Autonomous heavy truck research: entering operation and pre-installed mass production stage, dimension reduction and cost decrease are the industry solution

ResearchInChina released "China Autonomous Heavy Truck Industry Report, 2022", which combs through and summarizes R&D testing, product implementation and commercial operation of autonomous heavy trucks of current domestic leading autonomous driving solution providers and heavy truck OEMs.

AD heavy truck solution providers successively enter the actual operation and pre-installed mass production stage

ResearchInChina also released a research report on autonomous heavy trucks in August 2021. At that time, most autonomous heavy truck-related companies were busy in pulling investment, looking for logistics and OEMs while promoting road testing and technology iterations. On the one hand, the solution needs huge funds to maintain technology R&D and expand scale of test vehicles; on the other hand, they also expect their own technology to be implemented in OEMs and logistics fleets, and to really run on the road through a scaled fleet. By August 2022, the solution providers and OEMs are more advanced in autonomous/ takeover-free testing and commercial operations, and the focus gradually shifts from R&D testing to actual operations and pre-installed mass production.

Autonomous/ takeover-free testing

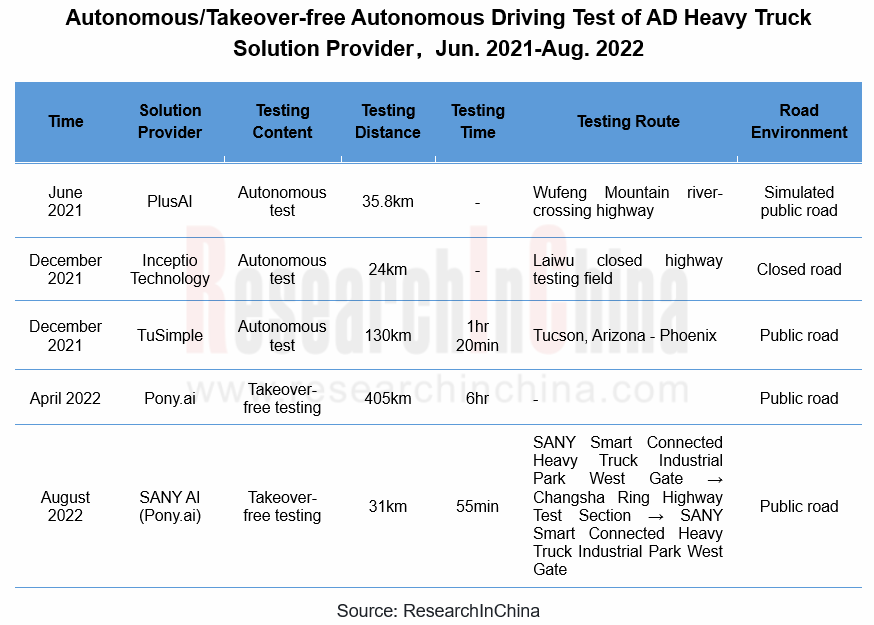

Starting in June 2021, the AD heavy truck solution providers gradually attempt to conduct autonomous or takeover-free public road testing for true real field autonomous/takeover-free technology validation. By August 2022, PlusAI, TuSimple, Pony.ai, etc. have all completed autonomous/takeover-free tests on public roads.

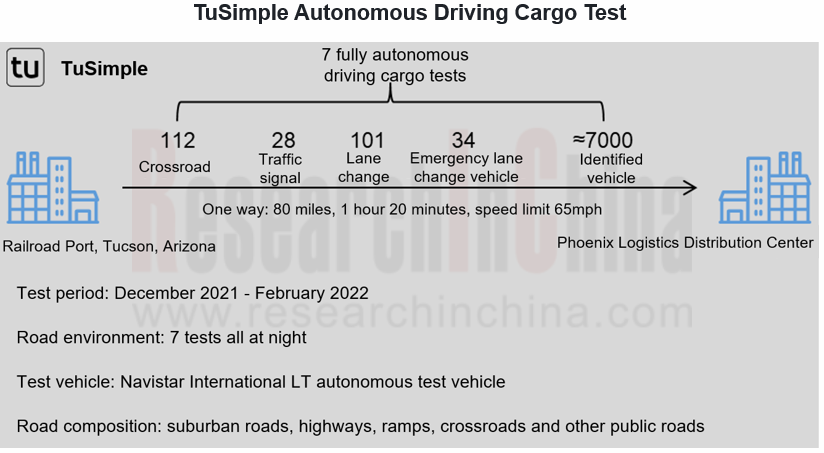

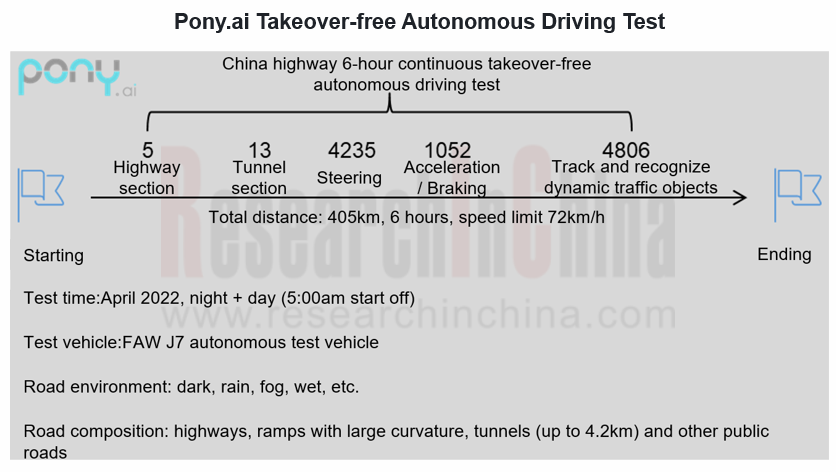

Among autonomous/takeover-free autonomous driving tests in the table above, TuSimple and Pony.ai are the most eye-catching.

According to the official statement, the fully autonomous test of TuSimple autonomous heavy truck on the public road took place at night, with no safety officers on duty or any human intervention throughout. The test was 80 miles long, including scenarios such as traffic signals, on and off ramps, emergency lane change vehicles and lane changes, and took 1 hour and 20 minutes. The entire test was conducted in close cooperation with Arizona Department of Transportation and law enforcement, with three safety and security vehicles in front of and behind the test vehicle to ensure safety of fully autonomous test operation.

In April 2022, Pony.ai completed 6 hours of continuous, takeover-free autonomous driving tests in China's highway scenarios, going from night to day, through long tunnels, experiencing heavy rain and fog, and encountering real scenarios such as occupying accident cars, low-speed cars and special-shaped trailers. According to the official statement, in 6 hours, the driving distance exceeded 405 km, experienced 5 different highways and 13 tunnels, executed 4,235 turns, 1,052 accelerations/brakes, and tracked and recognized 4,806 dynamic traffic objects.

Commercial operations

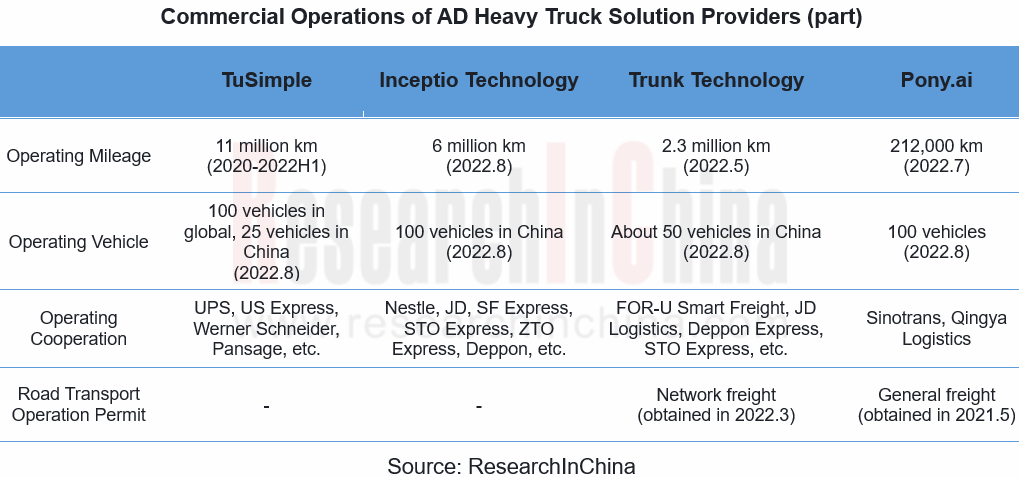

With the deepening of cooperation with logistics providers, solution providers have begun to show their strengths in actual road freight, allowing autonomous heavy trucks to earn freight. Trunk Technology and Pony.ai have obtained road transport operation permits and built their own fleets for transportation. Public data shows that the accumulated mileage of road transportation by TuSimple, Inceptio Technology, Trunk Technology and other solution providers have reached million-kilometer level, of which it has reached the most leading 7 million miles (about 11 million kilometers) during 2020-2022H1.

Pre-installed mass production

For capital, solution providers or logistics providers, what they are most looking forward to is the mass production and implementation of autonomous heavy trucks. Thus, the vehicle function, technical certification, vehicle sales and after-sales service and other related responsible parties can carry out road transport business activities.

The US RAND has estimated that an autonomous driving system needs to be validated for at least 11 billion miles (17-18 billion km) to reach mass production conditions. With a heavy truck driving 2000km in 24 hours, it would take 100 heavy trucks to drive about 240 years without stopping.

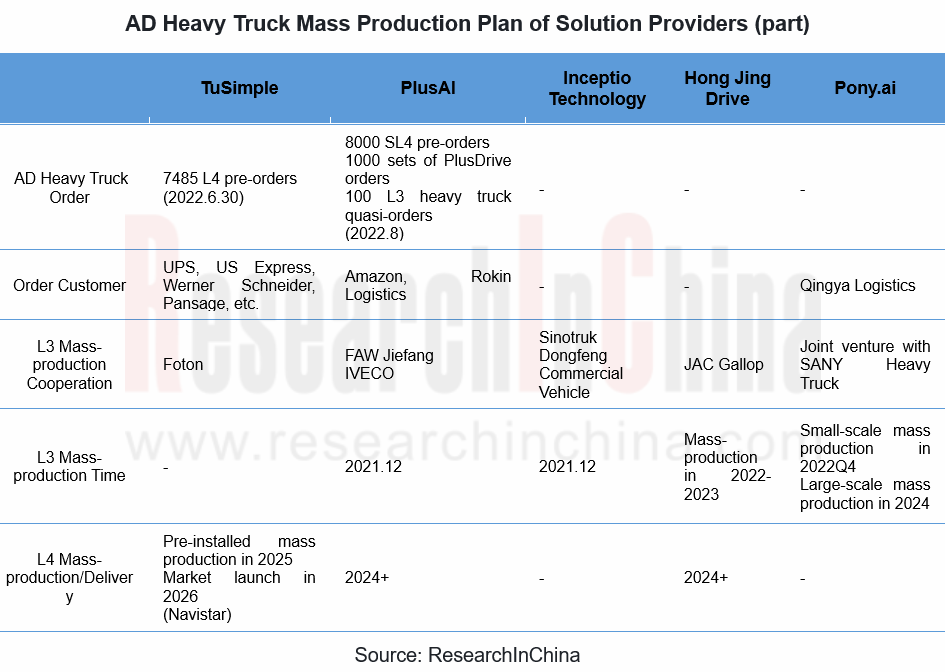

To obtain enormous real road test mileage, the only solution is pre-installed mass production and scaling to the market. At this stage, except for TuSimple, which insists on mass production of L4 heavy trucks, most solution providers are targeting L3 heavy trucks for mass production. They hoped that with mass production of L3 heavy trucks, autonomous driving system will run in large quantities on actual roads, thus obtaining massive road data, feeding back autonomous driving system and eventually realizing L4 autonomous driving.

PlusAI and Inceptio Technology, which are at the forefront of mass production, have each cooperated with heavy truck OEMs to produce L3 heavy trucks in late 2021 and have achieved some delivery results. In August 2022, PlusAI delivered five L3 FAW Jiefang J7 to its partner Rokin Logistics (with a total order of 100 vehicles, and the remaining 95 vehicles will be delivered within two years).

Big changes in autonomous heavy truck market

Emerging forces exist in passenger vehicle market, as well as in heavy truck market. Solution providers believe that the current traditional heavy truck manufacturers have many problems such as slow technical follow-up and unharmonious cooperation, which directly drag down the speed of mass production of autonomous heavy trucks. Therefore, in order to achieve better adaptation of software and hardware for autonomous driving and promote rapid implementation of autonomous heavy trucks, emerging forces such as DeepWay and Xingxing Technology have been established one after another. The biggest feature of heavy truck emerging forces is that they are built for autonomous driving, including fully redundant by-wire chassis, powertrain and cabin designed to meet needs of L4 autonomous driving.

Dynamics of some heavy truck emerging forces:

In September 2021, DeepWay released concept vehicle DeepWay-Xingtu, which is expected to be delivered in mass production in 2023.

In September 2021, DeepWay released concept vehicle DeepWay-Xingtu, which is expected to be delivered in mass production in 2023.

In April 2022, Xingxing Technology released Apebot I, an L4 autonomous pure electric van-type heavy truck for logistics, with mass production expected in 2023Q1.

In April 2022, Xingxing Technology released Apebot I, an L4 autonomous pure electric van-type heavy truck for logistics, with mass production expected in 2023Q1.

In June 2022, Hydron, a hydrogen-fueled heavy truck company founded by TuSimple co-founder Chen Mo, is expected to deliver its first-generation products in 2024Q3.

In June 2022, Hydron, a hydrogen-fueled heavy truck company founded by TuSimple co-founder Chen Mo, is expected to deliver its first-generation products in 2024Q3.

Some time ago, Ministry of Transport released "Autonomous Vehicle Transport Safety Service Guide (trial)" (draft for comment), proposing that "under the premise of ensuring transport safety, encourage the use of autonomous vehicles to engage in road general cargo transportation business activities in scenarios such as point-to-point trunk road transportation and relatively closed roads." The document will provide greater space for autonomous heavy truck road transport services, facilitate technical verification testing of autonomous heavy trucks, and directly promote them from test vehicles to mass production vehicles.

Dimension reduction for L2+/L3 pre-installed mass production, becoming a practical choice for autonomous heavy truck solution providers

Solution providers all target long-term goal of L4/L5 autonomous driving, while most enterprises adopt a progressive development strategy, such as PlusAI, Inceptio Technology, Hong Jing Drive, etc. They reduce dimension of L4 solutions accumulated and verified over the years, enter the vehicle R&D and mass production process as Tier 1 or Tier 0.5, and enable heavy truck OEMs to jointly mass produce L2+/L3 models by packaging software and hardware solutions. For example:

Based on the R&D of L4 full-stack autonomous driving technology, PlusAI joined forces with FAW Jiefang to create a supervised autonomous driving heavy truck (L2 +/L3), and at the same time used the commercialization of mass-produced autonomous heavy trucks to carry out technical iterations.

Based on the R&D of L4 full-stack autonomous driving technology, PlusAI joined forces with FAW Jiefang to create a supervised autonomous driving heavy truck (L2 +/L3), and at the same time used the commercialization of mass-produced autonomous heavy trucks to carry out technical iterations.

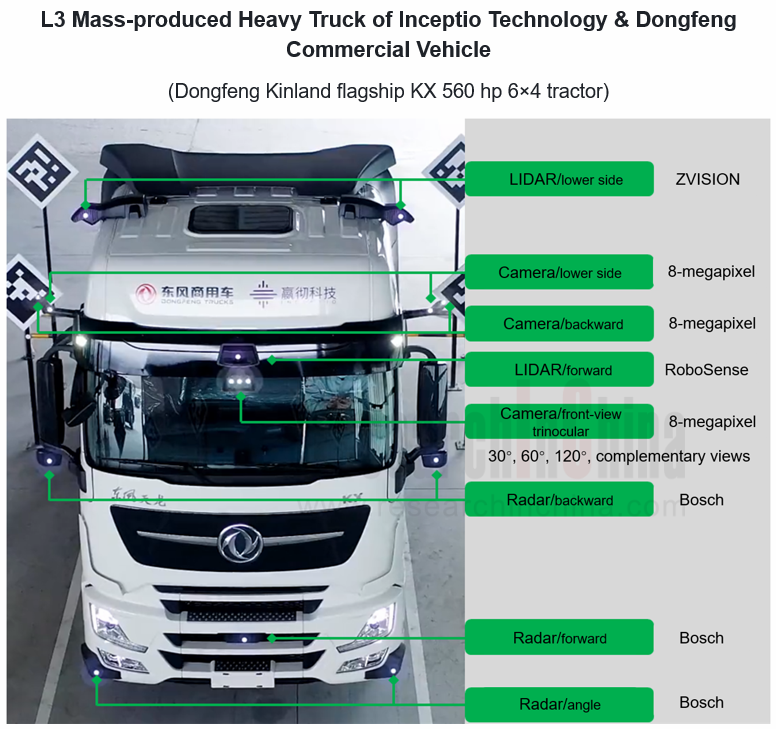

Inceptio Technology cooperated with Dongfeng Commercial Vehicles and Sinotruk to achieve mass production of L3 autonomous trucks, and a total of more than 200 vehicles of the two mass-produced models were rolled off the production line (as of August 2022).

Inceptio Technology cooperated with Dongfeng Commercial Vehicles and Sinotruk to achieve mass production of L3 autonomous trucks, and a total of more than 200 vehicles of the two mass-produced models were rolled off the production line (as of August 2022).

For autonomous heavy truck solution providers, mass production is the most practical choice in the near future. On the one hand, reducing product purchase/modification costs can also obtain certain income; on the other hand, it can realize data closed loop through large-scale operation of mass production vehicles and drive technology iteration.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...