C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022

C-V2X industry research: C-V2X was pre-installed in more than 20 production passenger car models, with a penetration rate of over 0.5%.

More than 20 production passenger car models were equipped with C-V2X, with a rising penetration.

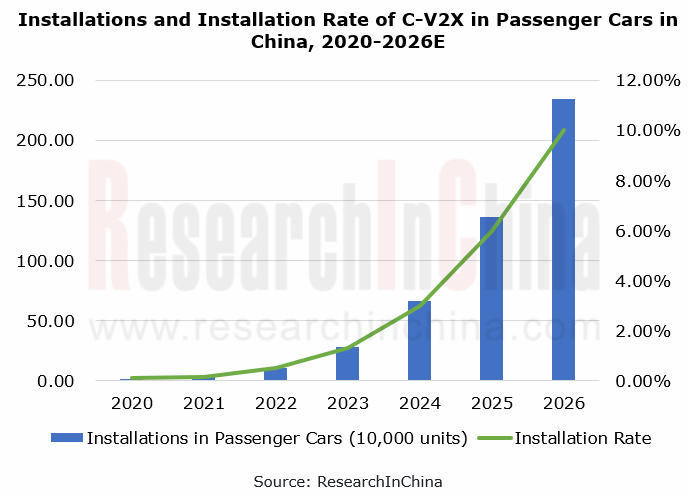

According to our statistics, from January to June 2022, the production passenger cars packing C-V2X technology reached about 46,000 units, with installation rate up to about 0.5%, the figures projected to reach 2 million units and 10% in 2026. We forecast installation rate growth based on following three considerations:

Consideration 1: Strategy for Innovation-driven Development of Intelligent Vehicles points out that by 2025, vehicle wireless communication networks (LTE-V2X, etc.) will provide regional coverage, and the application of new-generation vehicle wireless communication networks (5G+C-V2X) in some cities and highways will be phased in. This may be one of the reasons why automakers used more C-V2X modules in the past two years. In the future they can upgrade V2X functions over air (OTA) in the light of coverage of vehicle wireless communication networks.

In addition, China also has a plan for the penetration of autonomous driving. 5G+C-V2X is a crucial supplement to autonomous driving capabilities. Through the lens of technology development trends, OEMs also need to make some deployments ahead of time.

Consideration 2: in June 2022, Audi acquired China’s first “LTE-V2X Safety Warning Function Certification” at International Forum on Testing and Certification Technology for Intelligent Connected Automobile Products, indicating the application effectiveness of telematics warning function and powering OEMs in installation of C-V2X technology

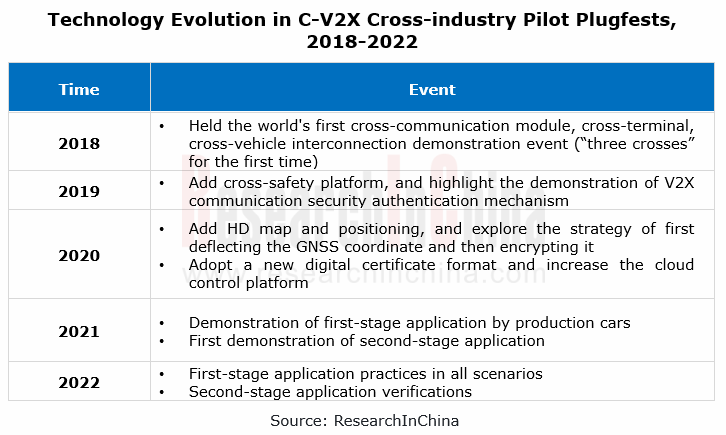

In addition, the 2022 C-V2X Cross-industry Pilot Plugfest indicates first-stage application practices (e.g., safety warning function and traffic information prompt) and second-stage application verifications (e.g., cooperative lane change and roadside perception data sharing).

Consideration 3: the rising penetration of passenger car OEM 5G modules will facilitate the pre-installation of C-V2X. In August 2022, Ministry of Industry and Information Technology indicated its attempts to research and plan 5G-V2X frequency use in a timely manner, in a bid to promote coordinated development of current LTE-V2X and future 5G-V2X technological regimes. In the future the realization of autonomous driving is inseparable from 5G and C-V2X technologies. It is predicted that in 2024, the penetration of 5G in passenger cars will exceed 10%.

As a whole, by our conservative estimate the installation rate of C-V2X in 2024 will be around 3% and higher than 10% in 2026.

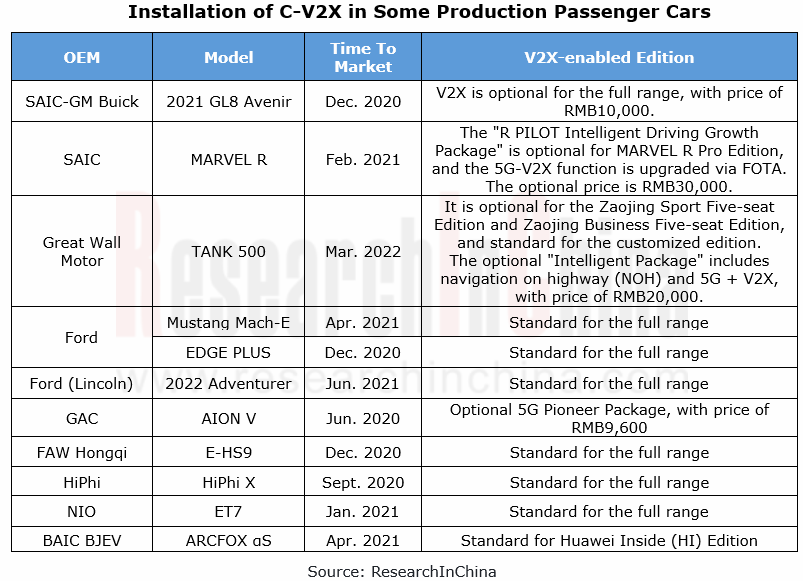

Our statistics show that since the mass production and installation of C-V2X in 2020, China has had more than 20 production models carrying C-V2X technology, of which the full range of quite a few models was equipped with it as a standard configuration: Hongqi E-HS9, HiPhi X, NIO ET7, Ford’s new-generation Mondeo, EVOS, Mustang Mach-E, Edge PLUS, etc.

In function’s term: in current stage, V2X technology is often used to enable basic safety functions such as traffic light signal push, green wave speed, green light startup alert, red light warning, intersection collision warning and road information broadcasting, still playing a minor supporting role in intelligent driving.

For now, automakers’ vigorous C-V2X deployments probably aim to provide sufficient redundancy for subsequent high-level autonomous driving systems, and to improve future V2X function upgrades via OTA.

Lincoln: the V2X technology mounted on 2022 Lincoln Adventurer allows the car to know in advance how long a traffic light will remain before approaching intersection and work out whether to safely pass the intersection in current speed before green light turns red, and gives the corresponding prompts – if it can, displaying green ripples on the floating center console, and if not, issuing audible and visual warnings.

In terms of installation form: from the mass-production solutions installed by OEMs, it can be seen that V2X terminals as independent devices can be integrated into vehicles, or V2X modules can be integrated into conventional T-BOX or further into smart antennas, and may be integrated into domain controllers in the future.

Anhui Jianghuai Automobile Group: in August 2022, it launched a new vehicle OEM C-V2X product created with Datang Gaohong Zhilian Technology - 5G+C-V2X Information Domain Controller that integrates Gaohong Zhilian's automotive C-V2X module DMD3A and C-ITS protocol stack. In the future, they will jointly work on pre-research on C-V2X and ADAS integration and enable mass production of modules and application in vehicles.

Chinese players have built a complete C-V2X industry chain, providing technical support for mass production.

The C-V2X industry chain is long and involves multiple players. This report summarizes and analyzes the high-quality suppliers in the C-V2X industry chain, including top 15 suppliers of C-V2X vehicle terminals, top 14 suppliers of C-V2X modules, top 10 suppliers of C-V2X software stacks, top 10 suppliers of roadside units (RSU), top 10 suppliers of C-V2X solutions, and top 6 suppliers of C-V2X chipsets.

Take C-V2X module as an example:

From the software and hardware layout, it can be seen that Chinese companies have built a complete C-V2X industry chain.

C-V2X chip: technology keeps iterating

For C-V2X chips pose a high technical barrier, currently only a few companies like Qualcomm, Autotalks, Huawei and Morningcore Technology have the capacity of mass production and supply. Although Chinese players have broken foreign monopoly, their market shares are still low. Most C-V2X modules on market still use chips from Qualcomm and Autotalks. Huawei HiSilicon chips are largely supplied for Huawei C-V2X modules. Besides private use, Morningcore Technology’s chips are also provided to Gaohong Zhilian, Mobiletek Communication, nFore Technology and Alps Alpine among others.

At present, Chinese and foreign companies are all working hard on C-V2X chip technology interaction to meet mass production and application requirements.

Autotalks: TEKTON3 and SECTON3, the third-generation C-V2X chipsets launched in July 2022, are the world's first V2X chipsets that support 5G-V2X for Day 2 scenarios (compatibility to any Day 1 vehicle) and introduce Functional Safety certification. First samples are expected to be available in early 2023, and the first cars equipped with the new chipsets are set to be available in 2025.

Morningcore Technology: the first-generation CX1860 and the two series of second-generation chips, CX1910 and CX1911 have been rolled out. The leading SDR SoC technology is used for performance optimization and continuous technology evolution through software reconfiguration.

Morningcore Technology’s first-generation chip CX1860 is the industry’s first C-V2X SoC that integrates baseband and application processors. The second-generation chips CX1910 and CX1911 are developed and mass-produced for OEMs, offering big improvements in communication capability, application processing capability and CVIS application scenarios. They enable the smooth evolution to the latest communication standards, and support more advanced intelligent driving scenarios.

C-V2X module: Chinese suppliers are dominant.

Our statistical results show that domestic players prevail in the C-V2X module market. In addition to C-V2X modules, major suppliers are also working to deploy 5G+C-V2X modules. Examples include Quectel AG55xQ Series, Huawei's second-generation MH5000, Neoway A590, and Gosuncn GM860A.

Quectel: the mainstream C-V2X module supplier boasts abundant product lines expanded from initial C-V2X module AG15 to LTE-A + C-V2X module AG52x Series, 5G+C-V2X module AG55x Series and AG215S AP module, and further integrating such functions GNSS and 5G.

Quectel's C-V2X modules have been spawned and mounted on vehicles. Currently all the V2X-enabled production models on offer like Buick GL8 Avenir, Hongqi E-HS9 and HiPhi X use Quectel's C-V2X modules.

C-V2X software protocol stack: independent development can sharpen competitive edges.

V2X software protocol stack is the core technology and competitive edge in the V2X field. In view of current market demand, customers prefer custom or secondary development based on original V2X standard protocol stacks. Industry providers therefore are trying hard to develop C-V2X software protocol stacks on their own. At present in China, Neusoft Group, NEBULA LINK, Gosuncn, Baidu, ISMARTWAYS and the like have the self-development capability.

Neusoft Group: as a key C-V2X standard setter and commercialization promoter, Neusoft Group has deeply partaken in the formulation of 46 international/Chinese V2X industry standards, and 49 V2X invention patents. It has introduced China's first self-developed complete V2X protocol stack product VeTalk, and has complete CVIS solutions and end-to-end C-V2X products. Up to now, the company’s self-developed cooperative vehicle-infrastructure system (CVIS) has been widely used by major OEMs and intelligent connected vehicle demonstration areas in China. Its 5G TBOX was the first one to be certified by the Ministry of Industry and Information Technology, and has secured mass production orders of several leading domestic automakers.

C-V2X (Cellular Vehicle to Everything) and CVIS (Cooperative Vehicle Infrastructure System) Industry Report, 2022 highlights the following:

C-V2X industry (standardization process, CVIS business models, market size, etc.);

C-V2X industry (standardization process, CVIS business models, market size, etc.);

Key technologies and solutions for C-V2X mass production (C-V2X chip and module, software stack, vehicle terminal, key roadside unit (RSU) technologies, leading suppliers, etc.);

Key technologies and solutions for C-V2X mass production (C-V2X chip and module, software stack, vehicle terminal, key roadside unit (RSU) technologies, leading suppliers, etc.);

C-V2X mass production and application scenarios (passenger cars, autonomous passenger transport, autonomous freight transport, etc.);

C-V2X mass production and application scenarios (passenger cars, autonomous passenger transport, autonomous freight transport, etc.);

Key suppliers of C-V2X chips, modules, terminals and system solutions (main products, status quo, cooperation dynamics, etc.).

Key suppliers of C-V2X chips, modules, terminals and system solutions (main products, status quo, cooperation dynamics, etc.).

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...