Automotive seating research: automotive seating enjoys an amazing boom in the context of autonomous driving.

As autonomous driving develops, vehicles, a simple mobility tool, are tending to be positioned as a "third mobile space" centering on human-vehicle interaction experience. As an important part of the "third mobile space", seating is also evolving in an intelligent direction. This report summarizes the main development trends of the automotive seating industry by combining the planning and layout of the world's major automotive seat suppliers and the seat configurations of marketed vehicle models and concept cars of OEMs in recent years.

1. Seating becomes more comfortable and intelligent.

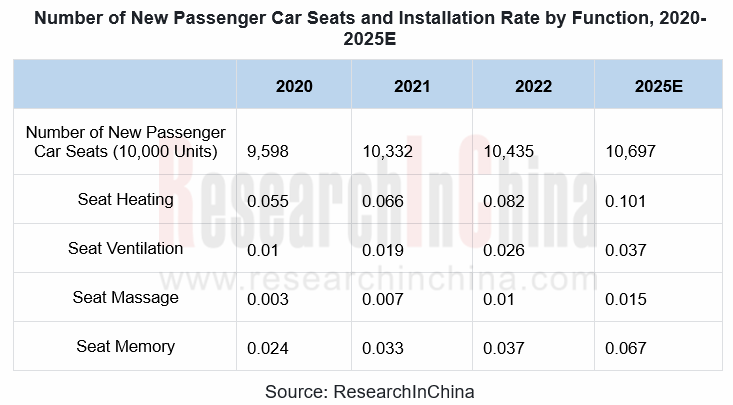

From January to August 2022, China demanded 63.09 million units of new automotive seats, of which fabric, leather and artificial leather ones shared 21.7%, 18.8% and 47.8%, respectively. In terms of seat functions, seat heating boasted an installation rate of 7.9%, and 52.2% of vehicle models priced at RMB100,000-250,000 installed this function; the installation rate of seat ventilation stood at 2.7%, and 55.3% of vehicle models priced at RMB100,000-250,000 carried this function, of which the RMB100,000-200,000 models showed a rising installation; the installation rate of seat massage reached 1.1%, and the percentage of RMB200,000-350,000 vehicle models packing this function reached 49.0%, a surging rate mainly driven by Volkswagen ID Series, AITO, TANK 300 and Li Auto ONE.

2. Carbon fiber composites become the first choice for lightweight seats.

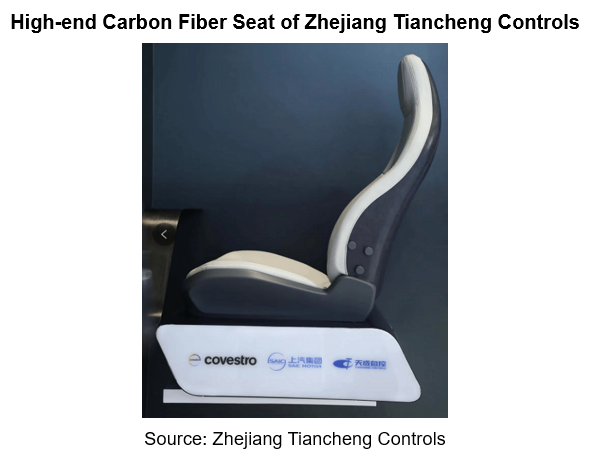

Carbon fiber composite is a structural material compounded by carbon fiber and metal, ceramics, resin, etc. This lightweight, high strength material with a quarter of steel density and tensile strength higher than 3500Mpa, is a very suitable alternative to metal materials to make seat frames.

For example, in April 2021, Nobo Automotive Systems displayed a carbon fiber frame seat at the Shanghai International Automobile Industry Exhibition. The back frame of this seat is integrally formed with carbon fiber composites, and uses a small number of parts, reducing the weight by a staggering 35%. The high-end carbon fiber seat introduced by Zhejiang Tiancheng Controls in November 2021 adopts one-piece molding, thermosetting and injection molding processes, with weight about 30% lighter than conventional steel ones.

As well as use of new materials, suppliers also reduce seat weight through structural optimization and manufacturing processes.

For example, the UltraThin seat launched by Adient in August 2022 adopts the seat construction of thermoplastic elastomer (TPE) panels, reducing overall seat trim outline volume by 30%, overall seat part count by 10%, and overall mass by 14%.

3. Recyclable and renewable materials help to achieve the goal of carbon neutrality.

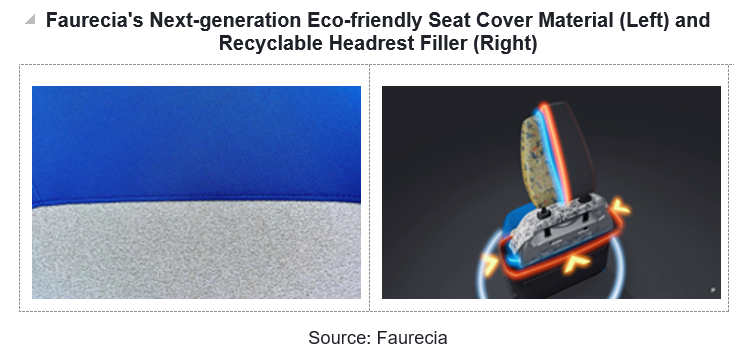

In response to energy conservation and emission reduction, suppliers put more focus on "green" and renewable eco-friendly materials in seat design and development.

For example, in August 2022, Faurecia launched a new eco-friendly seat. The seat cover material is a recyclable material with a recycling rate of 85%, reducing 52% carbon emissions compared with conventional cover materials; the seat headrest filler uses foam material, a lightweight recyclable material based on the concept of blended fibers, with a recycling rate of up to 70%, slashing 56% carbon emissions. In February 2022, Hyundai Transys unveiled its future green mobility concept seat, a new seat concept co-created with Italian and Korean manufacturers using leather waste. The seat part uses recycled tanned leather; the seat backrest uses woven leather; the seat headrest is structured using recycled aluminum powder.

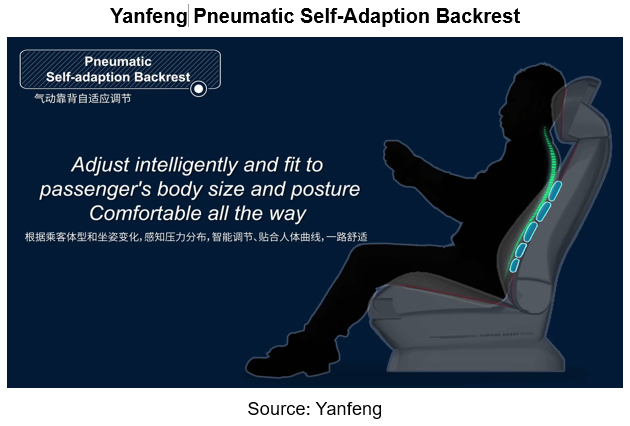

4. Intelligent technology redefines automotive seating comfort.

Intelligent adjustment seats can be adjusted via mobile phone, voice or intention perception. For example, the SU seat launched by Yanfeng in 2022 has a pneumatic backrest that can sense the pressure distribution and adjust adaptively according to changes in the passenger's body size and sitting posture; the four-way pressure-sensitive headrest can automatically recognize the occupant's head position to intelligently adjust the height.

Xpeng G9 marketed in September 2022 packs an ultra-low frequency rhythm seat provided by Adient. The seat can vibrate with the beat of music, and move with the plot of the film source. Using artificial intelligence and other technologies, Hyundai Transys provides comfortable ride experience that matches body sizes of occupants, for example, the seat can make active adjustments according to body size, posture and habits of occupants.

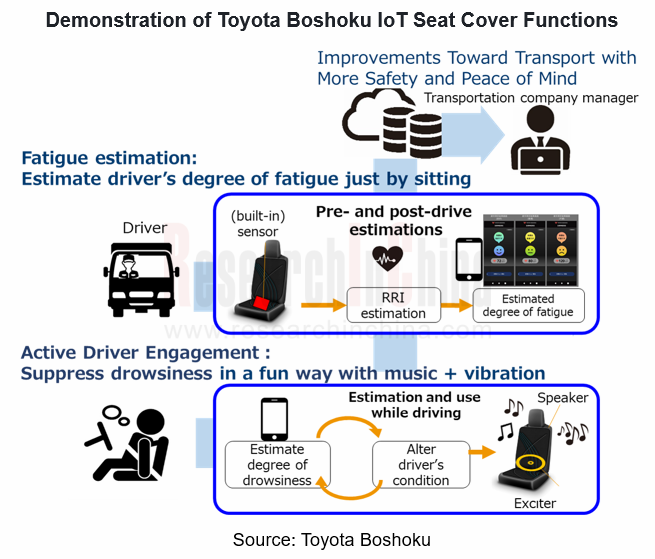

The intelligent health sensor automatically senses health indicators such as heartbeat and breathing rate via the non-contact sensor installed inside the seat, and then automatically provides intelligent adjustments such as massage, music play and ambient light control, according to physical state. For example, in March 2022, Toyota Boshoku announced an IoT seat cover equipped with two systems: the fatigue estimation system that uses a built-in sensor to measure the driver's heart beat and thereby estimate their state of fatigue; the active driver engagement system that vibrates the seat cover and plays music accordingly to suppress drowsiness.

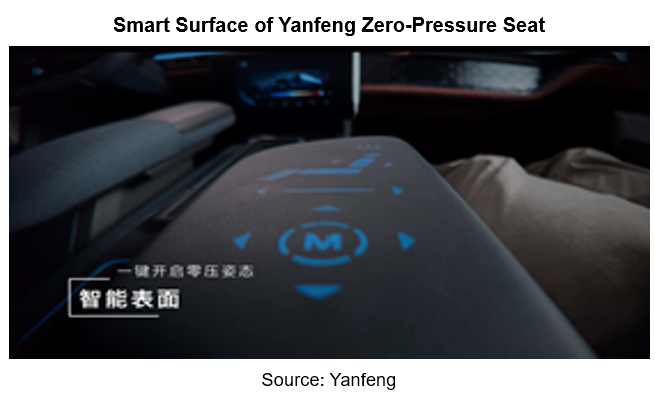

Smart surfaces not only allow touch control on seats instead of conventional buttons, but display information. For example, the zero-pressure seat, integrated luxury seat and SU seat unveiled by Yanfeng in 2022 all pack smart touch control armrests that enable such functions as seat position adjustment, seat ventilation, heating, massage and leg drag, as well as one-button activation of zero-pressure posture.

5. The "changeable cockpit" in the autonomous driving environment.

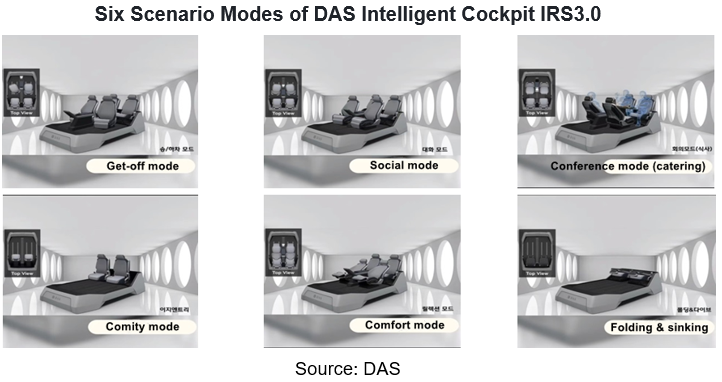

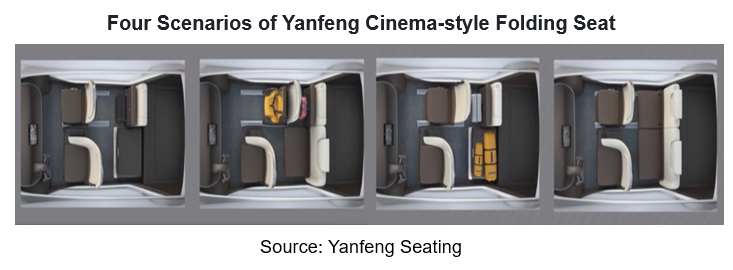

In the future, vehicle cockpits will not only be used for riding, but enables switching between different scenarios by flexibly adjusting seats, so as to meet people's needs.

For example, in the new intelligent cockpit IRS3.0 launched by South Korea's DAS Corporation in 2021, the seats carry ultra-long slides and allow 360° omnidirectional rotation, realizing six scenarios including social contact mode, conference mode and comfort mode. The cinema-style folding seat released by Yanfeng Seating in 2022 can be folded and slid to enable scenarios like commuting mode, family mode, travel mode and joy mode.

Automotive 12V/48V Low-Voltage Lithium-ion Battery/Sodium-ion Battery Industry Research Report, 2026

Research on 12V/48V automotive low-voltage lithium-ion (sodium-ion) batteries: promoted by regulations and standardization, it is imperative to "replace lithium-ion (sodium-ion) batteries with lead-ac...

Next-Generation Automotive Wireless Communication Technologies (6G/5G-A, NearLink, Satellite Communication, UWB, etc.) and Automotive Communication Module Industry Report, 2026

Research on Next-Generation Communication and Modules: Accelerated Deployment of 5G-A, Satellite Communication, NearLink, UWB and Other Technologies in Automobiles

Automotive wireless communication t...

Research on Zonal Architecture: Smart Actuators (Micro-motors) and Application Trends in Sub-scenarios, 2026

Smart Actuator and Micro-motor Research: Under Zonal Architecture, Actuators Are Developing towards Edge Computing, 48V, and Brushless Motors.

The core components of automotive zonal architecture mai...

China Passenger Car Navigate on Autopilot (NOA) Industry Report, 2025

In 2025, NOA standardization was popularized, refined and deepened in parallel. In 2026, core variables will be added to the competitive landscape.

The evolution of autonomous driving follows a clear...

Smart Car OTA Industry Report, 2025-2026

Automotive OTA Research: In the Era of Mandatory Standards, OTA Transforms from a "Function Channel" to a New Stage of "Full Lifecycle Management"

Driven by the development and promotion of AI and so...

Automotive AI Box Research Report, 2026

Automotive AI Box Research: A new path of edge AI accelerates

This report studies the current application status of automotive AI Box from the aspects of scenario demand, product configuration, and i...

Automotive Fragrance and Air Conditioning System Research Report, 2025

Automotive Fragrance and Air Purification Research: Intelligent Fragrance Equipment to Exceed 4 Million Units by 2030, "All-in-One" Integrated Purification Becomes Mainstream

The "Automotive Fragranc...

Intelligent Vehicle Cockpit-driving Integration (Cockpit-driving-parking) Industry Report, 2025

Cockpit-Driving Integration Research: 36% CAGR by 2030, Single-Chip Cockpit-driving integration Solutions Enter Mass Production

ResearchInChina releases the "Intelligent Vehicle Cockpit-driving Integ...

Research Report on Overseas Layout of Chinese Passenger Car OEMs and Supply Chain Companies, 2025

Automotive Overseas Expansion Research: Accelerated Release of OEM Overseas Production Capacity, Chinese Intelligent Supply Chain Goes Global

This report conducts an in-depth analysis of the current ...

Passenger Car Intelligent Steering Industry Research Report, 2025-2026

Intelligent steering research: Rear-wheel steering prices drop to RMB200,000-250,000

1. Rear-wheel steering installations increased by 36.5% year-on-year.

From January to October 2025, the number of...

Global Autonomous Driving Policies & Regulations and Automotive Market Access Research Report, 2025-2026

Research on Intelligent Driving Regulations and Market Access: New Energy Vehicle Exports Double, and "Region-Specific Policies" Adapt to Regulatory Requirements of Various Countries in A Refined Mann...

Two-wheeler Intelligence and Industry Chain Research Report, 2025-2026

Two-Wheeler Electric Vehicle Research: New National Standard Drives Intelligent Popularization, AI Agent Makes Its Way onto Vehicles

ResearchInChina releases the "Two-wheeler Intelligence and Industr...

China Smart Door and Electric Tailgate Market Research Report, 2025

Smart Door Research: Driven by Automatic Doors, Knock-Knock Door Opening, etc., the Market Will Be Worth Over RMB100 Billion in 2030.

This report analyzes and researches the installation, market size...

New Energy Vehicle Thermal Management System Industry Research Report, 2025-2026

Policy and Regulation Drive: Promoting the Development of Electric Vehicle Thermal Management Systems towards Environmental Compliance, Active Safety Protection, and Thermal Runaway Management

Accord...

Intelligent Vehicle Redundant Architecture Design and ADAS Redundancy Strategy Research Report, 2025-2026

Research on Redundant Systems: Septuple Redundancy Architecture Empowers High-Level Intelligent Driving, and New Products Such as Corner Modules and Collision Unlock Modules Will Be Equipped on Vehicl...

Passenger Car Mobile Phone Wireless Charging Research Report, 2025

Automotive Wireless Charging Research: Domestic Installation Rate Will Exceed 50%, and Overseas Demand Emerges as Second Growth Driver.

The Passenger Car Mobile Phone Wireless Charging Research Repor...

Automotive 4D Radar Industry Research Report 2025

4D radar research: From "optional" to "essential," 4D radar's share will exceed 50% by 2030.

1. 4D imaging radar has transformed from an "optional" to a "must-have" sensor.

4D radar adds the detecti...

China Automotive Multimodal Interaction Development Research Report, 2025

Research on Automotive Multimodal Interaction: The Interaction Evolution of L1~L4 Cockpits

ResearchInChina has released the "China Automotive Multimodal Interaction Development Research Report, 2025"...