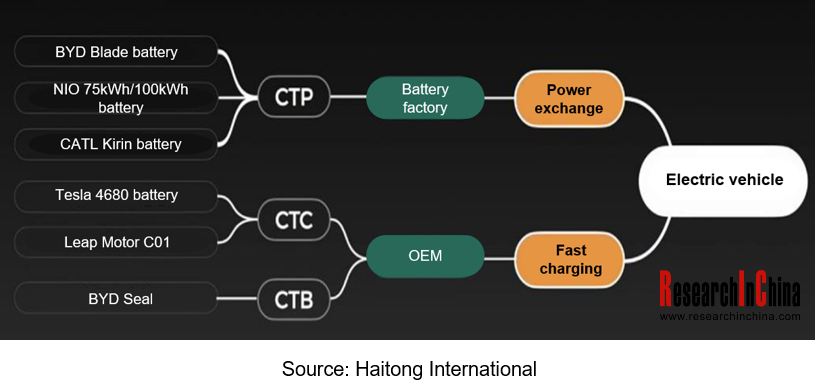

Integrated battery research: three trends of CTP, CTC and CTB

Basic concept of CTP, CTC and CTB

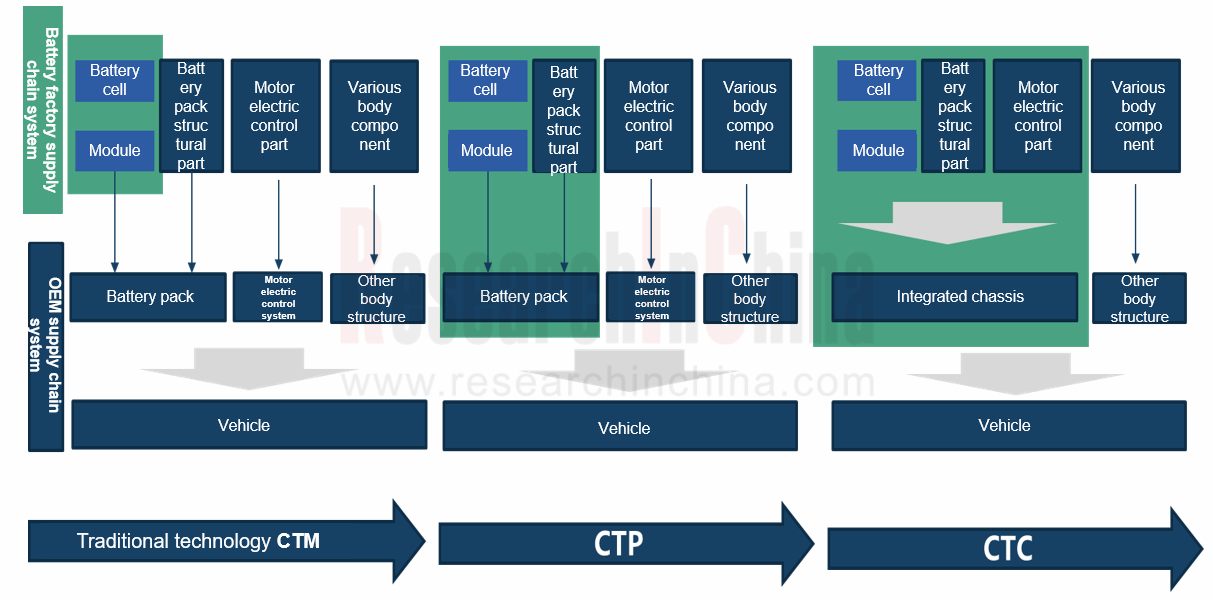

The traditional integration method of new energy vehicle power system is CTM, that is, "Cell to Module", which represents the mode of integrating battery cells on modules. The module is a development path for different models with different battery requirements and different battery cell sizes of battery manufacturers, which helps the formation of scaled economies and unified products. The general configuration is: battery cell - module - PACK - installed in vehicles; but such method only takes space utilization of 40%, largely limiting the space for other components. The development of battery integration (CTP, CTC, CTB) is gradually becoming the key research and application direction of the industry.

CTP is "Cell to Pack", which skips the standardized module and directly integrates battery cells into battery pack, which effectively improves space utilization and energy density of battery pack. This integration method was firstly proposed by CATL in 2019. Since then, BYD and SVOLT Energy have successively released their own CTP solutions. Among them, the more representative is BYD's "Blade" battery, which arranges individual battery cells together in an array, and then inserts them into the battery pack like a "blade", which is why everyone calls it a "blade battery".

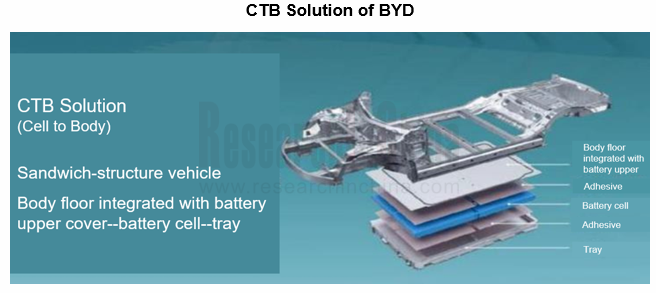

CTB (Cell to Body) is a new way of battery cell integration proposed by BYD to realize the transformation from body integration to battery-body integration, which helps to improve space utilization and further performance release of electric vehicles.

From the perspective of structural design, BYD's CTB technology combines body floor panel and the upper shell of battery pack into one, which is integrated into flat sealing surface formed by upper cover of battery, threshold and front and rear beams. The passenger cockpit is sealed with sealant, and the bottom is assembled with body through mounting point. That is, when designing and manufacturing battery pack, the battery system is integrated with body as a whole, sealing and waterproof requirements of the battery itself can be met, and sealing of battery and passenger cockpit is relatively simple, so the risk is controllable.

CTB technology is an extension of CTP technology, BYD's first CTB is more simplified and direct in structure, reducing the space loss caused by connection between body and battery cover, which is expected to further improve the overall space utilization. Under this structure, the battery is not only energy body, but also structural body to participate in force transmission and stress of the whole vehicle, which can reduce the intrusion of the side pillar by 45%.

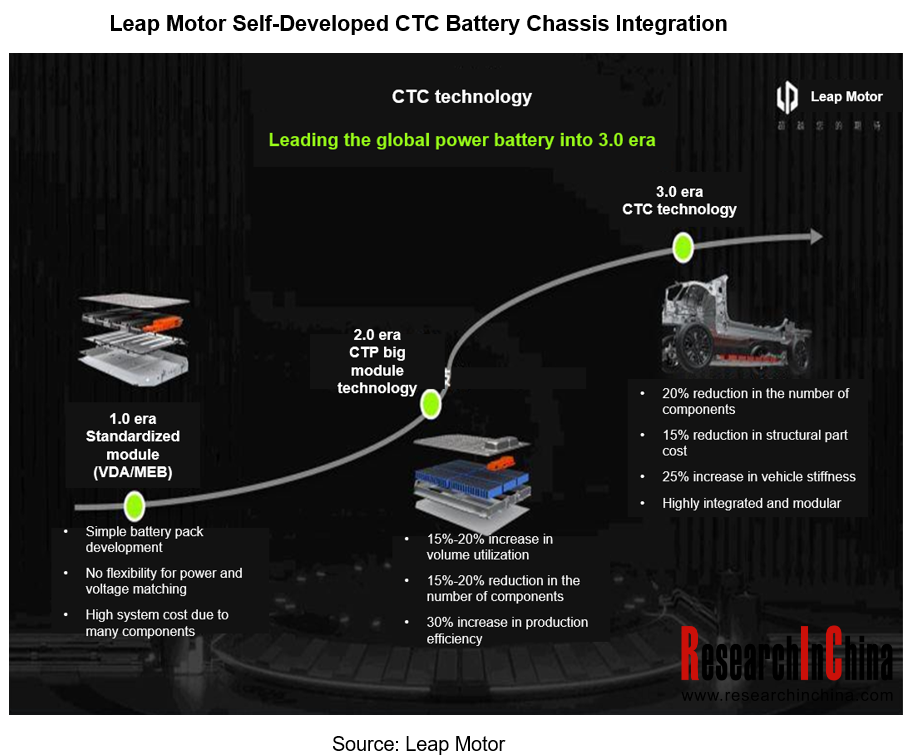

CTC (Cell to Chassis) is the process of integrating the battery cells directly into the vehicle chassis. It further deepens the integration of battery system with EV power system and chassis, reduces the number of components, saves space, improves structural efficiency, significantly reduces vehicle weight and increases battery range. The future stage of CTC will enable the matching efficiency to reach more than 90%, space utilization to reach more than 70%, and the number of components will be further reduced to about 400.

In September 2020, Tesla unveiled CTC technology at Battery Day. The battery cells or modules are installed in the body, connecting the front and rear body castings, and replacing cockpit floor with a battery upper cover. The technology is to be used in 2022 Model Y. Tesla predicts a 55% reduction in investment per GWH and a 35% reduction in space occupied with CTC technology.

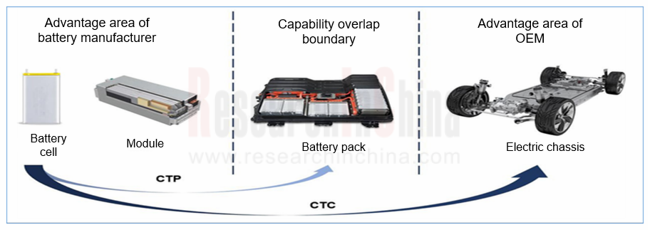

CTC is not a simple extension of CTP, CTP does not break through PACK itself. Battery companies/professional PACK companies can complete development independently, but the technology does not extend downstream. The appearance of CTC will break limitation of PACK and directly involve the vehicle chassis, which is the most critical core component of the vehicle, and is the core advantage accumulated by OEMs through long-term development, which is difficult for battery companies/professional PACK companies to develop independently. Therefore, in terms of business model and cooperation mode, CTC and CTP have great differences.

The current CTC technology is still in the early stage of development. In the future, CTC technology will be deeply combined with skateboard chassis. In addition to the integration of battery system and chassis, electric drives, electronic controls, wire-controlled actuation components, and power domain controllers will all be highly integrated with chassis to further optimize power distribution, reduce energy consumption, improve production efficiency, reduce production costs and product development cycles, etc.

In 2022, the passenger car battery integration shows following trends.

Trend 1: Large-scale installation of CTP, CTC, CTB technologies in 2022

In 2022, CTP, CTC and CTB technologies achieve scale installation. Users of CATL CTP include Tesla Model 3/Y, Xpeng P7/G3, NIO ES6/ET7, Roewe RES33, Neta and many other models; Leap Motor released CTC battery-chassis integration and BYD launched CTB for Seal series.

With integration of new energy vehicles and the help of wire-controlled technology, the pattern of supply chain has been further reshaped. From the perspective of OEMs, the standard module technology advocated by VDA is the first-generation technology, CTP is the second generation, and various CTC, CTB, etc. are the third generation. From CTP to CTC/CTB, the dominance of OEMs is further enhanced.

The year 2022 is the first year of mass production of CTC technology, Tesla Model Y and Leap Motor C01 are the first to achieve mass production in the industry with their respective CTC technology.

Trend 2: New energy vehicle battery pack and chassis industry chain transfer to the battery factory

At present, battery companies have the voice over the new energy vehicle industry chain, which also means that the core value of OEMs has been weakened and the profit space has been greatly reduced. Powerful battery manufacturers take the opportunity to extend their capabilities to the field of chassis development.

CATL will officially launch its highly integrated CTC (Cell to Chassis) battery technology around 2025. Cai Jianyong, former general manager of intelligent vehicle control in Huawei Intelligent Vehicle Solutions BU, joined CATL and was in charge of CTC battery-chassis integration business.

According to CATL, the company will achieve integrated CTC by 2025 and intelligent CTC by 2030, in which the integrated CTC technology will not only rearrange batteries, but also include power components such as motors, electronic controls, DC/DC and OBCs. Intelligent CTC technology will further optimize power distribution and reduce energy consumption through intelligent power domain controllers.

Trend 3: Integration

The difference between modulization and integration lies in the way of energy replenishment: power exchange for modular CTP; fast charging for CTC/CTB. The more integrated CTC/CTB battery will be mainstream, and the integrated CTC/CTB route often has higher requirements for thermal management, and the importance of heat pump air conditioning is highlighted. The most technically aggressive BYD Seal has confirmed that it will be equipped with heat pump air conditioning thermal management system, and it is expected that heat pump air conditioning will become standard configuration in CTC/CTB models in the future.

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...

Automotive Vision Industry Report, 2025

Automotive Vision Research: Average Camera Installation per Vehicle Reaches 5.2 Units, and Front-View Tricam Installation Exceeds 1.2 Million Sets.

From January to September 2025, the total installa...

Automotive Infrared Night Vision System Research Report, 2025

Automotive night vision research: The rise of infrared AEB, with automotive infrared night vision experiencing a 384.7% year-on-year increase from January to September.

From January to September 2025...

New Energy Vehicle Cross-Domain (Electric Drive System and Powertrain Domain) Integration Trend Report 2025-2026

Electric Drive and Powertrain Domain Research: New technologies such as three-motor four-wheel drive, drive-brake integration, and corner modules are being rapidly installed in vehicles.

Electric dri...

Analysis on Desay SV and Joyson Electronic's Electrification, Connectivity, Intelligence and Sharing, 2025

Research on Desay SV and Joyson Electronic: Who is the No.1 Intelligent Supplier?

Both Desay SV and Joyson Electronic are leading domestic suppliers in automotive intelligence. "Analysis on Desay SV ...

OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025

ResearchInChina released the "OEMs and Tier 1 Suppliers' Cost Reduction and Efficiency Enhancement Strategy Analysis Report, 2025", summarizing hundreds of cost reduction strategies to provide referen...

Automotive Fixed Panoramic Sunroof and Smart Roof Research Report, 2025

With the intelligent application of car roofs as the core, this report systematically sorts out a series of new products such as fixed panoramic sunroof/openable sunroof, ceiling screen, roof ambient ...

Automotive-Grade Power Semiconductor and Module (SiC, GaN) Industry Research Report, 2025

SiC/GaN Research: Sales volume of 800V+ architecture-based vehicles will increase more than 10 times, and hybrid carbon (SiC+IGBT) power modules are rapidly being deployed in vehicles.

Sales volume o...

Cockpit Agent Engineering Research Report, 2025

Cockpit Agent Engineering Research: Breakthrough from Digital AI to Physical AI

Cockpit Agent Engineering Research Report, 2025 starts with the status quo of cockpit agents, summarizes the technical ...