Smart parking research: there are 4,000 players, and city-level parking platforms have been established.

Smart parking market shows great potentials, and Baidu, Alibaba, Tencent and Huawei (BATH) have set foot in.

By the end of 2021, there have been nearly 4,000 companies engaged in smart parking business across China, bringing about a very low market concentration. Smart parking companies in the core circle are divided into three major camps: system integrators, intelligent hardware companies, and investors/operators. Some of them boast both system integration and investment/operation capabilities.

Attracted by enormous potential of smart parking market, technology firms including Baidu, Alibaba, Tencent and Huawei (BATH) have also entered the market.

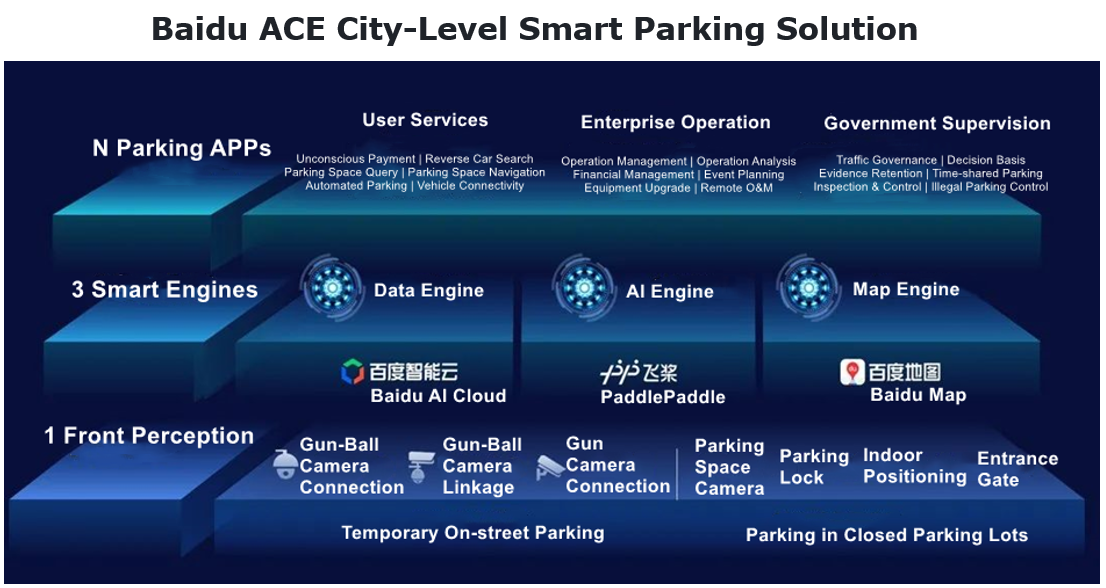

For example, Baidu previously launched Baidu Map Smart Parking Solution based on Baidu Map. In June 2021, Baidu bought a 100% stake in Beijing Lottop Technology, aiming to shore up its weak spots in static traffic smart parking and deploy city-level smart parking. In October 2021, Beijing Lottop Technology introduced "Baidu ACE City-level Smart Parking Solution". At present, Baidu has launched city-level smart parking projects in more than 30 areas.

City-level parking platform: one city, one network

The implementation of city-level parking platforms is led by local competent authorities. Within an administrative region (city/district/county), all or most parking resources are connected to a platform, providing the public with services including parking inquiry, navigation, reservation and payment and building an overall pattern of "one city, one network, one APP", through integrating static and dynamic data of parking lots. The investment in construction of a single city-level parking platform project ranges from one million to hundreds of millions of yuan. City-level smart parking is therefore the most promising smart parking segment. It is also the main development direction of smart parking in current stage.

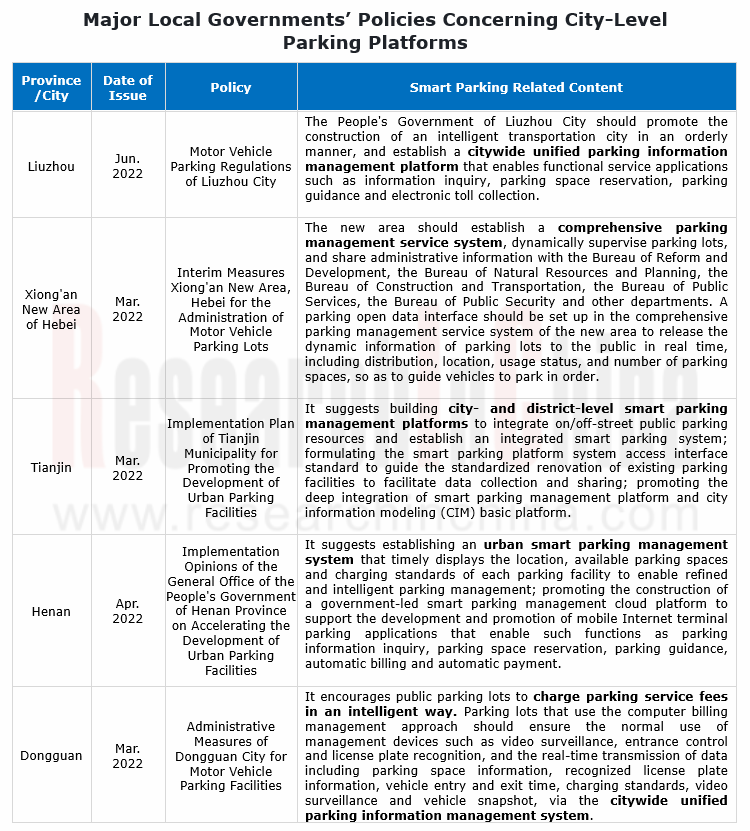

Policies and regulations favor the construction of city-level platforms: the people's governments of all cities are required to develop mobile terminal smart parking service applications that integrate service functions such as information inquiry, parking space reservation and electronic payment, and promote the deep integration of parking information management platform and city information modeling (CIM) basic platform, according to the Opinions on Promoting the Development of Urban Parking Facilities issued by the General Office of the State Council in May 2021. In addition, local governments including Liuzhou, Xiong’an New Area of Hebei, Tianjin, Henan and Dongguan have also released relevant policies requiring the building of city-level parking platforms.

Urban parking platforms mushroom in China: driven by relevant policies, about 300 cities across the country, typically Beijing, Shanghai, Kunming, Dongguan, Nanjing, Qingdao and Ningbo, have launched smart parking platforms.

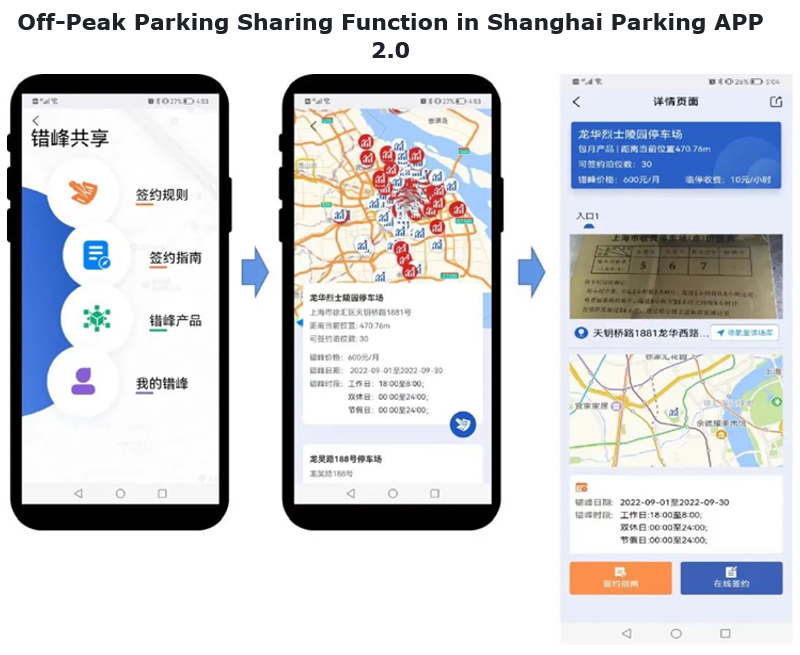

In Shanghai’s case, “Shanghai Parking”, a city-level smart parking platform launched in 2020, has covered a total of 890,000 public parking spaces in more than 4,300 public parking lots (garages) and toll road parking lots in the city. In August 2022, Shanghai Parking 2.0 was introduced. It supports over 2,800 public parking lots (garages) and all toll road parking lots, offers the unified electronic payment feature "parking payment", and allows 49 hospitals to provide online parking reservation service.

Shared parking is also a smart parking application field encouraged by China. The off-peak parking sharing function in Shanghai Parking APP 2.0 has been available to 212 parking lots (garages), providing one-click inquiry and order signing services for residents in surrounding communities, that is, residents can park their cars conveniently within the usage period after signing contract online.

Layout of automakers in smart parking: improve parking experience for car owners.

According to the survey data from Parkopedia, relatively speaking, 56.6% smart parking users tend to use vehicle navigation to receive parking information, so it is necessary to embed parking information in IVI systems.

At present, major automakers have embedded smart parking functions in their telematics systems by way of cooperating with parking data service providers or telematics service providers. Typical parking data service providers are Parkopedia and EZParking, of which Parkopedia makes a global layout and often cooperates with foreign automakers such as Mercedes-Benz and Audi; EZParking deploys the Chinese market and most of its partners are Chinese automakers.

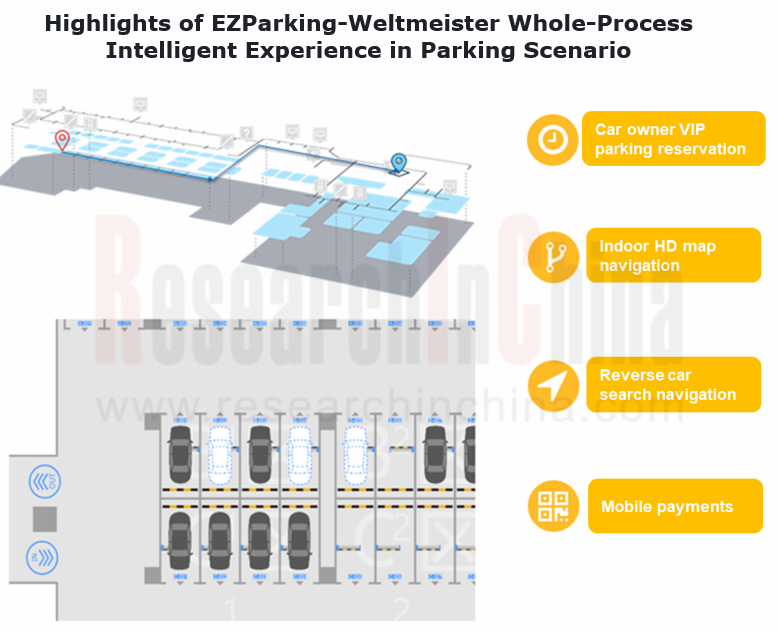

Weltmeister and EZParking joined hands in smart parking: in August 2022, the "Smart Parking" service jointly developed by Weltmeister and EZParking was launched on the WM iMOTOR APP, allowing Weltmeister owners to enjoy free inquiry services, for example, inquiring about the information of more than 10 million parking spaces (available/busy/full) of more than 70,000 parking lots (garages) in more than 100 cities.

Weltmeister will continue the iteration of its "Smart Parking" service. In the future, it will enable such functions as mobility route intelligent planning and navigation, indoor HD map navigation in parking garages, automatic parking and reverse car search, and unconscious payments when leaving parking lots.

Honda together with Parkopedia provides parking information and payment solutions for Chinese car owners: in October 2021, Honda, Parkopedia and MXNAVI together added the parking information and payment solution to the Honda CONNECT 3.0 entertainment system.

Honda owners can inquire about dynamic parking information via Honda CONNECT 3.0. The vehicle intelligent voice assistant can provide drivers with nearby parking suggestions when approaching the destination. Honda owners can also pay parking fees through the in-vehicle password-free parking payment service or the QR code displayed on the car screen.

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...