China Driving Recorder Market Research Report, 2022

-

Sept.2022

- Hard Copy

- USD

$4,000

-

- Pages:210

- Single User License

(PDF Unprintable)

- USD

$3,800

-

- Code:

ZXF006

- Enterprise-wide License

(PDF Printable & Editable)

- USD

$5,700

-

- Hard Copy + Single User License

- USD

$4,200

-

Driving recorder research: sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year in 2022 H1

In April 2021, the Ministry of Industry and Information Technology stipulated: "Each passenger car should be equipped with an event data recorder (EDR) that complies with GB 39732. The passenger car equipped with an automotive video driving record system (driving recorder/ digital video recorder) that complies with GB/T 38892 should be deemed to meet the requirements." The regulation has been applied to newly produced vehicles from January 1, 2022. As EDRs has become the standard configuration of new cars, the OEM installation rate of driving recorders/digital video recorders (DVRs) has also risen.

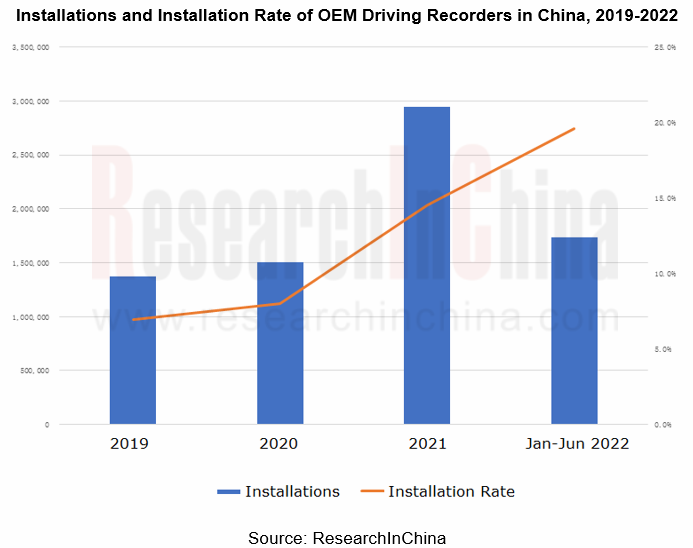

In 2022H1, the sales volume of passenger cars equipped with OEM DVRs increased by 52.5% year-on-year

From a monthly trend, the OEM installation rate of driving recorders in passenger cars (note: the sales proportion of passenger cars with driving recorder as standard configuration as a percentage of the total passenger car sales volume) jumped from 8.9% in April 2021 to 21.9% in June 2022.

On annual basis, the OEM installation rate of driving recorders in passenger cars hit 7.0% in 2019, 8.0% in 2020, 14.5% in 2021, and 19.6% in 2022H1. It is expected to be 22% in the entire 2022.

Independent brands and new energy vehicles are the main roles that include driving recorders into standard configuration

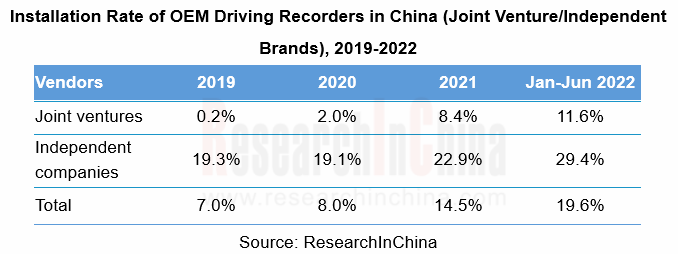

The installation rate of driving recorders as standard configuration for independent brand models has been at a relatively high level, reaching 19.3% in 2019 when joint venture brands only secured 0.2%. In 2022, independent brand models will achieve installation rate of 29.4% as the main force in the standard configuration of driving recorders.

However, since 2021, the installation rate of joint venture brands has made progress quickly, from 2.0% in 2020 to 8.4% in 2021 and 11.6% in 2022H1. Compared with 2019, it increased by 11.4 percentage points, higher than 10.1 percentage points gained by independent brands.

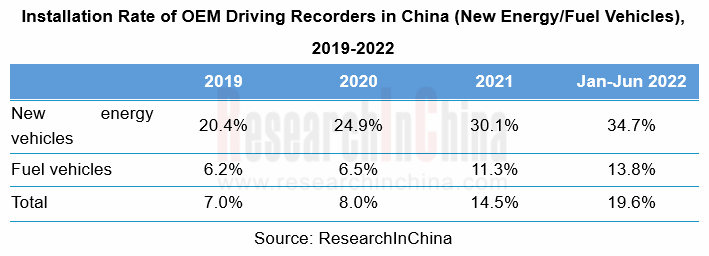

The installation rate of OEM driving recorders for new energy vehicles swelled by 14.3 percentage points from 20.4% in 2019 to 34.7% in 2022H1. For traditional fuel vehicles, the installation rate rose by 7.6 percentage points from 6.2% in 2019 to 13.8% in 2022H1. The growth in the sales volume of new energy vehicles also led to the growth of OEM driving recorders.

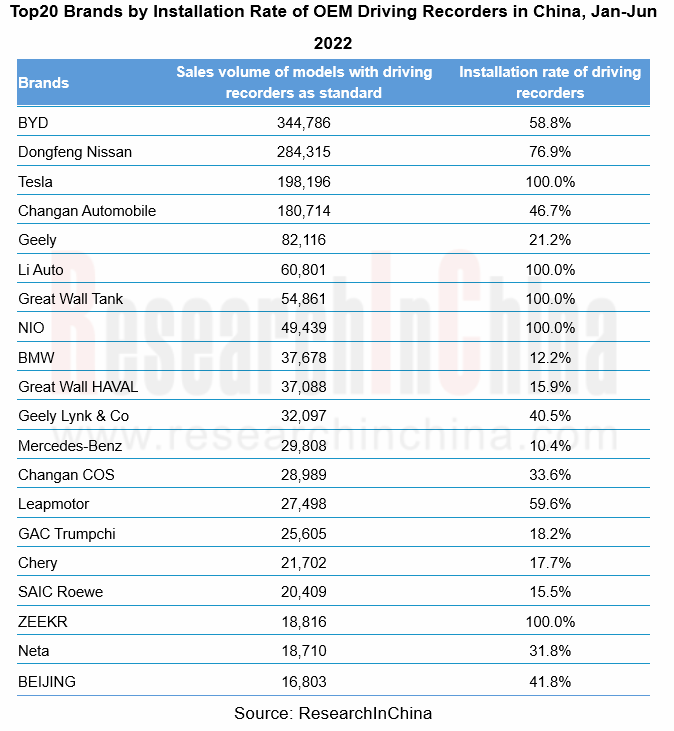

By the sales volume of models with driving recorders as standard in 2022H1, the top five brands included BYD (345,000 units), Nissan (284,000 units), Tesla (198,000 units), Changan Automobile (187,000 units) and Geely (82,000), with the respective installation rate as standard configuration of 58.8%, 76.9%, 100.0%, 46.7% and 21.2%. Chinese local new energy vehicle brands Li Auto and NIO regard driving recorders as standard, while traditional brands BMW and Mercedes-Benz only install OEM driving recorders on 12.2% and 10.4% of their vehicles respectively.

Driving recorder technology integration: ADAS, streaming media and intelligence

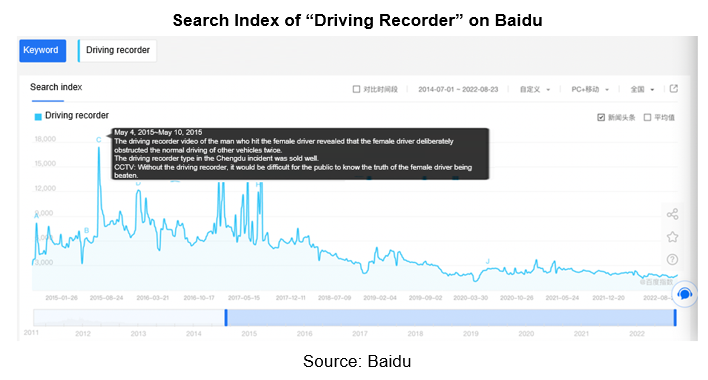

Driving recorders are undoubtedly indispensable for Chinese car owners. In 2015, the driving recorder video incident directly spurred the driving recorder aftermarket where 10 million driving recorders were sold that year as the best-selling automotive electronic products on Double 11, a Chinese unofficial e-commerce holiday and shopping festival similar to Black Friday in the U.S.

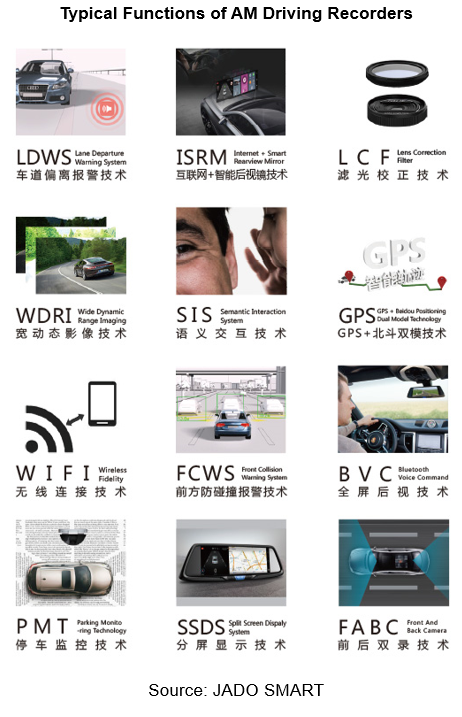

In addition to navigation, preventing accident frauds, assisting in handling traffic accident disputes and electronic violation disputes, driving recorders offer more and more functions. With the development of automotive intelligent connectivity, functions such as electronic fence, parking monitoring and alarm, and even ADAS functions like LDWS and FCWS have become standard for driving recorders, but AM driving recorders only integrate the most basic ADAS functions due to limitations of hardware, software and vehicle data acquisition.

With a higher installation rate, driving recorders can share the inputs (cameras) and outputs (displays) with other smart cockpit devices, which not only saves costs, but also better realizes integration of intelligent connection functions.

1. Driving Recorder Market Overview

1.1 Definition and Classification

1.2 Composition

1.3 Development History

1.3 Driving Recorder Baidu Index

1.4 Development Trend

2 Driving Recorder Technology Integration and Industry Trends

2.1 Fusion I: ADAS

2.1.1 Built-in ADAS of Driving Recorder Starts from AM

2.1.2 There are Inherent Deficiencies in Built-in ADAS of AM Driving Recorder

2.1.3 Driving Recorder fusion ADAS from OEM to AM

2.2 Fusion II: Streaming Rearview Mirror

2.2.1 Streaming Rearview Mirror

2.2.2 Industry Chain

2.2.3 Regulations Related to Streaming Rearview Mirror

2.2.4 Product Structure and Characteristics

2.2.5 Installation Rate of Streaming Rearview Mirror Models

2.2.6 OEM Streaming Rearview Mirror Solution

2.2.7 Suppliers and Product Solutions

2.2.8 Advantages and Future Development Trends

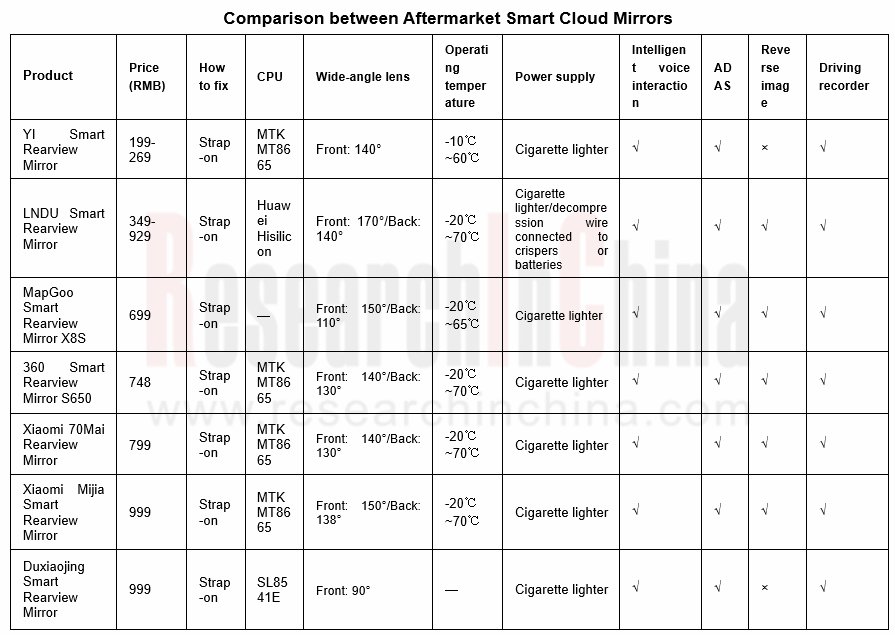

2.3 Fusion III: Intelligent Cloud Mirror

2.3.1 Industry Chain

2.3.2 Market Products

2.3.3 Development Trend

2.4 Fusion IV: Electronic Exterior Rearview Mirror

2.4.1 Development History

2.4.2 Product Advantages

2.4.3 Product structure and Characteristics

2.4.4 Market Status

2.4.5 Industry Chain

2.4.6 Models Equipped with Electronic Exterior Rearview Mirror (1)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (2)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (3)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (4)

2.4.6 Models equipped with Electronic Exterior Rearview Mirror (5)

2.4.7 Suppliers and Product Solutions

3 Driving Recorder Market Size and Forecast

3.1 Quantity and Installation Rate of OEM Driving Recorders in China, 2019-2022

3.2 Monthly Trend of Installation Rate of OEM Driving Recorders in China, 2019-2022

3.3 OEM Driving Recorder Market Size in China, 2021-2026E

3.4 AM Driving Recorder Market Size in China, 2021-2026E

3.5 Installation Rate of OEM Driving Recorder in China (by Model Price Range), 2019-2022

3.6 Installation Rate of OEM Driving Recorder in China (Joint Venture/Independent; New Energy/Fuel Vehicle), 2019-2022

3.7 Installation Rate of OEM Driving Recorder in China (by Brand), 2019-2022

3.8 Installation Rate of OEM Driving Recorder in China (by Automakers) , 2019-2022

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced below 100,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 10-150,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 15- 200,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 20- 250,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 25- 300,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 30-350,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 35- 400,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2022 (Models priced 40- 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

3.9 Top 20 Models by Sales of Pre-installed Driving Recorder in China, 2021 (Models priced over 500,000 yuan)

4 Major Driving Recorder Enterprises

4.1 Gentex

4.1.1 Profile

4.1.2 Driving Recorder - Full-screen Display Rearview Mirror

4.1.2 Driving Recorder - Electronic Rearview Mirror

4.1.2 Driving Recorder - Camera Monitoring System (CMS)

4.1.3 Financials

4.1.4 Customer Supporting Relationship

4.1.5 Application Solution

4.1.6 Development Planning

4.2 Magna

4.2.1 Profile

4.2.2 Smart Rearview Mirror Products

4.2.3 Development Planning

4.3 Ficosa

4.3.1 Profile

4.3.2 Intelligent Rearview Monitoring System (IRMS)

4.3.2 Electronic Exterior Rearview Mirror

4.3.3 Application Solution

4.4 ADAYO Group

4.4.1 Profile

4.4.2 Product Layout

4.4.3 Product Roadmap

4.4.4 Application Solutions

4.5 LongHorn

4.5.1 Profile

4.5.2 Product Layout

4.5.3 Product Revenue

4.5.4 Major Customers

4.6 Aoni Electronics

4.6.1 Profile

4.6.2 Product Layout

4.6.3 Product Revenue

4.7 Coligen

4.7.1 Profile

4.7.2 Product Layout

4.7.3 Product Revenue

4.8 Shanghai Yuxing Electronics

4.8.1 Profile

4.8.2 Product Layout

4.8.3 Application Solutions

4.9 Mobvoi

4.9.1 Profile

4.9.2 Product Layout

4.9.3 Core Technology

4.9.4 Smart Rearview Mirror Products

4.10 Banya Technology

4.10.1 Profile

4.10.2 Smart Cloud Mirror Product Solution

4.10.3 Streaming Media Rearview Mirror Product Solution

4.11 Teyes

4.11.1 Profile

4.11.2 Smart Rearview Mirror Product Solution

4.12 Shenzhen Roadrover Technology

4.12.1 Profile

4.12.2 Smart Rearview Mirror Products

4.13 Yuanfeng Technology

4.13.1 Profile

4.13.2 Business Layout: 1 + 3 + N Business Architecture

4.13.3 Product Structure Process

4.13.4 Mass Production Customers

4.13.5 Application Solutions

4.14 Willing Tech

4.14.1 Profile

4.14.2 Product Layout

4.14.3 Application Solutions

4.15 DDPAI

4.15.1 Profile

4.15.2 Product Introduction - Car Smart Screen

4.15.2 Product Introduction - X5 Pro

4.16 Haikang Automotive Electronics

4.16.1 Profile

4.16.2 Product introduction

4.16.3 Business Analysis

4.17 JADO

4.17.1 Profile

4.17.2 Product Introduction

5 OEMs' Driving Recorder Solution

5.1 Models with Driving Recorder as Standard Configuration

5.1.1 Dongfeng

5.1.2 BYD

5.1.3 Changan

5.1.4 Geely

5.1.5 Great Wall Motor

5.1.6 Chery

5.2 OEMs' Driving Recorder Solutions

5.2.1 Dongfeng Aeolus

5.2.2 Chang'an UNI-K

5.2.3 Great Wall Mocha DHT-PHEV

5.2.4 FAW E-HS9

5.2.5 FAW HS5

5.2.6 SAIC Buick GL8

5.2.7 GAC Toyota Wildlander

5.2.8 GAC Honda e

5.2.9 BAIC Mofang

6 Key Enterprises in Driving Recorder Industry Chain

6.1 Allwinner Technology

6.1.1 Profile

6.1.2 Product Layout

6.1.3 Product Solutions

6.2 Rockchip

6.2.1 Profile

6.2.2 Product Solutions

6.3 Spreadtrum Communications

6.3.1 Profile

6.3.2 Product Solutions

6.4 Qualcomm

6.4.1 Profile

6.4.2 Product Solutions

6.5 Novatek

6.5.1 Profile

6.5.2 Product Solutions

6.6 Ambarella

6.6.1 Profile

6.6.2 Product Layout

6.6.3 Product Solutions

6.6.4 Electronic Rearview Mirror Solution Based on Ambarella Chip

6.7 MediaTek

6.7.1 Profile

6.7.2 Product Solutions

6.8 Xilinx

6.8.1 Product Layout

6.8.2 Product Solutions

6.9 Camera Solutions

6.9.1 Automotive Camera Industry Chain

6.9.2 Camera Module Summary

6.9.3 OFILM Product Layout

6.9.4 Sunny Product Layout

6.9.5 Q Tech Product Layout

6.9.6 Product Layout of Lianchuang Electronic Technology

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...