the lane. When unlocking and exiting the car, the digital Matrix LED headlights can cast projections onto floors or walls. This is known as the dynamic coming home/leaving home animations.

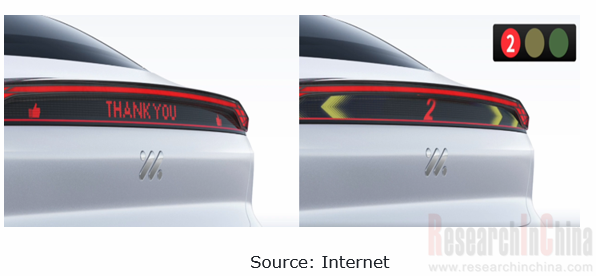

IM Motors’ intelligent lighting system

IM L7 carries HASCO Visio’s intelligent lighting system composed of second-generation 2.6MP DLP and 5,000 LED ISCs. The intelligent interactive signal light system consisting of 5,000 LEDs makes the car a large interactive screen, displaying user-defined information on the rear interactive screen.

The 2.6MP DLP headlights can project clear guidance signs onto the road in navigation mode, so that the driver can more intuitively know where the car goes. When driving at night, the light moves with the driver's line of sight, bringing a clearer view.

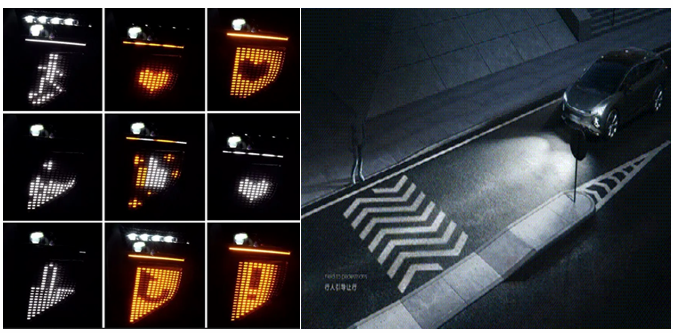

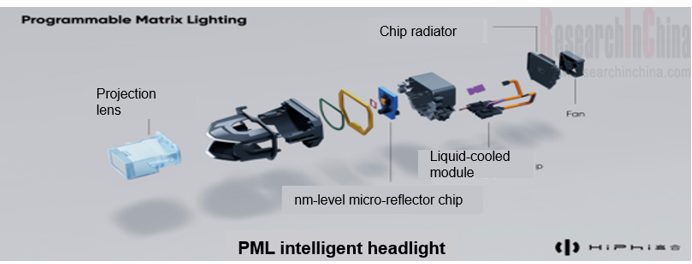

Intelligent interactive lighting system for HiPhi X

Developed by HASCO Vision, the system is comprised of PML intelligent headlights and ISD intelligent interactive combination lights. It can perceive the road environment and make decisions on its own, thus realizing all-scenario adaptive lighting and intelligent tracking and interaction with external people and vehicles. The ISD lights are deployed at the front fog lamps and the area below the taillights. The main body of the ISD intelligent interactive lights is four LED matrix panels with 1,712 LED light sources.

The PML headlight includes 2.6 million independently controllable nanoscale micro-reflectors that deliver stepless deflection every +/-12°. It also bears an infrared night vision camera, an independent customized ECU chip and an intelligent computing platform to ensure computing capacity and speed, judge road conditions, calculate distance, and output images. The PML intelligent headlight allows intelligent light pattern adjustment with speed and can automatically switch 4 driving lighting modes (standard low beam, urban high beam, standard high beam, and centralized high beam). In addition, it can also intelligently recognize driving scenarios and enable 6 intelligent lighting functions (vehicle tracking in obscuration, driving trajectory prediction, lane departure warning, blind-spot lane change warning, low-speed steering assistance, and active horizontal adjustment).

Ambient light: with a penetration up to 31%, it is a promising market.

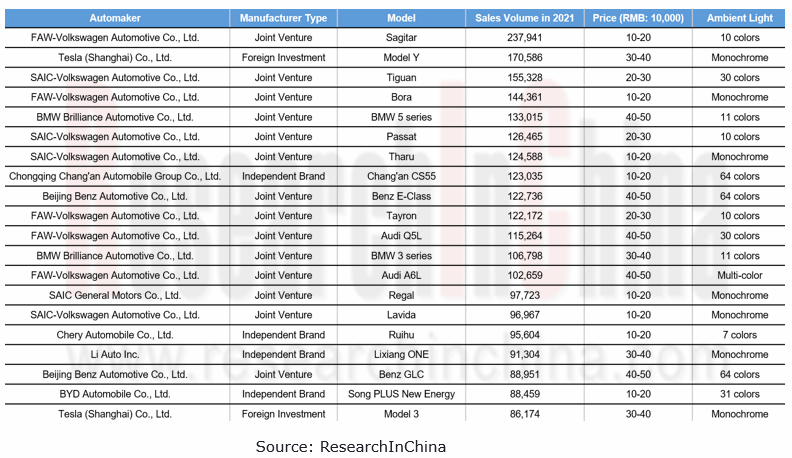

Before 2017, except luxury models of Mercedes-Benz, BMW and Audi which were directly pre-installed with ambient lights, other models packed this function in the aftermarket. Yet since the second half of 2017, OEMs have begun to equip their mid-end models with ambient lights. In 2021, the penetration of ambient lights hit 31%. From the models with ambient lights as a standard configuration in 2021, it can be seen that 36% of them carried monochrome ambient lights, and the 64-color, 7-color, and 11-color followed, accounting for 13%, 8%, and 6%, respectively.

As OEMs are committed to building cars into a third space other than home and workplace and make continuous efforts to improve the intelligence and comfort levels of cars, the penetration of ambient lights will go higher in the future.

Passenger Car Digital Chassis Research Report, 2026

Research on Digital Chassis: Leading OEMs Have Completed Configuration of Version 2.0 1. Leading OEMs Have Completed Configuration of Digital Chassis 2.0

By the degree of wired control of each c...

Vehicle Functional Safety and Safety Of The Intended Functionality (SOTIF) Research Report, 2026

Multiple Mandatory Standards for Intelligent Vehicles in China Upgrade Functional Safety Requirements from Recommended to Mandatory Access Criteria In 2026, China has intensively issued and promo...

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...